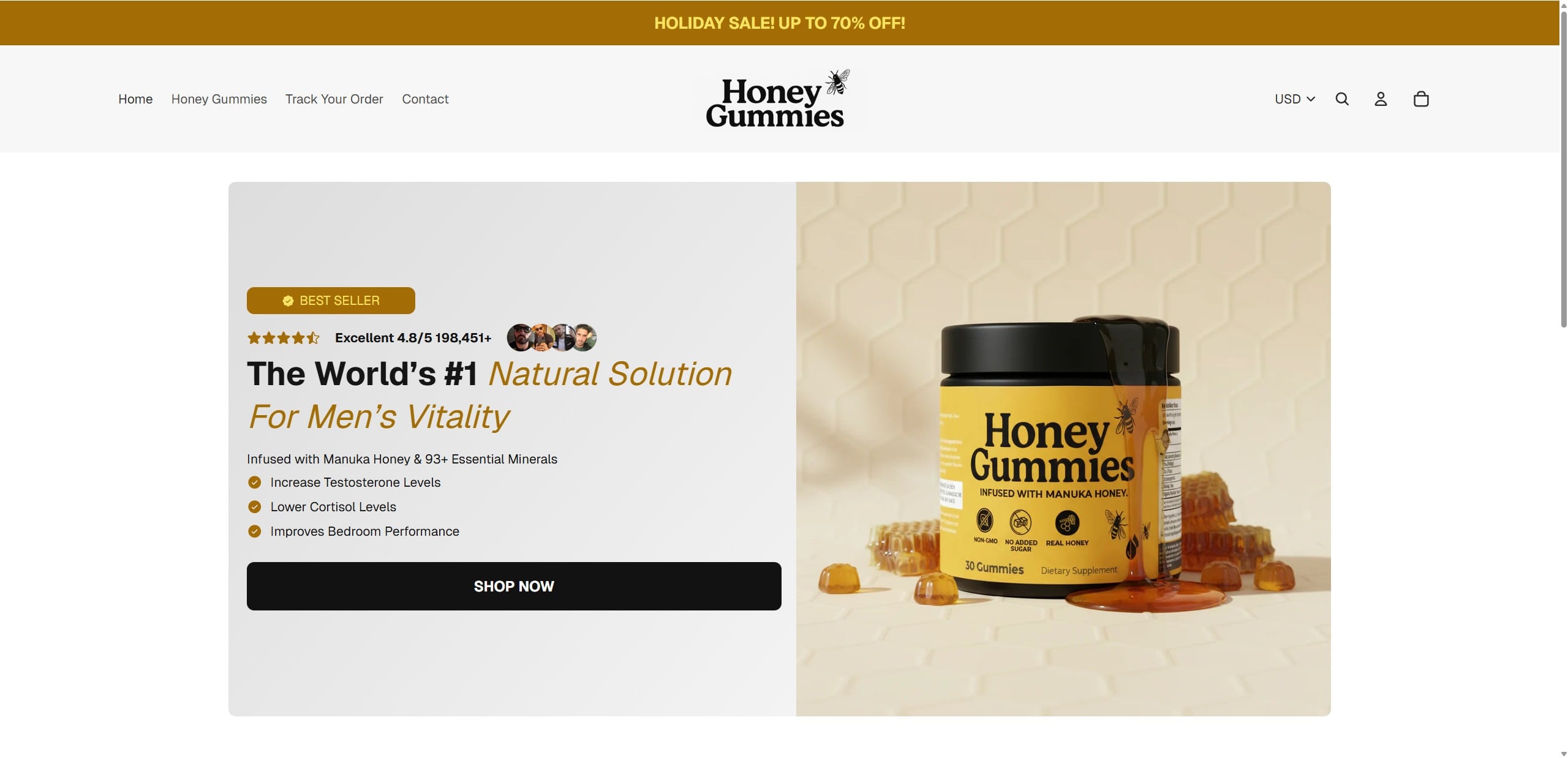

“Honey Gummies” is the kind of product that’s easy to click on when it shows up in your feed. The pitch is simple: a natural, daily gummy that supports men’s vitality, stamina, testosterone, and performance, with no prescriptions and no “awkward” pharmacy run.

If you’ve landed on the Honey Gummies site (or seen the ads), you’ve probably also noticed the heavy emphasis on big results, big discounts, and big numbers. That can make the decision feel urgent. It can also make a careful buyer pause and ask the right question:

Is this something you should actually buy, or is it another modern direct-to-consumer supplement that looks better in ads than it performs in real life?

