Have you received an alarming text claiming you have unpaid Florida tolls? Exercise extreme caution before reacting. Deceptive scammers are targeting residents with fraudulent toll texts to steal personal and financial data.

This comprehensive guide examines how the Florida Tolls Services scam unfolds, telltale indicators, steps if targeted, and how to safeguard yourself from this prevalent phishing tactic. Don’t let urgency over alleged unpaid tolls cloud your judgment. Learn to detect this toll invoice scam.

Overview of the Florida Tolls Services Scam

A common new and increasingly prevalent phishing technique has emerged that should raise major concern for all Florida drivers and residents. This scam involves highly deceptive text messages stating recipients suddenly have unpaid Florida toll road invoices that require immediate payment. However, in reality, these fraudulent texts actually originate from sophisticated scammers who are ruthlessly trying to trick users into handing over their sensitive personal and financial information and payment card data, which will then be used to commit identity theft and financial fraud.

The deceitful scam messages appear to come from an entity called “Florida Tolls Services.” However, this agency name is completely fabricated by the fraudsters carrying out the phishing campaign. There is no real toll authority or services company by that name operating in Florida. The scammers make up the name “Florida Tolls Services” solely to try and dupe targets into believing the texts come from a legitimate toll issuer to get them to lower their guard.

The messages claim the recipient has a small outstanding unpaid toll balance, often around $7 to $10. The texts state that hefty fees will soon result if this fabricated unpaid toll is not addressed super quickly. However, in truth, the entire supposed unpaid Florida toll notice is 100% fake. No unpaid balance actually exists on the recipient’s account, and no real toll fees are coming if drivers don’t pay – it is all a ruse concocted by the scammers to trick unsuspecting victims.

Every single aspect of the scam Florida turnpike toll texts – the contacting toll entity, unpaid balance cited, and threats of imminent fees if not paid – are complete and utter lies fabricated out of thin air by the fraudsters perpetrating this phishing campaign. It is an elaborate deception designed to prey on drivers’ fears of owing fees in order to get them to hand over their personal information and payment card details, believing they are settling a real unpaid urgent toll bill to avoid getting hit with penalties. In reality, it is an ingenious information theft tactic based on trickery and manufactured urgency.

Red Flags Exposing It’s a Scam

While made to look legitimate, certain revealing signs expose the text as a scam:

- Sense of urgency – Threats of imminent fees trigger hasty actions.

- Unknown sender – Texts come from peculiar 10-digit numbers with odd area codes.

- Spelling/grammar errors – Messages often contain typos, syntax issues, and awkward wording.

- Fake domain names – Sites use lookalike but non-official web addresses.

- Request for sensitive data – Legitimate agencies don’t request financial data via online forms.

Potential Harm from Entered Information

If victims submit the requested personal details and payment information, crooks can:

- Commit identity theft using names, addresses, SSNs, and dates of birth.

- Make unauthorized purchases by cloning provided debit/credit cards.

- Access and drain bank accounts if account numbers are entered.

- Take over online accounts using compromised login credentials.

- Carry out boundless other financial frauds using the stolen data.

Avoiding the Toll Invoice Scam Texts

Drivers can steer clear of the fake Florida toll text scam through vigilance and proactive precautions:

- Scrutinize texts about unpaid tolls before providing any personal or financial details.

- Independently confirm unpaid toll claims directly through official channels.

- Only enter payment information on verified legitimate websites after validating first.

- Use strong unique passwords and enable two-factor authentication when available.

Staying alert for phone and online scams can help Florida residents detect and avoid toll phishing ploys.

Anatomy of How the Florida Tolls Services Scam Unfolds

The Florida Tolls Services scam employs devious techniques to appear believable. Here is an in-depth look at how this toll invoice phishing attack typically progresses:

1. Targets Receive Unexpected Texts

The scam usually starts with people receiving surprising text messages claiming unpaid toll invoices. The random nature makes the texts seem valid.

2. Texts Cite Fake Unpaid Tolls

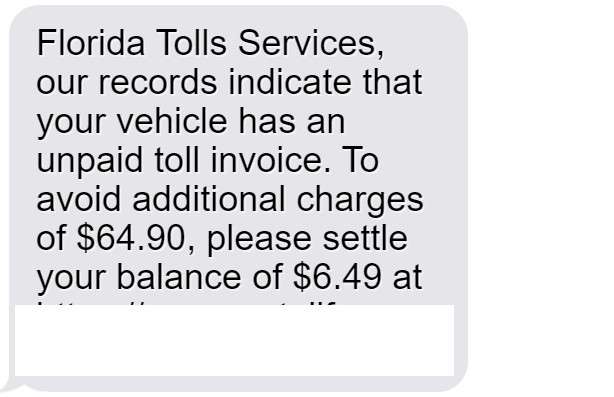

The message states it’s from “Florida Tolls Services” and cites a low unpaid toll balance, often around $6.49.

The small amount aims to get victims to pay rather than dispute. A larger toll would raise more doubt.

3. Threats of Looming Fees if Not Paid Quickly

To create urgency, the text threatens steep fees, usually 10 times the stated toll balance, if not paid immediately.

For example, “Failure to pay the unpaid toll invoice of $6.49 immediately will result in additional penalties and fees totaling $64.90.”

This induces fear of consequences, prompting hasty action.

4. Link Included to Fake Toll Website

The text includes a link to a fraudulent Florida toll website designed to harvest entered data.

The domain name contains “Florida” and “toll” to seem real but differs from the official URL.

5. Fake Site Requests Personal and Financial Details

When victims click the phishing link, a website styled to resemble a legitimate toll payment portal appears. The site prompts entry of personal details like full name, address, phone number, email, and vehicle information.

