If you have been searching for ways to check your credit score, improve your credit profile, or compare loans without getting rejected, a website like CreditGenius.co.uk can look like the perfect shortcut.

- Quick Verdict: Is CreditGenius.co.uk Legit or Should You Avoid It?

- What CreditGenius.co.uk Claims To Offer

- The Pricing Detail Many People Miss: Free Trial Then £24.95 Per Month

- Trustpilot Snapshot: Why The Rating Raises Concern

- The Most Common Complaints Reported By Customers

- The QuidMarket Loans UK Link: Why It Matters

- Red Flags We Noticed From The Website Presentation

- How These “Credit Help” Sites Often Work Behind The Scenes

- What To Do If You Were Charged By Credit Genius or a Related Name

- How To Vet a Credit or Loan Website Before Sharing Details

- Safer Alternatives for Checking Credit in the UK

- Final Thoughts: Should You Use CreditGenius.co.uk?

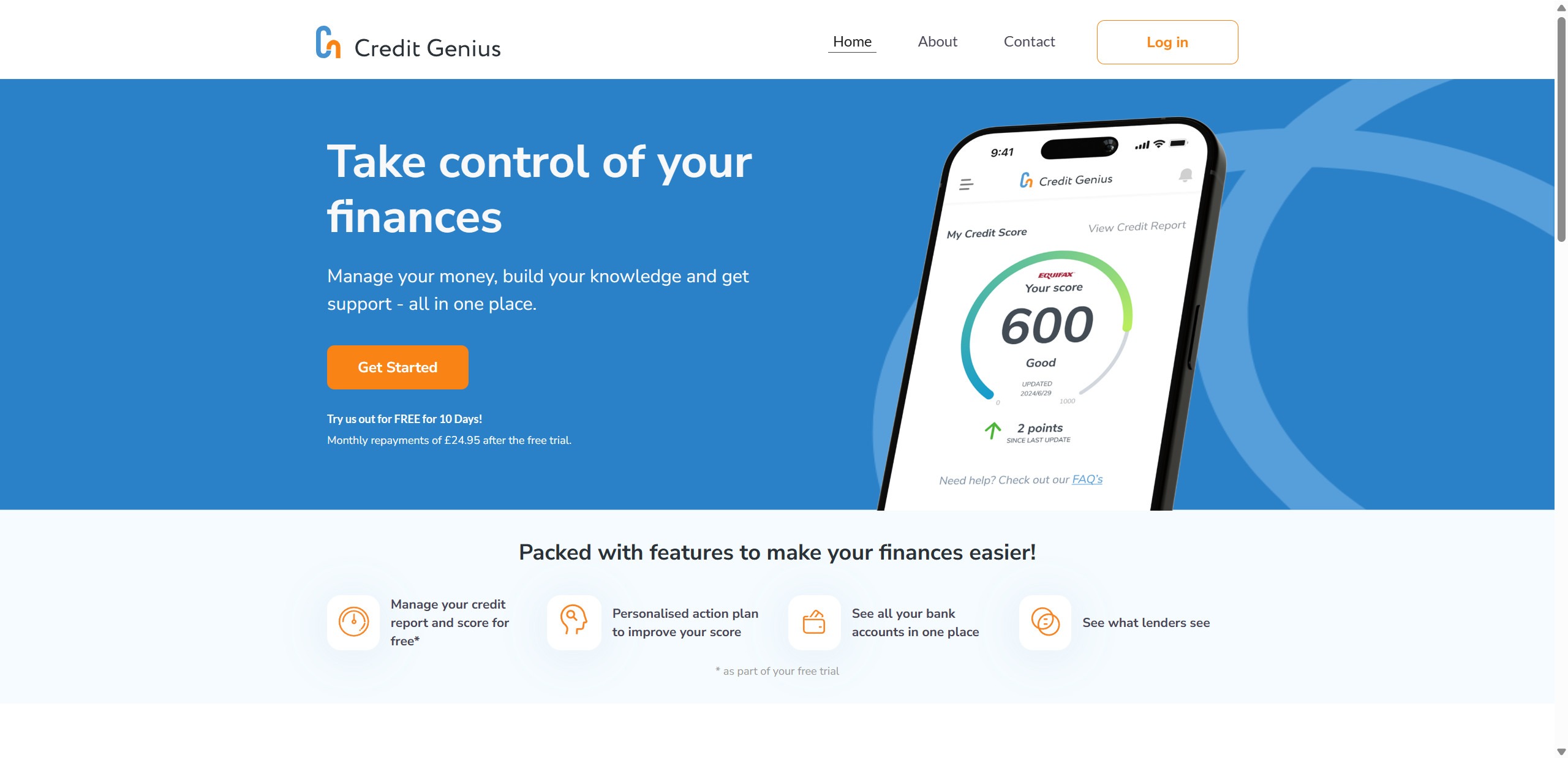

A clean homepage. A big “Get Started” button. Promises of help, monitoring, and credit offers.

But when a financial site asks for personal details, and especially when it nudges you toward payment information, you should slow down and verify exactly what you are signing up for.

In this review, we’re going to break down what CreditGenius.co.uk claims to offer, what we noticed on the website itself, and why so many consumers are warning others to be cautious based on their experiences.

Quick Verdict: Is CreditGenius.co.uk Legit or Should You Avoid It?

