It comes in like any other text. No warning, no context, just a blunt “Final Notice” and a clock that starts ticking the second you read it.

Twenty-four hours, it says. Pay now, or your registration gets suspended. Your license could be next. Even your credit score is suddenly on the line.

Most people feel the same thing in that moment, a quick spike of panic, followed by one question: is this real?

Before you tap anything, there’s something you need to know about these Florida FLHSMV DMV scam texts, because the part that looks most official is often the most dangerous.

Scam Overview

The Florida FLHSMV DMV text scam is a type of “smishing,” which is phishing delivered through SMS text messages. Instead of sending you a suspicious email that you might ignore, scammers choose text because it feels more immediate, more personal, and harder to dismiss.

Most people do not expect a government-related fraud attempt to arrive by text. Scammers know that. They also know that driving is not optional for many Floridians. If someone believes their license or registration is at risk, they might pay quickly just to make the problem disappear.

That is the scam’s core strategy: create pressure, offer a quick fix, and steal what they can in the moment.

The exact scam text pattern Florida drivers are seeing

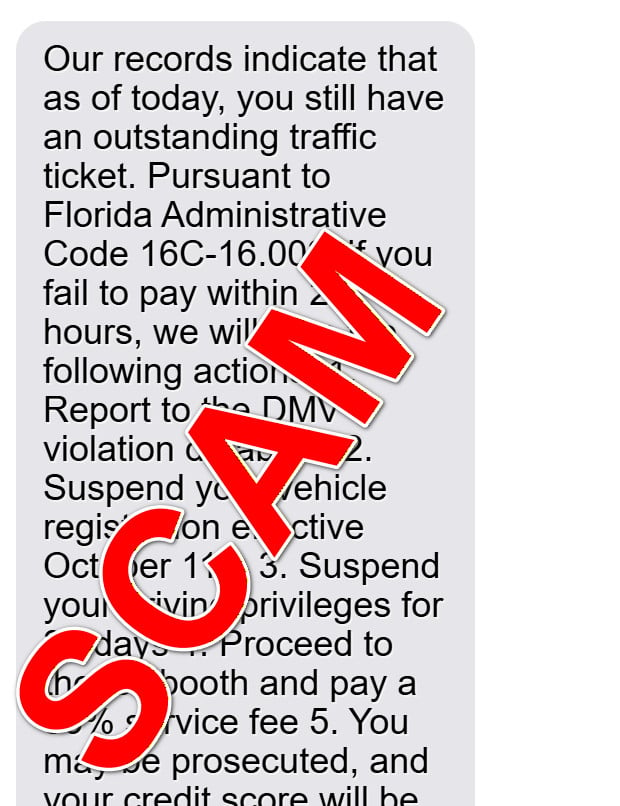

You provided a version of the scam message. It matches the broader template that has been circulating across multiple states, including Florida. It typically looks like this:

“Our records indicate that as of today, you still have an outstanding traffic ticket. Pursuant to Florida Administrative Code 16C-16.003, if you fail to pay within 24 hours, we will take the following actions:

- Report to the DMV violation database

- Suspend your vehicle registration effective October 11th

- Suspend your driving privileges for 30 days

- Proceed to the toll booth and pay a 35% service fee

- You may be prosecuted, and your credit score will be affected

Pay Now: …

(If the link is unclickable, reply ‘Y’ and reopen this message…)

flhsmv.gov

FLHSMV”

At first glance, it hits all the right “official” notes:

- It claims “records indicate” you owe something

- It references a Florida administrative code

- It lists enforcement actions in numbered format

- It includes scary consequences most people want to avoid

- It pushes a rapid deadline: 24 hours

- It tries to look legitimate by mentioning “flhsmv.gov” and “FLHSMV”

It is designed to feel like a final warning, not a first notice.

Why this scam feels so believable

Scammers borrow credibility from real systems you already trust. They are not trying to invent a new fear. They are aiming straight at fears you already have:

- Losing your license

- Getting pulled over with a suspended registration

- Paying extra fees

- Getting sent to collections

- Credit score damage

The scam does not need to be perfect. It only needs to feel plausible for 30 seconds. That is long enough for someone to click.

