Imagine receiving an alarming text message claiming you have an unpaid toll balance from the Ohio Turnpike. The message urges you to click a Ohezp.com link and pay a small fee immediately to avoid a hefty $35 late charge. In a panic, you might be tempted to comply. But hold on – this is a phishing scam designed to steal your sensitive financial and personal data. The Ohezp.com scam is one of the latest iterations of toll payment cons preying on unsuspecting drivers.

In this in-depth article, we’ll unmask the tactics behind this scheme, show you how to spot the warning signs, and guide you on what to do if you’ve fallen victim.

Scam Overview

The Ohezp.com scam revolves around deceptive text messages that appear to come from an official source related to the Ohio Turnpike toll system. Scammers craft these urgent-sounding texts to manipulate recipients into believing they have unpaid toll violations that must be resolved at once to avoid significant penalties.

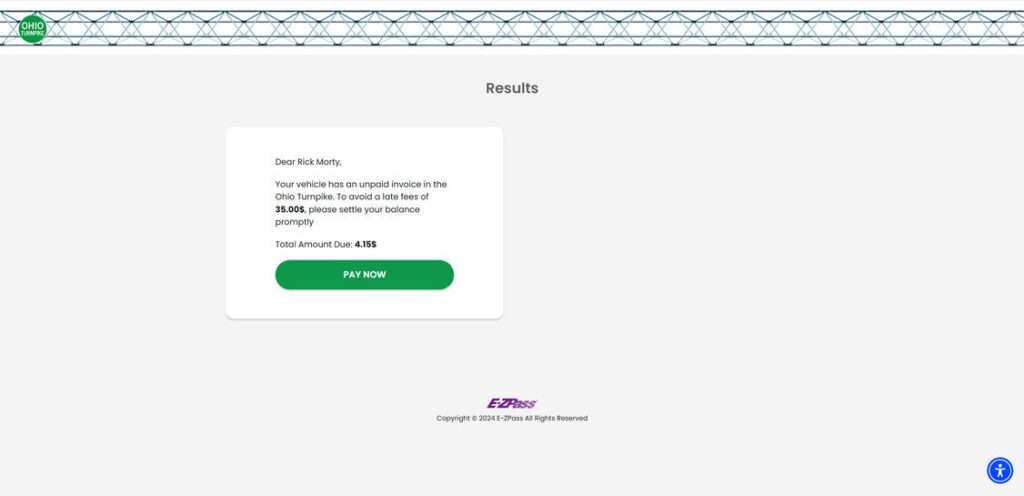

A typical Ohezp.com scam text claims that the Ohio Toll Services have noted an outstanding toll balance, usually a small and specific amount like $4.15, tied to your vehicle. To give the message an air of legitimacy, the scammer may include real details like “Ohio Turnpike” or “Ohio Toll Services” – entities that sound plausibly connected to the state’s toll operations.

The fraudulent text then warns that failure to pay this minor toll debt right away will result in a much larger late fee, often $35. By citing an exact late penalty amount, the scammer aims to make the threat feel credible and concrete, increasing the pressure on the target to act quickly without much scrutiny.

