Cryptocurrency trading and investing comes with inherent risks, but some platforms amplify those risks through deceptive and fraudulent practices. Hucoins is one such platform that has emerged as a major scam operation.

This in-depth article will uncover how the Hucoins scam works, provide tips for avoiding this and similar scams, and offer guidance for victims of this scam.

Overview of the Hucoins Scam

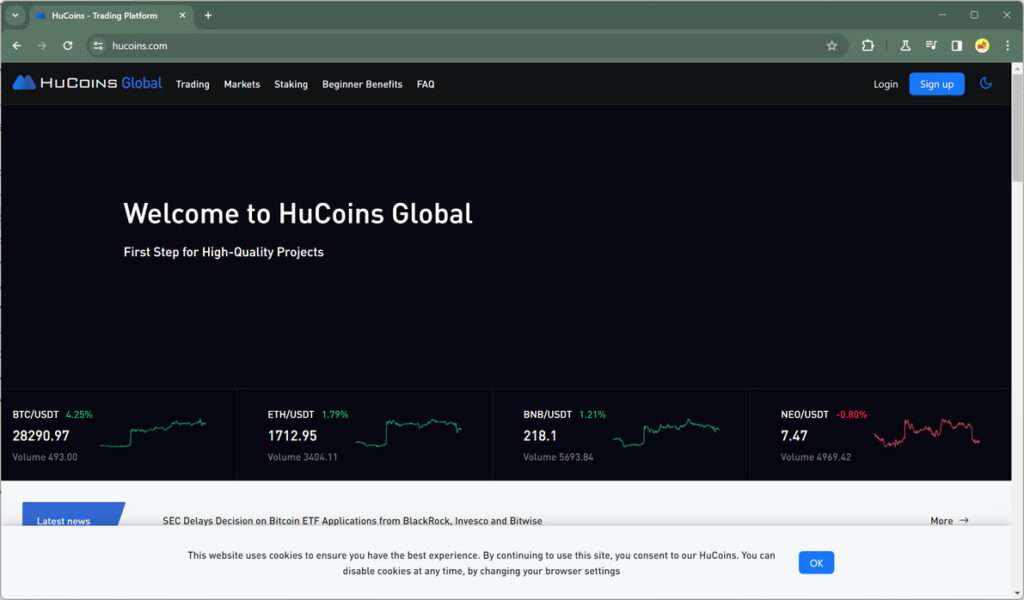

Hucoins markets itself as a cryptocurrency exchange and staking platform where users can earn high returns on crypto deposits. However, behind this facade lies an elaborate scam designed to steal user funds.

Here are some key details about the Hucoins scam:

- Operates without regulation or oversight from financial authorities

- Makes unrealistic promises of returns as high as 45% on staked crypto

- Uses fake bonuses and rewards to lure in victims

- Heavily promoted via social media ads and influencers

- Has scammy domain history and copied legal pages

- Completely lacks transparency about owners and operators

- Refuses withdrawals and requires additional deposits/fees

This scam exhibits many classic red flags associated with crypto investment scams. The promised returns are extraordinarily and unrealistically high. There is zero transparency about who owns or runs Hucoins. The website itself shows signs of being hastily put together using copied content. And once victims deposit funds, withdrawals are blocked unless more funds are deposited.

By promoting via social media channels like Facebook, TikTok, and Instagram, the scam targets unsuspecting investors new to the crypto space. The scam ensnares victims by making bold promises of free crypto, huge bonuses, and rewards. But in reality, any funds sent to Hucoins are likely lost forever.

How the Hucoins Scam Works

The Hucoins scam isquite sophisticated in how it leverages social engineering and clever UX design to manipulate and deceive victims. Here is an inside look at exactly how this scam operates at each stage:

Stage 1: Viral Promotion

The first pillar holding up any scam is promotion and visibility. Hucoins relies heavily on viral social media marketing across platforms like Facebook, Instagram, and TikTok to reach its audience.

Ads and sponsored posts portray Hucoins as a cutting-edge and lucrative crypto investment platform. The ads blanket these networks, targeting users who are most likely to take the bait.