To make that happen, scammers lean on five persuasion triggers that show up in almost every Florida DMV text scam variant.

1) Authority

Most people are conditioned to take government notices seriously. The scam impersonates FLHSMV or “the DMV” because those institutions carry weight.

FLHSMV has published scam alerts specifically warning Floridians that the agency will not contact you via text demanding payment or threatening suspension or arrest.

That warning exists for a reason: impersonation is the whole play.

2) Urgency

“Pay within 24 hours” is not a normal timeline for legitimate government processes. It is a pressure tactic.

Urgency does two things:

- It reduces your chance of verifying the claim

- It increases the chance you will act emotionally instead of logically

When people feel rushed, they skip steps. Scammers build their entire funnel around that moment.

3) Specificity

Scams used to be vague. Now the best ones are specific on purpose.

They include:

- A named agency (FLHSMV)

- A “code section”

- A list of enforcement steps

- A specific fee amount like 35%

- A date like “effective October 11th”

Specific details can be completely fake and still be persuasive. A lot of people interpret detail as proof.

4) Fear stacking

One threat can be dismissed. Five threats at once are harder to ignore.

That is why the scam piles on multiple consequences:

- DMV database reporting

- Registration suspension

- Driving privilege suspension

- Extra 35% fee

- Prosecution and credit score harm

Even if you doubt one item, the bundle makes you think, “What if one of these is true?”

The Federal Trade Commission has warned about these exact overdue traffic ticket scam texts, including language about a “DMV violation database,” registration and license suspension, an added 35% service fee, prosecution threats, and credit score damage.

5) A low-friction “solution”

The scam does not just scare you. It also offers relief: “Pay Now.”

The relief is one click away. That is critical.

A real ticket can be confusing. A real government portal can require multiple steps. This scam is smooth by design because the scammers want you to feel like the fastest path is the safest path.

What the scammers are really trying to steal

These scam texts are not about your driving record. They are about harvesting valuable data and turning it into money.

Depending on the version of the phishing site you land on, scammers may try to collect:

- Full name

- Phone number

- Home address

- Email address

- Date of birth (sometimes)

- Driver license number (sometimes)

- Payment details, including card number, expiration date, and security code

Even if the “fine” looks small, the real goal is almost always your card data and identity information.

Once scammers have your card details, they can:

- Run small test charges to see if the card works

- Make larger purchases later

- Sell the card details to other criminals

Once they have personal information, they can:

- Launch more targeted scams that reference your real name and address

- Attempt identity theft, such as opening accounts

- Sell your information in bulk to other scam groups

Why the “reply ‘Y’” instruction matters

Many versions include a line like:

“If the link is unclickable, reply ‘Y’ and reopen this message.”

That is not customer support. It is manipulation.

Replying does at least two useful things for scammers:

- It confirms your number is active and monitored

- It increases your psychological commitment, because once you respond, you are more likely to continue

It also conditions you to follow instructions. That is dangerous in any phishing flow.

Why scammers keep using “FLHSMV” and “flhsmv.gov”

Because it works.

Even if the link they provide is not actually a .gov website, many people will see the words “flhsmv.gov” inside the message and assume the link must be real.

This is one of the most important rules to remember:

A scam message can say “flhsmv.gov” while sending you to a completely different website.

Scammers often use lookalike domains, extra words, or strange endings. They may also hide the true destination behind a redirect.

That is why FLHSMV’s guidance focuses on behavior, not just appearance: do not click links in suspicious texts, and do not share personal or financial information through unsolicited messages.

Why Florida drivers are prime targets

Florida is a high-volume target for scams in general, and DMV-style threats are especially effective here for a few practical reasons:

- Many people rely on driving daily for work, school, and family responsibilities

- Tourists and seasonal residents can feel less confident about local systems

- Florida roads include toll infrastructure, so people are already used to “driving-related bills”

- Scammers can easily blend “traffic ticket” language with “toll fee” language

And once a scam template works in one state, criminals reuse it everywhere. They simply swap the state name, the agency name, and the “code” reference.

