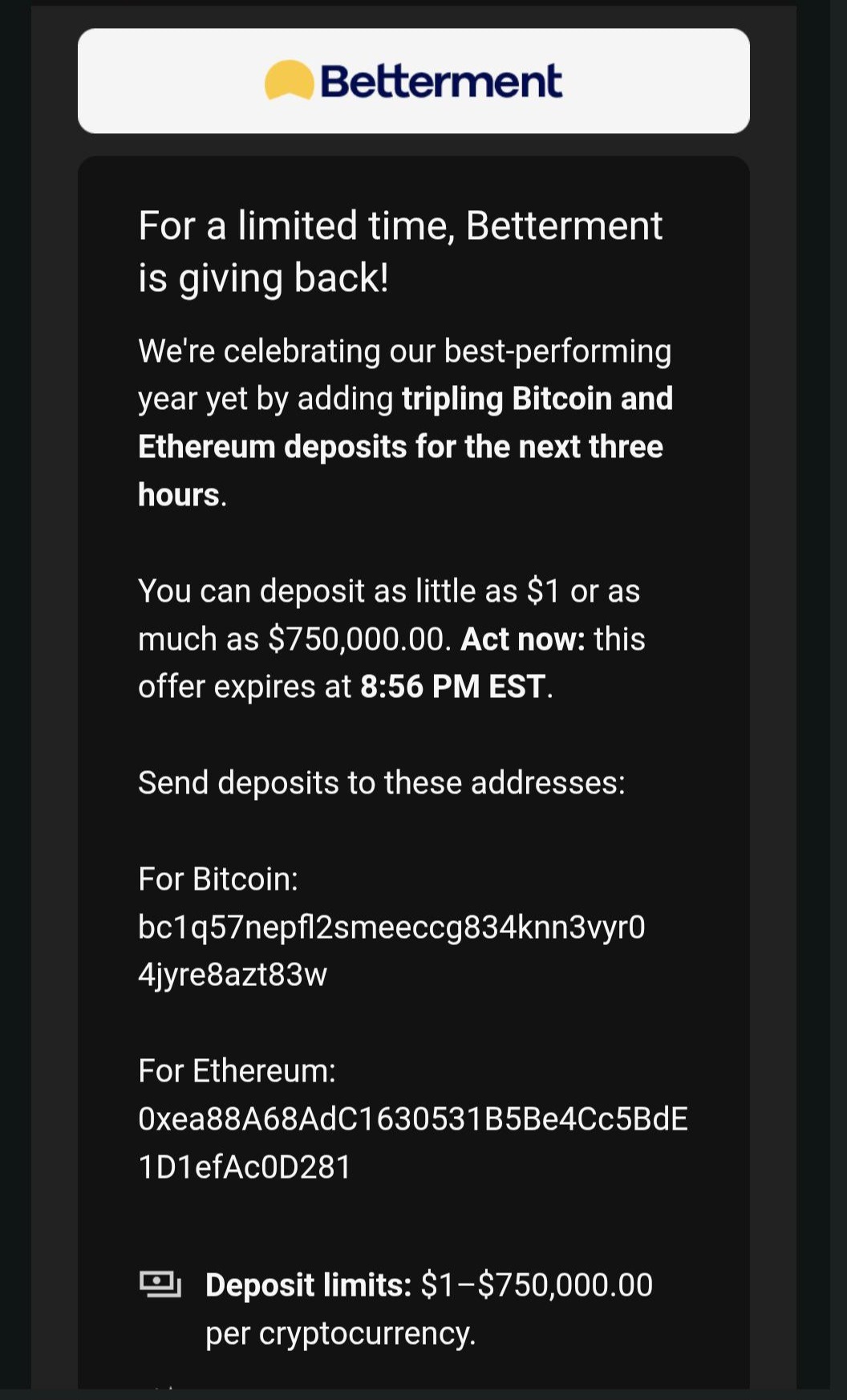

If you received an email or in-app notification that looked like it came from Betterment and promised to triple your Bitcoin or Ethereum, you were not looking at a “limited-time promotion”.

You were looking at a classic crypto giveaway trap dressed up in a trusted brand’s clothing. It pushed urgency, big rewards, and a simple action: send crypto to a wallet address and wait for “triple” back.