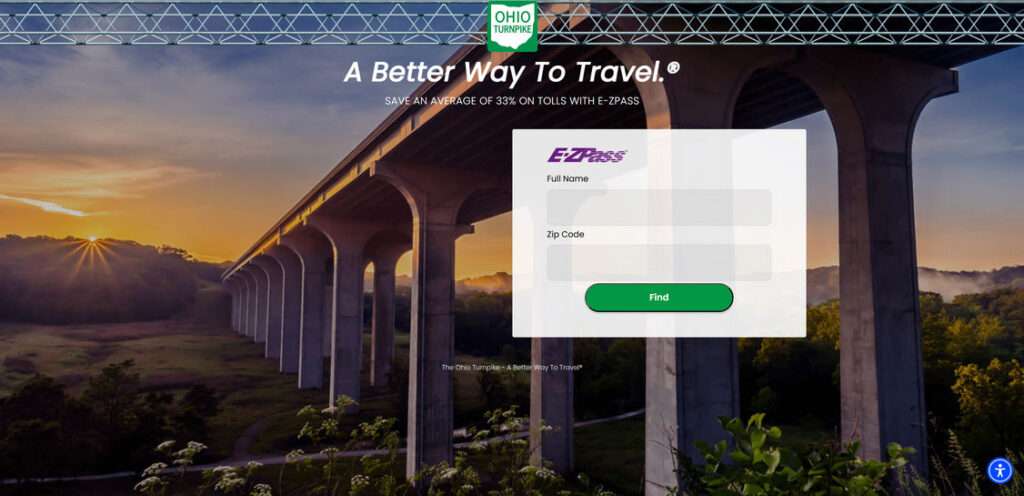

Here’s where the scam’s core deception comes in: the text provides a link, frequently including some variation of “ohezp.com” in the URL, where the supposed toll balance can conveniently be paid online. If the victim clicks this link, they are directed to a convincing but completely fake payment website designed to closely resemble an authentic Ohio toll portal.

This phony site’s sole purpose is to trick worried drivers into submitting their sensitive financial details, like credit card numbers, expiration dates, and security codes. Some bogus Ohezp.com payment forms may go even further and request additional personal information such as the victim’s full name, date of birth, address, driver’s license number, or Social Security number.

Once a victim enters this private data on the fraudulent Ohezp.com form and hits submit, the information is instantly captured by the scammer. The stolen financial details can then be used for unauthorized purchases, draining the victim’s accounts, or sold to other criminals on the dark web. Personal data swiped in the scam can also enable identity theft, potentially allowing crooks to open credit cards, secure loans, or commit other fraud under the victim’s name.

It’s critical to understand that authentic toll agencies, in Ohio or elsewhere, will never demand payment for account issues via text message, nor will they randomly contact you about tolls by SMS. Toll operators have secure portals on their official websites and mobile apps where drivers can log in and handle any legitimate toll business.

The Ohezp.com scam, like similar cons impersonating other state tolling systems, relies on catching targets off guard and pressuring them to act before thinking. By crafting messages with startling claims of debt and looming consequences, the scammers aim to stir up a sense of urgency and anxiety that can cloud the victim’s judgment.

In the following sections, we’ll break down exactly how Ohezp.com scams play out step-by-step, highlight the red flags to watch for, and share practical guidance on protecting yourself and recovering if you’re victimized.

How the Ohezp.com Scam Works

The Ohezp.com scam is a textbook example of a phishing con – a ploy that imitates trusted sources like government agencies or reputable businesses to dupe victims into revealing sensitive data. Here’s a detailed step-by-step dissection of how Ohezp.com scammers operate:

Step 1: Scammers Send Out Phony Toll Violation Texts

The scheme begins when the scammer dispatches a wave of fraudulent text messages to countless potential targets. These texts are designed to appear as if they’re from an official entity tied to the Ohio Turnpike toll system, lending a false sense of credibility. The sender name might say something like “Ohio Toll Services” or spoof an official-looking number.

Step 2: Creating a False Sense of Urgency and Threat

The scam text deploys alarmist language right off the bat, asserting that the recipient has an outstanding unpaid toll balance connected to their vehicle. Citing a precise dollar figure for the debt, often a small amount like $4.15, helps make the claim feel specific and plausible.

To crank up the pressure, the message warns of a looming $35 late penalty if the alleged toll isn’t paid immediately. This is a key psychological tactic – the scammer bets that the victim would rather quickly pay a smaller $4 “debt” than risk getting slapped with a much heftier $35 fee. By making the late charge exactly $35, the crook lends an air of authenticity.