The key truth FLHSMV wants drivers to understand

Here is the clearest line to anchor to:

FLHSMV will not contact you by text message demanding payment or threatening suspension or arrest.

If the first time you are hearing about an “outstanding ticket” is a text message with a payment link and a 24-hour deadline, you are almost certainly dealing with a scam.

How The Scam Works

Below is the step-by-step breakdown of how the Florida FLHSMV DMV text scam typically unfolds, including what the victim experiences and what is happening behind the scenes.

Step 1: Scammers send texts in bulk to thousands of phone numbers

This scam is built for scale.

Scammers do not need to know whether you have a ticket. They blast messages to large lists of numbers and rely on probability. If even a small percentage of people click, the scam is profitable.

Phone numbers can be obtained from:

- Data leaks and breached databases

- Purchased marketing lists

- Automated number generation

- “Lead” lists traded between criminal groups

This is why people who have never had a recent citation still get the text.

Step 2: The message creates panic with a “Final Notice” tone

The wording is intentionally sharp.

It does not sound like a polite reminder. It sounds like enforcement is already in motion. It uses phrases like:

- “Our records indicate…”

- “Pursuant to Florida Administrative Code…”

- “If you fail to pay within 24 hours…”

- “We will take the following actions…”

This framing triggers a very human reaction: fix it now.

The FTC has warned consumers about these overdue traffic ticket texts and specifically notes the pattern of urgent threats and the push to pay immediately.

Step 3: The text includes “legal dressing” to reduce skepticism

Most people do not know what Florida Administrative Code sections exist, and scammers exploit that.

A code reference like “16C-16.003” is there to send one message to your brain:

“This must be real. They know the law.”

In reality, scammers often use citations that are irrelevant, incorrect, or fabricated. The code is not there for accuracy. It is there to lower your guard.

Step 4: The scam stacks consequences to make inaction feel risky

This is the part of the text that often pushes people over the edge.

The threats are not subtle:

- Reporting to a DMV database

- Registration suspension

- License suspension for 30 days

- A 35% service fee

- Prosecution

- Credit score damage

This technique is called fear stacking. Even if one threat sounds off, the list makes you think at least one of them might be real.

And if you are busy, distracted, or stressed, that doubt can be enough to click.

Step 5: The scam uses a link to funnel you into a fake payment portal

The “Pay Now” link is the doorway.

Once you click, you are usually taken to a website that is designed to look like an official DMV or FLHSMV portal. These pages often include:

- Florida-themed headers and official-sounding language

- A clean layout that resembles a payment form

- A “ticket lookup” screen asking for your name, phone, or plate number

- Buttons like “Continue,” “Verify,” or “Pay Now”

Some are sloppy. Others are polished enough to fool someone who is already nervous.

Either way, the page is doing one thing: collecting your information.

Step 6: The site asks for personal details first, then payment information

Many victims expect a payment screen. They do not expect the amount of information the site requests.

A typical flow looks like this:

- “Confirm identity” screen

- Name

- Phone number

- Address

- “Violation details” screen

- A fake citation number appears

- A fake fine amount appears

- A countdown timer may appear to increase pressure

- “Payment” screen

- Card number

- Expiration date

- Security code

- Billing address

That “billing address” detail matters. It increases the chance the scammer can successfully run transactions that use address verification.

Step 7: The scam often asks for a small payment to make it feel harmless

Many versions of DMV text scams use a small dollar amount to reduce resistance.

It is easier to convince someone to pay $10 than $250.

The mindset scammers want is:

“This is annoying, but it’s not worth fighting. I’ll just pay it.”

Once you enter your card details, the amount does not matter anymore. The card data is the prize.

Step 8: The site shows a fake confirmation to buy time

After you submit payment, many scam sites show a “success” message.

This is a delay tactic.

If you think it worked, you might not check your banking app right away. You might not call your bank immediately. That gives scammers more time to use the card.

In some cases, the site may also show an “error” and ask you to enter a second card. That can happen if the scammers want multiple cards in one visit.

Step 9: Scammers monetize the card information quickly

Once scammers have your card details, they often move fast.