This article breaks down what Honey Gummies claims, what the ingredients can realistically do, what the marketing signals suggest, how a typical dropshipping-style supplement operation works, and what to do if you already placed an order.

Overview

Honey Gummies is marketed as a natural men’s vitality supplement built around a few familiar, highly marketable ingredients:

- Manuka honey

- Shilajit

- Ashwagandha

- Sea moss

The brand presentation is designed to feel premium and clinical at the same time. The site highlights themes like purity, verified batches, and third-party testing, while also pushing emotional hooks like “the real problem doctors don’t talk about.”

That combination is not automatically “bad,” but it’s a pattern you see constantly in aggressive supplement marketing. The question is whether the product’s proof, transparency, and real-world reputation match the confidence of the claims.

What Honey Gummies claims to do

Across the page and ad-style creative, Honey Gummies is framed as a daily “foundation” supplement rather than an “event-based” product. In other words, it’s not presented as a one-time boost. It’s presented as something that improves your baseline over time.

Common claims and themes include:

- Supports men’s vitality and bedroom performance

- Boosts testosterone markers

- Improves stamina and energy

- Helps with circulation and performance

- Positions itself as a “natural alternative” to Viagra-style products

- “No hidden drugs” messaging (often paired with warnings about other honey packets)

The brand also leans into medical-adjacent framing with lines about circulation, blood flow, and men who have diabetes or prediabetes. It suggests other “performance supplements” can make things worse due to hidden sugars or stimulants, and positions Honey Gummies as different.

Here’s the key point: even if ingredients like ashwagandha or shilajit have some research behind them, that does not automatically validate the big outcomes implied in the ads.

What’s actually in Honey Gummies

From the ingredient panel shown on the site, the highlighted actives per serving (1 gummy) are:

- Organic Manuka Honey (MGO +263) 340 mg

- Pure Shilajit 300 mg

- Ashwagandha 300 mg

- Organic Sea Moss 300 mg

The page also lists “other ingredients,” including items typical for gummies, such as sweeteners and gelling agents. Notably, the site indicates it contains sugarcane sugar and positions the formula as having no fillers or hidden ingredients.

That creates a built-in contradiction you should notice immediately:

- On one hand, the marketing leans hard into “sugar-free” or “safe for diabetics” vibes in some sections.

- On the other hand, the ingredients list mentions added sugar.

There are ways both could be “technically” true depending on serving size, total sugar grams, and labeling details, but the only way for a shopper to judge that fairly is to see a full Supplement Facts panel with:

- Total sugars per serving

- Added sugars per serving

- Calories per serving

- Full standardization details (especially for ashwagandha)

- Any allergen or manufacturing disclosures

If a product is leaning into diabetes-related reassurance, those details matter. A lot.

The “third-party tested” messaging problem

One of the strongest persuasive angles on the Honey Gummies page is testing and purity:

- “Third-party tested”

- “Verified pure”

- “Every batch”

- Mentions of certificates of analysis or “test results”

That sounds great. The issue is that supplement marketing often uses “tested” language as a substitute for showing the testing.

A real third-party testing claim becomes meaningful when you can easily verify:

- The name of the lab

- The batch number tied to your bottle

- The date of testing

- What was tested (heavy metals, microbial contamination, pesticide residues, identity, potency)

- The actual results and limits used

If a site relies on “trust us” language without publishing clear, batch-linked documentation, the testing claim functions more like a marketing slogan than consumer protection.

The big numbers and “too perfect” proof

Honey Gummies uses large, confidence-building numbers and percentage claims such as:

- Star ratings with very high review counts

- Large “results” figures like “184K+” style claims

- High “still using after 3 months” percentages

- Percentage increases in testosterone markers

Here’s the practical issue: numbers like these are easy to type into a webpage and hard to validate.

When a brand cites performance stats, a cautious reader should ask:

- Where did the data come from?

- Was it a study, a survey, or internal purchase metrics?

- How were participants recruited?

- Was there a control group?

- What does “increase in testosterone markers” mean in plain terms?

- Which biomarkers? Total testosterone? Free testosterone? SHBG? Something else?

- Over what timeframe?

If the page does not answer those questions, the numbers are persuasive, but not probative.

Product images and “AI-polished” creative

Many modern supplement brands use heavily edited images, 3D renders, or AI-assisted creative. That alone does not prove a product is fake.

