A new and alarming scam has emerged targeting small business owners across the United States and Canada. Scammers are sending fake government tax forms labelled “Form 4022” that threaten penalties if recipients do not pay a $117 “processing fee.”

- Scam Overview – An Elaborate Ploy Putting Businesses at Risk

- How the Elaborate Form 4022 Scam Works

- Red Flags – How To Spot the Form 4022 Scam

- What To Do If You Receive a Fake Form 4022 Letter

- Frequently Asked Questions About the Form 4022 Scam

- The Bottom Line – Protect Your Business Against the Bogus Form 4022

This article provides a comprehensive, in-depth examination of the Form 4022 scam. We will analyze how it works, who is behind it, and most importantly, how you can protect yourself and your business.

Scam Overview – An Elaborate Ploy Putting Businesses at Risk

The Form 4022 scam is an intricate, well-designed fraud scheme aimed at deceiving small business owners into handing over money and sensitive identifying information.

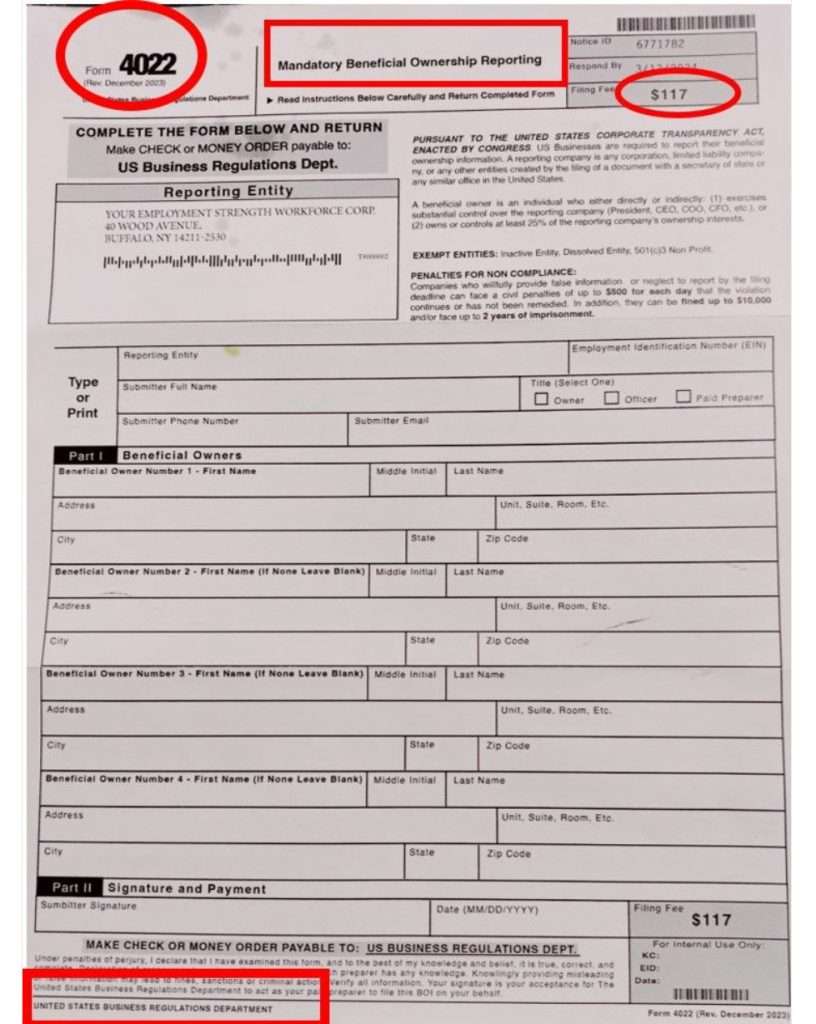

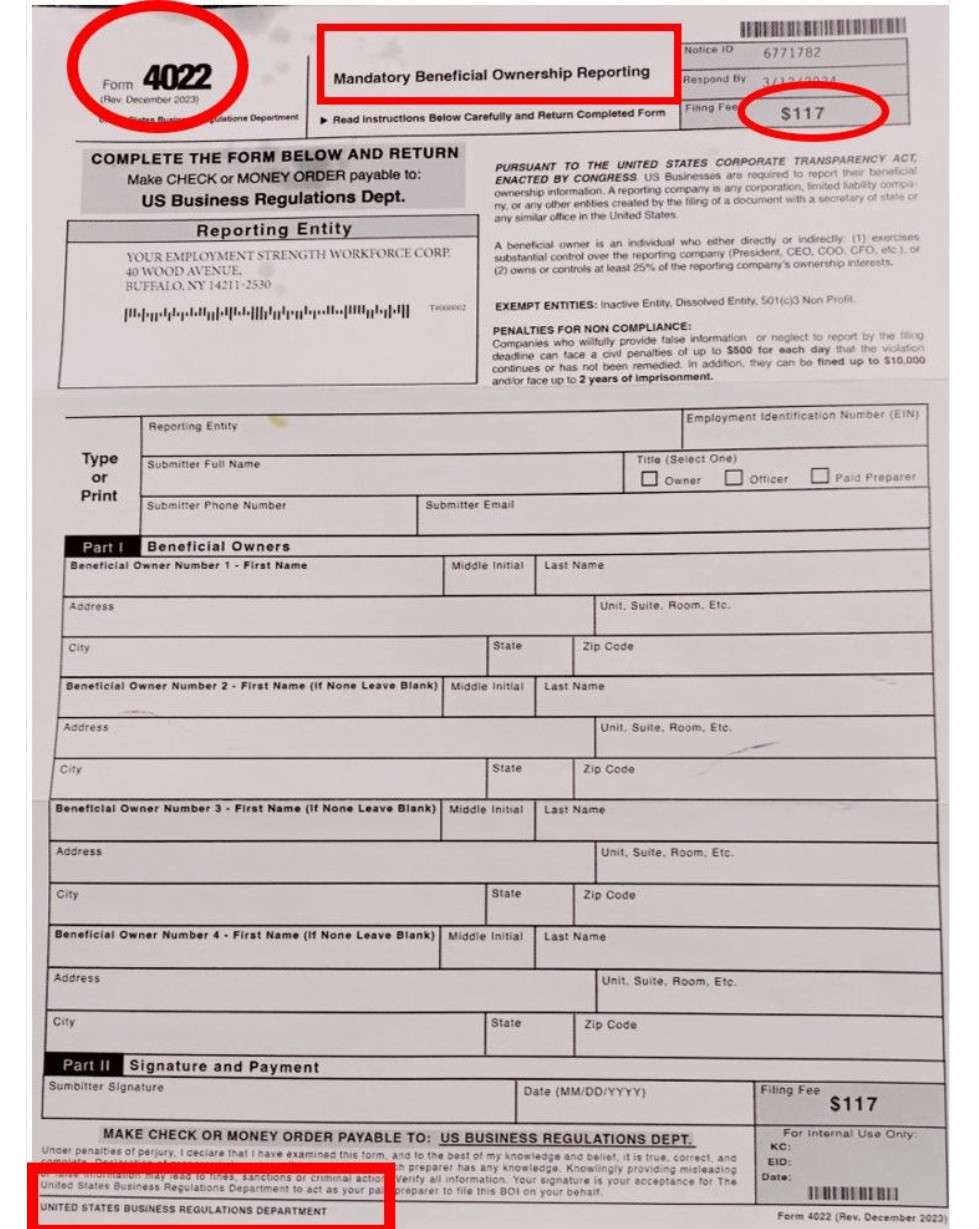

Scammers are mailing fake tax paperwork that mimics official IRS forms. These letters claim to be from a non-existent “U.S. Business Regulations Department” and cite an urgent “Mandatory Beneficial Ownership Reporting” requirement.

The fraudulent Form 4022 states businesses must pay a $117 processing fee and provide their company EIN, owner data, and other identifying details. It threatens $500 daily fines and imprisonment for not complying.

All of these claims are complete fabrications. There is no real Form 4022, mandatory reporting deadline, or penalties from any government agency. This is an elaborate ploy to unlawfully obtain money and identities.

Unfortunately, this scam has already affected thousands of small business owners. The sophisticated fraudsters behind it have detailed processes for crafting authentic-looking correspondence and obtaining target victims’ mailing addresses.

