Have you received a text message that appears to be from Arvest Bank alerting you about suspicious activity or restricted access to your bank account? Unfortunately, these “Arvest alerts” are phishing scams aimed at stealing your personal and financial information. This scam is circulating widely and catching many recipients off guard due to appearing to come from a trusted source.

In this comprehensive guide, we’ll explain everything you need to know about the Arvest alert scam text message, including:

- An overview

- How the scam works

- What to do if you clicked the link or provided information

- Key takeaways

We’ll provide need-to-know details on how this phishing attack operates, actions to take to protect yourself if your data was compromised, and top tips so you don’t fall victim. Let’s dive in.

Overview of the Arvest Alert Phishing Scam

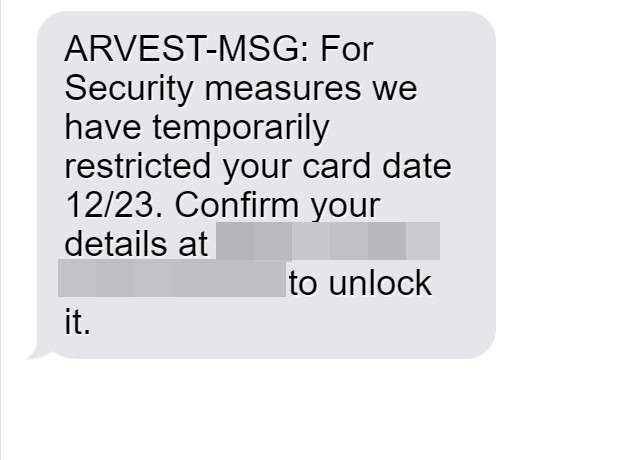

In the common version of this scam, recipients receive a text that appears to come from Arvest Bank stating that suspicious activity was noticed or access to your account has been temporarily restricted.

The message then prompts you to click on a link (which routes to a fake website mimicking Arvest’s real portal) to “unlock” your account or review flagged activity.

Of course, this is a fraudulent website setup solely to steal sensitive personal details and banking/login credentials from Arvest members. Sophisticated phishing scams leverage the name and branding of a trusted bank or company to catch targets off guard and convince them to input information without thinking twice.

By gathering key details like names, account numbers, SSNs, login IDs, passwords and more, scammers aim to gain access to accounts for financial theft or sell data on the black market.

Unfortunately, this scam tactic is rampant lately, with many major banks seeing their names tied to similar text and email phishing campaigns. The messages often instill fear or urgency in recipients, increasing the chance you’ll click and provide data hastily without realizing it’s a fraud.

How the Arvest Phishing Text Scam Works

Now that you know the overview of this scam, let’s explore exactly how it operates. We’ll provide in-depth detail on common messages used, fraudulent sites they lead to, and what happens after targets provide sensitive information.

1. Phishing Text Message Themes

While Arvest phishing texts may vary slightly, most follow similar themes and prompts to lure in victims. Two extremely common script versions say:

- “For security measures we have temporarily restricted your card date 12/23. Confirm your details at [fake site URL] to unlock it”

- “Unusual activity on your account was noticed. Please verify all transactions at [fake site URL] immediately to avoid restrictions”

Often, the texts include Arvest Bank branding and colors too, increasing perceived legitimacy. Messages aim to create fear and urgency that access could be lost or fraud is happening.

Of course, these predatory texts are only sent to gather sensitive personal financial details from Arvest members. There was no actual suspicious activity, account restriction or security breach triggering the message.

2. Fraudulent Phishing Sites

When recipients click the link in the text, it routes to a sophisticated fake portal impersonating the real Arvest online banking login site.

The fraudulent site looks nearly identical to Arvest’s actual member platform, featuring official branding, logos, color schemes and web design. This tricks visitors into believing the portal is legitimate.

In most cases, a pop-up message then appears, often also citing suspicious activity detected, prompting users to “verify account details immediately.” Scam sites will have input fields for sensitive info like:

- Full name

- Home address

- Phone number

- Email address

- Account and routing number

- SSN

- Bank card details

- Account login credentials

Once users input any of these details into the fake portal, scammers capture it instantly. You’ve now provided crooks with a wealth of sensitive personal and financial data.

3. Dangers After Data Is Stolen

So what happens after scam artists obtain your sensitive personal or banking details through this phishing site? Unfortunately, many troublesome outcomes including:

- Account Access & Fund Withdrawals: With bank account and login details, thieves can access real Arvest accounts for theft directly from authenticated portals. This allows large, fraudulent withdrawals that appear legitimate since crooks login with real usernames and passwords.

- Identity Theft Risks: Full names, SSNs, addresses and dates of birth give fraudsters enough ammo to open fraudulent new lines of credit for large purchases under victims’ names. Data sells for high prices on black markets too.

- Malware Infections: In some advanced cases, simply visiting or entering data on certain fake sites can infect devices with dangerous trojans and info-stealing malware. This is another sneaky way crooks gather intelligence and monitor activity.

As you can see, immense financial and identity theft damages can stem from divulging sensitive data to fraudsters carrying out sophisticated Arvest phishing scams via text.