Hucoins also pays influencers on these platforms to promote the scam to their followers. Unwitting influencers share Hucoins ads and singing its praises. This tactic lends a sense of credibility in the minds of viewers.

Stage 2: “Hook” Website

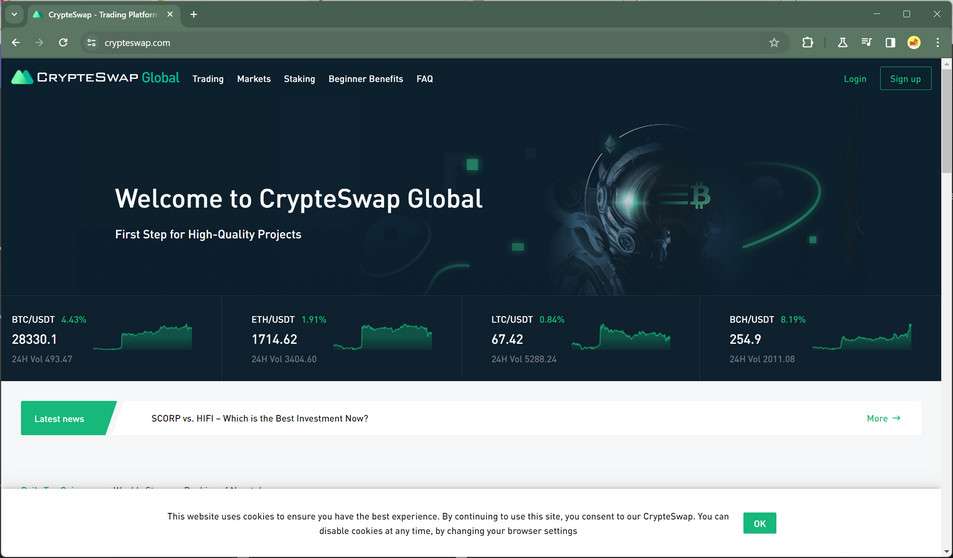

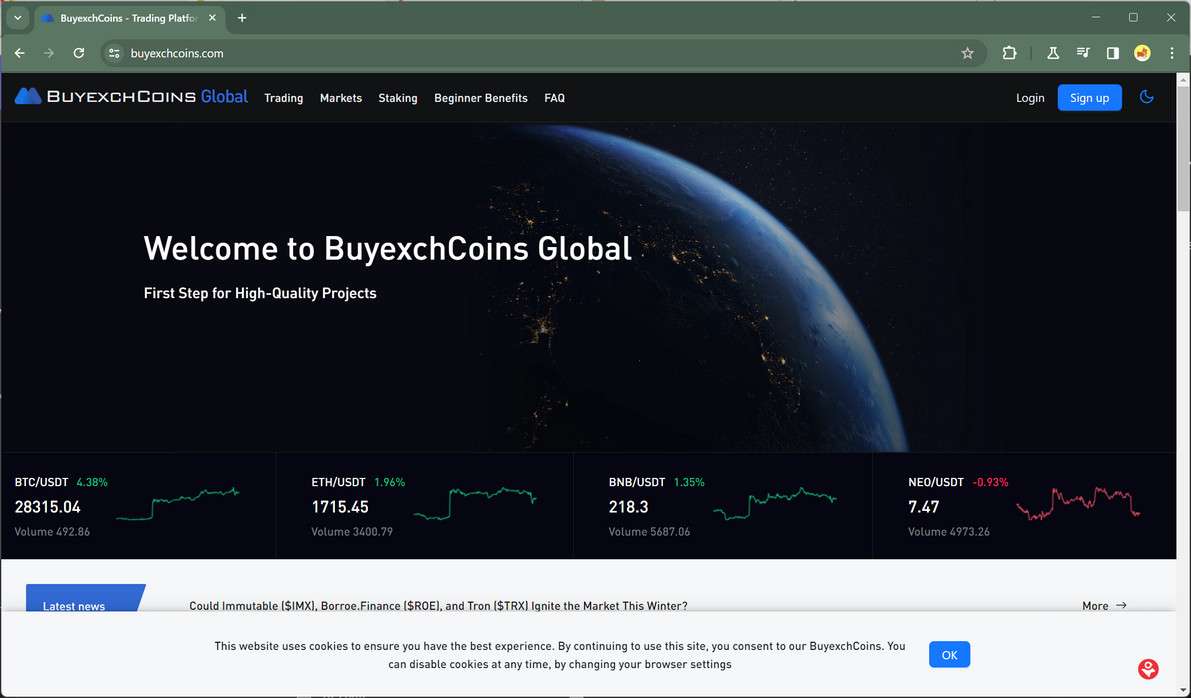

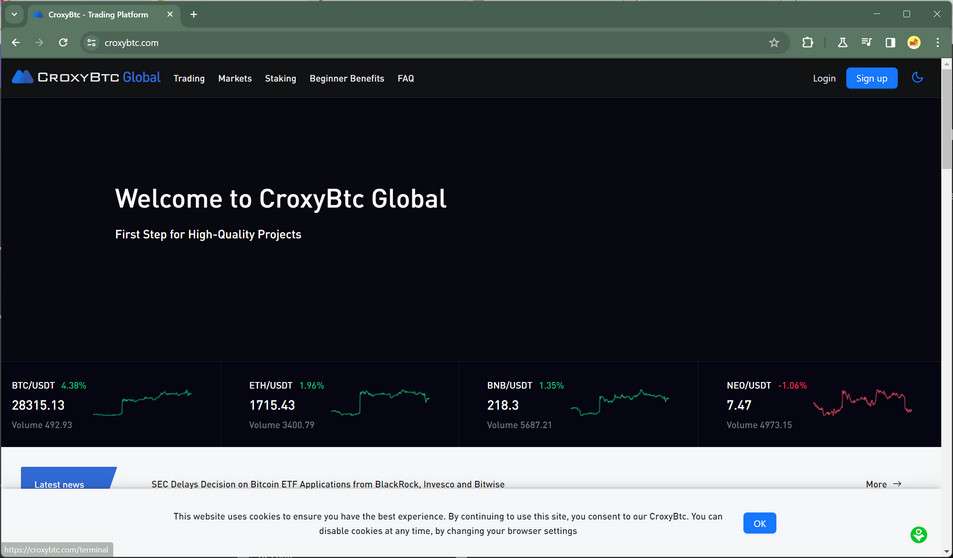

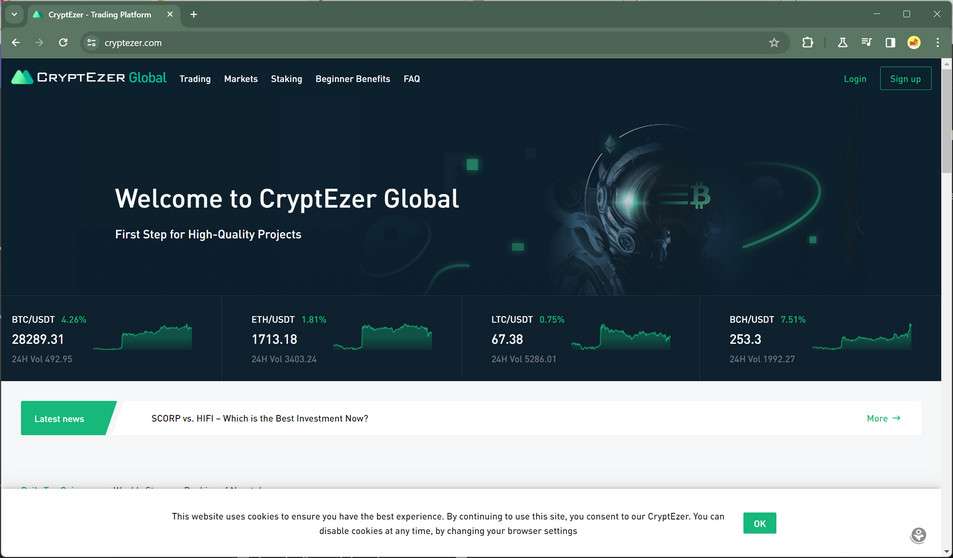

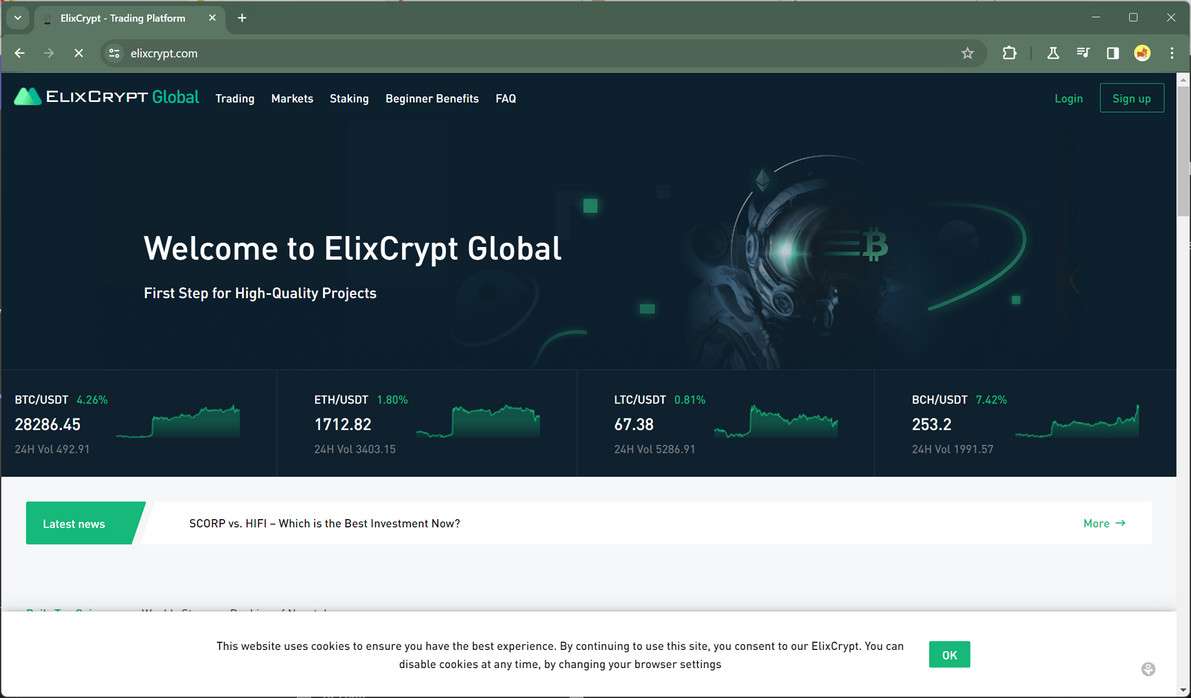

The Hucoins website itself acts as the “hook” to draw in and catch victims. The site utilizes effective web design best practices to build trust with visitors.

Visually, the site looks sleek, modern, and professional. Web elements like hero images, bold colors, and simple layouts convey legitimacy. The homepage headlines with “rewards” and “bonuses” spark interest fast.

Hucoins loads the site copy with marketing speak, buzzwords, and claims of being a “first step for high-quality projects”. This aims to portray an image of a premier crypto brand.

On the surface, the site gives the impression of a legitimate operation. But digging deeper reveals red flags like the lack of concrete details on owners, leadership, or regulation compliance.

Stage 3: Deceive With Staking Offers

The next phase further reels in victims with deceptive staking offers. Hucoins prominently displays staking packages for assets like BTC, ETH, DOGE, and ADA on the homepage.

These staking offers tout inflated and unrealistic annual percentage yields up to 45%. For context, the highest stable returns offered by legitimate platforms rarely exceed 10-15% APY.

Hucoins then layers on fake scarcity and urgency cues, such as:

- Strict minimum and maximum deposit amounts

- Countdown timer for offer expiration

- Limited slots remaining

This pressures visitors to deposit funds as soon as possible to “secure” these staking rewards. In reality, any deposited assets are likely stolen.

