The ATM Card Email Scam is a prevalent fraud that targets innocent people via email. This persuasive con aims to steal money and personal information from victims. If you receive a suspicious letter promising an ATM card with a large sum of money, be very wary. This guide will provide an in-depth overview of how the ATM Card Email Scam works, what to do if you get targeted, and how to stay safe online.

An Overview of the ATM Card Email Scam

The ATM Card Email Scam is a prevalent email phishing attack where scammers send messages claiming you will receive an ATM card loaded with thousands of dollars. This con targets individuals around the world and has many slight variations. However, the general premise involves a supposed “friend” or “business partner” informing you about completing a lucrative deal.

As a reward for your “assistance” with this fictional business venture, you will allegedly receive an ATM card with a massive amount of money on it, usually in the range of millions of dollars. Of course, this is completely false. The scammers fabricate this elaborate story to trick victims into sharing personal information and paying fraudulent fees.

This scam often begins with an email containing a vague, rambling message about a successful business deal and owing the recipient money as a thank you gift. The criminals pose as an old friend or previous work colleague to build trust. The email will seem personalized with details like your name and positive remarks about your character.

Common Traits of the Scam Emails

While the messages vary slightly, most ATM Card Email Scams include:

- A vague reference to a joint business venture or deal you supposedly assisted with

- Mention of a lucrative outcome like “multi-million dollar” profits

- A claim that the funds can’t be directly wired so you will receive an ATM card instead

- An ATM card with a random high balance like $3,750,000 USD promised as a reward

- Request for personal info like your name, address, and phone number to “deliver” the ATM card

- Poor grammar, spelling errors, and inconsistent details

The emails often have a general, ambiguous tone and lack specific proof about the so-called business deal. The absurd premise and massive dollar amounts promised are strong indicators this is a scam. No legitimate business or financial institution would operate like this.

Who Gets Targeted?

The ATM Card Email Scam casts a wide net targeting individuals globally. Victims are often random since scammers purchase email lists and send out mass messages. However, older individuals seem to be frequent targets.

Spam filters on email providers like Gmail help block many scam messages, but some still slip through. Stay vigilant and don’t let the personalized details trick you. This con has swindled countless innocent people so you must be careful.

This is how the ATM Card Email Scam looks:

Subject: For your past effort.

Hello good friend,

Good day and how are you today? I hope all is well with you and your family? I am using this opportunity to inform you that the multi million-dollar business that we both are working on before has been finally concluded with the assistance of another partner from Iceland who financed the transaction to a logical conclusion. The fund wasn’t transferred into your account due to one reason or the other. And for my kind gesture I have left an ATM Card for you worth $3,750.000 USD ( three Million Seven Hundred Fifty Thousand United States Dollars Only) To show my appreciation for your pass assistance. I must confess, you are truly a humble and a sincere person.

However, I will gladly appreciate and happier wherever I am to hear that you have received your ATM Card; It will be a great honor to me because you deserve it. and do to my new business establishment with my new partner in Iceland I will be very busy for a very long time. Kindly contact him now Rev Lawrence Mensa With the below information to enable him to negotiate with the courier company for the delivery of your ATM Card to you,

Contact person: Rev Lawrence Mensa Email: lawmensa@aliyun.com

Therefore you should send him your full Name and telephone number/your correct mailing address where you want him to send the ATM card to you. This information is what will enable him to deliver the ATM Card to you. as I have left instructions on your behalf.

Thanks for your pass effort and God bless you and your family.

Hoping to hear from you.

Regards, Mrs. Precious Mpho

How the ATM Card Email Scam Works

The ATM Card Email Scam involves multiple steps to gradually build trust with victims and steal their money and information. Here is an overview of how this insidious con operates:

Step 1: The Initial Scam Email

The first contact comes via a seemingly innocent email. The criminals carefully craft messages to appear like they’re from an old friend or business partner. Vague references to a lucrative business deal you “worked on” together establish backstory.

The message expresses gratitude for your help and claims you deserve a large cash reward. Allegedly, funds cannot be wired directly to you, so you will receive an ATM card pre-loaded with a massive balance like $5 million.

Of course, none of this is true. The scammers completely fabricate these stories. Their emails have intentional spelling and grammar mistakes to bypass spam filters that major email providers use.

Step 2: Requests for Personal Information

Once you respond to the initial email, the scammers will request personal details like your full name, home address, phone number, etc. Supposedly, they need this information to properly “deliver” your ATM card reward.

The criminals may have you contact a fake associate/courier company they claim will handle the delivery logistics. Emails will seem professional and convincing, but it’s all a scam.

Step 3: Demands for Upfront Fees

After securing your personal information, the scammers will contact you about paying various upfront fees before releasing the ATM card. These include:

- Shipping/Delivery Fees: Scammers will claim you need to pay shipping or courier costs for your ATM card parcel delivery. These fees can be hundreds to thousands of dollars.

- Taxes/Duties: Criminals may pretend taxes or import duties need to be paid before an international courier company can deliver your card. Again, they will request you to wire high dollar amounts.

- Processing Fees: Scammers may cite additional fees to finish processing your supposed cash reward before shipment. More requests for bank wires and/or gift card payments.

