It starts like any other text. No greeting. No explanation. Just a blunt warning from “Parking Enforcement” and a link that looks like it was meant to be clicked fast.

Most people don’t remember every meter, every garage, every quick stop where they “definitely paid.” So when the message says your account has been marked for a violation and you owe $8.99, it lands in that uncomfortable space between doubt and urgency.

And that’s the moment this scam is built for.

Because the real problem isn’t the $8.99. It’s what happens after you tap the link.

Scam Overview

The “Parking Enforcement: Account Marked For Reporting Handle Violation” scam is a text-message phishing attack designed to look like a legitimate parking ticket notification. It’s built to trigger a very specific emotion: pressure.

Most people have parked in a city lot, near a meter, at an airport, or in a garage where rules change quickly. You might have paid, but maybe the meter timed out. Maybe you typed your plate number wrong. Maybe signage was confusing. So when a message suggests you have a violation, your brain fills in the gaps with “That could be possible.”

Scammers exploit that uncertainty.

At the center of this scam is a simple pattern:

- An official-sounding sender name like “Parking Enforcement”

- A warning that your account has been “marked” or “flagged”

- A vague phrase like “Reporting Handle Violation” that sounds bureaucratic on purpose

- A link that claims to resolve the issue

- A small amount due, commonly $8.99, that feels easier to pay than to investigate

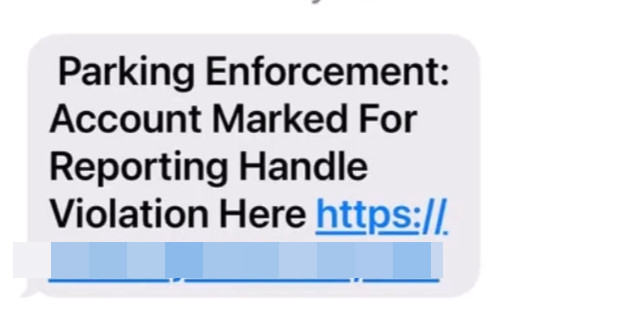

The message shown in many reports looks like this:

“Parking Enforcement: Account Marked For Reporting Handle Violation Here [link]”

That link is a major clue. Real municipal parking systems typically use recognizable government or contracted vendor domains, not random-looking addresses. Scammers often rely on strange subdomains and unfamiliar domain names because they can spin them up quickly, abandon them quickly, and replace them when they get blocked.

What makes this scam especially effective is how little information it provides.

Legitimate parking citations usually include details such as:

- Your license plate number (or at least a reference to it)

- A citation number you can verify

- The city, authority, or contractor name

- The location, date, or time of violation

- Official payment options and dispute instructions

This scam does the opposite. It keeps things vague so you do not stop to verify. It pushes you toward the link, where the scammers control the entire story.

Why the $8.99 parking violation amount is a powerful trap

The $8.99 amount is not random. It’s a sweet spot.

If the scam demanded $189, many people would slow down, question it, and search online. But $8.99 feels like:

- A minor “administrative” fee

- A meter overage

- A small violation you could plausibly forget

- A quick fix that saves time

That low amount is intentional because it lowers your defenses. The payment is framed as an inconvenience, not a crisis.

But even when the charge is small, what you type into the payment form can be worth far more to criminals than $8.99.

What scammers actually want from you

Depending on how the fake site is designed, the scam may try to collect:

- Full name and phone number

- Home address and email

- Date of birth

- Credit or debit card number, expiration date, and CVV

- Sometimes additional “verification” details that can support identity theft

Even if the page looks like it only needs payment, the form fields often reveal the scam’s real motive: data harvesting.

And once scammers have that data, they can use it in several ways:

- Make unauthorized card purchases

- Test your card with small “validation” charges

- Sell your information to other fraud groups

- Attempt account takeovers using your email and phone number

- Use your details for more convincing follow-up scams

Why these texts feel legitimate at first glance

This scam is part of a wider trend called smishing, where scammers use texts instead of emails because texts are more likely to be opened quickly.

A lot of people are conditioned to trust certain types of messages on mobile:

- Delivery updates

- Bank security alerts

- Password resets

- Appointment confirmations

- Short notices from “official” services

Parking notices fit that same mental category. They are plausible, time-sensitive, and easy to ignore until they become expensive. That’s why scammers love this theme.

