Scams and phishing attempts have become increasingly prevalent in today’s digital age. Cybercriminals are constantly devising new tactics to trick unsuspecting individuals into revealing their personal information or financial details. One such scam that has recently gained attention is the American Express ‘Primary Cardmember Message’ phishing scam. This article aims to provide a comprehensive overview of this scam, including what it is, how it works, what to do if you have fallen victim, technical details, and relevant statistics.

What is the American Express ‘Primary Cardmember Message’ Phishing Scam?

The American Express ‘Primary Cardmember Message’ phishing scam is an attempt by cybercriminals to deceive American Express cardholders into divulging their personal and financial information. The scam typically involves sending fraudulent emails or text messages that appear to be from American Express, informing the recipient of an urgent message regarding their credit card account.

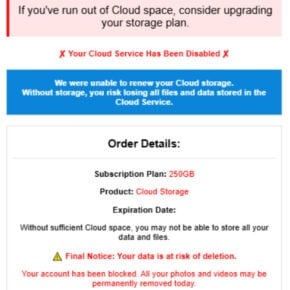

The messages often contain alarming subject lines, such as “Important Account Update” or “Suspicious Activity Detected,” designed to create a sense of urgency and prompt the recipient to take immediate action. The content of the messages usually includes a link or attachment that directs the victim to a fake website or downloads malware onto their device.

How Does the Scam Work?

The American Express ‘Primary Cardmember Message’ phishing scam relies on social engineering techniques to trick individuals into providing their sensitive information. Here is a step-by-step breakdown of how the scam typically unfolds:

- The victim receives an email or text message that appears to be from American Express, claiming to have an important message regarding their credit card account.

- The message contains a link or attachment that the victim is instructed to click on to access the message.

- Upon clicking the link or opening the attachment, the victim is directed to a fake website that closely resembles the official American Express website.

- The fake website prompts the victim to enter their login credentials, credit card details, or other personal information.

- Once the victim submits their information, the cybercriminals behind the scam gain access to their sensitive data, which can be used for various fraudulent activities, such as identity theft or unauthorized transactions.

What to Do If You Have Fallen Victim?

If you have fallen victim to the American Express ‘Primary Cardmember Message’ phishing scam or suspect that your personal information has been compromised, it is crucial to take immediate action to minimize the potential damage. Here are the steps you should follow:

- Change your passwords: Start by changing the passwords for all your online accounts, especially those associated with your American Express card and financial institutions.

- Contact American Express: Reach out to American Express directly through their official customer service channels to report the incident and seek guidance on further steps.

- Monitor your accounts: Regularly monitor your credit card and bank statements for any suspicious activity. If you notice any unauthorized transactions, report them immediately to the respective financial institution.

- Scan for viruses and malware: Run a thorough scan of your devices using reputable antivirus software, such as Malwarebytes Free, to detect and remove any potential malware or keyloggers that may have been installed.

- Enable two-factor authentication: Whenever possible, enable two-factor authentication for your online accounts to add an extra layer of security.

Technical Details of the Scam

The American Express ‘Primary Cardmember Message’ phishing scam utilizes various techniques to deceive recipients and make the fraudulent messages appear legitimate. Here are some technical details of the scam:

- Spoofed email addresses: The scammers often use sophisticated techniques to spoof email addresses, making it appear as if the messages are coming from a legitimate American Express email account.

- Phishing websites: The fake websites used in the scam are designed to closely mimic the official American Express website, including logos, colors, and layout, to deceive victims into entering their information.

- Malware distribution: In some instances, the scam may involve the distribution of malware through email attachments or malicious links. This malware can compromise the victim’s device and allow the cybercriminals to gain unauthorized access.

Statistics on Phishing Scams

Phishing scams, including the American Express ‘Primary Cardmember Message’ phishing scam, continue to pose a significant threat to individuals and organizations worldwide. Here are some statistics that highlight the prevalence and impact of phishing scams:

- In 2020, the Anti-Phishing Working Group (APWG) reported a total of 241,324 unique phishing attacks worldwide.

- According to the FBI’s Internet Crime Complaint Center (IC3), phishing scams resulted in over $54 million in losses in 2020 in the United States alone.

- A study conducted by Verizon found that 22% of data breaches in 2020 involved phishing attacks.

- Phishing attacks targeting financial institutions accounted for 35% of all phishing attacks in 2020, according to the APWG.

Summary

The American Express ‘Primary Cardmember Message’ phishing scam is a deceptive tactic employed by cybercriminals to trick American Express cardholders into revealing their personal and financial information. By sending fraudulent emails or text messages, the scammers create a sense of urgency and prompt victims to click on malicious links or provide sensitive data on fake websites. If you have fallen victim to this scam, it is crucial to take immediate action by changing passwords, contacting American Express, monitoring accounts, scanning for malware, and enabling two-factor authentication. Phishing scams, including this one, continue to be a significant threat, and individuals must remain vigilant to protect themselves from falling victim to such fraudulent schemes.