What it can signal is this:

- The brand’s priority is conversion-first marketing

- The visuals may be aspirational rather than documentary

- You should verify the basics before buying (company identity, fulfillment, returns, and real external feedback)

If product photography looks “too clean,” that’s not a reason to panic. It’s a reason to slow down and verify.

The ingredients: what they can realistically do

Let’s talk about the core ingredients in normal, grounded terms.

Manuka honey

Manuka honey is best known for:

- Antibacterial properties in certain contexts

- Unique compounds associated with Manuka grading systems (like MGO)

What it is not known for is being a direct, reliable solution for erectile dysfunction or testosterone.

Honey can be a useful food. Manuka can be a premium honey. But the leap from “Manuka honey” to “stronger, longer-lasting erections” is not a standard scientific conclusion. If a brand uses honey as a hero ingredient for male performance, it’s usually because honey is a powerful story ingredient, not because it’s a clinically established ED solution.

Also, 340 mg is a very small amount in food terms. Honey is usually consumed in grams, not milligrams.

Shilajit

Shilajit is often marketed for:

- Energy

- Vitality

- Testosterone support

- General wellness

There is some research interest here, but the big consumer risk with shilajit is quality control. Shilajit can be contaminated depending on sourcing and processing, which is why real, verifiable testing matters.

If you buy any shilajit-containing supplement, you want clarity on:

- Purification method

- Heavy metals testing

- Identity testing

If a brand says “verified clean,” that should come with documentation you can trace to a batch.

Ashwagandha

Ashwagandha is one of the more studied supplement ingredients for:

- Stress support

- Sleep quality improvements in some people

- Small-to-moderate benefits in specific contexts

It is not a guaranteed testosterone booster. Some studies suggest it may support testosterone or related outcomes in certain populations, but results vary and depend on:

- The extract type (KSM-66, Sensoril, or other standardized extracts)

- The withanolide content

- The dose

- The duration

- The individual’s baseline health, sleep, and stress

A key marketing phrase to be wary of is “clinically dosed” without specifying the standardized extract and the active compounds. “Ashwagandha 300 mg” could mean many different things.

Sea moss

Sea moss is frequently marketed as a mineral-rich superfood. The reality is more complicated:

- Mineral content varies widely by source

- Iodine content can be a real concern for some people

- Claims around hormones and performance are often exaggerated

If sea moss is included, it should be approached as a general wellness ingredient, not a targeted male performance solution.

The biggest practical question: is it a daily gummy or a performance product?

Honey Gummies frames itself as “daily support” rather than a fast-acting option like sildenafil.

That matters because it changes what you should expect.

A daily supplement, even a good one, tends to produce subtle effects:

- Better sleep can improve libido

- Lower stress can improve performance

- Improved exercise habits can support confidence and energy

But when a brand implies strong, direct erection improvements and compares itself against Viagra-like expectations, it’s mixing two worlds:

- The “wellness” world (subtle, slow, lifestyle-linked)

- The “ED medication” world (more direct, more predictable, clinically regulated)

When those get blended in marketing, buyers can end up disappointed even if the gummies are “real.”

Red flags worth taking seriously

You shared several concerns that are absolutely worth paying attention to as a consumer. Based on the page style and typical tactics in this category, here are the main risk signals:

- Aggressive discounts and “up to 70% off” urgency framing

- Price anchoring that makes the “sale” feel too good to miss

- Unverified “third-party tested” claims without clear, batch-linked proof

- Big performance stats with no clear methodology

- Extremely high onsite review counts that do not easily match independent review ecosystems

- Highly polished creative that looks more like ads than documentation

None of these prove wrongdoing on their own. What they do prove is that the brand is optimized for impulse conversion. That means you should be twice as careful about verifying the business basics.

Green flags that would change the picture

If Honey Gummies wants to be taken seriously as a premium, clean supplement, there are several transparency steps that would reduce buyer risk immediately:

- A public, easy-to-find company identity (not just a contact form)

- A clear returns and refunds policy that is readable and specific

- Shipping timelines that match real fulfillment

- Batch-specific COAs from a named lab

- A full Supplement Facts panel with sugar details

- Independent reviews on established platforms, not just onsite widgets

If you can verify those points with confidence, your risk drops a lot.

Who might still consider it, and who should avoid it

This is where a practical, buyer-first answer matters.