Step 3: Providing a Convenient (But Bogus) Payment Link

Helpfully, the very same text that alerts the target to their supposed toll trouble also offers a solution: just click on the included link to a website where the balance can be speedily resolved! But this link is the linchpin of the scam, directing the victim not to a legitimate payment portal but to the scammer’s carefully laid trap.

The URL provided usually includes a variation of “ohezp.com” to give it a patina of authenticity (as “oh” suggests Ohio and “ezp” implies an easy payment). But any resemblance to the real Ohio Turnpike site is purely cosmetic.

Step 4: Victim Lands on Convincing Phony Payment Page

If a target takes the bait and clicks the scam link, they are instantly whisked away to an imposter website that is cunningly designed to closely mimic an official Ohio toll payment portal. From the colors and fonts to the placement of logos and navigation elements, the bogus page may appear nearly indistinguishable from the genuine article at a frightened glance.

Front and center, the phishing site declares the victim’s precise dollar “debt” cited in the original text. It may even sprinkle in data points like the target’s phone number (effortlessly grabbed when they clicked the scammy link) to lend a false sheen of legitimacy and access to their info. A countdown clock ticking toward the $35 “late fee” deadline ratchets up the sense of urgency.

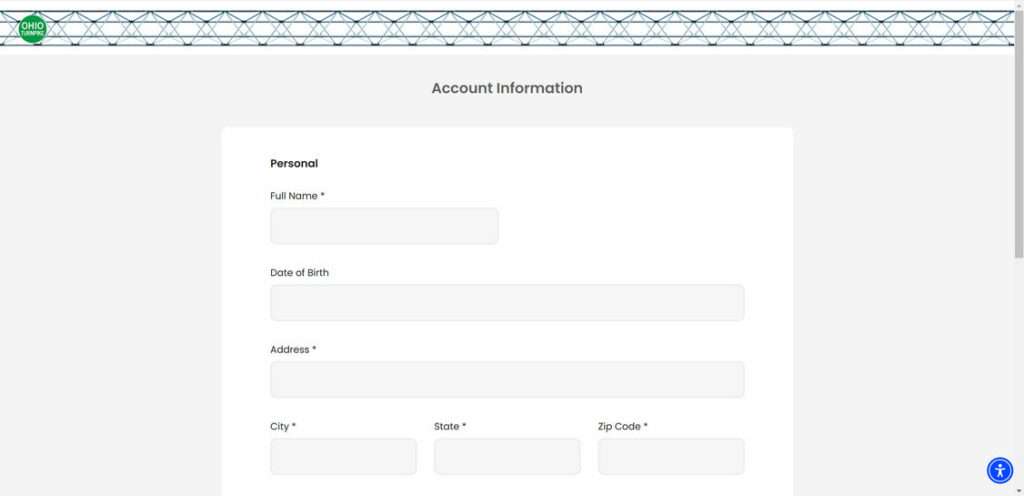

Step 5: Phishing Site Demands Sensitive Financial and Personal Data

Of course, the heart of the phony payment page is the online form where the debt can supposedly be cleared up. This form requires the victim to input highly sensitive details ostensibly needed to process their toll balance. Typical fields ask for the target’s full credit or debit card number, card expiration date, CVV security code, and billing ZIP code.

Some Ohezp.com cons take the ruse even further by requesting additional private information like the victim’s complete legal name, date of birth, home address, phone number, driver’s license ID, or even Social Security number. Scammers know that the more personal data points they can extract, the easier it becomes to commit identity theft or other fraud later.

Step 6: Scammers Harvest Victims’ Data for Fraud

As soon as an unwitting target submits their financial and personal information on the phishing page, that sensitive data is instantly captured and transmitted to the scammers behind the Ohezp.com ploy. The victim may see a reassuring but fake confirmation message on the page, or get bounced to an error screen, but the damage is already done.

Armed with the victim’s credit card or bank account details, the scammers can swiftly begin making unauthorized purchases, siphoning money, or selling the data to other criminals on the dark web. And any additional sensitive info entered, like a Social Security or driver’s license number, can be weaponized to steal the victim’s identity and commit more extensive fraud.