They also rely on the fact that most people do not know what a real parking authority text should look like. Some cities do send text reminders for meter sessions or permits, and some parking apps send texts about expiring time. That creates just enough reality for a fake to hide inside.

Common language patterns used in the Parking Enforcement scam text

While scammers constantly tweak wording, many “account marked” parking scam texts share these patterns:

- “Final notice” or “last warning”

- “Account flagged” or “marked for reporting”

- “Violation requires action”

- “Pay now to avoid additional penalties”

- Vague references to “handle” or “reporting” to sound procedural

That odd phrasing is not an accident. Terms like “reporting handle” are meant to sound official, even if they do not make much sense. The goal is not clarity. The goal is compliance.

Where the link takes you

After clicking, victims typically land on a page that looks like a ticket payment portal. It often includes:

- A heading that suggests a city parking department

- A prompt to “resolve your violation”

- A due amount, often $8.99

- Fields to enter card details and personal info

- A big button like “Pay Now” or “Confirm”

In some versions, the site adds extra pressure by claiming the fine will increase if you do not pay immediately.

In other versions, it says your “account is marked” and implies escalation, such as collections, license holds, or reporting. Those threats are designed to short-circuit your judgment.

Why the scam spreads so quickly

Scammers can scale text scams cheaply and fast.

They use tactics such as:

- Bulk SMS services and rotating phone numbers

- Spoofed sender IDs (where possible)

- Massive lists of phone numbers from data breaches or scraped sources

- Automated site templates that can be cloned in minutes

If a link gets blocked, they swap domains and keep going.

That’s why you may see different URLs, even though the scam message feels identical.

Who is most likely to be targeted

The truth is, this scam targets almost everyone. It does not require scammers to know where you parked or whether you even drive.

But it can be especially effective against:

- City residents who park regularly

- Travelers who used airport parking or rental cars

- People who recently used a parking app

- Anyone who has ever received a legitimate ticket before

- Busy people who handle tasks quickly from their phone

And importantly, scammers do not need you to be “careless.” They just need you to be human for one moment, distracted, rushed, or trying to clear notifications.

The biggest misconception about this scam

Many victims blame themselves because the fee is small and the text looks “obviously fake” in hindsight.

But scams like this are designed for hindsight to be cruel.

In the moment, the message arrives like a tiny emergency you can erase with $8.99. That is the hook. The scam is not built for careful analysis. It’s built for real life.

Once you understand that, it becomes easier to respond calmly, protect yourself, and move forward without shame if you already clicked.

How The Scam Works

Below is a step-by-step breakdown of how the “Parking Enforcement: Account Marked For Reporting Handle Violation” scam typically unfolds, including what’s happening behind the scenes and why each stage is engineered to keep you moving forward.

Step 1: The scammer sends a short, official-sounding text

The first step is the text message itself. It’s usually minimal because minimal messages get read faster.

The wording is crafted to do three things immediately:

- Establish authority (“Parking Enforcement”)

- Signal risk (“Account Marked” or “Reporting”)

- Provide a single action (“Handle Violation Here” with a link)

Many versions avoid naming a specific city because scammers want the message to work anywhere. If they named a city and you didn’t live there, the scam would fail instantly. Keeping it generic expands the victim pool.

Step 2: The message triggers a fast emotional response

This part is subtle, but it’s the engine of the scam.

A parking violation is believable because it’s common and annoying. It is not like “You won a prize.” It’s the opposite. It’s a negative surprise that feels realistic.

The text creates a mental loop:

- “Did I park somewhere wrong?”

- “I don’t want fees to increase.”

- “I’ll just pay it and move on.”

That loop is what scammers want. When you’re inside it, you are less likely to verify the source.

Step 3: The link pushes you onto the scammer’s turf

Once you click the link, the entire environment changes.

Text messages are constrained. A website gives scammers room to build a convincing stage set. They can add logos, official language, and structured forms that look like real payment systems.

The URL itself may look odd, but many people do not check URLs carefully on mobile, especially when the page loads quickly and appears “official enough.”

In some cases, the link may redirect through multiple pages. That can help scammers:

- Track which victims clicked

- Rotate pages based on device type

- Avoid filters by changing final destinations

Step 4: The site presents a small fine, often $8.99

This is where the scam becomes dangerously persuasive.