Based on mailings recovered, key indicators the Form 4022 is fake include:

- Claims to be from a non-existent agency – “U.S. Business Regulations Department”

- Demands payment of a $117 “processing fee”

- Threatens $500 daily fines and imprisonment for non-compliance

- Says businesses must respond urgently, often citing a short 1-2 week deadline

- Seeks sensitive company, owner, and financial details

- Appears nearly identical to an official IRS tax form

This scam is especially insidious because it builds on new beneficial ownership reporting rules under the Corporate Transparency Act. But make no mistake – the Form 4022 is 100% fake. Sadly, the scammers behind this scheme have been highly successful in deceiving and profiting off small businesses so far.

How the Elaborate Form 4022 Scam Works

The criminals running this scam have a sophisticated process to both mass produce fraudulent Form 4022 letters and maximize profits. Here is how the scheme typically operates:

1. Scammers Obtain Business Addresses

The scammers likely purchase known business mailing lists through illegal channels on the dark web. They may also harvest addresses from business license databases, chamber of commerce directories, or past data breaches. This enables them to mail letters directly to potential victims.

2. Realistic-Looking Fake Forms Are Produced

Using mail-merge tools, the scammers can instantly generate thousands of personalized Form 4022 letters addressed to each target.

The letters are made nearly indistinguishable from a real IRS tax form. They include official logos, reference codes, and government form layouts. Even experts could easily mistake these fakes as real.

3. Letters Threaten Legal Action for Non-Compliance

The letters state there are mandatory reporting requirements and a specific deadline to reply. But crucially, they also threaten $500 daily fines and imprisonment for failure to comply.

These threats prey on citizen’s ingrained fears of consequences from government authorities. This helps pressure victims to respond out of fear.

4. Money and Information Are Illicitly Obtained

If a letter recipient pays the $117 fee, the scammers immediately profit. Any bank details provided can then be used for further fraud.

The scammers then have the victim complete a detailed information form. This provides all the data needed to steal identities and commit other financial crimes in the victim’s name.

5. Stolen Information Fuels Immediate and Future Fraud

Possessing someone’s business and personal information enables nearly unlimited fraud potential. The scammers can unlawfully apply for loans or credit, register businesses, file fake tax returns, launder money, and much more.

They can also sell the data on the black market to fuel an entire network of illegal activity by identity thieves around the world. The potential for long-term financial damages is enormous.

This is what makes the Form 4022 scam so dangerous – it can instigate a never-ending cycle of identity theft and financial fraud if businesses fall victim.

Red Flags – How To Spot the Form 4022 Scam

While the fake Form 4022 letters are designed to appear real, there are a few subtle red flags that indicate it is a scam:

- No official form number – Real government forms have an OMB control number on them, which this scam letter lacks.

- Poor print and image quality – Low resolution images and text often indicate a scam made from scanned materials.

- Grammatical errors – The letters often have writing mistakes uncharacteristic of official agencies.

- Aggressive threats – Language threatening steep fines or jail time right away is atypical and signals deception.

- Requests sensitive data – Asking for private business identifiers and owner info is not normal and very risky.

- Short deadlines – Giving 1 week or less to pay fees and respond is extremely unusual for agencies.

- Unknown department – There is no such government organization called the “Business Regulations Department.”

With knowledge of these scam indicators, small business owners can more readily identify the fraudulent Form 4022 and avoid being victimized.

What To Do If You Receive a Fake Form 4022 Letter

If you receive a Form 4022 letter demanding payment and making threats, don’t panic. Here are the steps experts recommend:

1. Do Not Pay or Provide Any Information

First, recognize that the entire thing is a scam attempt. Do not send any money, provide your EIN, or fill out any enclosed forms.

2. Safely Discard the Letter Immediately

You can simply throw the fraudulent letter away. There is no reason to engage with obvious fraudsters.

3. Report the Scam Activity to Authorities

Notify the IRS, FTC, and your state attorney general about the scam letter so they can investigate.

4. Warn Your Business Contacts and Community

Spreading awareness helps prevent other innocent victims. Post on social media and notify local business groups.