You might consider a product like this if:

- You understand it as a general wellness supplement, not an ED fix

- You are comfortable paying a premium for branding and convenience

- You can verify transparent testing and fair refund terms

- You do not need fast, predictable results

You should avoid it, or at least pause, if:

- You are looking for a medication-like effect

- You have diabetes, prediabetes, or need tight control of sugar intake and the labeling is unclear

- You take blood pressure meds, heart meds, or nitrates (you should speak with a clinician before taking performance supplements)

- You have thyroid issues (iodine sensitivity can matter with sea moss)

- You are sensitive to supplement hype and want external proof before buying

How The Dropshiping Operation Works

Not every direct-to-consumer supplement is “dropshipped” in the classic sense of a factory shipping single parcels from overseas. Some use U.S. fulfillment centers. Some use contract manufacturers. Some are private label products with domestic logistics.

But the business model you’re pointing to is real: a conversion-driven storefront paired with aggressive advertising, bundle pricing, and a brand story that can be launched fast.

Here is how these operations typically work, step by step, and what to look for at each stage.

Step 1: Create a brand that sells a feeling, not a formula

The first move is not the supplement. It’s the identity.

A modern supplement brand is built around:

- A simple name that’s easy to remember

- A clean label design that photographs well

- A hero ingredient story (Manuka, shilajit, ashwagandha)

- A single emotional promise (vitality, confidence, performance)

The formula can be secondary because the ads do the heavy lifting.

This is why product visuals often look “studio perfect.” The goal is to remove friction and make the product feel premium at a glance.

Step 2: Use ads that hook fast and trigger curiosity

Most shoppers do not search for “Honey Gummies supplement” first. They discover it through ads.

Common hook styles include:

- “Doctors don’t talk about this”

- “The real reason men struggle with performance”

- Before-and-after style storytelling

- Testimonial-driven short clips

- “A buddy told me…” narrative framing

This style works because it feels personal, not corporate. It also bypasses a shopper’s normal skepticism by making it feel like a recommendation, not a pitch.

Step 3: Send traffic to a long-form sales page built for conversion

Once you click, you land on a page designed to keep you scrolling.

Conversion pages in this niche usually include:

- A bold headline that declares a ranking, like “World’s #1”

- Star ratings and massive review counts

- A short list of benefits in plain language

- Lifestyle images of confident, healthy-looking people

- Multiple sections that repeat trust themes: purity, testing, clean ingredients

The page is built to answer objections before you fully form them.

Step 4: Add credibility signals that look scientific, even if they are not verifiable

This is where the “certificate,” “lab tested,” “verified pure,” and “every batch” language often appears.

These signals can be legitimate.

They can also be vague on purpose, because vague credibility is easier to maintain than specific proof.

What you should look for here:

- Are the documents real, readable, and tied to batches?

- Can you match the report to the exact product you receive?

- Is the lab clearly identified?

If the answer is no, the testing claim is functioning as marketing.

Step 5: Use price anchoring and bundle math to force a “smart” decision

This is one of the most recognizable tactics in this category.

The page will show:

- A high “original” price

- A limited-time discount, often up to 70%

- Bundle deals like buy 2 get 1, or buy 3 get 2

- Messaging that frames the larger bundle as the best value

This does two things:

- It makes you feel the product is expensive and premium

- It makes you feel the discount is an opportunity you’ll lose

The psychology is powerful. It’s also a reason to slow down.

A simple rule that helps:

If a supplement is “70% off” all the time, it was never priced at the original amount in a meaningful way.

Step 6: Push upsells at checkout

Many supplement funnels use:

- Order bumps (add another bottle for $X)

- A “protection” add-on

- Priority processing

- Extra bundles with slightly lower per-unit prices

None of this is inherently wrong.

The risk is that it can make the final charge higher than expected, especially if the checkout design is optimized to nudge you into extras.

If you buy, take screenshots of:

- The cart page

- The final checkout total

- Any subscription or recurring billing language

Step 7: Fulfill through a third-party logistics chain

This is the operational heart of the model.

Common fulfillment setups include:

- Private label supplement made by a contract manufacturer, shipped from a fulfillment warehouse

- A bulk product sourced from a supplier, labeled and packed by a third party

- A hybrid approach where marketing is one company and fulfillment is another

What this means for the buyer:

- Shipping times can vary

- Customer service can be slow or scripted

- Returns can be inconvenient, especially across borders

- The brand may not control the full customer experience

Step 8: Manage reputation with onsite review widgets and controlled testimonials

When a site displays huge review counts, the natural question is: where else are people talking about this?