That “triple” never comes. And because crypto transfers are designed to be irreversible, people who sent BTC or ETH can lose the funds in minutes.

This article breaks down what happened, why this Betterment tripling crypto message is so convincing, how the scam works step by step, and exactly what to do if you interacted with it.

Scam Overview

The Betterment “tripling Bitcoin and Ethereum” message is a modern version of an old scam: the crypto giveaway or crypto doubling scheme. The hook is always the same. A trusted name claims it is “giving back” and promises a guaranteed return if you send crypto first.

In January 2026, Betterment users reported receiving a notification and, in some cases, a matching email that claimed Betterment would triple Bitcoin and Ethereum deposits for a short window of time. The message used celebratory language such as “best-performing year” and relied heavily on urgency, telling recipients they had only a few hours before the offer expired.

Betterment publicly warned users that the crypto promotion message was unauthorized and should be disregarded. Reports indicated the message was sent through a third-party system used for marketing and customer communications.

What the scam message tries to make you feel

This scam is carefully written to trigger very specific reactions:

- Excitement: “We’re giving back” is meant to feel like a surprise reward.

- Trust: Betterment is a legitimate financial brand, so the brain wants to believe it.

- Urgency: “Next three hours” is designed to prevent careful thinking.

- FOMO: You start imagining the regret of missing out, which pushes impulsive action.

- Simplicity: No long onboarding, no verification, no steps. Just “send crypto here.”

Scammers know that the strongest scams are not the ones with the best technology. They are the ones that create the strongest emotional shortcut.

The biggest red flags in plain English

Even if you had never seen a crypto scam before, this “tripling BTC and ETH” pitch contains multiple red flags that should stop you instantly:

1) Guaranteed returns

In legitimate finance, guaranteed high returns without risk basically do not exist. The promise to triple your money is not “a good deal”. It is a signature of fraud.

2) “Send crypto to this address”

Real companies do not run promotions by asking customers to send funds to a random wallet address. That is not how regulated financial promotions work. That is how scammers work.

3) Extreme urgency

A three-hour deadline is not a customer-friendly promotion. It is a pressure tactic. Any message that makes you feel rushed is trying to take away your ability to verify.

4) Strange deposit limits

The message often includes dramatic ranges like deposits as low as $1 and as high as $750,000. That is there to make the “promotion” feel universal and official, while also encouraging high-value victims to send life-changing sums.

5) No normal product context

A real Betterment offer would usually direct you to log into your account, review terms, see disclosures, and take action inside an authenticated flow. Giveaway scams skip all of that and go straight to payment.

Why this scam is especially dangerous

Many people are used to spotting crude phishing emails. Bad grammar, suspicious links, weird sender addresses, obvious nonsense. This scam can be more convincing for two reasons:

It may arrive through channels you normally trust.

Victims reported it appearing as a notification that looked native to the Betterment experience, and also as an email to some users.

It uses a real-world pattern people have seen before.

Crypto giveaway scams have been circulating for years, often impersonating celebrities, exchanges, or major brands. The copy is familiar: “We’re celebrating”, “limited time”, “send crypto”, “we’ll send back more”.

When you’ve seen the format enough times on social media, it becomes weirdly normalized. Scammers rely on that.

Betterment’s response and what it means for customers

Betterment stated that the message was unauthorized, and that users should disregard it. Public posts also described it as coming through a third-party system used for marketing and customer communications.

In a later update shared publicly, Betterment indicated that an unauthorized individual gained access to certain Betterment systems that enabled impersonation and distribution of the fraudulent offer, and that clicking the notification did not compromise the security of the Betterment account.

There are two important takeaways here:

- The “promotion” is fake, period.

No one is tripling deposits. If you send BTC or ETH, it goes to the scammer. - Clicking is not the same as sending.

If you only opened the notification, Betterment said it did not compromise account security.

That said, it is still smart to treat the event as a security moment. You should review your account, enable strong authentication, and make sure your email is protected, because scammers often try follow-up attacks.

What happens if someone sends BTC or ETH

This is the part that hurts: crypto transfers do not work like credit cards.

With a credit card, you can dispute a charge. With a bank transfer, there may be recall options in limited situations. With crypto, once you approve a transfer and it is confirmed on-chain, there is usually no “undo” button.

If victims sent BTC or ETH to the addresses in the message, they should not expect to receive anything back. The “tripling” promise is the bait, and the destination wallets are controlled by the scammer.

