Text messages claiming that a $615 State Safe Driver balance is waiting to be claimed have spread across the United States, catching many people off guard. These messages often come from short codes like 40494 or from random phone numbers, and they direct recipients to click on links that lead to websites such as safedriverbenefit.com, motorpolicies.com, smarterauto.com, and wagoninsured.com. While the message sounds like a government benefit or insurance refund, the truth is far different. No legitimate agency owes anyone $615, and the sites behind these texts are not offering any real benefits. Instead, they are designed to harvest personal information and funnel users into extensive marketing lists.

This detailed investigation explains how the operation works, why these texts are misleading, and what steps victims should take.

Overview

The SafeDriverBenefit.com scam texts form part of a growing wave of deceptive insurance-related marketing schemes that rely on misleading claims, urgency, and false financial incentives. In this case, the central promise is a fictional $615 State Safe Driver balance. The messaging appears official at first glance, using words such as “State,” “Safe Driver,” and “Unclaimed Balance.” These are chosen carefully to mimic language often found in government programs, rebates, or insurance refunds. However, there is no state program offering a $615 payout to drivers, and there never has been.

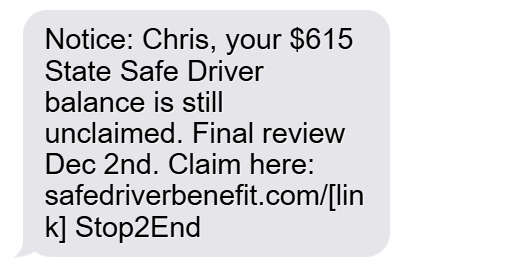

Recipients report receiving messages similar to the following: “Notice: Chris, your $615 State Safe Driver balance is still unclaimed. Final review Dec 2nd. Claim here: safedriverbenefit.com/[…] Stop2End.” The use of a name like “Chris” attempts to personalize the message, even when the phone number does not belong to anyone with that name. This inconsistency is one of several signs that the messages are mass-generated and not tied to any authentic records.

These texts often originate from short code 40494 or from other rotating numbers. Scammers commonly rotate numbers to avoid detection or blocking by mobile carriers. Because the sender appears different each time, victims may not immediately recognize the pattern. The linked website in the message also changes frequently. While many messages point to safedriverbenefit.com, users report being redirected to other domains, including motorpolicies.com, smarterauto.com, and wagoninsured.com. Some of these domains are used interchangeably, usually in clusters, to distribute traffic, evade detection, and prolong the lifespan of the operation.

The landing pages appear to offer insurance quotes or savings opportunities. While they may resemble legitimate comparison sites, they rely on misleading tactics to gather personal information such as names, phone numbers, addresses, vehicle details, and in some cases, consent to be contacted by thousands of marketing partners. This operation exploits a gray zone in online lead generation, where certain companies use aggressive or deceptive marketing funnels to create lists of “leads” that are later sold to insurers, agencies, telemarketers, robocallers, and data brokers.

The primary deception lies in the claim of the $615 benefit itself. That number does not originate from any state, government program, insurer, or rebate system. It has no basis in reality. Its purpose is to serve as a hook to drive traffic to the website. The operators know that for many users, any mention of unclaimed money triggers curiosity or fear of missing out. This psychological effect is intentional. The numbers used in such scams often change depending on the campaign. In this case, the figure of $615 appears consistently across multiple reports. Its consistency suggests that the promoters tested different hooks and found that this number generated high engagement.

