You’re cruising down a Georgia highway when suddenly a new text pops up on your phone – you allegedly owe money to “Georgia SunPass Toll Services” and must pay immediately to avoid fees. Don’t race to click that link! This digital deception is sweeping the Peach State, with scammers posing as fictional toll agencies to trick motorists out of cash. Consider this your roadside assistance to avoid being taken for a ride. I’ll illuminate how to steer clear of these tech-savvy thieves seeking easy marks. Drivers, start your engines and let’s outpace these swindlers together!

Scam Overview

This digital deception takes advantage of Georgia motorists’ heavy reliance on Peach Pass and the SunPass toll system for daily travel and commerce. Criminals are exploiting that familiarity and trust by impersonating a completely fabricated entity dubbed “Georgia SunPass Toll Services.”

Unsolicited text messages arrive insisting you have unpaid toll charges requiring immediate payment to avoid substantial late penalties upwards of $50 or more. The texts cite an oddly specific amount like $11.69 and provide a link to hastily settle the “debt.”

However, no such unpaid toll actually exists. The urgent threats of fines for delayed payment are pure fiction as well, invented solely to panic recipients into hasty action. Even the name “Georgia SunPass Toll Services” is a fake, made-up to sound legit.

In frantic desperation to avoid imminent steep penalties described in alarming detail, users click the provided link which leads not to any valid state portal but to deceptive websites designed specifically for stealing personal information and payment data.