Step 7: Fallout for Victims – Financial, Credit, and Security Woes

Many Ohezp.com victims discover they’ve been conned in the worst way – strange purchases on their bank statements, maxed out credit cards, or sudden debt collection notices for accounts they never opened. Undoing the financial and credit damage inflicted by clever phishing scams can be a draining ordeal.

Aside from monetary losses and credit report hits, identity theft stemming from data compromised in schemes like Ohezp.com can haunt victims for years as crooks exploit their info. Clearing your name after scammers use it for fraud is often an uphill battle.

The emotional distress of realizing you’ve been scammed and the anxiety of watching your accounts can also take a harsh toll. Victims frequently report feelings of embarrassment, anger, powerlessness, and eroded trust.

What to Do If You’ve Fallen for the Ohezp.com Scam

If you suspect you’ve been deceived by an Ohezp.com phishing text, acting swiftly is essential to minimize potential harm. Take these key steps if you think you’ve given information to scammers:

- Immediately contact your credit card issuer and bank. Report that your accounts may be compromised. Ask them to cancel your current cards, issue new ones, and flag your account for fraud monitoring. Scrutinize your statements for any unauthorized charges and dispute them with your financial institution.

- Change the login passwords for any accounts that could be impacted, especially your bank and credit card accounts. Use strong, unique passwords for each. Enable two-factor authentication when available for an extra layer of security.

- Closely watch your credit reports from all three major bureaus (Equifax, Experian, and TransUnion) for warning signs of identity theft, like accounts or inquiries you don’t recognize. You can request one free report from each bureau per year at AnnualCreditReport.com. Consider placing a fraud alert or freeze on your credit files.

- Report the phishing text to your mobile carrier by forwarding it to 7726 (SPAM). This helps carriers identify and block scam numbers.

- File a complaint with the Federal Trade Commission at ReportFraud.ftc.gov. The FTC tracks data on phishing scams to better educate the public and combat fraud.

- Notify the actual Ohio Turnpike and Infrastructure Commission of the scam using the contact info on their official website. They can investigate and alert other customers.

- Stay alert to other potential scam attempts. Criminals may re-target past victims, so be wary of unsolicited messages claiming to be from government agencies, banks, or anyone seeking your personal info.

Remember, being victimized by a sophisticated phishing con is never your fault. These schemes are meticulously designed to deceive even cautious consumers. The crucial thing is to respond rapidly, notify key parties, and take steps to protect your accounts and identity moving forward.

Frequently Asked Questions About the Ohezp.com Unpaid Ohio Toll Scam

Q1: What is the Ohezp.com Ohio toll scam, and how does it work?

A: The Ohezp.com scam involves fraudulent text messages claiming to be from the Ohio Turnpike authority, alleging that the recipient has an unpaid toll balance, usually around $4.15. The texts pressure victims to click a link and submit payment immediately to avoid a hefty $35 late fee. However, the link leads to a convincing but fake payment site designed to steal people’s sensitive financial and personal information.

Q2: How can I tell if a text message about an unpaid Ohio toll is a scam?

A: Be on the lookout for these warning signs that often indicate an Ohezp.com toll phishing scam:

- Unsolicited texts claiming to be from the Ohio Turnpike or “Ohio Toll Services”

- Messages claiming you have a small unpaid toll balance from a recent trip

- Threats of a substantial late penalty (usually $35) if you don’t pay right away

- Pressure to click a link and submit payment urgently to avoid fees

- A sense of undue urgency or aggressive language atypical of legitimate toll notices

Remember, the real Ohio Turnpike authority will never contact you out of the blue demanding toll payment via text message.

Q3: I’m not sure if a text I got about an unpaid Ohio toll is real or a scam. How can I check?

