A new wave of fraudulent BlackRock job offers are circulating globally tied to fictitious sites dubbed “BlackRock Mall.” Scammers are impersonating BlackRock, attempting to exploit economic hardship and offer unbelievable work-from-home positions.

- Overview of the Viral BlackRock Mall Scam

- How the BlackRock Mall Job Scam Unfolds

- How to Detect Fake BlackRock Mall Employment Platforms

- How to Identify the BlackRock Mall Scam Offers on Messaging Apps

- What to Do If You Already Paid the BlackRock Mall Scam

- Avoiding BlackRock Employment Scams

- Frequently Asked Questions About the BlackRock Mall Scam

- The Bottom Line

This article provides an in-depth look at how the BlackRock Mall scam ensnares victims desperate for income. We’ll examine their psychological tricks, fake task processes, and means of gradually siphoning money. Advice is also included on avoiding this scam and measures to take if you were manipulated into sending funds.

Overview of the Viral BlackRock Mall Scam

This prolific employment scam typically begins with unsolicited messages randomly sent to victims’ phones, emails, social media pages, and messaging platforms like WhatsApp or Telegram. Scammers pose as BlackRock “recruiters” and advertise unbelievable remote customer service, brand ambassador, or product promoter roles paying over $500+ weekly. However, they promise this high income will require less than 5 hours of simple work daily activities like sharing affiliate links, writing reviews, surveying products, processing orders, and other basic digital tasks related to BlackRock merchants and product listings.

