The phone number +1-833-234-0299 has been linked to a variety of fraudulent schemes and scams targeting unsuspecting victims across the United States. This comprehensive guide will provide an in-depth look at how the +1-833-234-0299 scam operates, how to identify signs of the scam, and most importantly, what steps to take if you or someone you know has fallen prey to the +1-833-234-0299 scam.

An Overview of the +1-833-234-0299 Phone Scam

The +1-833-234-0299 phone scam refers to illegal and deceptive acts carried out by scammers using the +1-833-234-0299 number to defraud victims. This number disguises itself as a legitimate customer support or billing contact number for major corporations and government agencies in order to gain the trust of recipients.

Once a potential victim calls the number or responds to fraudulent communications referencing the number, the scammers pose as representatives and attempt to trick them into revealing personal information or sending money. The end goal is identity theft or stealing funds from the victim’s accounts.

Some of the most common tactics utilized through the +1-833-234-0299 phone scam include:

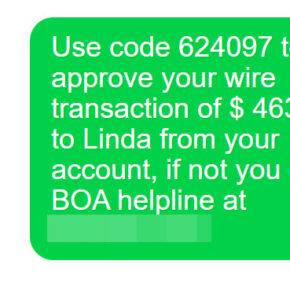

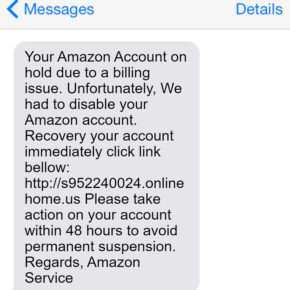

- Fake customer support calls/messages: Scam messages that masquerade as customer service calls or inquiries from companies like Apple, Microsoft, Amazon, or the Social Security Administration. The messages insist that there is an issue with your account that requires immediate attention by calling +1-833-234-0299.

- Phishing tax calls: Fraudulent calls impersonating IRS or treasury agents claiming you owe back taxes or fees and demanding payment through threatening legal action if +1-833-234-0299 is not called.

- Impersonation of government officials: Scammers pretending to be government employees or law enforcement officials claiming your SSN or benefits are compromised and your identity is at risk if you do not call +1-833-234-0299.

- Billing and utility scam calls/messages: Scam calls or voicemails threatening to suspend your electricity, water service, or other bills if you do not call +1-833-234-0299 and make an immediate payment.

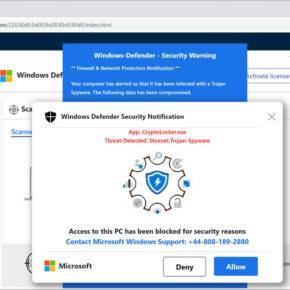

- Tech support scam messages/websites: Fraudulent tech support websites and pop-up messages that say your computer is infected with a virus or compromised in order to get you to call +1-833-234-0299 for expensive, unnecessary “support”.

- Loan and credit report scams: Scammers promise loans, credit card rate reductions, or amazing credit scores if you pay an upfront fee via +1-833-234-0299 first.

- Romance scams: Fraudsters posing as romantic interests they met online tell victims they need money urgently and provide +1-833-234-0299 as a contact to wire money.

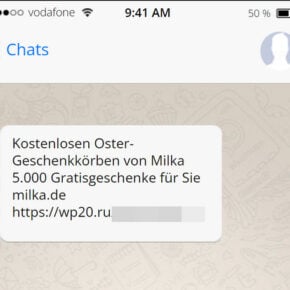

- Prize and lottery scams: Victims get calls saying they won a contest/lottery prize, but must first use +1-833-234-0299 to pay fees before they can collect it.

These are just a few examples of the endless variations of fraudulent schemes utilizing +1-833-234-0299 to lure innocent consumers into traps. Keep reading to learn how to protect yourself from this scam.

How the +1-833-234-0299 Phone Scam Works

Now that you know the premise behind the +1-833-234-0299 scam, it is crucial to understand the nitty gritty details of how scammers manipulate and deceive people through this harmful scam.