The site often shows a pre-filled amount like $8.99, sometimes framed as:

- A base violation fee

- An administrative charge

- A “processing” fee required to close the case

The page may claim the fine increases soon, or that your account is already flagged. It might also suggest this is your last chance to avoid escalation.

Even if those claims are false, they create urgency, and urgency produces action.

Step 5: The form asks for personal and payment details

Once the victim agrees to pay, the site requests information. This is the core extraction phase.

A typical phishing form may ask for:

- Name and phone number

- Address and postal code

- Card number, expiration date, CVV

- Sometimes email and date of birth

Some scam pages add a “citation number” field to appear legitimate. They may auto-generate one, or allow you to type anything and still proceed.

That’s a key sign you’re on a fake portal: real systems validate citation data before accepting payment.

Step 6: The site confirms a “successful payment,” then the real damage begins

After submission, many victims see a success screen or a “thank you” page. This is designed to prevent immediate suspicion.

If you think the problem is solved, you are less likely to call your bank right away. That delay gives scammers time to use your data.

From there, scammers may:

- Run small test charges to confirm the card works

- Move on to larger purchases or transfers

- Use your personal info to craft more targeted fraud

- Sell the card details to other criminals

In some cases, the scammers may not even process the $8.99 as a “parking payment.” The transaction descriptor could look unrelated, confusing victims and delaying reporting.

Step 7: Follow-up scams may target you again

Once a scammer knows you clicked and submitted information, you can become a more valuable target.

Some victims receive additional messages such as:

- “Your payment failed, please retry”

- “Additional fee required to close the violation”

- “Your account is still marked, verify identity”

This is called re-engagement. It’s designed to pull more information, more money, or both.

If you ever clicked once, treat any follow-up messages as high risk.

Step 8: Why blocking the number is not enough

A lot of people block the sender and move on. Blocking helps reduce spam, but it does not solve the broader issue because:

- Scammers rotate numbers constantly

- Many messages come from new senders each time

- Some are sent through services that generate fresh routes

Blocking is useful, but verification habits are what truly protect you.

What makes this scam different from “normal” spam

Classic spam tries to sell something. This scam tries to impersonate authority and create consequences.

The most effective scams do not look like offers. They look like obligations.

That’s why this parking enforcement text scam works so well. It blends into the same category as real-world responsibilities, and it arrives in the most interruptive place possible: your lock screen.

What To Do If You Have Fallen Victim to This Scam

If you clicked the link, entered information, or paid the $8.99 parking violation, take a breath. You are not alone, and there are clear steps you can take right now to reduce risk.

The key is to act quickly, but calmly.

- Stop interacting with the message and the website

- Do not click again, even if it says your payment failed.

- Do not reply to the text.

- Close the webpage completely.

- If you entered card details, contact your bank or card issuer immediately

- Tell them you believe your card information was entered on a phishing site.

- Ask to cancel the card and issue a replacement.

- Review recent transactions together while you are on the phone.

- Dispute any suspicious charges, even small ones.

- Turn on transaction alerts

- Enable real-time alerts for purchases, transfers, and online transactions.

- If your bank supports it, set alerts for any charge over $1.

- Alerts help you catch test charges that often come before larger fraud.

- If you shared personal information, take identity-protection steps

- Consider placing a fraud alert with credit bureaus if your address, date of birth, or other identifying info was provided.

- If you suspect a higher risk of identity misuse, consider a credit freeze.

- Monitor your credit report for new accounts you did not open.

- Change passwords if you reused any personal details

- If the phishing page asked for an email address and you use that email as a login elsewhere, update your passwords.

- Prioritize:

- Email accounts

- Banking logins

- Payment apps

- Retail accounts with saved cards

- Use unique passwords, not variations of the same one.

- Check your device for suspicious behavior

- This scam is primarily about phishing, but it’s still smart to be cautious.

- Look for:

- New apps you do not remember installing

- Browser pop-ups that persist

- Strange battery drain or unusual data usage

- Run a reputable mobile security scan if you have one available.

- Update your phone’s operating system to the latest version.

- Report the scam text

- Forward the message to 7726 (SPAM) if your carrier supports it.

- Report it through your phone’s built-in “Report Junk” option if available.

- File a report with consumer fraud reporting resources in your country or region.

- Reporting helps carriers and platforms identify patterns and block campaigns faster.