CreditGenius.co.uk appears to operate as a subscription-style service with a free trial and a recurring monthly charge afterward (the site displays a free trial and then a monthly fee of £24.95).

Subscription services are not automatically scams. Many legitimate companies use trials, memberships, and recurring billing.

The concern here is the volume and consistency of complaints from consumers, particularly around unexpected charges, difficulties cancelling, poor communication, and references to billing linked to “QuidMarket Loans UK” in customer reports.

Based on the review patterns and the red flags discussed below, CreditGenius.co.uk is a website you should approach with extra caution before entering card details or sharing sensitive personal information.

What CreditGenius.co.uk Claims To Offer

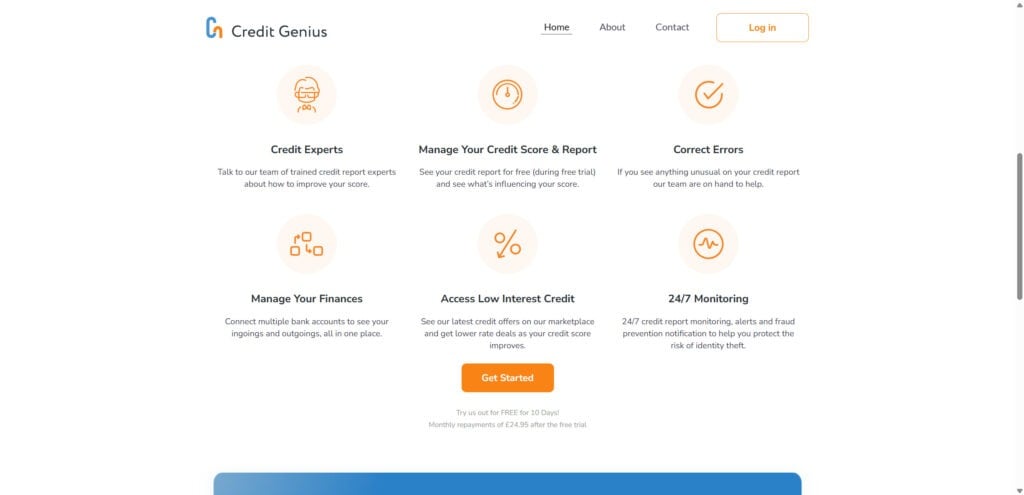

From the homepage screenshots provided, Credit Genius positions itself as an all-in-one place to “take control of your finances.”

It promotes features that sound helpful on paper, including:

- Managing your credit report and score (during the free trial)

- A personalised action plan to improve your score

- Seeing multiple bank accounts in one place

- Understanding “what lenders see”

- Access to credit offers through a lending partner network

- Eligibility checks that claim not to impact your credit score

- Monitoring and alerts for credit report changes and potential fraud

In other words, it presents itself as a mix of credit score dashboard, financial management tool, and loan comparison marketplace.