Here is a step-by-step breakdown of the inner workings of the +1-833-234-0299 scam:

Step 1: Scammers Obtain Your Personal Information

The scammers first gain access to names, phone numbers, emails, addresses and sometimes other private data of potential victims. This can happen through:

- Data breaches and hacking into accounts

- Buying bulk data from the dark web

- Malware infections on devices

- Retrieving information from public records

- Randomly cold contacting numbers

Step 2: The Scammers Contact You Posing as a Trusted Source

Armed with some personal information, the fraudsters contact victims while impersonating:

- Well-known companies like Apple or Amazon

- Government agencies like Social Security Administration

- Utility companies

- Law enforcement or other officials

They communicate urgent messages via:

- Telephone calls

- Emails

- Text/SMS messages

- Pop-up alerts on websites

- Mailed letters

Their messages are intended to instill fear and urgency so you call +1-833-234-0299 immediately.

Step 3: Scammers Pressure You to Provide Confidential Information

Once contacted, the scammers pressure and manipulate victims to divulge private details. They may:

- Threaten account suspension or legal consequences

- Offer enticing rewards or too-good-to-be-true offers

- Generate a sense of urgency to call +1-833-234-0299 ASAP

- Request sensitive info to “verify account ownership”

Data they commonly phish for includes:

- Full name, birthdate, SSN, IDs

- Login usernames & passwords

- Bank account and routing numbers

- Credit/debit card numbers and CVV codes

- Answers to security questions

- Remote access to devices

Step 4: Scammers Monetize Your Information

In the final stage, scammers monetize your information and payments in various forms, including:

- Emptying bank accounts and stealing money

- Committing credit card and identity fraud

- Selling your information on the dark web

- Using accounts to file fake tax returns and benefits claims

- Charging exorbitant fees for fake tech support services

Unfortunately by this point, the scammers already have your data and payments, leaving you with limited recourse.

Warning Signs of the +1-833-234-0299 Scam

Now that you understand how the mechanics of the scam work, here are some big red flag warnings to help you detect the +1-833-234-0299 scam:

- They contact you first out of the blue: Real customer support only reaches out if you contact them first.

- They request immediate action: Scammers always insist the issue is urgent and you must call +1-833-234-0299 right now. Legitimate businesses give you time to review the situation.

- Odd timing of contact: Be wary of calls/messages claiming there’s an issue with your account that happen at weird hours outside normal business times.

- Aggressive insistence on only calling: Pressuring you to immediately call +1-833-234-0299 and rejecting any other contact method is a huge red flag.

- Threats and consequences: Real customer service does not threaten account suspension or legal action if you don’t call a number.

- Promises of guaranteed rewards: Claims you can get large cash sums, jackpot prizes or outstanding loans by first calling a number are always scams. Legitimate giveaways don’t require an upfront fee.

- Requests for unusual forms of payment: Government and utilities do not demand payment solely via gift cards, cryptocurrency, wire transfers, prepaid debit cards or other hard to trace forms.

- Poor grammar/spelling errors: Carefully crafted scam messages often have typos, grammar issues and awkward phrasing.

- You don’t have an account with the company: Scammers randomly contact numbers claiming issues with accounts at companies you don’t even do business with.

- No record of the issue claimed: Log into your real account to verify any claims of unusual charges, account deactivation or other problems before calling any number.

- Weird or inconsistent call back numbers: Scammers spoofing legitimate businesses use non-working callback numbers or numbers that don’t match any official company contacts when you research.

Trust your gut. If anything seems suspicious or too good to be true, avoid calling +1-833-234-0299 or providing personal details.

What to Do If You Already Fell For the +1-833-234-0299 Scam

If you or someone you know unfortunately already fell victim to the +1-833-234-0299 scam, stay calm. Here are the most important steps to take in order to minimize damages and regain control:

1. Immediately Contact Your Bank and Credit Card Companies

Alert your bank and credit/debit card companies that your account information is compromised. Request that:

- They flag your accounts and monitor for fraudulent charges.

- Issue new account and card numbers to replace compromised ones.

- Reverse any fraudulent charges already made if possible.

- Increase security protocols for online/phone transactions.