Stage 4: Manipulate Users With “Tasks”

After getting users to deposit funds into a staking pool, Hucoins moves to further manipulate them into depositing more. This is accomplished via gamification centered around fake “beginner tasks”.

Hucoins presents new users with beginner tasks like:

- Completing security verification

- Depositing more funds

- Referring friends

Completing these tasks supposedly unlocks bonus rewards. This offers yet another incentive designed to extract more deposits.

Gamifying the process taps into psychological motivations centered around loss aversion. Victims already deposited funds once. The prospect of losing out on bonuses compels them to double down by depositing again.

Stage 5: Steal Funds and Prevent Withdrawals

The endgame of any crypto scam is transferring funds from victims into the scammer’s wallets. Once adequate funds are extracted via staking deposits and tasks, Hucoins makes its move.

At this point, any withdrawal requests fail. Hucoins either:

- Imposes withdrawal fees greater than the withdrawal amount

- Claims technical issues preventing withdrawals

- Asks for additional security steps and verification

No matter the excuse, extracted funds remain locked in the platform. Victims face a dead end trying to retrieve their money.

Some may get asked to deposit more funds to “unlock” withdrawals or bonuses. This starts the scam cycle anew by baiting victims to invest even more, which too gets stolen.

Red Flags to Spot the Hucoins Scam

The operators behind Hucoins go to great lengths to make the platform appear legitimate. But upon closer inspection, several red flags give away the scam:

Promises of Unsustainably High Returns

The staking packages advertised on Hucoins promise annual returns of up to 45%. This wildly exceeds return rates from trustworthy platforms. Sustainable yields in crypto typically fall within single digit to low double-digit percentages. Consistently earning over 20% returns is a virtual impossibility. If an offer appears too good to true, it almost always is.

No Information About Company or Team

Hucoins’s website and other internet presence is completely devoid of any specifics on who owns or runs the business. No leadership team, company history, mission statement, or community is present. This lack of transparency is highly suspect for a company handling millions in funds. Legitimate firms openly provide details about corporate leadership and structures.

Aggressive Social Media Marketing

The heavy promotion of Hucoins across social platforms like Facebook and Instagram is a tactic highly correlated with scams. Legitimate firms gain users organically or pay for standard online ads. They don’t bombard networks with questionable influencer promotions or far-reaching spam campaigns.

Website Copy-and-Pasted From Other Scams

Analyzing Hucoins’s website HTML reveals chunks of copied code from known scam platforms. The privacy policy, terms of service, and other legal pages appear plagiarized. This signals the site was hastily constructed using fragments from other scam sites already shut down.

Domain Registered Recently

A look at Hucoins’s domain registration history shows the website was registered very recently. This fits the pattern of scam sites that build new domains to launch schemes, extract funds quickly, and vanish. Legitimate businesses use domain names with longer histories.

New crypto platforms carrying these warning signs should be avoided entirely. Those unwilling to prove basic transparency and ethics should not be trusted with user funds.

What to Do If You Are a Victim of the Hucoins Scam

If you already deposited funds or crypto into Hucoins, you unfortunately may not be able to recover those assets. The anonymous scam operators are unlikely to respond with withdrawals without further payment. Still, there are a few avenues victims can pursue:

Step 1: Stop All Activity with Hucoins

Immediately cease any further engagement with the Hucoins platform. Do not deposit any additional funds in hopes of unlocking withdrawals. This will only lead to more lost funds. Stop referral programs or other activities that benefit the scam.

Step 2: Contact Your Bank or Payment Provider

If you purchased crypto using a credit card, bank account, or payment app, contact that provider right away. Report the transactions as fraudulent. Request to chargeback any purchases sent to Hucoins. This may allow you to recover lost fiat funds, even if the crypto is untraceable.

Step 3: Report Hucoins to Authorities

File reports about Hucoins and how the scam affected you to authorities such as:

- Federal Trade Commission (FTC)

- Securities Exchange Commission (SEC)

- Cybercrime divisions of local law enforcement

These reports build critical mass to spur investigation and legal action against the scam. Provide as many specifics as possible in your complaint.