- Transaction Fees: Scammers may pretend the bank needs fees to activate and load your ATM card balance before delivery. More fake costs.

None of these upfront fees are real. The criminals make up fake charges to defraud victims. Any request for payment via wire transfer, gift cards, cryptocurrency, etc. is an immediate red flag.

Step 4: Stealing the Victim’s Money

Once scammers convince victims to wire payment for the initial fake fees, they will continually invent new charges. More processing fees, transaction fees, customs costs, taxes, insurance, etc. These demands can quickly escalate into thousands or tens of thousands of dollars stolen.

Victims drained of funds may even be convinced to provide sensitive information like online banking passwords so the criminals can steal directly from their accounts. Email hacking may also occur.

At some point, when the victim is depleted of money, the scammers cease all contact. No ATM card reward ever arrives, and the victim is left penniless. The cons walk away with quick cash conning people via email.

Warning Signs of the ATM Card Email Scam

The ATM Card Email Scam can be convincing, especially if you don’t know the tactics. Watch for these common red flags:

- Email from a stranger referring to you as a “friend” or “business partner”

- Vague descriptions about a “business deal” you don’t recall

- Claims of a massively profitable venture earning millions

- Notification you will receive an ATM card loaded with a ridiculous amount of cash

- Poor grammar, spelling mistakes, and inconsistent details

- Requests for personal information like your name, address, phone number, etc.

- Demands for upfront payment via bank wire, gift cards, cryptocurrency, etc.

- Constant excuses why the ATM card can’t be delivered and more fees are required

Any email you receive making outrageous claims about free money should raise alarms. No legitimate bank or business operates this way. Never pay any upfront fees via wire transfer, gift cards, or cryptocurrency. Remember, if it sounds too good to be true, it always is.

What to Do if You Get Targeted by the ATM Card Email Scam

If you receive a suspicious email claiming you will get an ATM card loaded with cash, here are important tips:

1. Avoid Responding to the Email

Do not reply to the scam email or contact the senders in any way. The criminals are fishing for responses to reel in victims. Replying confirms your email is active. Instead, delete the message right away.

2. Watch for Follow Up Emails or Calls

Scammers may continue attempts via additional emails or phone calls. Their tactics can be quite aggressive and persuasive. Simply ignore all future contact and keep blocking phone numbers.

3. Contact Your Bank if You Paid Fees

If you already sent payments via wire transfer, gift cards, or cryptocurrency, immediately call your bank. Report the fraudulent charges and request to stop any money transfers not yet processed. Your bank may be able to freeze the account, recall a wire transfer, or possibly track where the money went. The sooner you report, the better.

4. Notify Law Enforcement

File a scam report with agencies like the FBI Internet Crime Complaint Center at www.ic3.gov. Provide details on how the criminals contacted you and any payments sent. Reporting helps authorities track and build cases against scammers, even those overseas.

5. Mark Email as Spam

Ensure to mark the scam email as spam in your email account. This helps train your email provider’s spam filters to better detect and block similar scam messages for you and other users in the future. Other users reporting the scam emails helps strengthen this filtering too.

6. Run Security Scans on Your Devices

As a precaution, run a Malwarebytes antivirus scan on your computer or smartphone used to interact with the scam email. Criminals could have embedded malware to compromise your device. Scans help detect and remove any potential infections or spyware. Avoid accessing sensitive accounts like online banking from that device until its clean.

7. Reset Account Passwords as a Precaution

Consider resetting passwords for any important online accounts as a security precaution, especially financial accounts or emails. If you did provide sensitive information to the scammers, they could target your other accounts. Updating passwords locks them out. Enable two-factor authentication for an extra layer of security too.

8. Beware of Recovery Scams

Criminals may contact you pretending to be law enforcement, bank officials, or government agents who can “recover” your lost money. These will be scams trying to extract more money from victims. Police do not contact people soliciting or offering help returning lost funds. Further engagement with any supposed recovery assistance leads to more fraudulent payments. Simply cease all communication.

How to Avoid the ATM Card Email Scam

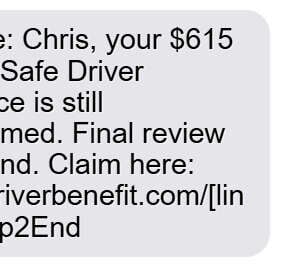

While this scam primarily spreads via email, you must be vigilant across all communication channels, including text messaging. Here are smart tips to avoid getting swindled:

- Be wary of random contacts – Legitimate banks and businesses don’t contact people randomly via email or text making lavish promises. View any unsolicited contacts referencing money or financial requests as highly suspicious.

- Avoid communicating with strangers – Don’t reply to any texts, emails, or calls from unknown contacts you have no previous relationship with. This gives scammers opportunity to manipulate you. Simply ignore or block them.

- Research senders – If any contact claims to be an old friend, colleague, bank representative, law enforcement, government agency, etc. double check their identity. Call the organization directly for verification using a legitimate contact number – not the one provided. Imposters often spoof real identities.

