Have you received an urgent text message claiming your credit score has suddenly dropped? Don’t fall for it – this is likely the notorious “scoreinfos.com” scam designed to steal your personal information. Read on to uncover everything you need to know about spotting and avoiding this devious phishing scam.

Overview of the Scoreinfos.com Credit Score Scam

The scoreinfos.com scam revolves around fraudulent text messages that appear to come from Equifax, the major credit reporting agency. These texts claim there has been suspicious activity on your account or that your credit score has significantly decreased.

The message then directs you to click on a link, often “http://scoreinfos.com/score”, supposedly to access more details about the issue. However, this link actually redirects to a fake, lookalike site intended to steal personal information.

This scam is essentially a form of phishing, using misleading texts about your credit to provoke fear and trick you into handing over valuable data. The texts are designed to seem credible and urgent, preying on people’s concerns about their financial security.

However, Equifax does not contact consumers through unsolicited texts with alerts about credit information. Any legitimate notifications come through official channels, like mailed letters or your online account dashboard.

By understanding the tactics behind this scam, you can avoid becoming a victim. Keep reading to learn exactly how the scoreinfos.com scam works and how to protect yourself.

How the Scoreinfos.com Credit Score Scam Typically Operates

The scoreinfos.com scam generally follows these steps:

- You receive an unsolicited text message on your smartphone. This will appear to be from Equifax and often says something like “Urgent notice” or “Fraud alert.”

- The message claims there is an issue with your credit score or account. This is intended to provoke fear and urgency. The text may say your score dropped significantly or that suspicious activity was detected.

- You are provided with a link to “check” or “resolve” the issue. This link uses a domain like “scoreinfos.com” instead of Equifax’s real site. The scam texts make the link seem credible.

- Clicking the link redirects you to a fake website. This site impersonates Equifax or another trusted entity. It may look convincingly professional at first glance.

- You are prompted to enter personal info like your SSN, account logins, etc. The site will claim this is needed to access your report or fix the issue. However, this data goes straight to scammers.

- Your information is stolen and likely used for identity theft or sold on the dark web. Even if you don’t enter details, just visiting the site can infect your device with malware.

This simple but effective process allows scammers to reel in many unsuspecting victims. All it takes is a misleading text to provoke real fear about your financial security.

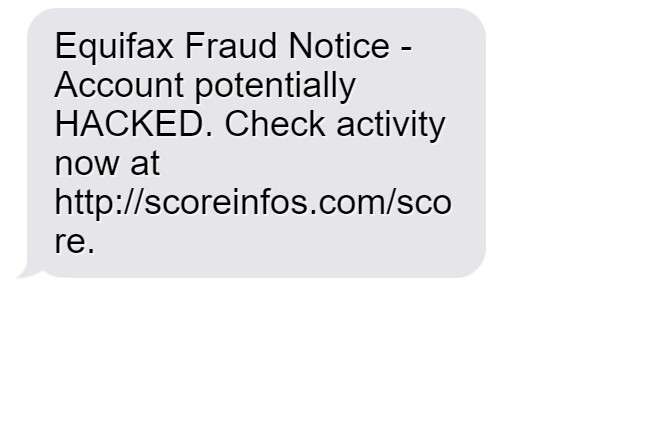

Examples of Fraudulent Scoreinfos.com Text Messages

To provide an idea of what these phishing texts look like, here are some examples reported by consumers:

- “URGENT from Equifax: Your credit score changed. Suspected identity theft. Please verify account at http://scoreinfos.com/score NOW.”

- “ALERT: EQUIFAX detected an attempt to access your credit file. Verify account to avoid freeze. http://scoreinfos.com/score”

- “Equifax Fraud Notice – Account potentially HACKED. Check activity now at http://scoreinfos.com/score.”

- “EQUIFAX ALERT: Your credit score dropped 61 points due to unpaid debt. More info: http://scoreinfos.com/score.”

- “Equifax Notification: Your credit score has been updated. View changes now at http://scoreinfos.com/score.”

These examples show how the texts mention Equifax, credit scores dropping, and fake links, while creating urgency to click immediately.

Key red flags include:

- Unsolicited nature – you didn’t request Equifax to send an alert

- Claims of sudden score drops or “fraud detected”

- Links to non-Equifax domains like “scoreinfos.com”

- Pushy demands to act now and verify account

Any text with these traits should be considered highly suspicious.