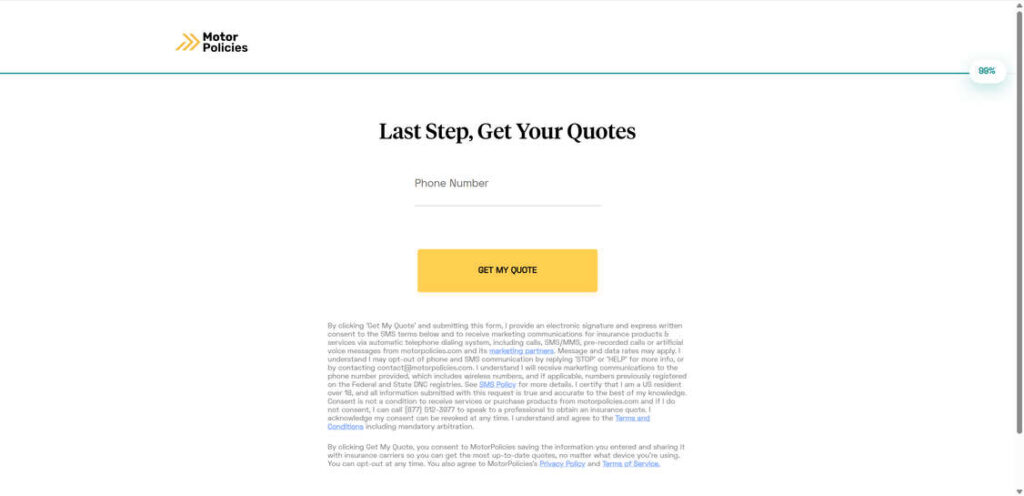

Once a user clicks the link, the page encourages them to complete a sequence of steps under the impression that they are unlocking details about the supposed $615 balance or verifying eligibility. Instead, the forms request personal details. Throughout the process, users rarely see any indication that they are signing up for marketing communications. However, buried in extremely small text below the “Get My Quote” or “Continue” buttons is a lengthy, legally protective disclosure. On one version of the site, this fine print begins with, “By clicking ‘Get My Quote’ and submitting this form, I provide an electronic signature and express written consent to the SMS terms below and to receive marketing communications for insurance products and services via automatic telephone dialing system, including calls, SMS/MMS, pre-recorded calls or artificial voice messages from motorpolicies.com and its marketing partners.” The term “marketing partners” hides a vast network of third-party companies that may purchase, exchange, or share user information across multiple industries.

This disclosure structure is not accidental. Lead generation companies use these techniques to remain legally defensible by claiming that the user willingly opted in. While the legality of these tactics varies, the ethical considerations are far more questionable. The average user will not scroll, zoom, or deeply read microscopic text beneath a button. In fact, the surrounding design often encourages quick progression. The bright buttons and bold headings are intended to guide the user forward, while the fine print is intentionally inconspicuous.

The operation also gains value from traffic regardless of whether users complete the forms. Simply visiting the page may allow tracking cookies or scripts to extract certain data points such as IP addresses and approximate locations. These details help marketers build demographic profiles or retarget users across ad networks. When combined with the personal details users voluntarily enter, a detailed marketing profile emerges. This profile may then be sold or traded repeatedly.

An additional concern is that some domains associated with such operations share hosting patterns, name servers, IP structures, or registration anonymization tactics. These patterns often point toward large networks of interconnected lead generation or affiliate marketing operations. Many operators register clusters of similar domains at once, allowing them to rotate between them if one becomes flagged, blocked, or loses reputation.

Furthermore, these operations frequently use urgency as a tool. Messages referencing “Final Review,” “Last Chance,” or deadlines like “Dec 2nd” create pressure. These dates are arbitrarily chosen and can change from message to message. Their purpose is not to provide real deadlines but rather to limit rational thinking and speed up user engagement.

It is also worth noting that the operation uses an opt-out mechanism such as “Stop2End” at the end of the message. While at first glance this seems like a sign that the sender is legitimate, it may actually confirm to the sender that the number is active as soon as the recipient responds. Engaging with the opt-out message may result in further unwanted messages from related marketing operations. Many users who text “Stop” or “Stop2End” report receiving additional spam over time from other senders.

Ultimately, this operation offers no $615 payout, no government benefit, and no legitimate insurance discount tied to any state program. Instead, it relies on deception, misinformation, and manipulative website structures to harvest personal information. Understanding how the entire funnel works is essential to avoiding it. The next section breaks down the mechanics of this operation step by step, revealing the detailed process behind the messages and websites.

This scam has been also investigated by Jordan Liles on his YouTube channel, where he offers a detailed video on the subject. We recommend watching his content for a comprehensive understanding of the scam.

Next, let’s break down exactly how scammers carry out this scam from start to finish.

How The Operation Works

The SafeDriverBenefit.com scam operation is designed as a multi-step funnel engineered to capture personal data from unsuspecting recipients. These types of funnels, sometimes referred to as lead traps, follow a predictable pattern: initial attention-grabbing messaging, redirection to a landing page, progressive data collection, consent harvesting in fine print, and eventual distribution of user information to marketing networks. Below is a detailed breakdown of how this particular operation functions from start to finish.

Step 1: Mass Text Message Distribution

The operation begins with an automated mass texting campaign. The messages originate from short codes like 40494 or from a variety of random numbers. These numbers change frequently, making it difficult for carriers or recipients to block them effectively. The operators use SMS gateway services or bulk messaging software capable of sending thousands of messages within minutes. These tools are often used legitimately by businesses, but in this context, the operators apply them deceptively.

The messages typically say something like: “Notice: Chris, your $615 State Safe Driver balance is still unclaimed. Final review Nov 2nd. Claim here: safedriverbenefit.com/[link] Stop2End.” The use of a specific name is a psychological tactic. Even when the name is incorrect, the message feels more personalized. Many users assume a mistake in the name could be a clerical error from a legitimate agency, which lowers their skepticism.