Why scammers love impersonating finance brands

It is not random that scammers choose a name like Betterment.

Finance brands carry three things scammers desperately want:

- Credibility: The brand reduces skepticism.

- Access to motivated users: People using finance apps already think about money and investing.

- A believable storyline: Promotions, bonuses, and incentives are common in finance, so the setup feels plausible at first glance.

And when a scam arrives in a format that resembles normal customer communications, it can bypass the mental filters people use for random internet messages.

The psychological “trap door” in this scam

Most victims do not fall for scams because they are careless. They fall because the scam creates a moment where normal caution collapses.

This one does it with a simple loop:

- “This is from a trusted company.”

- “It expires soon.”

- “I can send a small amount first.”

- “If it works, it’s a huge win.”

That “small amount first” idea is especially dangerous. It lowers the barrier to action. And once someone sends $50 or $100, the scammer’s next step is often to push for more. They may claim you need to send a minimum. Or they may say your “bonus” is pending and you need to “verify” with another transfer.

Even when the initial message does not include follow-up, victims can end up chasing the loss. That is how a $100 mistake becomes a $5,000 disaster.

A quick reality check you can keep forever

If a message says:

- Send crypto first

- Get more crypto back

- Limited time

- Guaranteed return

Treat it as a scam until proven otherwise. And “proven otherwise” means verified on the company’s official website or inside a secure account experience, not inside the message itself.

How The Scam Works

Below is a practical, step-by-step breakdown of how the Betterment tripling Bitcoin and Ethereum email scam typically unfolds. This is written to help you recognize the pattern quickly and avoid the trap, not to encourage wrongdoing.

Step 1: A real brand name is used as the “trust anchor”

The scam begins with the most valuable ingredient: a brand people recognize.

Victims reported receiving a message that appeared to be from Betterment, using Betterment branding and a promotional tone.

This first step matters because it bypasses your most basic defense: skepticism. When you see a trusted name, your brain relaxes.

Step 2: The scam presents a “celebration” story that feels normal

The message does not start with “Send us crypto.” It starts with a storyline:

- “We’re giving back”

- “We’re celebrating our best year”

- “Limited time”

It is framed like a marketing campaign, not like a request for payment. That framing is deliberate. It makes the next step feel like a natural continuation.

Step 3: Urgency is introduced to prevent verification

Then comes the three-hour window.

Urgency is not a detail. It is the engine of the scam.

When people feel rushed, they:

- Do not search for confirmation

- Do not check the official app carefully

- Do not ask a friend

- Do not think through how unrealistic the promise is

In reports, the message pressured users to act quickly, promising the tripling benefit only within a short time window.

Step 4: A huge reward is promised, framed as “simple math”

“Triple your BTC or ETH” is intentionally easy to understand.

Scams often use rewards that are:

- Large enough to trigger greed and excitement

- Simple enough to feel certain

It is not “up to 12% APY” or “a promotional bonus based on tiered requirements.” It is “send X and get 3X back.”

That is not how legitimate promotions work, but it is how scam hooks work.

Step 5: The message directs you to send crypto to wallet addresses

Now comes the irreversible step.

The scam instructs victims to send Bitcoin or Ethereum to specific wallet addresses. This is the moment where the scam stops being a “message” and becomes a “loss”.

A critical detail here: the scam does not ask you to log in and “deposit” through your account in a normal way.

Instead, it asks for a direct blockchain transfer. That means:

- No standard fraud protections

- No chargebacks

- No customer support reversal

And if you send it, you are not “depositing”. You are transferring funds to a wallet controlled by someone else.

To reduce the chance of more people being harmed, you should not repost or share the full wallet addresses publicly. If you are reporting the scam, share them only with the platform, law enforcement, or investigators.

Step 6: Victims rationalize the risk because they can “test small”

Many victims do not send $10,000. They send $20, $50, $100.

From a psychology standpoint, this is brilliant and cruel.

A small “test” feels safe. People think:

- “If it’s fake, I only lose a little.”

- “If it’s real, I discovered a money glitch.”

But the scam is designed so that any amount is a win for the scammer.

Also, once someone has taken the first step, they become more vulnerable to the next message, whether it comes from the same scammers or copycats who target the same victim list.

