Many Americans struggle with debt and could benefit from accessing loans with reasonable terms to pay off high-interest credit cards or cover emergency expenses. Unfortunately, predatory scammers try to take advantage of those financial difficulties. One scheme you need to watch out for is the New Path Advantage scam loan offer.

- Overview of the New Path Advantage Scam Loan Offer

- Step-by-Step Explanation of the New Path Advantage Scam Process

- How to Spot the New Path Advantage Loan Scam

- What to Do If You Already Fell Victim to This Scam

- Frequently Asked Questions About the New Path Advantage Scam

- The Bottom Line on the New Path Advantage Scam

Overview of the New Path Advantage Scam Loan Offer

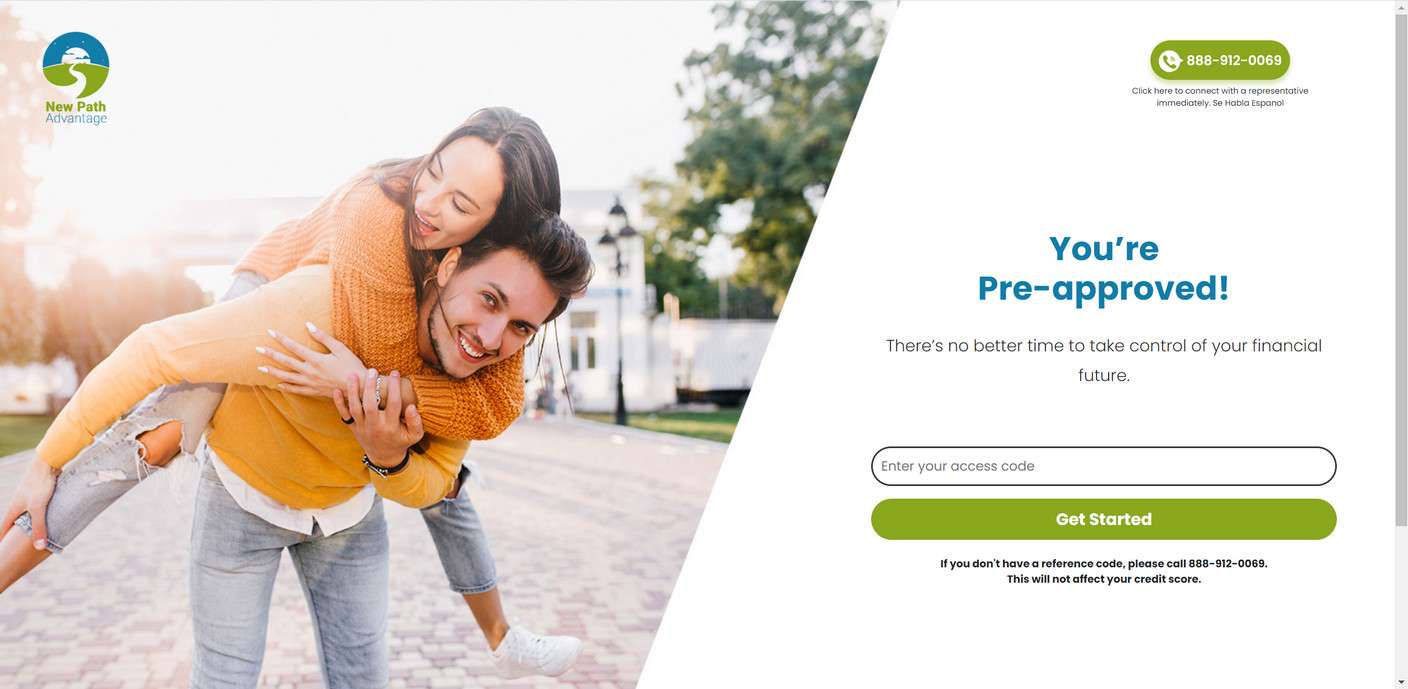

New Path Advantage poses as a legitimate loan company but uses predatory techniques to take advantage of borrowers. Here are the key details on how this scam operates:

- Imposter company – New Path Advantage is not actually a real lending company, despite claiming to be one. Their website at NewPathAdvantage.com provides no valid details on their business.

- Unsolicited contact – Most people learn about this “loan offer” through unsolicited phone calls or voicemails. Victims did not proactively seek out this loan.