That combination is not unusual in the UK market. The real question is whether the service behaves transparently, bills fairly, and supports customers properly when something goes wrong.

The Pricing Detail Many People Miss: Free Trial Then £24.95 Per Month

One important line on the CreditGenius.co.uk homepage is easy to overlook if you are focused on the “FREE for 10 days” messaging.

The site states that after the trial, monthly repayments are £24.95.

That detail matters because a huge percentage of negative experiences with subscription services come from one of these situations:

- You thought you were doing a one-time check, but you actually enrolled in a recurring plan.

- You forgot the trial end date, and the subscription renewed.

- The cancellation process was confusing, buried, or simply did not work properly.

The brand name on the bank statement did not match what you typed into Google, so it looked like an “unknown” charge.

Even in perfectly legitimate businesses, this is where trust is either earned or lost. When complaints pile up about “unauthorised charges,” it often means customers did not understand what they agreed to, or they could not stop the billing when they tried.

Trustpilot Snapshot: Why The Rating Raises Concern

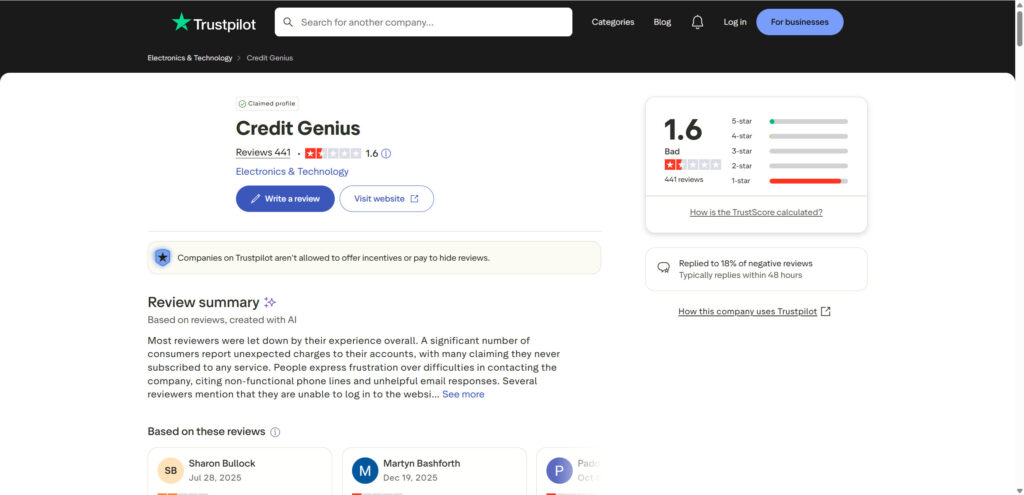

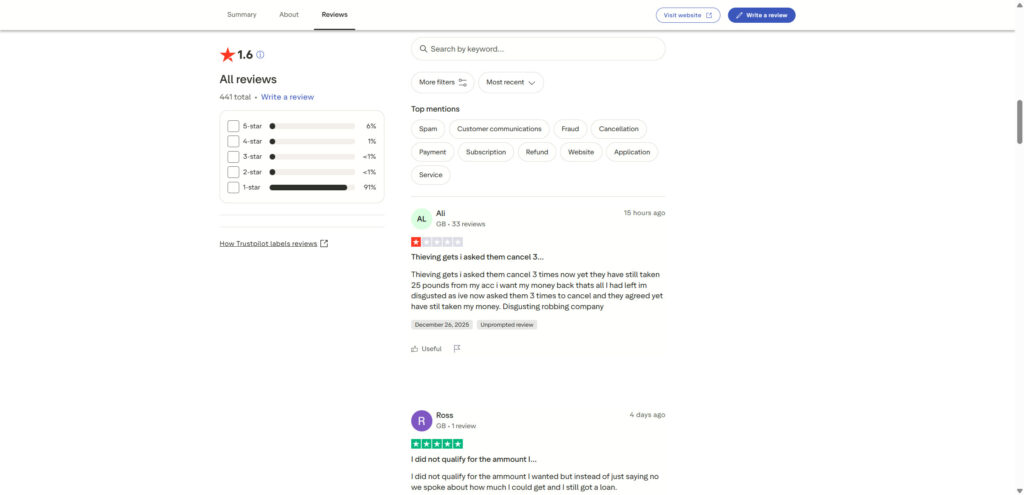

From the Trustpilot screenshots you provided, Credit Genius shows:

- A very low TrustScore around 1.6 (marked “Bad”)

- 441 reviews displayed in the screenshot

- A review distribution heavily dominated by 1-star ratings (shown as 91% 1-star in the screenshot)

That is not just “a few angry customers.” A profile with hundreds of reviews and an overwhelming majority at 1 star is a serious warning sign, especially for a service that touches banking, payments, credit, and identity data.

To be clear, Trustpilot is not a court. Reviews are not proof on their own.

But patterns matter. When the same complaints appear again and again, across months and years, it becomes harder to dismiss them as misunderstanding.

The Most Common Complaints Reported By Customers

Looking at the themes referenced in the Trustpilot screenshots and the script you provided, several repeated issues stand out.

1) Unexpected Charges and “Unauthorised” Withdrawals

This is the most alarming theme.

Multiple reviewers describe money being taken from their account unexpectedly, or repeated attempts to withdraw funds even after they tried to cancel.

Some reviews use strong language like “they took money without permission” or “stealing,” which reflects how consumers felt in the moment.

Even if the business believes it has consent through terms, the real-world impact is the same: people felt blindsided and struggled to stop the billing.

2) Difficulty Cancelling and Stopping Payments

A common frustration in negative subscription reviews is not just the first charge.

It is what happens next.

Consumers describe trying to cancel, emailing support, calling, getting no clear response, and then seeing new charges attempted again.

In several accounts, people say they only managed to stop the payments after contacting their bank directly.

That’s a big deal because a reputable subscription company should make cancellation straightforward and should not require “bank intervention” as the normal path.

3) Poor Communication and Unresponsive Support

The screenshots and transcript repeatedly mention:

- Emails going unanswered

- Phone calls not picked up

- Automated systems that do not help

- Slow or no refunds

Again, any business can have busy periods.

But when “no response” becomes the dominant customer story, especially around billing disputes, it erodes trust fast.

4) Confusing Branding or Billing References

One of the most interesting details is the repeated mention of “QuidMarket Loans UK” in customer complaints.

This can happen in a few ways:

A company operates multiple brands, and the payment descriptor is tied to a different trading name.

A third-party billing processor appears on statements instead of the consumer-facing brand.

A lead generation service routes applicants to offers, and billing is handled under a related entity.

Whatever the explanation, confusion around the name attached to a charge is a classic trigger for “I never signed up for this.”

If consumers cannot easily connect the charge to what they clicked, they will treat it as suspicious. And if they cannot get support to explain it, trust collapses.

The QuidMarket Loans UK Link: Why It Matters

When reviewers repeatedly connect Credit Genius billing or cancellation issues to QuidMarket Loans UK, that raises a practical concern for consumers:

If you sign up expecting “Credit Genius,” but your bank statement shows another name, you may not recognise it quickly enough to stop it early.

This is not just annoying. It can become expensive.

Many subscription disputes grow because customers spend weeks trying to identify the merchant, chasing the wrong contact details, or assuming the bank will block it automatically.

If multiple brands or descriptors are involved, you want clarity upfront:

Who is charging you?

What will the statement descriptor look like?

How do you cancel, and what confirmation do you receive?

If a company cannot answer those questions cleanly, you are taking a risk by entering payment details.

Red Flags We Noticed From The Website Presentation

A site can look professional and still create customer harm. Design is not proof of integrity.

Here are the practical red flags that stood out based on the site screenshots and the points in your transcript.

No Customer Reviews Displayed On The Website

Many legitimate financial services display some form of user feedback, even if it is curated.