A: If you’re unsure about the legitimacy of a supposed unpaid toll text, do NOT click any links in the message itself, as they could direct you to a scammer’s phishing site. Instead, visit the official Ohio Turnpike website directly by typing the URL into your browser. Log into your account there to see if any outstanding toll issues appear. You can also contact the Ohio Turnpike customer service using the phone number listed on your previous billing statements or the official website. If the unpaid toll in question doesn’t show up in your official account or records, it’s almost certainly a scam attempt.

Q4: What could happen if I click a link or enter my information on a scam Ohezp.com payment form?

A: If you click a link in an Ohezp.com phishing text, it will send you to a fake payment website cleverly created to closely resemble a legitimate Ohio Turnpike payment portal. There, you’ll be asked to enter your credit card number, expiration date, CVV code, and ZIP code to supposedly pay the claimed toll balance. Some bogus forms may request even more sensitive details like your full name, birthdate, address, driver’s license number, or Social Security number.

Any information you enter on these phony Ohezp.com sites is instantly transmitted to the scammers and can be used to make unauthorized purchases, empty your bank account, or steal your identity to open new accounts in your name. Scammers may also sell your data to other criminals on the dark web for further exploitation.

Q5: I fell for an Ohezp.com scam text and gave my personal information. What should I do now?

A: If you believe you’ve entered sensitive data on a scam Ohezp.com site, take these steps immediately to mitigate potential damage:

- Contact your credit card issuer and bank right away to report the compromise. They can cancel your cards, issue new ones, flag your account for suspicious activity, and help you dispute any fraudulent charges that arise.

- Change your login passwords for any accounts that may be impacted, especially your online banking and Ohio Turnpike accounts if applicable. Always use strong, unique passwords for each site and enable two-factor authentication when offered.

- Carefully review your upcoming credit card and bank statements for unauthorized transactions and promptly report any you find to your financial institution.

- Check your credit reports from all three major bureaus (Equifax, Experian, and TransUnion) for red flags like mystery accounts or inquiries. Visit AnnualCreditReport.com for your free reports. Consider placing a fraud alert or security freeze on your credit files.

- Report the phishing text to your mobile carrier by forwarding it to 7726 (SPAM) and file complaints with the FTC and the actual Ohio Turnpike authority to help combat this scam.

Q6: Are Ohezp.com toll phishing scams limited to Ohio drivers, or could people in other states be targeted?

A: While the Ohezp.com scam specifically targets Ohio Turnpike customers, the general tactics used in this con could easily be modified to mimic toll authorities in other regions. Similar schemes might spoof the names of major toll operators nationwide like E-ZPass, SunPass, FasTrak, or TxTag to deceive their customer bases.

Specific website names and details may differ, but the essential goal is always the same: to manipulate victims into revealing financial data and personal details under the guise of paying allegedly unpaid tolls and late fees.

No matter where you live or what toll roads you use, always be wary of surprise texts that demand swift toll payments to avoid penalties. Reach out to your local toll agency directly using official contact info if you have any doubts.

Q7: How can I avoid falling for Ohezp.com and similar toll phishing scams in the future?

A: Protect yourself from Ohezp.com scams and other toll phishing cons with these precautions:

- Be highly suspicious of any unsolicited text messages about supposed unpaid tolls or fees, even if they appear to come from a toll agency you use. Scammers often spoof real company names.

- Never click on links in unexpected toll collection texts, especially those that threaten dire consequences for not paying immediately. Legitimate toll authorities will not send payment demands via text.

- Avoid replying to suspicious texts with any personal or financial information. No genuine toll agency will ask you to provide sensitive details via text.

- Always navigate to the toll operator’s official website by entering the URL manually in your browser, never through links in unsolicited messages.

- Keep your phone’s operating system and security apps updated to ensure you have the latest protections against emerging phishing threats.

Q8: What should I do if I receive a suspicious text message claiming to be from the Ohio Turnpike about an unpaid toll?

A: If you receive a text that you suspect is an Ohezp.com toll phishing scam, take these steps:

- Do NOT reply to the message, click on any links, or call any numbers provided in the text.