- Document what happened

- Take screenshots of the text, the link, and any payment confirmation page.

- Note the date, time, and any transaction descriptors that appear on your statement.

- This helps your bank investigate and strengthens any dispute.

- Watch for follow-up scams

- If scammers know your number is active, they may try again with:

- “Payment failed” messages

- Fake refund offers

- Threats about escalation

- Treat any similar message as suspicious, even if it references the $8.99 payment.

- If scammers know your number is active, they may try again with:

- If you are feeling overwhelmed, simplify your next step

- If you do only one thing today, call your bank.

- That single action often prevents the most immediate financial damage.

- Everything else can be done afterward, one step at a time.

The Bottom Line

The “Parking Enforcement: Account Marked For Reporting Handle Violation” scam text is built to feel real, fast, and easy to resolve. The $8.99 parking violation amount is a clever psychological hook, but the real cost can be much higher if your card or personal information is captured.

The safest approach is simple: do not click links in unexpected enforcement texts. If you’re worried about a real parking ticket, look up your local parking authority through a trusted search, then log in or call using official contact information.

And if you already clicked, it’s not the end of the world. A quick call to your bank, smart monitoring, and a few security steps can put you back in control.

Frequently Asked Questions

1. What is the “Parking Enforcement: Account Marked For Reporting Handle Violation” text scam?

It’s a smishing scam (SMS phishing) where scammers pose as a parking enforcement agency and claim your account has been “marked” or flagged for a violation. The text pushes you to click a link and pay a small “ticket,” often $8.99, but the real goal is to steal your card details and personal information.

2. Is the $8.99 parking violation real?

In scam versions, no. The $8.99 amount is commonly used because it feels believable and small enough that people pay without double-checking. Real parking tickets usually include specific details such as a citation number, location, date, and the issuing authority.

3. How can I tell if a parking ticket text message is fake?

Common warning signs include: – A vague message with no city name, license plate, or citation number – Strange wording like “Reporting Handle Violation” – A link with an unfamiliar domain (not a city website or known vendor) – Pressure tactics like “final notice” or implied escalation – A request to pay immediately through the link

4. Should I ever click the link to check if it’s legitimate?

No. If you’re concerned, verify safely by searching for your city’s official parking authority website yourself and checking your account there. Never rely on the link inside an unexpected text.

5. What happens if I clicked the link but didn’t enter any information?

If you only clicked and closed the page without submitting details, your risk is much lower. Still, it’s smart to: – Clear your browser tabs – Monitor for any unusual pop-ups or redirects – Update your phone OS and browser – Be cautious of follow-up texts that try to pull you back in

6. What if I entered my credit card information on the site?

Act quickly: – Call your bank or card issuer right away – Cancel the card and request a replacement – Dispute any suspicious charges, even small test charges – Turn on transaction alerts so you see activity instantly

7. Can scammers steal my identity from this scam?

They can, depending on what you entered. If you provided name, address, phone number, email, or date of birth along with payment details, scammers may use it for identity fraud, account takeovers, or selling your data to other criminals.

8. Why does the scam message sound awkward or oddly worded?

Many scam texts use strange phrasing because they’re written quickly, translated, or intentionally vague. Odd wording can also help scammers avoid spam filters. Phrases like “marked for reporting” and “handle violation” are meant to sound official without providing verifiable details.

9. Do real parking enforcement departments send text messages?

Some cities and parking apps send texts, but legitimate notices usually: – Identify the city or vendor clearly – Provide a verifiable citation or account reference – Direct you to official websites you can confirm independently If the text is vague and pushes a random link, treat it as suspicious.

10. How do I report this parking enforcement scam text?

You can: – Forward the text to 7726 (SPAM) to report it to your mobile carrier – Use your phone’s “Report Junk” or “Report Spam” feature – Report the incident to consumer fraud reporting services in your region Reporting helps improve blocking and takedowns over time.

11. Why would scammers target random people who may not even have a parking ticket?

Because it’s a numbers game. They blast these messages to thousands of people. Even if most ignore it, a small percentage will click and pay, and those victims are profitable.

12. I paid the $8.99. Does that mean the scam is over?

Not necessarily. Many scammers run small charges first, then attempt larger charges later or sell your card details. If you paid, treat it as compromised and contact your card issuer immediately.