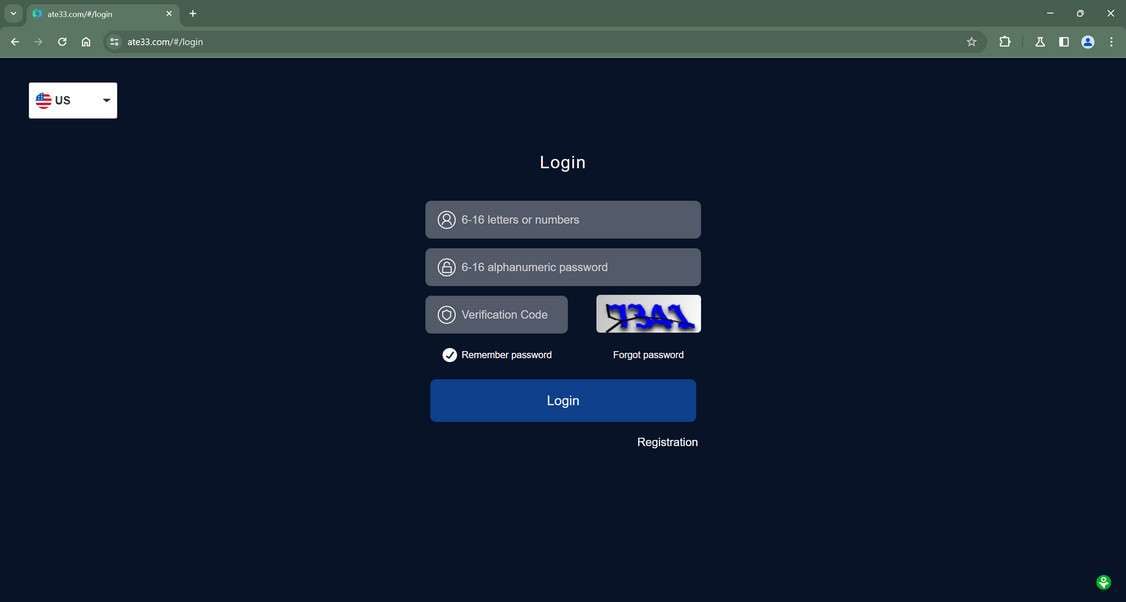

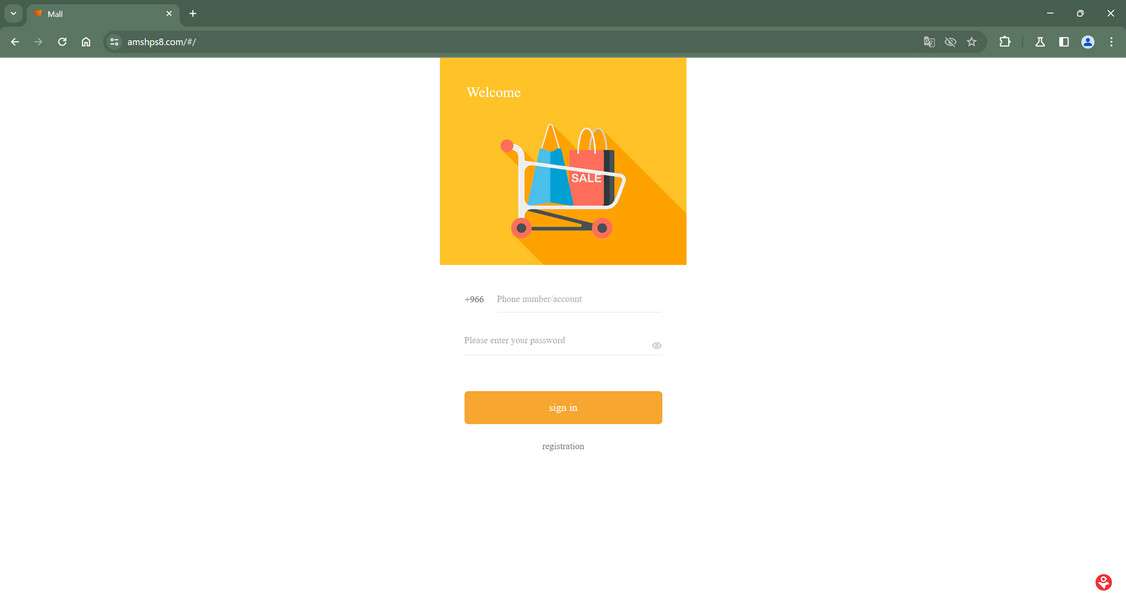

If interested recipients inquire further, scammers direct them to an elaborate fake portal called “BlackRock Mall” to sign up for available positions and manage assigned responsibilities. This slick website resembles an actual BlackRock training platform with logos, branding, and interfaces mirroring real corporate portals. However, it exists solely to enact an intricate scam stealing money.