- Claim of pre-approval – The scam voicemail or call claims you’ve been “pre-approved” for a loan (often for a suspiciously large amount up to $51,000). This is a deceptive technique to get your attention.

- Request for personal information – If you call back, they ask you to confirm personal details like SSN, bank account numbers, etc. under the guise of “approving” the loan.

- Advance fee scam – In order to “process” the loan, they require that you pay hundreds of dollars in fees upfront. This is an illegal process that legit lenders do not use.

This overview makes it clear that New Path Advantage exhibits many red flags. They disguise their scam as a helpful loan offer, when in reality they are trying to steal your personal information and money.

Step-by-Step Explanation of the New Path Advantage Scam Process

Now that you know the big picture, let’s walk through exactly how the New Path Advantage scam unfolds:

Step 1) Unsolicited Call or Voicemail

Most victims receive an unsolicited voicemail or call from a woman claiming to be “Barbara from New Path Advantage.”

The pre-recorded voicemail states:

“This is Barbara with New Path Advantage. My phone number is 866-666-0544. I’m not sure if you’ve spoken to an assigned agent regarding our advantage program. I do see your pre-approval is for up to $51,000 so I’m just gonna go ahead and keep this in pending status for you. And if you’ve got about 10 minutes today, give me a call back. We can go over the details as well as the benefits. Again my number is 866-666-0544. I do hope to hear from you soon and have a great day.”

This voicemail is carefully crafted to sound appealing and urgent. Phrases like “pre-approval” and listing the high dollar amount catches listeners’ attention. Most people who receive this unsolicited message assume it is somewhat legitimate and call back to learn more.

Step 2) Call Back and Information Gathering

When victims call the 866 number from the voicemail, an agent answers claiming to be from New Path Advantage. They thank the victim for calling back about their “loan approval.”

The agent then asks the victim various questions to gather sensitive personal information:

- Full legal name

- Date of birth

- Social security number

- Employer details

- Annual income

- Banking information

They claim this info is necessary to “confirm approval” and check eligibility for the loan amount mentioned. However, they are simply gathering data to enable identity theft and access bank accounts.

Step 3) Request for Upfront “Processing Fees”

After collecting personal info, the scammer explains that before they can deposit the full loan amount, the victim first has to pay a few hundred dollars in “processing fees.”

These required fees can range from $200 to $500. The agent claims this money is necessary to process paperwork, run credit checks, finalize approval, etc.

In reality, this is an advance fee scam, which is illegal. Legitimate lenders do not ask for money upfront before approving and dispersing a loan.

Step 4) Theft of Money and Identify

Unfortunately, any money sent to New Path Advantage is now gone. The “company” will disappear and stop responding once they receive those processing fees.

And now the scammers have all the victim’s personal information – full name, DOB, SSN, bank details, etc. This enables them to open fraudulent credit cards or bank accounts, take out loans in the victim’s name, and commit identity theft.

The New Path Advantage scam voicemail is just a ruse to steal money and identities. No actual loan is ever dispersed.

How to Spot the New Path Advantage Loan Scam

New Path Advantage uses deceptive techniques and psychological manipulation to trick victims. Being able to recognize the common signs of this scam can prevent you from falling for their predatory trap. Here are key details to be aware of:

Robocall from Unknown Number

One of the first signs is receiving a robocall voicemail from an unknown number. Take caution whenever an unsolicited call claims you’ve been pre-approved for a loan. Real lenders market services transparently, not via random cold calls.

Request for Personal Info

Scammers will request a lot of your sensitive personal information early in the process. Things like full name, home address, SSN, bank details, etc. No legitimate lender would ask for all that just to “confirm your eligibility.” This is a huge red flag.

Pressure to Act Quickly

Another sign is pressuring urgency by saying the loan offer will expire soon if you don’t act immediately. This is a manipulation tactic to get you to call back right away before thinking it through. High-pressure sales tactics are common in scams.

Promise of Guaranteed Approval

Comments stating you have already been approved or “pre-qualified” without even applying are also suspicious. Real lenders carefully evaluate borrowers on an individual basis before approving loans. There is no such thing as guaranteed, instant approval.