The CreditGenius.co.uk homepage shown does not appear to showcase real customer reviews or testimonials.

That is not a deal-breaker on its own.

But when external review platforms show heavy negativity, the absence of transparent feedback on the site feels like a missed opportunity to build trust.

The “Free Trial” Hook Combined With a High Monthly Fee

£24.95 per month is not a tiny add-on.

For consumers who thought they were doing a quick eligibility check or a one-time credit view, that recurring price can be a shock.

High-fee subscriptions tend to generate more complaints when:

The trial terms are not crystal clear.

The cancel option is buried or confusing.

The service value is not obvious.

The user only discovers the subscription after the first charge.

Lack of Clear “Who We Are” Transparency

Financial services should be easy to verify.

Your transcript notes that the company is described as a trading style of “Credit Smart Ltd,” but that the site does not clearly display details like licensing numbers or VAT registration in a way that builds confidence.

To be fair, not every helpful financial site is FCA-authorised because some are not lenders. Many are lead generators or comparison platforms.

Still, when a company is collecting sensitive data, transparency matters. Consumers should be able to quickly find:

The legal entity name

A verifiable company registration

Clear contact details that match public records

A privacy policy and data handling explanation that is easy to understand

Questionable Support Details

Your transcript also highlights something that, if accurate, is a major concern: that the address and phone number appear to be copied from other websites.

A copied address or reused phone number can mean:

A template site built quickly with recycled details

A lead-gen network using shared support infrastructure

A company that is not truly staffed to handle disputes

Even in the best interpretation, it suggests weak accountability.

When billing problems arise, weak support is what turns “I made a mistake” into “this is a nightmare.”

No Real Social Media Presence

Plenty of legitimate companies keep a low social profile.

But for a consumer-facing service, especially one asking for personal and financial information, an absence of visible social channels can make the business feel harder to verify.

It also reduces the public pressure that often improves customer support.

If there is no active presence and no public engagement, customers may feel they have nowhere to turn when email and phone support fail.

How These “Credit Help” Sites Often Work Behind The Scenes

To understand why complaints like these happen, it helps to know the common business models in this niche.

Model A: Credit Score Dashboard Subscription

In this model, you pay monthly for access to:

Credit score updates

Credit report views

Monitoring and alerts

Identity-related tools

This can be legitimate and useful, but it must be clear, cancellable, and supported.

Model B: Lead Generation and Loan Matching

In this model, the “credit help” site is primarily a marketplace.

It collects your data, assesses eligibility, and routes you to third-party lenders or brokers.

The site may still charge a membership fee for tools, monitoring, or “access.”

The main risk here is confusion: users think they are applying for a loan, but they also start a subscription.

Model C: Hybrid Subscription Plus Marketplace

This is what CreditGenius.co.uk appears to present, based on the homepage claims.

Hybrid models can work, but they create more friction points:

People may not understand what is included.

People may feel they paid but only received marketing offers.

People may feel the subscription is not worth the cost.

People may feel trapped if cancellation is difficult.

When you combine a recurring fee with high-stress consumer needs (credit problems, urgent loans, financial vulnerability), complaints can escalate quickly.

What To Do If You Were Charged By Credit Genius or a Related Name

If you believe you have been charged unexpectedly, the priority is stopping future payments and documenting everything.

Here’s a practical, step-by-step approach that works in the UK for most subscription billing disputes.

1) Check Your Bank Statement Carefully

Look for:

The exact merchant name shown on the transaction

Any reference numbers

The date and amount

Whether it is a card payment, a recurring card payment, or a direct debit

This matters because your bank will ask for specifics.

Also, if the descriptor is not “Credit Genius,” that could explain why you did not recognise it at first.

2) Try to Cancel Through the Official Account Area

If you created an account, log in and look for:

- Subscription settings

- Billing settings

- Membership plan

- Cancel subscription

- Download or screenshot any cancellation confirmation.

If the site only offers cancellation by email, send an email and keep a copy. If you can, request a confirmation reply.