Step 4: Warn Others About the Scam

To prevent more victims, publicly expose Hucoins tactics online. Share your experience on social media and crypto forums. Leave negative reviews about the platform on sites like TrustPilot. This helps warn the crypto community and potentially saves others from being defrauded.

Step 5: Learn From This Experience

Being scammed can be a difficult lesson. But take it as a teaching moment for identifying the warning signs of investment scams. Learn how to properly vet crypto platforms, manage risks, and avoid emotional decisions. With more knowledge, you can invest smarter moving forward.

How to Avoid Hucoins and Similar Scams

Dodging schemes like Hucoins requires following basic scam avoidance best practices:

- Ignore social media ads promoting investment opportunities or cash giveaways. These are often scams.

- Research any crypto platform extensively before investing. Search for reviews, fraud reports, and transparency on the founders.

- Beware of any crypto staking or exchange product offering returns above 15% APY. This level of earnings is likely unsustainable.

- Check domain registration details on sites. Scam sites tend to use new or throwaway domains instead of established sites with history.

- Never provide payment or crypto deposit of any kind in exchange for a promised bonus or prize. These offers are intended to steal funds.

- Pay close attention to grammar, spelling, and overall quality of engagement from a platform. Scams tend to not invest in polished communications or customer service.

- Setup two factor authentication (2FA) using an authenticator app for any account on a crypto platform. This prevents unauthorized access even if your password is compromised.

Avoiding online scams ultimately requires always erring on the side of caution when approached with investment opportunities involving money or crypto. If something appears questionable, trust those instincts and steer clear.

Frequently Asked Questions about the Hucoins Scam

What is Hucoins?

Hucoins is a fraudulent cryptocurrency platform marketed as allowing users to stake and earn interest on their crypto. However, it is an elaborate scam designed to steal deposits from victims.

How does the Hucoins scam work?

The scam operates in stages:

- Promoting itself via social media ads and influencers

- Using a slick website to build credibility

- Luring victims with unrealistic staking returns

- Manipulating users to deposit more funds through fake “tasks”

- Refusing withdrawal requests while stealing deposited crypto

What are some warning signs of the Hucoins scam?

Red flags include promises of returns above 15% APY, no transparency of who owns it, aggressive marketing tactics, copied legal pages, and a recently registered domain name.

Can I get my money back if I deposited into Hucoins?

Unfortunately, recovering lost funds or crypto from this scam is very unlikely. Victims should stop engagement, report the scam to authorities, and warn others about it.

Should I deposit more into Hucoins to unlock my withdrawals?

Absolutely not. This is a common tactic scammers use to steal even more funds from victims. Do not deposit any additional money or crypto into Hucoins.

How can I avoid Hucoins and other crypto scams?

Do research before investing anywhere. Check registration details, reviews, transparency of founders, and be skeptical of returns above 10-15% APY. Never invest solely based on social media promotions.

What should I do if I suspect a crypto platform is a scam?

Trust your instincts. Cease any activity or engagement with the platform and warn others about it online. Report it to authorities to spur investigation. And learn from the experience to better spot scams.

Is it possible to earn 45% APY on crypto?

No. Consistently earning yields of over 15% is unrealistic and unsustainable. Any crypto platform advertising returns of 30%, 45%, or higher is likely operating a scam.

Conclusion

In the fast-moving world of cryptocurrency, investors must stay vigilant for scams hiding beneath legitimate facades. Hucoins exemplifies one such elaborate crypto scam designed to lure victims via social media and fake staking promises.

Those who deposit funds into its platform are unlikely to ever retrieve their assets. Hucoins exhibits all the red flags of a scam operation, from unbelievable staking rewards to plastering influencers with promotions.

Hopefully this inside look at how the Hucoins scam ensnares its victims provides valuable insight for the broader crypto community. Understanding these deceptive tactics makes one better prepared to identify and avoid such schemes in the future.

The Golden Rule of the internet still applies as strongly as ever: if an investment opportunity appears too good to be true, it almost certainly is. Stay cautious and carefully vet any platform or offer before parting with hard-earned money or crypto.