What to do If You Fell Victim to the Arvest Phishing Text Scam

Have you received this Arvest phishing text and already clicked the link or entered information into a suspicious site? First and foremost, don’t panic. While falling victim to scams is extremely common today amid highly-sophisticated attacks, there are key steps to take in response:

Step 1: Alert Arvest Immediately

If you believe your Arvest Bank username and password has possibly been compromised, your first call should be to Arvest’s 24/7 customer support line at (800) 601-8655.

Explain the situation in detail and request they temporarily freeze access, reset login credentials and monitor for fraudulent activity under your profile. Doing so ASAP limits possibility of fund/data theft.

Step 2: Initiate Fraud Alerts at CRA’s

Secondly, contact all three major credit reporting agencies (TransUnion, Experian and Equifax) to set up free credit monitoring alerts in case crooks do attempt to open new lines of credit in your name after gathering personal data via the phishing site.

This allows agencies to watch for and notify you of potential fraudulent new account activity so it can be halted quickly versus damaging your score and going unpaid accumulating interest down the road.

Step 3: Scan Devices For Malware Threats

Another smart protective step is to scan all devices that accessed the fake phishing site thoroughly for malware and spyware threats left behind to continuing monitoring information in the background. Use efficient anti-malware suite programs for this step.

Delete anything suspicious discovered to avoid invasive trojans sending your data back to scammers behind the scenes or allowing them remote access for more theft down the road.

Step 4: Change Passwords on All Accounts

Even if crooks didn’t nab every username and password combination you use during the Arvest phishing encounter, still take the opportunity to reset credentials everywhere as a precaution.

Use unique, complex 12+ character passwords with special symbols, numbers and case variations for highest safety. Enabling two-factor authentication provides an extra account access verification layer too.

This limits potential damages if any credentials were saved by fraudsters for infiltration attempts later on additional financial or retail accounts, email, etc. Make password hygiene a priority in scam aftermath.

Frequently Asked Questions on the Arvest Phishing Text Scam

Wondering if that Arvest fraud alert text in your messages is legitimate or how to best react if you provided data? Below we answer the most commonly asked questions on this prevalent scam to eliminate confusion and ensure readers have reliable information.

Am I at risk of receiving an Arvest phishing text?

Unfortunately, YES – this scam has circulated widely over past months targeting Arvest members across all servicing regions. The fraudulent texts impersonate alerts from the bank itself, meaning any existing or even non-members could receive messages unexpectedly. Maintain caution opening any texts citing account issues.

How can I identify or confirm real Arvest texts?

Arvest would never contact clients via unsolicited messageLinks routing to external sites for input of sensitive information. Legitimate technical or security-related requests would route you to established Arvest support pages after logging into the verified member portal directly. As a precaution, manually navigate to online banking through known bank site URLs versus clicking any links.

What specific details do Arvest phishing texts ask for?

These fraudulent messages will ultimately route victims to fake login portals gathering various details like full names, physical addresses, SSNs, account/routing numbers, card information, account credentials and more. Entering any of this data hands ammo to scammers to infiltrate accounts or commit identity fraud.

What if I clicked the link or entered details – now what?

First, alert Arvest Bank immediately of any account credential, card or personal data possibly compromised through the scam site so they can halt access and monitor closely for fraud. Additionally, set up credit reports fraud alerts, scan devices that accessed the fake portal for lingering malware threats, and reset all account passwords across financial, email, retail and social platforms as a safety protocol against potential future targeting.

How can I avoid falling for the Arvest phishing scam in the future?

Utilize common phishing scam indicators like grammatical errors, threats demanding immediate action, request for sensitive data, and unfamiliar links to identify and delete fraudulent texts immediately without clicking anything. Manually navigate to Arvest’s portal through known safe URLS versus texts or emails moving forward while enabling enhanced login securities like MFA.

Recap and Key Takeaways

Being vigilant against increasingly common and well-executed phishing scams is crucial to protect finances, identity and sensitive data in today’s digitally-driven world.

To recap this guide’s key details, remember:

- Arvest fraud texts often cite account restrictions or suspicious logins to spur urgency – Message themes vary slightly but mostly aim to create fear of frozen access or fraud to persuade clicking links.

- Phishing links route to sophisticated fake sites mimicking Arvest’s portal – These fraudulent pages are specifically designed to closely impersonate the real login portal’s look and feel, tricking visitors into entering account details, card data, SSNs and more.

- Crooks use stolen data for devastating account theft or identity fraud – Criminals can login directly with compromised usernames/passwords or sell info to other fraudsters. They may also leave spyware allowing future data access or remote device control.

- Immediately contact banks and credit agencies if you fell victim – Alerting financial providers, resetting account access credentials, monitoring credit reports and scanning devices helps limit damages from lost financial or personal data.

- Reset passwords everywhere as a safety protocol – Even if crooks only gather specific account details, still reset all credentials across financial, email, retail and social media accounts to maintain safety.

Be vigilant against scam calls, emails and texts impersonating banks and companies by following smart online safety protocols like never clicking unverified links, avoiding entering sensitive data on sites you don’t 100% trust, installing anti-malware software, and enabling login/purchase verification protections. Combining awareness with proactive precautions is your best defense against fraud damages.