Some brands rely heavily on:

- Onsite reviews only

- Testimonials that cannot be traced externally

- Influencer-style clips that are actually paid creatives

This creates a closed-loop reputation system. You see praise only where the brand controls the environment.

A healthier sign is when you can find:

- Consistent discussions in independent spaces

- Mixed reviews, not only perfect ones

- Third-party retailer feedback, if applicable

Step 9: Handle refunds and disputes as a cost center, not a service

In high-volume funnels, refunds are treated like an expected percentage of sales.

That can lead to patterns like:

- Slow responses

- Requests for “proof” that create friction

- Partial refunds offered to avoid returns

- Strict return windows that are hard to meet if shipping is slow

Again, not every brand does this. But it’s common enough that you should read the refund policy before buying, not after.

Step 10: Rebrand fast if the product stops converting

One reason this business model is powerful is speed.

A brand can pivot quickly by:

- Launching a new domain

- Changing the label and product name

- Reusing the same formula with new marketing

That’s why transparency matters more than the story.

If you cannot easily identify who owns the brand and where it’s fulfilled, you’re buying into a funnel, not a company relationship.

A quick checklist to spot a high-risk funnel

If you see several of these at once, proceed carefully:

- Constant “up to 70% off” messaging

- Huge review numbers only on the site itself

- Big stats with no explanation

- Vague testing claims without batch-linked reports

- No clear company address or corporate identity

- Return policy that is hard to find or very strict

- Heavy pressure to buy multiple bottles immediately

What To Do If You Have Bought This

If you already ordered Honey Gummies, you’re not stuck. The key is to act calmly, document everything, and protect yourself from surprises.

Here’s a practical, step-by-step plan.

- Save your order proof immediately

Download or screenshot:- Order confirmation page

- Email receipt

- The product page sections that influenced your decision (testing claims, guarantees, shipping timelines)

- The final checkout total, including any add-ons

- Check for recurring billing language

Look closely at:- The checkout page text

- The confirmation email

- Your bank statement descriptor

- Track the shipment and note the timeline

If you received tracking:- Screenshot the tracking page

- Note the carrier name

- Note the estimated delivery date

- Read the refund policy now, not later

Find the policy and screenshot it.Pay attention to:- Return window length

- Whether you must return unopened bottles only

- Who pays return shipping

- Whether refunds exclude shipping or “processing” fees

- Any restocking fees

- Contact customer support in a documented way

Use email or a support ticket system where you can keep records.Keep it short and clear:- Provide your order number

- State what you want (refund, cancellation, address correction)

- Ask for a written confirmation

- If the product arrives, inspect before you consume

Check:- Seals and packaging integrity

- Lot or batch number

- Expiration date

- Any manufacturer details

- Be cautious with use, especially with medical conditions

If you have heart issues, blood pressure concerns, diabetes, thyroid conditions, or you take prescription medications, consider speaking with a qualified clinician before taking any performance supplement.If you feel unusual symptoms after taking it, stop and seek medical advice. - If support is unresponsive, escalate through your payment method

If you paid by card and you cannot resolve it with the merchant:- Contact your card issuer

- Ask about a chargeback window

- Provide your screenshots and email trail

- Report misleading supplement marketing if needed

If you believe the marketing was deceptive, you can report it to relevant consumer protection channels in your country. In the U.S., consumers often use FTC reporting pathways, and adverse reactions can also be reported through FDA channels. - Protect yourself from follow-up marketing

After purchases in this niche, people sometimes get targeted with:

- Additional supplement offers

- “Limited-time” refill deals

- Bundles and upsells sent by email

Use common-sense hygiene:

- Do not click links you do not trust

- Keep purchase records

- Monitor your statements for unexpected charges

The Bottom Line

Honey Gummies is marketed as a clean, natural men’s vitality gummy built around Manuka honey, shilajit, ashwagandha, and sea moss. On paper, those ingredients sound compelling. In real life, the biggest concerns are not the buzzwords, but the proof.

When a supplement leans heavily on massive discounts, pressure-driven messaging, unverified stats, and “tested” language without easy-to-check documentation, the safest approach is caution. That does not mean the product is automatically fake. It means the marketing is doing more work than the transparency.

If you want a daily wellness supplement, you should only buy after you can verify batch-linked testing, clear labeling, and fair refund terms. If you want medication-like results, a gummy supplement is unlikely to match those expectations, no matter how confident the sales page sounds.