Step 2: The Link Leads to a Rotating Domain

The link provided in the message does not always lead directly to safedriverbenefit.com. In some versions, it redirects to several different domains including motorpolicies.com, smarterauto.com, or wagoninsured.com. Redirect rotations are common in deceptive marketing funnels for several reasons:

- To distribute traffic load across multiple domains

- To bypass carrier-level link blocking

- To prolong operational lifespan by rotating domains if one is flagged

- To hide the true ownership or structure of the network

Often, these domains are registered using privacy protection services that mask ownership information. This anonymity is a red flag in itself when combined with unsolicited misleading promotional messages.

Step 3: The Landing Page Mimics an Official Service

Once the user arrives on the landing page, the design mimics an insurance comparison service or a governmental program. It may display reassuring elements such as badges, icons, pseudo-official language, or graphics showing savings percentages or benefits. The landing page does not mention any $615 payout explicitly, but it continues the illusion of an insurance savings opportunity.

The user is prompted to enter basic information such as ZIP code, insurance status, vehicle type, or age bracket. These early questions are designed to feel harmless. Many users believe they are simply checking eligibility for a rebate or comparing rates. However, this information is the start of the data harvesting process.

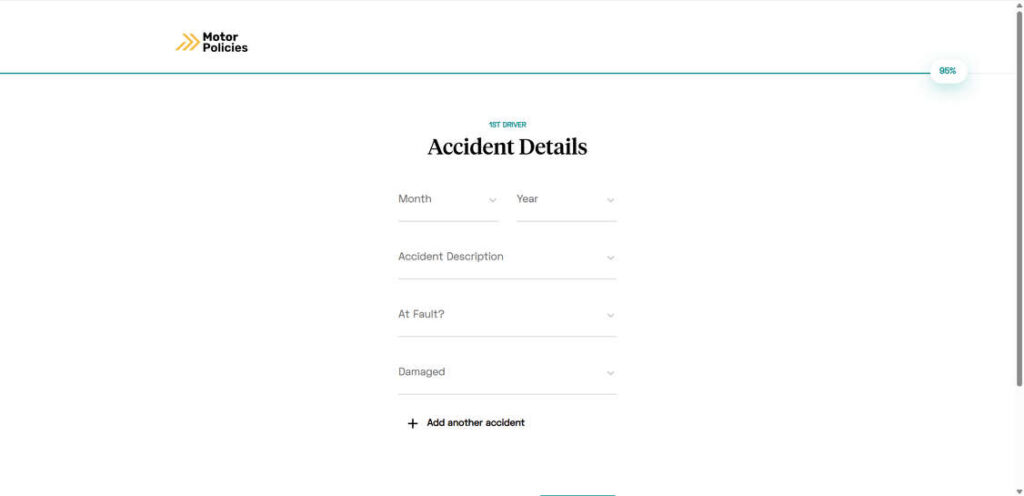

Step 4: Progressive Data Collection

The funnel progresses gradually. Each click brings the user to another page requesting more information. Common fields include:

- First and last name

- Phone number

- Address

- Vehicle details

- Insurance renewal dates

- Current insurer

The pages often display large, brightly colored “Next” or “Continue” buttons, guiding the user forward. Momentum encourages progression. Each step gives the appearance that the user is getting closer to unlocking their supposed $615 State Safe Driver balance. In reality, each field entered enriches the user profile that will later be sold or distributed.

Step 5: Tiny Fine Print and Consent Harvesting

The final steps in the funnel include a button labeled “Get My Quote,” “View Results,” or “Finish.” Directly beneath this button appears a block of microscopic text that the vast majority of users will not notice. This is the legal backbone of the operation. In one version seen on motorpolicies.com, the fine print reads:

“By clicking ‘Get My Quote’ and submitting this form, I provide an electronic signature and express written consent to the SMS terms below and to receive marketing communications for insurance products and services via automatic telephone dialing system, including calls, SMS/MMS, pre-recorded calls or artificial voice messages from motorpolicies.com and its marketing partners.”

This text is legally significant. It allows the operator to argue that the user knowingly opted in to receive communications even if the user had no intention of doing so. The key phrase is “marketing partners.” This phrase is intentionally vague. In reality, it may refer to hundreds or thousands of entities that purchase leads from data brokers. Once the user’s information enters this ecosystem, it can spread rapidly and be extremely difficult to remove.

Step 6: Submission and Data Dissemination

Once the user clicks “Get My Quote,” the information is submitted. What happens next often varies:

- The user may be shown a generic confirmation page.