- Watch for poor grammar/spelling – Scam emails and texts often have typos, incorrect grammar, and other linguistic clues indicating they are from foreign sources. The more polished and professional communication appears, the more credible it becomes.

- Analyze language patterns – Scammers may refer to you as “friend” or “valued customer” since they don’t know your name. Vague mentions of deals you assisted with should raise suspicion. Legitimate contacts provide specifics.

- Never pay unsolicited demands – Wire transfers, gift cards, cryptocurrency payments cannot be reversed. Any demands for upfront fees before releasing money are always fraudulent. No legitimate business or bank operates this way.

- Beware spoofing fraud – Criminals often spoof REAL organization phone numbers, email addresses, and website addresses to appear credible. Always contact the legitimate organization yourself using publicly advertised contact info. Don’t assume a number/email on caller ID or in a message is real.

- Set up spam call/text blocking – On smartphones, enable call/text spam blocking and screening through your cellular provider and phone settings. This stops many unwanted contacts from reaching your device directly.

- Avoid posting personal details online – Be careful sharing information publicly on social media sites that could be used to manipulate you or steal your identity. Scammers can collect details online to sound more credible in phone/email cons.

- Keep software updated – Ensure your devices have the latest security patches and anti-malware software. Cybercriminals exploit known software vulnerabilities using spyware and malware to compromise systems and steal data. Update as soon as new software versions release.

- Enable multi-factor authentication – For accounts that support it, turn on multi-factor or two-step authentication. This way if criminals compromised your password, they still cannot access the account without the one-time passcode sent to your mobile device.

Staying alert online and being wary of any random contacts can keep you safe. Never send money or personal information to strangers. Report scam attempts to help protect others too.

Frequently Asked Questions

What is the ATM Card Email Scam?

The ATM Card Email Scam is a fraud where scammers send emails claiming you will receive an ATM card loaded with thousands of dollars. They pretend to be an old friend or business partner who owes you money. It’s all a lie to steal personal information and money.

How does the scam work?

Scammers send vague emails about completing a lucrative business deal together. As a “reward”, you will supposedly get an ATM card with a high balance. They then ask for personal details to “deliver” it. Next, they claim you must pay various fake fees before getting the card. Victims tricked into sending money ultimately receive nothing.

What are red flags of the scam?

Watch for emails from strangers referring to you as friend/partner, vague claims about business deals, promises of an ATM card with ridiculous balances, requests for personal info, poor grammar/spelling, demands for upfront fees via wire transfer or gift cards.

What should I do if I get a scam email?

Do not respond to the email. Delete it immediately. Do not engage with the scammers at all. Report the scam attempt to your email provider and law enforcement agencies.

I already responded and paid fees, what now?

Contact your bank immediately to report unauthorized charges. Ask them to halt any pending transfers if possible. File a report with the FBI and FTC detailing the scam. Reset all account passwords for security. Do not pay any additional demanded fees.

How can I get my lost money back?

Unfortunately, it is very rare to recover money lost in these scams. Wire transfers and gift card payments cannot be reversed. However, reporting the crime provides info to help authorities in prosecuting scammers. Avoid any supposed recovery assistance offers – they are likely also scams.

How can I avoid this scam?

Do not communicate with unknown contacts. Research any identifiers a sender provides. Never pay unsolicited demands via wire transfer, gift card, crypto payments. Use anti-spam email filters. Enable multi-factor authentication on accounts. Keep software updated.

Are there other scam variations I should know about?

Yes, scammers constantly evolve new schemes via email, phone, text and social media. Any random contact referencing financial requests, surprise winnings, low-risk high-return investments, discounted loans, etc. should be met with extreme skepticism.

Who can I contact for more help against scams?

Report scams to the FTC and FBI IC3. Contact local law enforcement and state attorney general. Consult trustworthy cybersecurity websites like KrebsonSecurity for more scam insights. Enable call/text blocking through cellular providers.

Conclusion

The ATM Card Email Scam is a persistent fraud that targets victims globally via unsolicited messages. Scammers promise crazy rewards like an ATM card loaded with millions in cash. They leverage social engineering and manipulation tactics to trick people into sharing personal details and sending fraudulent fee payments amounting to stolen sums.

Massive dollar amounts dangled as bait and vague backstories about joint business ventures should immediately raise red flags. Any requests via email or phone for upfront fees to claim winnings are always fraudulent. Exercise extreme caution providing personal information or payment to random contacts you cannot independently verify.

Reporting scam attempts helps authorities track down these criminal networks, even when they operate overseas. Check for the warning signs, don’t fall for manipulation tactics, and be very wary of messages promising easy riches. Following smart cybersecurity practices keeps your identity and money protected.

Key Takeaways:

- The ATM Card Email Scam uses false promises of rewards like an ATM card loaded with money to trick victims.

- Scammers use social engineering via email to build trust and request personal details/payment.

- Never provide personally identifiable information or payment for unsolicited requests.

- Contact your bank immediately if you paid any fraudulent fees and report to law enforcement.

- Enable added account security, watch for follow up scams, and update software to avoid being victimized.

- Use smart cybersecurity practices to identify common scam warning signs and tactics.