Common patterns include:

- Small test charges, then larger charges

- Online purchases that can be resold quickly

- Digital gift card purchases

- Charges routed through payment processors that look unfamiliar

If the victim entered personal details, scammers may also begin preparing identity theft attempts or selling the identity data to others.

Step 10: The scam “refreshes” and repeats with new domains and new numbers

Even when a domain gets reported, scammers can replace it quickly.

They rotate:

- Phone numbers and sender IDs

- Website domains

- Page designs

- The exact wording of the threats

That is why the scam keeps resurfacing. It is not one person. It is a repeatable system.

Step 11: Many victims get targeted again with follow-up scams

Once scammers know a number is active and responsive, follow-up attempts are common.

These can include:

- A “refund” text claiming your payment was reversed and you must confirm banking details

- A “collections” text demanding additional fees

- A “fraud department” call pretending to help you fix it

- A second DMV-style text that looks even more convincing

This is why one of the best protections is to stop engaging entirely and verify through official channels you find yourself, not through the text.

Quick checklist: the biggest red flags in Florida DMV scam texts

If you want a fast way to spot the Florida FLHSMV scam, watch for these signs:

- A text message claims you owe a traffic ticket you never heard about

- A 24-hour deadline or “final notice” tone

- Threats of license suspension or registration suspension by a certain date

- A mention of a 35% fee or “toll booth” service fee

- A link that is not clearly an official .gov page

- Instructions to reply “Y” to activate the link

And most importantly:

FLHSMV says it will not text you demanding payment or threatening enforcement actions like suspension or arrest.

What To Do If You Have Fallen Victim to This Scam

If you clicked the link, replied to the message, or entered information, do not panic. You can still take control of what happens next.

Here is a calm, detailed action plan.

- Stop interacting with the text immediately

Do not click anything else. Do not reply again. Do not argue with the sender. Close the message. - If you entered card details, contact your bank or card issuer right away

Tell them your card was entered on a phishing site impersonating FLHSMV or the DMV. Ask them to:- Cancel the compromised card

- Issue a replacement card number

- Review recent and pending transactions

- Dispute any unauthorized charges

- Check your recent transactions and pending charges carefully

Look for:- Small test charges you do not recognize

- Purchases from unfamiliar merchants

- Pending charges that might post later

If you see anything suspicious, report it immediately.

- If you entered personal information, protect your identity next

If you submitted your name, address, or other identity details, consider taking stronger steps:- Place a fraud alert with the credit bureaus, or

- Freeze your credit to block new accounts from being opened

A credit freeze is especially useful if you entered sensitive details like date of birth or driver license number.

- Change passwords if there is any chance you reused credentials

If the scam site asked for logins, or if you typed a password you use elsewhere, change it now. Start with:- Email accounts

- Bank accounts

- Mobile carrier account

- Payment apps

Turn on 2-factor authentication wherever possible.

- Report the scam text to your phone provider

The FTC recommends forwarding unwanted scam texts to 7726 (SPAM) and using your phone’s built-in “report junk” feature. - Report the scam to the Federal Trade Commission

File a report through the FTC’s fraud reporting system. This helps track patterns and support enforcement efforts. - Report it to local law enforcement if money was taken or identity theft is suspected

If you have unauthorized charges or believe someone is opening accounts in your name, a police report can help when dealing with banks and credit bureaus. - Save evidence before deleting anything

Take screenshots of:- The original text message

- The sender number or sender ID

- The link (do not click it again)

- Any payment confirmation page you saw

Evidence helps banks, investigators, and fraud teams.

- Watch for follow-up scams for at least 30 to 60 days

Be extra cautious with:

- “Refund” offers

- “Collections” threats

- Calls claiming to be your bank or FLHSMV

If a caller pressures you, hang up and call the official number on your card or on an official website you navigate to manually.

- Use this experience to tighten your “verification habit”

Going forward, if you ever receive a traffic-related notice by text:

- Do not use the link in the message

- Go directly to the official website by typing it yourself

- Or call the official agency number you find independently

The habit is simple, but it shuts down most smishing attempts instantly.

The Bottom Line

The Florida FLHSMV DMV text scam works because it hits a nerve: the fear of losing your ability to drive, plus the pressure of a short deadline, plus a link that promises instant relief.