- The user may receive follow-up calls or texts from marketers.

- The user may be redirected to yet another insurance site.

Behind the scenes, the user’s information has already been captured and added to the lead generation network. The operators may sell the information in bulk to telemarketing firms, insurance agencies, or unrelated marketing partners. The selling price per lead varies based on perceived value. Insurance leads typically command higher rates because insurers pay more for potential clients.

Step 7: Repeat Outreach and Telemarketing

The final stage is the aftermath. Victims often report receiving repeated calls or messages from unfamiliar numbers. These communications might include:

- Insurance quotes

- Offers to compare auto policies

- Extended warranty promotions

- Robocalls unrelated to insurance

- SMS advertisements

Because the user’s number has now entered multiple datasets, the volume of outreach can increase dramatically over time. Removing one’s number from these lists is notoriously difficult because the data may have been resold multiple times.

What To Do If You Have Fallen For This

Users who clicked the link or submitted information through any of the connected domains should take the following steps to protect themselves. While this operation does not directly steal money, it does compromise personal information and increases exposure to unwanted marketing, robocalls, and possible phishing attempts.

1. Do Not Engage Further

Do not respond to additional texts or calls originating from unknown numbers. Responding or engaging confirms that your number is active, which can increase future spam.

2. Block the Sender Numbers

Block any number that sent the message. Although scammers frequently rotate numbers, blocking individual senders can reduce the frequency of messages.

3. Enable Carrier-Level Spam Protection

Most carriers offer spam blocking tools. Activate them to filter suspicious texts and calls automatically.

4. Register Your Number With the National Do Not Call Registry

Add your number to donotcall.gov. While not perfect, it provides a baseline protection and allows you to report violators.

5. Report the Text Messages as Spam

Forward the message to 7726, the spam reporting service used by major carriers. This helps carriers investigate and potentially block the sender.

6. Review Your Browser History and Clear Tracking Data

Delete cookies, cached files, and tracking scripts that may have been placed when you visited safedriverbenefit.com or any related domains.

7. Monitor Your Calls and Messages Carefully

Expect an increase in unsolicited calls and messages. Do not provide personal information to anyone who contacts you.

8. Avoid Signing Up for Additional Insurance Quotes for Several Weeks

This reduces the risk of blending legitimate inquiries with scam-related follow-ups. You want clarity on who is contacting you and why.

9. Check for Any Unexpected Charges

While this particular funnel does not typically request financial information, always review phone bills and linked accounts for unauthorized activity.

10. Consider Changing Your Phone Number If Spam Becomes Unmanageable

If robocalls and SMS spam escalate beyond control, a number change may be necessary. This is a last resort but can be effective.

11. Spread Awareness To Protect Others

Share your experience with friends and family. Many victims hesitate to discuss such incidents, but awareness can prevent further harm.

12. Proceed With Caution When Filling Out Online Insurance Forms in the Future

Before entering personal information, verify the legitimacy of the website and the company. Look for clear disclosures, reputable branding, and verifiable contact information.

FAQ

What is the SafeDriverBenefit.com $615 State Safe Driver Balance text message?

The SafeDriverBenefit.com $615 State Safe Driver Balance text message is a misleading SMS campaign that falsely claims you have an unclaimed $615 benefit related to safe driving. The message often comes from short code 40494 or random phone numbers and includes a link to safedriverbenefit.com or to other domains such as motorpolicies.com, smarterauto.com, or wagoninsured.com. The message suggests that you are entitled to a $615 balance, but no such benefit exists. The goal of the text is to get you to click the link and submit personal information.

Is the $615 State Safe Driver Balance real?

No. The $615 State Safe Driver Balance is not real, and no state program provides this payout. The amount is entirely fabricated and used as a hook to attract clicks. Recipients who visit the linked websites are not claiming any real money. Instead, they are entering a data collection funnel that feeds personal information into large marketing networks.

Who is sending the SafeDriverBenefit.com scam messages?

The messages appear to be sent by operators of insurance lead generation networks. These networks use mass texting tools, rotating numbers, and short codes to distribute misleading messages to thousands of users at a time. The domains used in this operation often hide their ownership through domain privacy services, making it difficult to identify the people behind them.

Why does the text message use names like “Chris” even when that is not my name?

The name in the text is randomly generated and used simply to make the message appear personal. Even if the name is incorrect, many people assume it is a clerical error or an account mix-up. This lowers suspicion and encourages clicks. Personalized messaging, even when inaccurate, is a common psychological tactic used in misleading SMS campaigns.

What happens if I click the link in the $615 Safe Driver text?