Asking for Upfront Fees

The biggest sign is requesting upfront fees before dispersing the “approved” loan amount. No legitimate lender charges processing fees until after approving the loan. Collecting money before finalizing approval is an illegal scam tactic.

No Contact Information

Finally, the lack of verifiable company information is a warning sign. Their website provides no real address, company history, or details on lending practices. The company cannot be validated.

Stay vigilant for these signs when contacted about loans. Spotting their questionable techniques early helps you avoid being manipulated into providing money or personal data. Make sure to report any scams to the proper authorities. Spreading awareness is critical to prevent more financial victimization.

What to Do If You Already Fell Victim to This Scam

If you called back and provided information or paid fees to New Path Advantage, take these steps immediately to limit the damage:

- Contact banks and credit cards – Alert your bank and all connected credit/debit cards that your information was compromised. Place warnings on accounts and consider closing any accounts that were accessed.

- Run credit reports – Request your free annual credit reports from Equifax, Experian and TransUnion to check for any signs of fraud. Look for inquiries from creditors you don’t have accounts with.

- Freeze credit – Place a credit freeze with the three major credit bureaus. This restricts access to your credit report, making it harder for scammers to open fraudulent accounts.

- Report identity theft – File an identity theft report with the FTC at IdentityTheft.gov. Provide this to creditors or banks if false accounts were opened in your name.

- Monitor accounts – Watch all your financial accounts closely for any suspicious charges or activity. Report unauthorized transactions right away.

- Avoid further communication – Do not provide any additional info or money to New Path Advantage. Stop answering their calls/texts to limit further risk.

- Report the scam – File complaints with the FTC, state attorney general, and Consumer Financial Protection Bureau so they can investigate this scam operation.

Take the above steps ASAP if the New Path Advantage scam already targeted you. Alerting banks, freezing credit, and monitoring accounts can help prevent significant financial damage.

Frequently Asked Questions About the New Path Advantage Scam

Many consumers have questions about the predatory New Path Advantage scam. Here are answers to some of the key frequently asked questions:

Is New Path Advantage a real company?

No, New Path Advantage is a fraudulent company set up to scam consumers out of money and personal information. They pretend to be a real lending company but provide no actual loans. Their website and operations cannot be validated.

How does the New Path Advantage scam work?

It starts with an unsolicited robocall claiming you were pre-approved for a $50,000+ loan. If you call back, they gather extensive personal information under the guise of “approving” the loan. Then they require $200 – $500 in upfront “fees” before dispersing funds. Once they receive the fees, they disappear without providing the loan.

What are signs of the New Path Advantage scam?

Watch for unsolicited calls about guaranteed loan approvals, requests for personal information early on, pressure tactics to act quickly, promises of loans without formal applications, and demands for upfront processing fees before final approval.

Should I pay upfront fees they request?

No, never pay upfront fees for a loan, even if they claim it’s for processing or credit checks. Legit lenders process applications first before charging fees, not the other way around. Collecting fees before approval is an illegal tactic.

Can I get back money lost to this scam?

Unfortunately, it is very difficult to recover any money sent to New Path Advantage. Even if you paid willingly under false pretenses, scammers make it nearly impossible to locate them or get refunds. Avoid sending any money unless you have verified a company’s legitimacy.

How can I report this scam?

File detailed complaints with the FTC, Consumer Financial Protection Bureau, and your state attorney general. Report any phone numbers, names, websites or payment details you have related to New Path Advantage. This helps authorities investigate and shut down their operations.

How can I avoid this scam in the future?

Be wary of unsolicited calls about guaranteed loan approvals. Never provide personal information or upfront fees to unverified companies. Research lenders thoroughly first and get loan terms in writing before sending money. If it seems suspicious, hang up.

The Bottom Line on the New Path Advantage Scam

The New Path Advantage scam relies on deceptive voicemails and calls pretending to offer a loan approval. They gather personal information and require payment of illegal upfront fees. No actual loan is provided.

If you receive an unsolicited call or voicemail from New Path Advantage:

- Do NOT call back or provide any personal details

- Hang up immediately

- Report the scam attempt

This comprehensive guide provided crucial details on how the New Path Advantage scam works and what to do if you already fell victim. Being aware of the deceptive techniques and red flags they use can help you avoid being taken by this predatory scam targeting people in financial need. Share this article to help others protect themselves from the sinister New Path Advantage scheme.