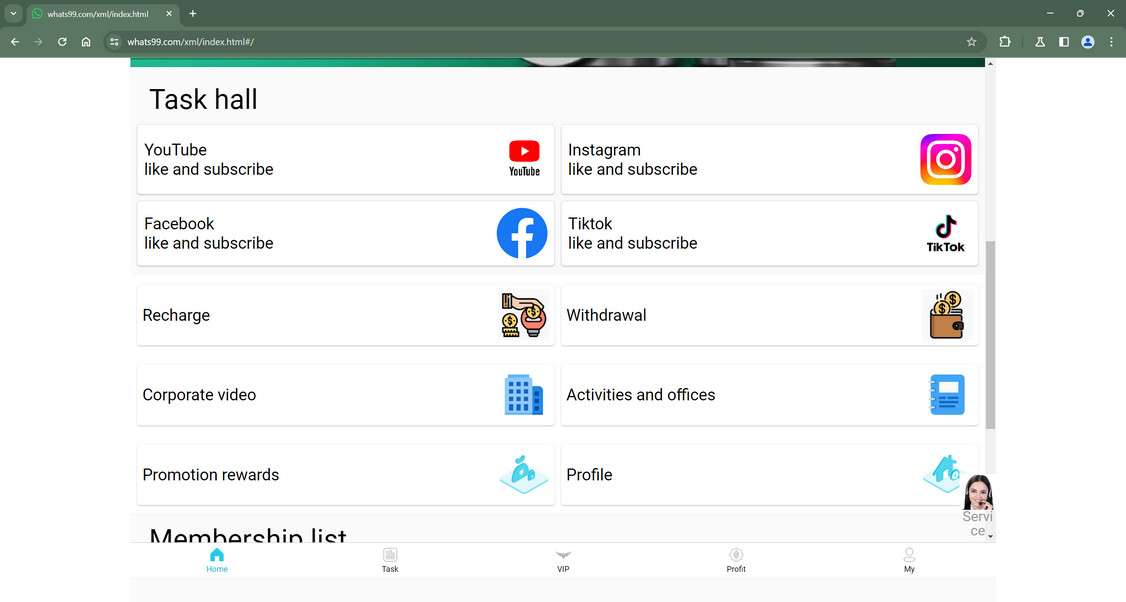

As new trainees on “BlackRock Mall”, victims must complete various simulated training tasks like watching promotional videos, liking social media posts, and giving referrals to friends. For each action, their online dashboard shows dollar amounts accumulating as commissions earned so far. Materials portray these payments becoming available after an initial two week training period.

However, just before the two week endpoint after victims have completed hundreds of tasks, reasons emerge demanding users first pay increasing upfront funds themselves in order to withdraw the four-figure commission totals now visible in their dashboards. Scammers cite a myriad of crooked reasons for these mandatory upfront fees – needing to upgrade account levels, fill tax obligations, release special bonuses, or fix administrative verification issues.

In reality, BlackRock Mall is completely fabricated with no actual jobs or salaries behind its glossy banners and videos. Yet the site can still dupe even savvy users through weeks of psychological manipulation tactics paired with an intricate plotted payment extraction schemes. No transferred money goes to releasing earnings – it only gets stolen by scammers.

Some known versions of portals supporting this fake BlackRock jobs and commissions scam include:

- BlackRockMall33.vip

- BlackRockMall994.vip

- BlackRocktasks212.com

- BlackRockTaskForce78.shop

- BlackRockMall4567.online

By impersonating a globally recognized giant, cunning scammers behind the completely fictional BlackRock Mall (and its many updated iterations with refreshed domains) have managed to steal untold cumulative fortunes from struggling and good-faith populaces spanning North America, Asia, Africa, Europe, and globally.

How the BlackRock Mall Job Scam Unfolds

The BlackRock Mall scam manages to deceive targets using clever psychological tricks and social engineering over extended interactions. The following provides a detailed breakdown of how this scam successfully manipulates victims.

1. Unsolicited Job Offer Messages

The first contact sees users receive messages randomly regarding unbelievable BlackRock work-from-home positions. Details mirror typical scam promises of high earnings for minimal effort.

Job titles vary or remain vague. But promised incomes upwards of $800 per week catch attention, especially among unemployed or financially struggling demographics.

2. Builds Trust Through BlackRock Branding

When interested users inquire, scammers direct them to the fake BlackRock Mall portal describing available customer service, product promotion and sales jobs tied to BlackRock.

The site appears legitimate, showing BlackRock logos and branding throughout. This fosters trust and perceived credibility regarding the opportunity.

3. Multi-Phase Onboarding Process

An intricate multi-phase onboarding process begins using psychology to manipulate users. First, simple liking and sharing tasks get introduced.

Gradually, additional responsibilities follow like surveys and reviewing products. Each phase offers growing associated “commissions,” taking days or weeks to fully onboard.

4. Dashboard for Tracking Simulated Earnings

Throughout onboarding, users access polished dashboards summarizing their video views, posts, referrals, and other metrics tied to assigned tasks.

Based on this purported activity, the dashboard shows dollar amounts earning for each action, depicting rapidly rising income potential.

5. Small Initial Funds Requests

Soon after totals reach several hundred dollars, scammers impose reasons requiring small upfront payments before users can withdraw earnings, such as fictional tax withholdings or distribution fees.

These minimal sums intend to normalize sending scammers money prior to even larger requests down the line.

6. Cryptocurrency Payment Direction

Shortly after the first wires go through, scammers provide cryptocurrency wallet details for all future payments instead of bank accounts.

This allows siphoning money without oversight and tracing that typical financial platforms provide.

7. Steadily Increasing Transfer Sizes

Over weeks, the wire transfer amounts increase from hundreds into the thousands of dollars, frequently citing various new reasons payments are temporarily needed to unlock user earnings.