If you click the link, you are taken to a landing page that appears to offer insurance discounts or comparison quotes. The site will request personal information such as your name, phone number, address, ZIP code, vehicle details, and insurance history. Beneath the “Get My Quote” button, the website displays tiny fine print that grants permission for your information to be shared with thousands of marketing partners. Submitting the form usually results in a large increase in telemarketing calls and spam messages.

Are the websites connected to this scam dangerous?

The websites involved, including safedriverbenefit.com, motorpolicies.com, smarterauto.com, and wagoninsured.com, are not designed to install malware. Instead, they focus on collecting personal information and gaining legal “consent” through hidden fine print. While not directly malicious in the technical sense, they expose you to privacy risks and aggressive marketing practices. The data you share may be sold repeatedly to insurance marketers, telemarketers, and data brokers.

Why do the websites ask for so much personal information?

The sites are structured as lead generation funnels. Every field you enter increases the value of your data on the marketing market. Insurance leads are especially valuable because they require detailed personal information. Once submitted, this information can be sold to multiple companies, which is why victims often experience a significant surge in spam calls and messages afterward.

Is it legal for these websites to collect and sell my information?

These operations attempt to make themselves legally defensible by placing tiny consent text under the “Get My Quote” button. In that fine print, you are agreeing to receive calls, texts, and marketing from the site and its partners. Even though most users never see the fine print, it may be enough for the operators to claim that the user gave consent. Whether this is ethical is a different question. Many consumer advocates consider these tactics deceptive, and complaints about similar schemes are common.

How do I know if I submitted my information?

If you typed in your name, phone number, email, or vehicle details and clicked any form submission button on one of the related sites, then your information has likely entered a marketing database. Even if you did not reach a confirmation page, lead forms often capture partial submissions. If you began receiving new spam calls or messages shortly after visiting the site, that is another indication.

What should I do if I gave my information to SafeDriverBenefit.com or related sites?

You should monitor your calls and texts closely, block suspicious numbers, enable spam protection on your phone, report the messages to your carrier, and avoid submitting further information online for a period of time. You may also need to clear your browser history and tracking cookies. If the spam becomes excessive, consider filing reports with the FTC or changing your phone number as a last resort.

Can responding “STOP” to the message make it go away?

Responding “STOP,” “STOP2END,” or similar commands may not help. These phrases are included to make the message appear legitimate. In many cases, replying simply confirms that your number is active, which can lead to additional spam from other marketing networks. It is safer to block the sender and report the message to your carrier.

Why do these scam texts reference deadlines like “Final review Nov 2nd”?

Fake deadlines are used to increase urgency and reduce critical thinking. The dates are not real and have nothing to do with any legitimate program. They are randomly inserted to push users to click the link immediately without verifying whether the benefit is real.

Does this scam have anything to do with my car insurance?

No. Your car insurance provider did not send the message, and there is no real program offering a $615 benefit. The websites only pretend to provide insurance quotes to justify collecting your information. Any insurance calls you receive afterward are from unrelated third-party marketers who bought your data.

How can I avoid falling for similar scams in the future?

Be cautious with messages about unclaimed money, refunds, government benefits, or urgent financial deadlines. Always verify the legitimacy of a website before entering personal information. Look for clear disclosures, reputable branding, and contact details from known companies. Never click links in unsolicited messages from unknown senders.

Should I be worried about identity theft?

This particular operation focuses on harvesting contact information rather than sensitive identifiers like Social Security numbers or payment data. While the risk of identity theft is lower than in financial scams, the risk of privacy invasion and increased spam is high. Continue monitoring your accounts and be cautious with future communications.

The Bottom Line

The SafeDriverBenefit.com State Safe Driver balance scam texts are not government programs, insurance refunds, or legitimate savings opportunities. Instead, they are part of a deceptive lead generation funnel designed to harvest personal information under the false promise of a $615 benefit. Recipients receive unsolicited texts urging them to click a link and claim a nonexistent balance. The website they land on then collects personal details and presents tiny, easily overlooked fine print that grants consent for widespread marketing communications. This operation relies on urgency, misleading claims, and vague disclosures to create a false sense of legitimacy.

There is no $615 waiting for anyone. The websites involved are not official, and the text messages are not sent by any state or insurance agency. By understanding how this operation works and taking the appropriate steps after engaging with it, users can protect their information and reduce future exposure to spam and telemarketing. Remaining cautious, verifying website legitimacy, and avoiding unsolicited links will help prevent falling into similar traps in the future.

If you need a shorter version, a rewritten version, or additional supporting content such as SEO titles or excerpts, I can prepare those as well.