Remain vigilant and review statements frequently for any suspicious activity.

2. Change All Account Passwords

Assume the scammers have gained access to any accounts for which you revealed usernames and passwords. Change logins and security credentials for:

- Email, social media and financial accounts

- Utility and phone accounts

- Retail sites, Amazon, eBay etc.

- Routing numbers for automatic payments/deposits

Use updated passwords that are complex and unique for each account.

3. Freeze Credit Reports

Request that Equifax, Experian and TransUnion freeze your credit reports. This stops scammers from fraudulently opening new credit or loans in your name. Expect fees up to $10 per bureau.

4. Monitor Your Credit Reports and Scores

Keep close watch over your credit reports from all three bureaus for any signs of false accounts or charges. Inspect your credit score frequently as damages lower it quickly.

Dispute any fraudulent activity immediately with credit bureaus to reduce lasting harm to your finances. Sign up for credit monitoring if possible.

5. File Reports With Law Enforcement

File reports about the scam with the following agencies so investigations can potentially catch the criminals:

- Your local police department

- FBI Cybercrime Division at www.ic3.gov

- FTC Complaint Assistant at www.ftccomplaintassistant.gov

- Phone number abuse reports to Federal Communications Commission

Unfortunately, recovery of lost funds is very rare. But reporting aids prevention of ongoing harm.

6. Learn From This Experience

Scammers are experts at psychological manipulation tactics that work on many victims. Don’t blame yourself.

Use this as a teaching moment to be more vigilant against future scams. Share your experience to warn family and friends too.

Review the techniques in this article to recognize the +1-833-234-0299 scam in the future before you become a victim again.

Staying informed on the latest scam tactics and threats is the best defense. Search for “common online scams” to find more guides that can help protect you.

In Conclusion

The +1-833-234-0299 phone scam is a dangerous threat that everyone should be aware of in order to avoid falling victim and suffering financial damages. But with knowledge of how this scam operates, the warning signs to look for, and steps to take if compromised, you can reduce chances of getting defrauded and minimize harm if targeted. Bookmark this page as an easy reference to refresh your memory on +1-833-234-0299 scam defense tactics. Share with your social circle as well to help others prevent their own victimization through education and vigilance.

Frequently Asked Questions

1. What happens if I call the +1-833-234-0299 number?

Calling the number connects you to scammers impersonating a trusted entity claiming you have an urgent issue to resolve. They will pressure and manipulate you into providing private account details or sending money that allows them to steal your identity and funds or sell your information.

2. What if I already called +1-833-234-0299 and gave them my information?

Immediately contact banks, credit bureaus, and any companies compromised to report unauthorized access before the scammers can capitalize. Freeze credit reports, monitor your credit and accounts diligently, and change all passwords. You may have to close accounts completely if fraud already occurred.

3. Why is providing my social security number to +1-833-234-0299 dangerous?

Armed with your full SSN, name, and address the scammers can open fraudulent credit accounts, file fake tax returns, steal government benefits, take out payday loans, and commit other identity theft in your name. Protect it at all costs.

4. Can the police find who is behind +1-833-234-0299?

Unfortunately, tracking down the scammers is very difficult since they use spoofing technology to mask their true locations and identities. But reporting assists authorities in building cases against larger criminal rings. Having documentation if you lost money also helps if prosecutions occur to potentially recover damages.

5 You mentioned credit freezes. How does that work?

Freezing your credit reports prevents new accounts being opened in your name without approval of a unique PIN only you know. This blocks scammers who gained your info from abusing it further. Expect fees up to $10 per bureau. You can easily lift the freeze whenever you need credit checks run.

Key Takeaways

- The +1-833-234-0299 phone number is used by scammers impersonating trusted companies or agencies to deceive victims into providing private information and money. Do not call it or provide data if contacted.

- Look for urgent demands, threats, unusual payment methods, and other red flags to detect the scam.

- Contact banks and companies affected if you already fell victim. Freeze credit reports, monitor your credit, and change all account passwords immediately.

- Share knowledge of this scam with family and friends to prevent them from being victimized.