5. Monitor Accounts Closely

Check statements routinely for any signs of unauthorized charges or accounts opened without your consent. Immediately report any suspicious activity.

6. Speak with Professionals if Needed

Consult qualified legal, tax, or fraud experts if you have any lingering concerns or questions about protecting yourself in the future.

With the right precautions, the Form 4022 scam can be defeated. Do not let these fraudsters intimidate or deceive you.

Frequently Asked Questions About the Form 4022 Scam

1. What exactly is the Form 4022 scam?

The Form 4022 scam involves fraudsters sending fake IRS-style letters to small businesses demanding payment of a bogus $117 “processing fee.” The letters falsely claim this is related to mandatory beneficial ownership reporting and threaten penalties for non-compliance. In reality, Form 4022 does not exist and is simply made up to unlawfully obtain money and sensitive identifying information.

2. Who is behind the Form 4022 scam letters?

They are sent out by sophisticated scammers and fraud rings specifically targeting small business owners. By impersonating government agencies, they aim to deceive recipients into believing the letters are real IRS tax forms.

3. How are businesses targeted for the Form 4022 scam?

Scammers obtain mailing lists of small business addresses, likely illegally purchased from data brokers or stolen in data breaches. This enables them to send the fraudulent letters directly to potential victims.

4. What are the exact fraudulent claims made in the letters?

The fake Form 4022 letters falsely claim:

- There is a mandatory beneficial ownership reporting requirement

- Businesses must pay a $117 “processing fee”

- Fines of $500 per day and imprisonment may occur for failure to comply

- The form is from the non-existent “U.S. Business Regulations Department”

5. What threats do the letters use to intimidate recipients?

The letters cite threats of:

- $500 daily fines for not complying

- Imprisonment of up to 2 years

- They use urgent deadlines, often 1 week, to reply

These threats prey on fears of penalties from government agencies.

6. Is there any real mandatory reporting requirement related to this?

Yes, but the deadlines are much later. The Corporate Transparency Act requires submission of beneficial owner information by 2025 (or within 90 days of opening a new business after Jan 2024). This filing is also free.

7. What are the scammer’s real motives with this scam?

Their goals are to:

1) Unlawfully obtain the $117 fee from each victim

2) Gather sensitive identifying information for identity theft

3) Use stolen data and IDs to commit wide-ranging financial fraud

8. What should I do if I receive a Form 4022 letter?

If you receive a scam letter:

1) Do not pay any money or provide information

2) Discard the letter immediately

3) Report the fraud to the IRS, FTC, and state attorney general

4) Monitor accounts closely for signs of identity theft

5) Consult a professional like a lawyer or CPA if needed

9. What precautions can I take to avoid being victimized?

Steps to take include:

- Watch for any mail claiming to be from unknown departments

- Verify any mandatory reporting deadline dates

- Consult professionals to fact check legal threats or fee claims

- Never provide sensitive data to unverified letter senders

10. How can I report this scam to help authorities stop it?

To report this scam:

- File an IRS scam report at IRS.gov

- Submit an FTC complaint at FTC.gov

- Contact your state attorney general’s office

- Warn peers and community business groups

Spreading awareness is key to putting an end to the Form 4022 scam.

The Bottom Line – Protect Your Business Against the Bogus Form 4022

The Form 4022 scam uses fear tactics and impersonates government agencies to try to unlawfully take money from small businesses and individuals. But armed with the right knowledge, business owners can avoid falling victim.

To recap, remember:

- The Form 4022 does not exist. Any letter demanding payment for “mandatory reporting requirements” is fake.

- Do not pay any fees or provide personal information per the scam’s instructions. This will only lead to identity theft.

- Report the scam activity to the IRS, FTC, state attorney general, and business peers to raise awareness.

- Monitor accounts closely for fraudulent activity and consult professionals for guidance as needed.

The Form 4022 scam may seem convincing, but now you can protect yourself and your local community. Share this article to spread the word so fewer small business owners get caught by this cruel fraud scheme.

![Remove Mudgentop.co.in Pop-up Ads [Virus Removal Guide] 4 McAfee scam 4](https://malwaretips.com/blogs/wp-content/uploads/2023/08/McAfee-scam-4-290x290.jpg)