Detailed Steps: How the Scoreinfos.com Scam Actually Works

Now let’s break down exactly how scammers carry out this phishing scam from start to finish:

1. Scammers Obtain Consumer Cell Phone Numbers

The first step is for scammers to acquire cell phone numbers for potential victims. They get these through:

- Data breaches – numbers are sold on the dark web after hacks

- Random number generation – texts are blasted randomly to see who responds

- Malware – spyware infects devices and steals contacts/numbers

- Social engineering – numbers are phished via other scams

2. Fraudulent Texts Are Sent En Masse

Once scammers compile cell phone numbers, they use special software to send the phishing texts en masse. The messages appear to be from a legit sender and are personalized if the scammers have names.

The texts follow similar templates about Equifax, credit scores dropping, and fake links to urgent “verify account” or “check activity” pages. These templates are highly effective at provoking panic in recipients.

3. Recipients Click The Links in The Texts

If the scam texts provoke enough fear in recipients, they will click the link without considering that the message is fake. The texts provide little time for critical thinking, urging recipients to act immediately to resolve supposed financial threats.

Even savvy individuals can be duped due to worries about identity theft or credit damage. The scammers bank on overriding logic with emotion.

4. Fake Websites Collect Personal Information

Clicking the phishing link sends users to a fraudulent website impersonating Equifax, banks, or other trusted entities that deal with credit data. The site looks professional at first to seem legitimate.

Recipients will be asked to enter personal info like SSN, account numbers, passwords, etc. to “verify their identity” and address the credit score issue mentioned in the texts. The scammers thus obtain the data they ultimately want to exploit.

5. Scammers Steal and Abuse Personal Data

With your information entered, the scammers can now steal and abuse it in various forms of identity fraud:

- Opening new credit accounts – Apply for loans, credit cards, etc. under victims’ names using the SSN and other details

- Accessing existing accounts – Log into bank, utility, or other accounts using phished usernames and passwords

- Government identity theft– File fraudulent tax returns, apply for benefits, or commit Medicare fraud using victims’ information

- Selling on the dark web – Data like SSNs, account numbers, passwords, etc. can fetch high prices when sold to other criminals on dark web markets

6. Victims Must Repair Credit and Identity Theft Damages

Unfortunately, victims of the scoreinfos.com scam are often left having to rebuild credit and restore identity information. This may involve:

- Placing fraud alerts and credit freezes with the major credit bureaus

- Changing usernames and passwords on all accounts

- Contacting banks and creditors to report identity theft

- Filing police reports about the scam

- Contacting government agencies about fraudulent activity done with the victim’s SSN

- Monitoring credit reports and financial accounts for any signs of further misuse

- Freezing ChexSystems to prevent bank account fraud

The aftermath of this scam can be a long, complex headache for unsuspecting victims. This underscores the importance of identifying and avoiding the fraudulent scoreinfos.com texts at the outset before personal data is handed over.

What to Do If You Receive a Suspicious Scoreinfos.com Text

If you get an unsolicited text message claiming to be from Equifax or another entity about your credit score dropping, take these steps:

1. Do NOT click any links in the text

This is crucial. The links in these phishing texts lead directly to fake sites intending to steal your information. No matter how legitimate the link looks, do not click it.

2. Forward the text to 7726 (SPAM)

Forwarding scam texts to 7726 reports them to your cell provider, which helps identify and block phone-based phishing scams.

3. Delete the text immediately

Remove the fraudulent text from your phone so you avoid accidentally clicking on it later. This eliminates the risk.

4. Contact Equifax to confirm validity

You can call Equifax customer service to confirm whether the text actually came from them (which it didn’t).

5. Log into your real Equifax account

Visit www.equifax.com and log into your Equifax account dashboard to view any real notifications or credit score changes.

6. Place a free credit freeze

Placing a credit freeze restricts access to your credit report, making it harder for fraudsters to open new accounts in your name. Freezes can be enacted for free at Equifax, Experian, and TransUnion.

7. Monitor your credit reports and bank statements

Keep close tabs on your credit reports from Equifax, Experian, and TransUnion, watching for any unauthorized activity. Also monitor bank and credit card statements for signs of fraudulent charges.

8. Enable two-factor authentication (2FA) everywhere

2FA adds an extra layer of security beyond passwords on accounts, using your phone or email to verify logins. Enable this protection on email, banking, credit cards, and anywhere available.

9. Change passwords on financial accounts

Create fresh, complex passwords for all financial accounts to lock out scammers with any phished login info. Avoid reusing passwords across accounts.