But FLHSMV has warned drivers clearly that it will not contact you via text message demanding payment or threatening suspension or arrest. The FTC has also flagged these overdue traffic ticket texts as a common scam pattern and recommends reporting spam texts and deleting them.

If you received the message, do not click. If you already clicked, act quickly and calmly: secure your card, monitor your accounts, report the scam, and protect your identity.

Most importantly, give yourself permission to slow down the next time a message tries to rush you. Scammers live in urgency. You do not have to.

FAQ: Florida FLHSMV DMV Text Scam

What is the Florida FLHSMV DMV text scam?

The Florida FLHSMV DMV text scam is a phishing scheme where scammers send text messages claiming you have an outstanding traffic ticket and must pay immediately. The message typically includes threats like license suspension, registration suspension, collections, and credit score damage. It then pushes you to click a link that leads to a fake payment portal designed to steal your personal and financial information.

Is FLHSMV allowed to text me about an unpaid traffic ticket?

Scammers want you to believe that, but legitimate FLHSMV-related enforcement and payment requests are not handled through random text messages with “Pay Now” links. If you receive an unexpected DMV-style text demanding payment, treat it as suspicious and verify through official channels you locate yourself, not through the message.

What does FLHSMV stand for?

FLHSMV stands for the Florida Department of Highway Safety and Motor Vehicles. Scammers often use the FLHSMV name to sound legitimate and to pressure Florida residents into acting quickly.

Why does the scam text mention “Florida Administrative Code 16C-16.003”?

Because it sounds official. Scam messages often include fake or misleading legal citations to make the threat feel real. The goal is to stop you from questioning the message and push you into paying before you verify anything.

What are the biggest red flags in a Florida DMV traffic ticket text?

Common warning signs include:

- A “Final Notice” tone or a 24-hour deadline

- Threats of immediate license suspension or registration suspension

- Claims your “credit score will be affected”

- Mentions of a 35% fee or “toll booth service fee”

- A payment link that is not clearly an official Florida government website

- Instructions like “Reply Y to activate the link”

If the text says “flhsmv.gov,” does that mean it is real?

No. A scam text can include the words “flhsmv.gov” while the actual link goes somewhere else. Scammers often rely on people skimming the message and assuming the link is official.

What happens if I click the phishing link?

Clicking the link may take you to a fake DMV payment portal. Even if you do not pay, the site may still:

- Track your device and location

- Prompt you to enter personal details

- Try to push you to continue with “verification” steps

If you entered any information, scammers may attempt fraud or target you again later.

What information do scammers try to collect on the fake FLHSMV site?

Many Florida DMV phishing pages attempt to capture:

- Full name

- Phone number

- Home address

- Email address

- Date of birth (sometimes)

- Driver license number (sometimes)

- Credit or debit card number, expiration date, and security code

Why do scammers ask for a small payment like $10?

Small amounts feel believable and “not worth fighting,” which increases the chance people pay quickly. The real objective is often the card details, not the initial amount. Once scammers have your payment information, they can attempt larger fraudulent charges later.

What does “reply Y and reopen the message” mean?

It is a social engineering trick. It pressures you to engage, and it can confirm your phone number is active. Engaging can also make you more likely to keep following instructions and complete the payment steps.

I paid through the link. What should I do first?

Act quickly and calmly:

- Call your bank or card issuer immediately.

- Tell them you entered your card details on a phishing site.

- Ask them to cancel the card and issue a replacement.

- Review recent transactions and dispute any unauthorized charges.

I only clicked the link, but I did not pay. Am I safe?

You reduced the risk by not entering payment details, but you should still be cautious. Monitor your accounts, watch for follow-up scam texts, and avoid clicking any additional links. If you entered any personal information at all, take extra steps to protect your identity.

How do I report the Florida FLHSMV scam text?

You can report it in several ways:

- Forward the text to 7726 (SPAM) to report it to your mobile carrier

- Report it to the FTC (Federal Trade Commission) through their fraud reporting site

- If money was stolen, file a report with local law enforcement

Also block the sender and mark the message as spam on your phone.