Step 7: The scammer counts on silence, confusion, and delay

After a victim sends crypto, the most common result is:

- Nothing happens

- No “triple” arrives

- The victim refreshes and waits

That waiting period is part of the scam’s effectiveness.

People often delay reporting because they feel embarrassed. Or they keep waiting because they want to believe it will arrive. That delay gives scammers time to move funds through additional wallets, exchanges, or mixing services, which can complicate recovery attempts.

Step 8: Betterment disavows the message and begins investigation

After reports spread, Betterment warned users that the promotion message was unauthorized and should be disregarded, describing it as sent through a third-party system used for marketing communications.

In a subsequent public update, Betterment said an unauthorized individual gained access that enabled impersonation and fraudulent outreach, and stated that clicking the offer notification did not compromise Betterment account security.

This is an important distinction for victims:

- If you only viewed or clicked the notification, it does not automatically mean your Betterment account was compromised.

- If you sent BTC or ETH, the funds likely left your control permanently, and your next steps should focus on reporting and damage control.

Step 9: Secondary scams often follow

Once a scam becomes public, a second wave often appears:

Recovery scams

Fake “investigators” message victims and promise they can recover the crypto for an upfront fee.

Support impersonation

Scammers pretend to be Betterment support, exchange support, or even law enforcement. They ask for:

- Seed phrases

- Two-factor codes

- Remote access

- Additional “verification” transfers

If you lose funds, be extremely cautious about anyone who contacts you offering help. Real support will not ask for your seed phrase or ask you to send more crypto to “unlock” anything.

Step 10: The core lesson, in one line

Any time you are told to send crypto to receive more crypto back, assume it is a scam and verify through official channels before doing anything.

What To Do If You Have Fallen Victim to This Scam

If you interacted with the Betterment tripling Bitcoin and Ethereum message, use the steps below. Stay calm. Move quickly, but do not panic.

- Stop all transfers immediately

Do not “test again”. Do not try to “complete the bonus”. Do not send more crypto for any reason, even if someone claims it will release the return. - If you sent BTC or ETH, document everything

Create a simple folder and save:

- Screenshots of the email or notification

- The wallet address shown in the message

- The transaction ID (TXID) from your wallet or exchange

- The date/time and amount sent

- Any follow-up messages

This documentation helps exchanges, investigators, and reporting agencies.

- Contact your crypto exchange or wallet provider right away

If you sent from an exchange account, contact their support immediately and provide the TXID. In some cases, they may be able to:

- Flag the destination address internally

- Assist with law enforcement requests

- Freeze funds if they hit the same exchange later

They usually cannot reverse a blockchain transfer, but fast reporting can still matter.

- Report the incident to Betterment through official support channels

Even if Betterment cannot recover funds, reporting helps them:

- Identify which customers were targeted

- Improve controls around messaging systems

- Share indicators with vendors and security teams

Betterment publicly stated the crypto message was unauthorized and should be disregarded.

- Secure your Betterment account and your email account

Even if Betterment indicated clicking the notification did not compromise account security, it is still smart to harden your setup.

Do the following:

- Change your Betterment password if it is reused anywhere else

- Enable multi-factor authentication wherever available

- Review recent account activity and connected devices

- Change your email password and enable MFA on your email (this matters a lot)

- Check email forwarding rules and filters (attackers sometimes add silent forwarding)

- Scan for follow-up scams and impersonation attempts

For the next few weeks, expect more attempts:

- “We can recover your funds” messages

- Fake support emails

- DMs on social platforms

Do not trust inbound help. Only use official websites and verified contact methods.

- File official reports

Reporting will not always result in recovery, but it creates a record and helps broader investigations.

- If you are in the US, consider reporting to IC3 (FBI) and the FTC.

- If you are outside the US, report to your local cybercrime unit and police, and include the TXID and wallet addresses.

- If a large amount was sent, consider professional guidance

For significant losses, consider speaking with:

- Your exchange’s fraud team (escalation)

- Local law enforcement cybercrime units

- A qualified attorney familiar with digital asset investigations in your jurisdiction

Be cautious: many “crypto recovery” services are scams. Never pay someone who guarantees recovery.