3) Contact Your Bank and Ask About Blocking Recurring Payments

If charges are continuing, call your bank and explain:

- You did not authorise the payment, or you cancelled and the charges continued.

- You want future payments blocked.

In the UK, banks can often block recurring card payments (sometimes called continuous payment authorities). The exact method can vary by bank.

If a direct debit is involved, you can cancel the direct debit through your bank, and the Direct Debit Guarantee may apply in many situations.

4) Dispute the Transaction if Appropriate

If you genuinely did not authorise it, or if you cancelled and billing continued, ask your bank about:

- Chargeback for card payments

- Refund routes for direct debits

Banks will usually want evidence. That is why screenshots and emails matter.

5) Change Your Card if the Attempts Keep Happening

In stubborn cases where payment attempts keep showing up, some people choose to:

Replace the card

Update card number

Tighten transaction controls in online banking

It is not ideal, but it can stop the cycle.

6) Monitor Your Credit File and Identity Signals

If you shared personal information on a site that later made you uncomfortable, consider extra monitoring:

- Keep an eye on your credit reports.

- Watch for unexpected searches, new accounts, or address changes.

- Use strong passwords and avoid reusing the same password across sites.

If you suspect identity misuse, act quickly.

How To Vet a Credit or Loan Website Before Sharing Details

If you want to avoid this situation in the future, here is a checklist you can run in a few minutes.

Verify the Legal Entity

Look for a company name and registration details.

Then cross-check it on Companies House.

If a site will not clearly tell you who owns it, treat that as a risk.

Check for FCA Authorisation When Relevant

Not every credit-related site must be FCA-authorised.

But if the site claims to arrange credit, broker loans, or provide regulated activities, check the FCA register.

If the company is not on the register and appears like it should be, step back.

Read the Pricing and Trial Terms Like a Contract

Before clicking “Get Started,” look for:

- Trial duration

- Recurring cost

- Billing frequency

- How to cancel

- Whether cancellation is online, by email, or by phone

If you cannot find these quickly, that’s a signal.

Search the Brand Name Plus Key Complaint Terms

Try searches like:

- “brand name subscription”

- “brand name refund”

- “brand name charge”

- “brand name cancel”

Look for patterns, not just one-off stories.

Check Trustpilot Distribution, Not Just the Score

A low score with 20 reviews is less informative than a low score with hundreds.

Also look at:

- How many 1-star reviews

- Whether the company responds

- Whether reviewers describe the same problem

The distribution shown in your screenshots is heavily skewed to 1 star, which is why it stands out.

Safer Alternatives for Checking Credit in the UK

If your main goal is simply to see your credit report, track your score, and understand what affects it, you have safer paths that are widely recognised in the UK.

Many consumers choose to use services tied directly to the major credit reference agencies, or well-established platforms that clearly disclose pricing and cancellation.

Options commonly used include:

- Services connected with Experian

- Services connected with Equifax

- Services connected with TransUnion (often via partner apps)

Each agency can show different data, so it is normal to see differences between them.

The key advantage is accountability and clarity. You generally know who you are dealing with, what you are paying for, and how to stop it if you change your mind.

Final Thoughts: Should You Use CreditGenius.co.uk?

CreditGenius.co.uk presents itself as a modern credit and financial support platform, with features like score monitoring, account visibility, and credit offer comparisons.

But the consumer feedback shown in the Trustpilot screenshots paints a very different picture.

When a financial subscription product attracts hundreds of reviews, and the overwhelming majority are 1-star with repeated complaints about unexpected charges and cancellation problems, it becomes difficult to recommend as a “safe” place to share sensitive financial information.

If you are considering signing up, the cautious approach is simple:

Do not treat it like a casual tool.

Treat it like you would treat handing your card to a stranger.

Read every term, assume it is a subscription, and only proceed if you are 100% comfortable with the billing, the cancellation route, and the company’s transparency.

And if you have already been charged and you believe it was not authorised or you cannot cancel, involve your bank quickly. That is often the fastest way to stop ongoing payment attempts and start the dispute process.