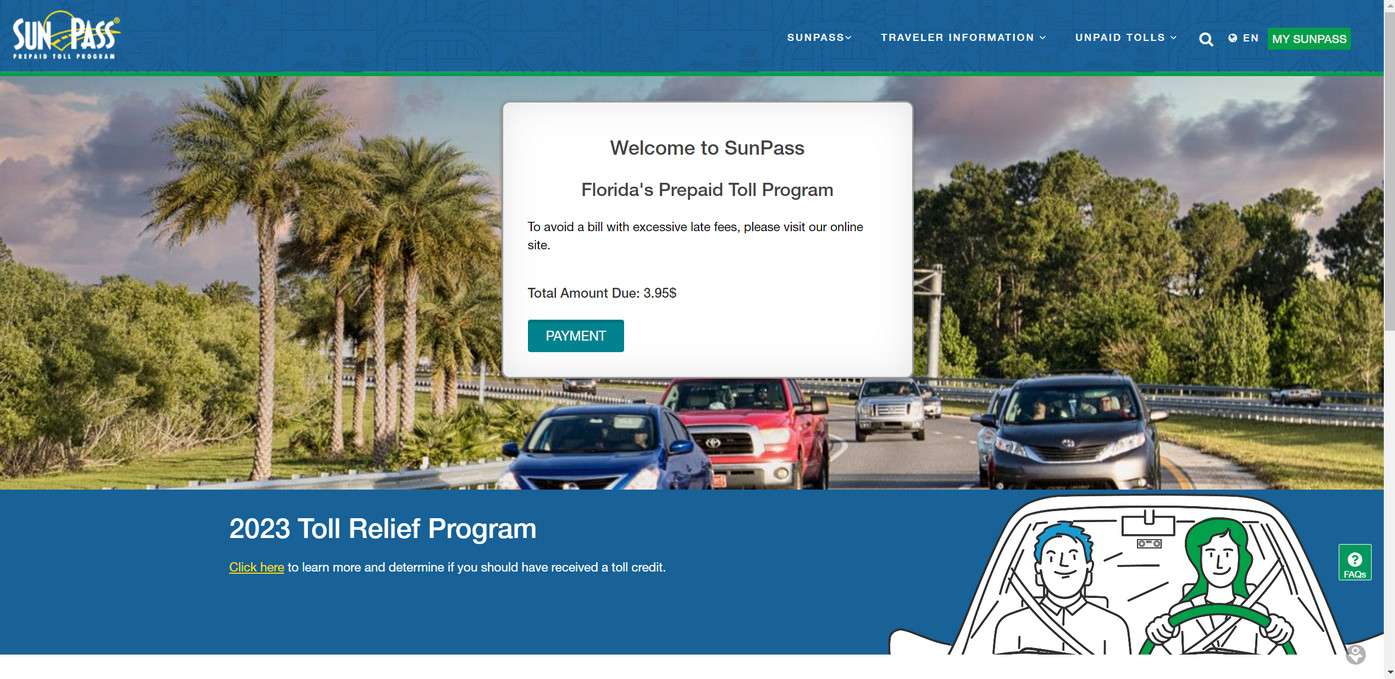

These fraudulent sites are engineered by scammers to closely resemble official Georgia toll payment interfaces, even incorporating official branding elements and colors to appear valid. But it’s just digital smoke and mirrors masking the criminals’ underlying motives.

After being tricked into inputting sensitive personal info, users are shown a convincing mock-up invoice for the exact phony toll amount first mentioned in the scam text. Oftentimes an additional fictional “late fee” is tacked on to further urgency.

Next, victims are instructed to enter credit card or banking details to clear this imaginary balance, at which point scammers capture financial data for misuse while the victim remains oblivious.

No money goes to pay any actual Georgia tolls, which never existed in the first place. The oddly specific fictional amounts are purely to subconsciously feel more realistic, as most real tolls end up rounded numbers.

In reality, scammers simply pocket ill-gotten gains and identities from those deceived by this toll payment ruse and the air of legitimacy woven throughout it. Don’t let scammers take you for a ride down Georgia’s highways. Guard your details closely and be wary of any shady texts insisting immediate toll payment is required. You have the power to navigate around this fraud.

How the Georgia SunPass Toll Scam Unravels

From the initial contact to the deceitful web portal, here’s an inside look at how scammers try pulling the wool over your eyes:

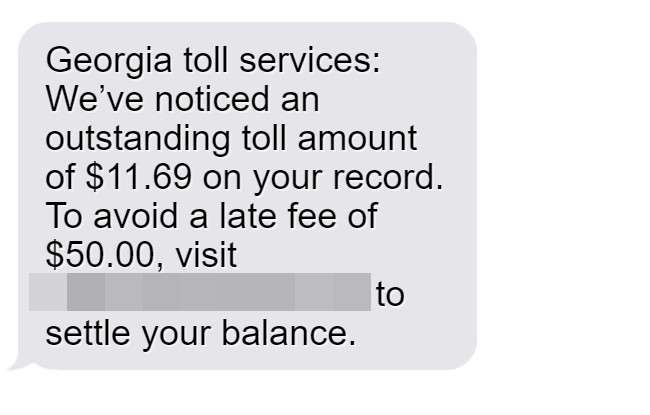

1. The Text Message

You’ll receive a text from a local number stating you owe immediate payment for unpaid toll charges. It threatens huge late fees if not settled ASAP by clicking their link.

For example:

“Georgia toll services: We’ve noticed an outstanding toll amount of $11.69 on your record. To avoid a late fee of $50.00, visit GeorgiaSunPassTollServices.com to settle your balance.”

The short deadline, lofty fine, and shady link are obvious red flags. Legitimate toll agencies do not operate this way.

2. Visiting the Fake Website

Clicking the link takes you to a slick fake website dressed up to look like an official Georgia toll payment portal. Scammers often mimic colors, logos, and graphics used by SunPass.

You’ll be prompted to enter personal details like full name, DOB, address, phone number, and more. This allows scammers to steal identities.

3. Entering Payment Information

After submitting your sensitive info, you’ll see a phony invoice for the exact unpaid toll amount mentioned in the initial text. Scammers usually tack on fictional late fees too.

You’ll be instructed to enter credit card information to pay this fabricated toll bill and avoid additional penalties. In reality, scammers pocket your payment info while your accounts and identity remain at risk.