It then requests financial information like payment card numbers, expiration dates, and CVV codes.

6. Scammers Steal Submitted Personal and Financial Information

When users submit their details, the crooks capture it from the fake site’s backend database.

All data entered into the phony toll payment forms gets harvested by the fraudsters, including contact information, identities, and payment card particulars.

7. Scammers Disable Fake Site After Collecting Data

With users’ information successfully stolen, the scammers quickly disable the fraudulent website.

Victims receive no payment confirmation and only realize they were scammed once identity theft or financial fraud takes place.

8. Criminals Misuse Stolen Data

Armed with names, birth dates, contact info, SSNs, driver’s license details and financials, the crooks can commit identity theft, payment card fraud, account takeovers, and other theft.

This illustrates why verifying alleged unpaid tolls directly through official channels is essential before submitting data based solely on questionable electronic communications.

Understanding the step-by-step playbook of this scam can help Floridians identify and avoid phony toll texts and sites.

What to Do If You Receive a Suspicious Toll Text

Here are important steps if you get an unsolicited text about owing toll fees:

- Don’t click any links or call numbers – This could compromise devices or enable tracking.

- Check account status directly – Log into your verified toll account online or call official customer service.

- Forward scam texts to 7726 – This free text reporting service notifies carriers of spam.

- Watch for unauthorized charges – Closely monitor financial statements for misuse of your data.

- Change passwords – Update passwords on all accounts that may be compromised. Enable two-factor authentication when available.

- Run malware scans – Check devices for any malware from clicking phishing links and remove detected threats. Avoid public WiFi when accessing sensitive accounts afterwards.

- Consider fraud monitoring – Proactive services can identify identity theft and fraud as it takes place for quicker response.

Prompt action is key to help minimize damage from any potentially stolen information.

Safeguarding Yourself from Toll Text Scams

Beyond responding to suspicious texts, here are proactive measures drivers can take to avoid toll phishing threats:

- Don’t click unverified links/numbers – Never respond to questionable texts with unknown links or phone numbers. Report scam texts to your carrier.

- Confirm first through official channels – Verify alleged unpaid tolls directly through official websites or phone numbers before providing any information or paying.

- Use strong unique passwords – Have distinct, complex passwords for each account. Enable multifactor authentication when available.

- Limit sharing personal data – Reduce unnecessary exposure of your info from accounts and apps. Opt out of marketing communications.

- Check credit reports – Periodically review your credit reports from Equifax, Experian, and TransUnion for any fraudulent activity.

- Consider credit monitoring – Proactive services can identify theft and fraud as it occurs for quicker mitigation.

Greater awareness, caution with links, and improved security practices can help drivers safeguard their data from toll text phishing scams.

FAQ: Identifying and Avoiding Florida Tolls Services Scam Texts

1. What is the Florida Tolls Services scam text?

This phishing scam involves fake text messages stating recipients have unpaid Florida tolls requiring immediate payment to avoid fees. However, the texts are from scammers aiming to steal personal and financial data.

2. How do I recognize a scam Florida toll text?

Watch for:

- Claims of unpaid tolls around $6-$10 and threats of $60-$200 fees if not paid quickly.

- Messages allegedly from the fabricated “Florida Tolls Services.”

- Odd 10-digit numbers or area codes for the sender.

- Typos, grammar issues, or awkward wording.

- Threats of immediate fees if fake tolls not paid urgently.

3. What website do the texts link to?

The phishing texts include links to fake websites scammers designed to look like legitimate Florida toll payment portals. But the URLs use lookalike domains that differ from the real site.

4. What information do scammers ask for?

The fraudulent Florida toll sites ask for:

- Personal details like full name, address, phone, email, vehicle info.

- Financial data like payment card numbers, expiration dates, CVV codes.

- Potentially other info like SSN, driver’s license, bank account numbers.

5. What do scammers do with my information?

Scammers can use your details to:

- Commit identity theft using names, addresses, SSNs.

- Make unauthorized purchases with stolen payment card data.

- Access and drain financial accounts.

- Take over online accounts.

6. Should I click links or call numbers in suspicious texts?

Never click links or call phone numbers in unsolicited toll texts, even if penalties or fees are threatened. Doing so can compromise your device and enable scams.

7. How can I check for real unpaid tolls?

Log into your verified toll account online or call official customer service numbers to check any legitimate balances.

8. What should I do if I got a scam toll text?

If you receive a suspicious toll text:

- Don’t click links or provide any personal/financial details.

- Forward it to 7726 (SPAM) to report it.

- Contact your bank and monitor statements for unauthorized charges.

- Place fraud alerts and check credit reports for opened accounts.

- Reset account passwords and enable multifactor authentication.

9. How can I avoid Florida toll scams?

To protect yourself:

- Never click unverified links or disclose data in texts/emails.

- Independently confirm unpaid tolls through official channels.

- Use strong unique passwords and multifactor authentication.

- Check credit reports regularly for signs of identity theft.

10. Who do I contact if my information was stolen?

If you entered information into a scam Florida toll site:

- Immediately contact your financial institutions to freeze accounts.

- Report identity theft to the FTC and your local police.

- Dispute any unauthorized opened accounts with credit bureaus.

- Continue monitoring credit reports and account statements.

The Bottom Line

The Florida Tolls Services scam texts attempt to trick drivers into revealing personal and payment details by citing fake urgent unpaid toll invoices. Use extreme care responding to any texts requesting toll payments. Independently confirm unpaid tolls only through official channels before providing information or paying. Remaining vigilant can help residents avoid this prevalent toll invoice phishing ploy.

(I hope this detailed article provides valuable insights to help readers steer clear of the Florida Tolls Services phishing scam text scheme. Let me know if you would like me to expand or clarify any sections further.)