Victims already invested and seeing earning potentials exceeding $500 per week become unlikely to halt sending growing payments.

8. Total Accrued Funds Stolen

Eventually after maximizing extracted payments, scammers who orchestrated the fictitious BlackRock Mall site block all contact.

No salaries or commissions materialize, just gradual theft fueled by an elaborate hoax scammers carefully built leveraging BlackRock’s brand recognition.

How to Detect Fake BlackRock Mall Employment Platforms

In addition to social media, this scam relies on elaborate fake portals mimicking BlackRock training sites to dupe victims. Here are red flags signaling fraudulent platforms:

1. Suspicious Domain Names

Inspect web addresses thoroughly. Scammers use typosquatting techniques like BlackRock-Mall56.vip to appear legitimate. Watch for misspellings or extra words in URLs.

2. Site Age

Conduct WhoIs domain lookups. Fraudulent sites were often just recently registered, unlike longstanding brands. Check creation dates for flags.

3. Poor Grammar/Spelling

Text content on scam platforms often demonstrates syntax or linguistic indicators suggesting non-native English sources rather than official corporations.

4. Stock Website Templates

Phony sites utilize common WordPress builds and themes. But BlackRock develops custom corporate portal designs optimized for their brand needs rather than scamming.

5. No Verifiable Contact Information

Check site pages and search and directories. Fake domains exclude ways to directly contact listed staff beyond online forms. Real companies provide multiple phone/email channels.

6. Too Good to Be True

If pay rates, effort levels, or ease of roles seems unrealistic compared to market data, apply skepticism. Outsized claims lure in targets deliberately while masking fraud.

7. Cryptocurrency Payment Requirements

Insistence on solely receiving wages via unregulated cryptocurrency wallets indicates likely fraud. This anonymizes transfers from victims.

How to Identify the BlackRock Mall Scam Offers on Messaging Apps

In addition to spoof websites, this scam depends on scammers using WhatsApp, Telegram, Facebook, texts and social media to send initial unsolicited job offers. Learning how to spot fraudulent BlackRock opportunities on these platforms is key to avoiding manipulation.

Here are common characteristics of fake BlackRock job posts, messages, and advertisements:

1. They Contact You First

Legitimate companies and recruiters rarely contact potential candidates completely unprompted. Cold messages touting jobs signal likely scams trying to cast wide nets for victims.

2. Vague Job Titles and Descriptions

Listings may generically tout “Online Assistants” or “Brand Ambassadors” needed urgently without formal titles or detailed duties. This lack of specifics indicates hastily fabricated opportunities.

3. Guaranteed High Income for Little Time

Promises of earnings upwards of $800+ weekly for less than one hour of work daily should trigger skepticism. Such outsized pay conflicts with reasonable rate ranges.

4. Poor Grammar and Spelling

Messages often demonstrate linguistic indicators suggesting non-native English speaking scammers targeting English speakers globally. Notice multiple awkward phrases or misspellings.

5. Requests for Personal Information

Scammers may request private details to “formalize” hiring before interviews or vetting. Genuine recruiters would not inquire about bank accounts, IDs, address, etc. prematurely.

6. Urgency to Send Money

Pressuring quick payments for training, bonuses, or supplies indicates attempted fraud. Real openings outline transparent onboarding processes devoid of employees fronting their own funds.

By recognizing these and other common red flags, social media users can more easily identify fraudulent BlackRock-tied opportunities used to enable financial scams. While scammers hide behind fake profiles, their inconsistent messaging reveals deceit.

What to Do If You Already Paid the BlackRock Mall Scam

If you suspect you were manipulated by fraudulent BlackRock job offers or its connected fake Mall portal, remain calm and promptly take the following actions:

Step 1: Cease All Engagement

Immediately cease any further interaction with supposed BlackRock reps directing you to the Mall platform. Block their accounts/numbers across all channels to prohibit access to you.

Step 2: Contact Banks and Credit Card Companies

Notify your bank and card providers regarding any unauthorized transactions tied to the scam job. Freeze affected accounts and dispute charges to halt further damages.