What to Do if You Are Scammed

If you fell for this SunPass toll trickery, take these steps immediately to minimize damages:

- Contact your bank/card provider to halt payments and contest unauthorized charges. Monitor closely for further suspicious activity.

- Put fraud alerts on your credit reports and consider signing up for credit monitoring to catch any misuse of your identity.

- Report the scam to the Georgia Attorney General’s office and file an FBI IC3 complaint online.

- Change account passwords, especially if reused on the phony toll website. Make them long and complex.

- Avoid further engagement with scammers who now have your contact information. Block their numbers.

- Contact SunPass via official channels to inquire about any legitimate unpaid tolls.

- Spread awareness to help prevent others from being swindled too.

Quick reaction can help curtail the fallout from compromised finances or personal data. Use the misstep as motivation for sharpening your scam prevention skills.

Frequently Asked Questions about the Georgia SunPass Toll Scam

1. What is the Georgia SunPass toll scam?

The Georgia SunPass toll scam involves scammers sending fake text messages claiming to be from Georgia SunPass Toll Services. The texts demand immediate payment for fake unpaid tolls to avoid fictional late fees. Their links go to phony websites designed to steal personal and financial information.

2. Who are the messages from?

The texts are not from Georgia’s real SunPass or any legitimate toll agency. “Georgia SunPass Toll Services” is a completely made up name that scammers use to execute this fraud.

3. What details do the scam texts include?

The texts cite a specific unpaid toll amount owed, threats of high fake fees, and links to fraudulent websites dressed up to look like official Georgia toll payment portals.

4. How can I recognize the Georgia SunPass toll scam?

Warning signs include getting unsolicited texts about unpaid tolls, steep late fees, links to fishy sites, requests for your personal information, and pressure to pay immediately. None of it is real.

5. What keywords should raise red flags?

Phrases like “Georgia SunPass Toll Services,” “outstanding toll,” “late fee,” and links to unfamiliar sites are red flags. Legitimate toll agencies do not contact you this way.

6. Are there sender IDs I can look out for?

The texts come from a variety of changing local phone numbers. Scammers often spoof caller IDs to appear credible. There are no specific numbers that always signal this scam.

7. How can I avoid this Georgia SunPass toll scam?

Do not click on links in questionable texts about tolls. Contact SunPass via official channels on government websites if you have toll questions. Only pay tolls through your real account on the official SunPass website.

8. What should I do if I get a suspicious text?

If you get a shady toll-related text, do not click the link or call the number. Report the scam to the Georgia Attorney General. Call SunPass directly using official numbers to inquire.

H3: 9. How can I safely pay any legitimate tolls?

Log into your account on the official SunPass website. Use real online or phone payment options only. Never pay toll bills on third-party sites, especially ones sent unexpectedly via text.

10. What should I do if I paid a fake toll bill?

If you shared information or paid, contact your credit card company right away to dispute the charges. Also place fraud alerts, monitor your statements, change account passwords, and contact the Georgia AG.

11. How can I get my money back if I paid a scam toll bill?

Unfortunately it is very difficult to recover money sent to scammers. File disputes with your bank and monitor for identity theft. Use extreme caution with all money transfer or data sharing requests moving forward.

12. How can I protect myself from identity theft if scammed?

If your information was compromised, enroll in credit monitoring services to detect misuse. Freeze credit reports if warranted. Continue monitoring accounts closely for any fraudulent activity and report it immediately.

The Bottom Line

The “Georgia SunPass Toll Services” scam exploits familiarity with Peach Pass and SunPass to defraud Georgia residents. Stay vigilant against texts demanding immediate toll payment and threatening extreme late fees.

Use the knowledge in this guide to recognize fraudulent toll collection scams and verify real agencies through official channels only. Refuse to let scammers pressure you into rash decisions that obscure your discernment.

Together we can stop these criminal masterminds in their tracks before they hoodwink more innocent commuters just trying to get around. Stay alert on Georgia’s roads and beyond – you have the power to protect yourself.