How to Avoid Falling Victim to the Scoreinfos.com Scam

Diligent precautions are needed to avoid becoming a victim of the scoreinfos.com phishing scam:

- Never click on links in unsolicited texts – This includes any urgent-sounding links about your finances or credit. Contact sources directly instead.

- Set up spam call & text blocking – Your cellular provider and smartphone likely offer this. Enable it to stop many scam texts preemptively.

- Know Equifax’s communication methods – Equifax only sends mail and emails for legitimate alerts, never texts with links.

- Freeze your credit – Freezing your credit restricts access to your reports unless you unfreeze, limiting scammers.

- Enable 2FA on all accounts – Two-factor authentication prevents crooks from misusing phished credentials.

- Monitor your credit reports & statements – Watch for any unauthorized activity and address it quickly via Equifax, Experian, and TransUnion.

- Report scam texts – Forward phishing texts to 7726 and report them to the FTC at ReportFraud.ftc.gov.

Remaining vigilant against phone and text-based scams is essential, as these threats continue evolving. But understanding the scoreinfos.com scam approach puts you steps ahead.

Frequently Asked Questions about the Scoreinfos.com Credit Score Scam

Consumers targeted by the scoreinfos.com scam often have many questions about these phishing texts and how to protect themselves. Here are answers to some frequently asked questions about this fraud scheme:

What is the Scoreinfos.com Scam?

The scoreinfos.com scam involves fraudulent text messages that appear to come from Equifax. The texts claim your credit score has suddenly dropped and provide a link to “check activity” or “verify account”. However, the link goes to a fake website that steals personal information.

Who is Behind the Scoreinfos.com Scam Texts?

These phishing texts originate from scammers and fraudsters, not really from Equifax. The scammers spoof the texts to make them seem authentic. Their goal is to trick consumers into handing over valuable personal data.

How Do Scammers Get My Cell Phone Number?

Scammers obtain cell phone numbers from data breaches, random number generation programs, malware on devices, and phishing for contact info via other scams. They then blast out the fake credit score texts en masse.

What Should I Do If I Get a Scoreinfos.com Scam Text?

If you receive one of these phishing texts:

- Do NOT click any links in the text

- Forward the text to 7726 to report it as spam

- Delete the text immediately

- Contact Equifax to confirm the text is fraudulent

- Place a credit freeze with Equifax, Experian, and TransUnion

Can the Links in the Texts Really Steal My Personal Information?

Yes, the fake links go to convincing lookalike sites that prompt the user to enter info like SSN, account logins, etc. This data goes straight to the scammers to use in identity theft. Even visiting the sites can infect devices with malware.

What Should I Do If I Already Clicked a Link and Entered Info?

If you provided scammers with personal information:

- Contact banks, creditors, etc. to report identity theft

- Place fraud alerts and credit freezes

- Monitor credit reports and financial account activity

- Change compromised account passwords

- File a police report about the scam

How Can I Spot and Avoid the Scoreinfos.com Scam?

To avoid this scam:

- Know Equifax only contacts consumers by mail or email, not text

- Don’t click on links in unexpected finance-related texts

- Enable call/text blocking and two-factor authentication

- Monitor credit reports and statements closely

- Report scam texts to 7726 and the FTC

Who Should I Contact About Losses from the Scam?

If you lost money or suffered identity theft:

- File complaints with the FTC and your state attorney general

- Report it to your local police department

- Contact your cell phone provider about blocking future scam texts

- Speak to an attorney about legal options and damages recovery

Staying vigilant for phone and smishing scams is key to avoid falling victim and suffering financial consequences. Report scam texts and freeze your credit to protect yourself.

The Bottom Line – Don’t Get Fooled by the Scoreinfos.com Credit Score Scam

The fraudulent scoreinfos.com texts prey on consumers’ fears of financial fraud to steal highly valuable personal data. By mimicking Equifax and other credible entities, these phishing messages convince many people to hand over information directly to scammers.

If you receive an unsolicited text about your credit score suddenly dropping, remember:

- Equifax does NOT contact consumers via text messages – Any legitimate alerts come via mail or your online account.

- Do NOT click links in suspicious texts – These links always direct to fake lookalike sites to steal your information.

- Forward scam texts to 7726 – This helps phone carriers identify and block phone phishing campaigns.

With vigilance and healthy skepticism, you can recognize these social engineering tactics and avoid becoming the next victim. Don’t let scammers exploit you through deceptive digital channels – keep your data safe and stay scam-free.