- Protect your remaining assets

If you used a self-custody wallet:

- Make sure your seed phrase has not been shared anywhere

- Move remaining funds to a fresh wallet if you suspect exposure

- Never type your seed phrase into a website, form, or “support chat”

If you used an exchange:

- Enable withdrawal whitelists if available

- Review API keys and delete anything you do not recognize

- Give yourself a clean, honest debrief

This matters more than people think. Ask:

- What made the message feel believable?

- What was the moment you felt rushed?

- What verification step would have stopped you?

This is not about blame. It is about building a stronger reflex for next time.

The Bottom Line

The Betterment “tripling Bitcoin and Ethereum deposits” email and notification is a fraudulent crypto giveaway scam. It uses brand trust and short deadlines to push people into sending irreversible crypto transfers to scammer-controlled wallets. Betterment warned that the message was unauthorized and should be ignored, and publicly indicated that clicking the notification did not compromise Betterment account security.

If you only saw the message, treat it as a near miss and tighten your account security. If you sent BTC or ETH, act fast: document, report, contact your exchange, and watch for recovery scams.

And keep this simple rule close: no legitimate company triples your crypto because you sent it to a wallet address first.

FAQ: Betterment “Tripling Bitcoin and Ethereum” Email Scam

Is Betterment really tripling Bitcoin and Ethereum deposits?

No. The “tripling” message is a scam and not a legitimate Betterment offer. Betterment publicly warned users to disregard it.

I clicked the notification or opened the email. Is my Betterment account compromised?

Betterment stated that clicking the offer notification did not compromise the security of your Betterment account.

Even so, it’s smart to change passwords (especially if reused elsewhere) and enable multi-factor authentication.

I sent BTC or ETH to the wallet address. Will I receive the promised “triple” back?

No. Those wallet addresses belong to the scammers. Victims who send BTC or ETH should not expect any return.

Can Betterment reverse the crypto transfer?

No. Blockchain transfers are typically irreversible. Betterment cannot “pull back” BTC or ETH once it has been sent to a scammer wallet.

Can my exchange or wallet provider get my crypto back?

Usually not, but you should contact them immediately. In some cases, they can:

- Flag the destination address

- Assist with law enforcement requests

- Potentially freeze funds if they hit the same exchange later

Recovery is not guaranteed, but speed matters.

Why does the scam mention a short deadline like “next three hours”?

Urgency is a pressure tactic. It’s designed to stop you from verifying the offer through official channels and push you into acting impulsively.

What are the biggest red flags that prove it’s a scam?

Common giveaway-scam warning signs include:

- Promises to “double” or “triple” crypto

- Guaranteed returns

- Instructions to send crypto to a wallet address first

- Very short deadlines

- No verified, logged-in flow inside the official platform

Should I post the wallet addresses publicly to warn others?

Be careful. Sharing scam wallet addresses widely can unintentionally spread the scam message itself. It’s better to report the addresses to:

- Betterment support

- Your exchange

- Law enforcement or official reporting portals

If you do share publicly, remove the “send to this address” context and avoid reposting the full scam text.

What if someone contacts me saying they can recover my funds?

Assume it’s another scam. “Crypto recovery” scams often target victims and demand upfront fees, seed phrases, or remote access. No legitimate party will ask for your seed phrase or require you to send more crypto to “unlock” a refund.

How do I safely verify whether a Betterment promotion is real?

Use only official channels:

- Log into the Betterment app or website directly (not through links in messages)

- Check Betterment’s official help center or security updates

- Contact support using verified contact methods from the official website

What security steps should I take right now?

At minimum:

- Change your Betterment password if it’s reused anywhere

- Enable multi-factor authentication on Betterment and your email

- Review recent sign-ins/devices on your email account

- Check for suspicious email forwarding rules and filters

Why would scammers target Betterment users specifically?

Scammers pick trusted finance brands because they create instant credibility. A familiar brand name lowers skepticism, and the “investment bonus” storyline feels believable to users who already think about money and deposits.

If Betterment says accounts weren’t accessed, why should I still worry?

Because scams often come in waves. Even if your Betterment account is safe, your email could be targeted again with:

- Fake “support” follow-ups

- New phishing attempts

- Recovery scams

Treat it as a cue to strengthen security and stay alert.

Where should I report this scam?

Report to:

- Betterment support (official site)

- The exchange you used to send funds (if applicable)

- Your local cybercrime reporting channel

If you’re in the US, commonly used options include IC3 (FBI) and the FTC for fraud reporting.