- Forward the text to 7726 (SPAM), a universal number used by mobile carriers to collect data on potential scam messages.

- Delete the suspicious text from your phone.

- Contact the Ohio Turnpike and Infrastructure Commission through official channels on their website or your previous billing statements to verify if there are any legitimate issues with your toll account. Do not rely on any contact information from the suspicious text.

- Report the phishing attempt to the Federal Trade Commission at ReportFraud.ftc.gov to aid their monitoring of scam trends.

- Notify the Ohio Turnpike and Infrastructure Commission and the Ohio Attorney General’s office about the suspected scam to help alert other motorists.

Q9: What are the potential legal consequences for scammers behind Ohezp.com phishing schemes?

A: Criminals who orchestrate Ohezp.com phishing scams can face serious legal repercussions under federal and Ohio state laws.

Prosecutors may charge scammers with a range of felonies, including wire fraud, identity theft, credit card fraud, computer crimes, and money laundering. Convictions could result in lengthy federal prison sentences – often 20 years or more per offense – as well as heavy fines frequently reaching hundreds of thousands or even millions of dollars.

Multiple law enforcement agencies, from the FBI and FTC to Ohio’s Attorney General and Highway Patrol, collaborate to investigate and bring charges against phishing scammers. Many suspects are prosecuted for several related offenses and can face decades behind bars.

Reporting suspected Ohezp.com phishing attempts helps authorities track these scams, warn potential victims, and work to bring perpetrators to justice.

Q10: What should I do if I spot a social media post, website, or online ad promoting an Ohezp.com unpaid toll scam?

A: If you encounter an online post, website, or advertisement spreading the Ohezp.com scam:

- Do NOT interact with the content in any way. Avoid clicking links, sharing posts, or submitting any information.

- Report the scam content to the platform where you found it:

- On social media sites like Facebook or Twitter, use the built-in reporting options to flag posts as scams or fraud.

- For suspicious websites, contact the site owner or hosting provider to alert them. You can look up website owners via WHOIS database searches.

- Report scammy online ads to the advertising network or publisher displaying them, such as Google Ads or the website owner.

- Notify the Ohio Turnpike and Infrastructure Commission about the scam content so they can investigate.

- File a complaint with the FBI’s Internet Crime Complaint Center at IC3.gov to aid law enforcement efforts against online toll scammers.

- Consider warning friends, family, or social media followers about the circulating Ohezp.com scam to help protect your community.

By promptly reporting Ohezp.com scam content you find online, you can help stop these cons from reaching more potential victims. Collective action is key to combating evolving toll phishing threats.

The Bottom Line on Ohezp.com Scam Texts

The Ohezp.com scam is a stark reminder of the growing threat that phishing cons pose as our lives increasingly move online. By impersonating trusted entities like state toll agencies and using manipulative tactics to provoke a sense of urgency, these schemes can pressure even savvy individuals into exposing their sensitive data.

As more toll systems embrace electronic payment and enforcement methods, scammers are finding fertile ground to exploit drivers’ familiarity with getting toll notices via text or email. The Ohezp.com ruse underscores the importance of approaching any unsolicited request for payment or personal information with a healthy dose of skepticism.

If you receive a text claiming to be from the Ohio Turnpike about an unpaid toll, always remember that legitimate agencies will never threaten you or demand payment by text message. If in doubt, contact the toll authority directly using verified info from your official billing statements or their secure website.

For those who have fallen prey to Ohezp.com or similar scams, acting quickly to secure accounts, dispute fraudulent charges, and alert authorities is critical. The road to financial and identity recovery can feel daunting, but swift response can help limit the damage.

![Remove Emotomalf.com Pop-up Ads [Virus Removal Guide] 10 McAfee scam 4](https://malwaretips.com/blogs/wp-content/uploads/2023/08/McAfee-scam-4-290x290.jpg)