Step 3: Gather Any Available Evidence

Before blocking the scammers, capture all available website screenshots, chat logs, transaction records, and identifying details on them and reported income.

Step 4: Report Losses to Authorities

File detailed fraud reports outlining losses and the scam tactics used with the FTC and FBI Internet Crime Complaint Center to aid related investigations.

Step 6: Explore Recovery Options

Depending on specific payment methods used, engage professional recovery assistance to potentially reclaim lost money. Certain cases allow alternatives like chargebacks.

Avoiding BlackRock Employment Scams

Here are key measures users can take to steer clear of viral job scams imitating trusted brands like BlackRock:

Avoid Unsolicited Offers

Exercise extreme caution regarding any unprompted remote job offers, especially replying to random texts or messages, as this signals likely fraud efforts.

Research All Companies Thoroughly

Vet any mentioned companies independently before further engaging. Search reputable business records and directories to confirm identities, not just provided websites.

Watch for Red Flags

Remain vigilant for other common scam giveaways like grammatical errors, urgently high income promises, cryptocurrency demands, fake user testimonials, any request for payments to work, etc.

Confirm Video Interviews

Insist on live video screening interviews via Skype or similar software with supposed hiring managers before providing personal data. Scammers will provide excuses to avoid revealing deceit.

Listen to Your Intuition

Trust inner doubts or concerns signaling if unsolicited offers seem questionable. Don’t ignore initial gut reactions warning about potential scams exploiting job desperation.

Frequently Asked Questions About the BlackRock Mall Scam

What is the BlackRock Mall scam?

The BlackRock Mall scam uses unsolicited job offers promoting unbelievable work-from-home roles with BlackRock paying very high incomes. But “BlackRock Mall” is a fake platform scammers created to steal bank account details and money from victims under the guise of employment.

How are victims targeted initially?

Random unprompted messages are sent via SMS text, WhatsApp, Telegram, etc. advertising flexible BlackRock positions paying over $500 weekly. This hooks targets to gather details for further manipulation.

What techniques do scammers use?

Tactics include mirroring BlackRock branding on “BlackRock Mall”, gradually building trust through fake tasks tracking “earnings”, insisting funds get sent to unlock commissions visible in dashboards, demanding growing payments, and blocking victims after extracting maximal funds.

What are some fake site URLs used?

- BlackRockMall.site

- BlackRockSurveyTakers.co

- BlackRockBrandAmbassadors.us

- BlackRockTaskForce.ca

- BlackRockCSjobs.biz

How can I recognize fraudulent offers or sites?

Watch for unsolicited random contact, claims too good to be true, grammatical errors, urgent payment demands, cryptocurrency only wages, inability to directly contact listed recruiters, recently created domains, and other warning signs outlined here.

Should I pay any requested funds?

No, never pay any upfront fees to secure a job opportunity. Real hiring doesn’t require employees to spend their own money for training, supplies, or starter costs to begin working. Payment requests always enable financial theft.

Can stolen money be recovered?

Potentially yes if acted upon quickly. Contact your bank immediately about suspicious charges related to fake BlackRock job offers to potentially reverse payments not yet processed. Certain cases also allow alternatives like civil recovery lawsuits.

How can I avoid this BlackRock scam?

Be wary of all unprompted job leads, thoroughly vetting all claims, companies mentioned, and links provided rather than acting hastily solely based on urgency tactics or highly alluring income guarantees without market foundation.

The Bottom Line

The BlackRock Mall illustrates the dark side of viral job scams leveraging familiar consumer brand names — organized criminals hiding internationally constructing elaborate hoaxes. Still, the insights into scammer psychological tactics andstructions provided here offer potential victims valuable armor to protect finances and avoid conversion altogether.

By proactively protecting finances using fraud avoidance best practices rather than acting hastily regarding appealing job offers, those struggling with employment can safeguard themselves during volatility. With vigilance, the facade of scammer tools like fake “BlackRock Mall” platforms crumbles. Awareness represents power against manipulation against viral job scams falsely using icons like BlackRock.