Out of the blue, you receive an electrifying message: a major bank has approved you to receive a multi-million dollar payment! Your mind races imagining what you could do with such a vast, life-changing windfall. As incredible as it seems, the message looks official. Could this financial fantasy actually come true?

Unfortunately, the harsh reality is this amazing text is a cunning scam attempt. Cybercriminals are running an ingenious con to access your personal details under the false pretense of processing the payment. Once they have your information, you’ll never see a dime.

This twisted bait-and-switch is known as the City Bank compensation payment scam. In the following deep-dive exposé, we’ll reveal how scammers are exploiting this well-known brand to target unsuspecting consumers with the promise of sudden riches beyind belief. You’ll learn exactly step-by-step how this devious fraud scheme works, red flags to watch for, and most importantly, how to avoid being deceived by this brazen act of manipulation.

The opening of an unbelievable financial windfall seems incredibly enticing. But this dream scenario can quickly turn into a nightmare for victims lured in by the masterfully designed City Bank compensation payment scam. Read on to uncover the shocking truth behind this mass deception campaign and learn how to protect yourself from their predatory duplicity. Your identity, assets, and peace of mind may depend on it.

Overview of the Scam

The City Bank compensation payment scam is a sophisticated act of deception targeting everyday citizens with the false promise of a massive financial windfall. This brazen fraud scheme aims to exploit unsuspecting individuals by baiting them with mentions of hefty sums from well-known institutions in order to steal personal information and money.

Through unsolicited text messages, scammers posing as City Bank representatives notify recipients that a compensation payment worth millions of dollars has been approved and deposited in the victim’s name. To retrieve these funds, the message urges victims to provide sensitive identifying details like their full name, home address, email, phone number and more under the guise of processing the transaction.

In reality, there is no compensation payment, and the scammers are phonies looking to defraud people. Once obtained, the criminals use the victim’s information for activities like:

- Opening fraudulent bank accounts

- Taking out loans or credit cards

- Filing fake tax returns for refunds

- Committing identity theft and ruining the victim’s credit

The text messages are crafted to appear credible, mentioning specific banks like City Bank and locations like Atlanta, GA. They also namedrop legitimate-sounding organizations like the World Bank and European Union board of directors as the sources approving this payment.

This aims to make the scam look official and bypass scrutiny from recipients. After all, who would question a surprising windfall from esteemed global financial entities?

However, a closer look reveals contradictions and errors proving the deceptive nature of these messages:

- Poor grammar, spelling errors, and inconsistent formatting

- Requests for personal information and urgency to act quickly

- Vague claims without concrete details that can be independently verified

The promise of easy money is the bait used to reel in victims. The texts dangle irresistible dollar amounts like $20 million to capture attention and trigger excitement over life-changing sums. This initial elation clouds better judgment and leads victims to provide the requested personal information under the belief it will facilitate receiving the funds.

In 2021, the median household income in the U.S. was just over $70,000. So a payment worth hundreds of times more than average annual earnings is an unbelievable windfall for most normal citizens. The huge dollar amounts cited in the scam play into people’s dreams of sudden riches.

Once the scammers have the victim’s details, they leverage them to infiltrate and monetize the target’s assets through fraud. Victims may start seeing unusual activity like:

- Accounts opened in their name that they didn’t initiate

- Charges and purchases they didn’t authorize

- Credit applications submitted using their identity

- Tax refunds fraudulently claimed on their behalf

The scammers often follow-up stating reasons why the victim must pay additional fees before receiving the large compensation payment. These include:

- Processing and transfer fees

- Taxes and duties

- Customs charges

- Account validation fees

They may threaten dire consequences like criminal prosecution if the payment is refused. However, any fees the scammers demand are simply additional tactics to steal money. There will never be any multi-million dollar compensation payment dispensed.

The criminals behind this scam are organized groups who cast a wide net targeting as many potential victims as possible. Even a small success rate yields profitable ill-gotten gains. Their methods combine social engineering techniques to manipulate psychology and exploit human tendencies.

By staying informed and vigilant, individuals can recognize this scam attempt and avoid being manipulated. Do not provide personal info or payment to unknown parties. Protecting personal and financial data is key to defending against fraud schemes like the City Bank compensation scam.

How the Scam Works

The City Bank compensation scam ensnares unsuspecting victims through meticulously designed psychological manipulation tactics and precisely choreographed procedural steps.

Step 1: Initial Contact

The first point of contact comes via an unsolicited text message sent to the target’s mobile phone. The scammers obtain numbers through illegal practices like phone number databases sold on the dark web or malware-infected apps that harvest contacts. With the massive trove of personal data now available illicitly online, virtually anyone’s phone number can end up in a scammer’s possession.

The message is written to appear as if it comes officially from City Bank. The well-known bank name drops early to establish legitimacy and trust right away. The text also specifies a location – Atlanta, GA – to sound credible. Atlanta is in fact where City Bank’s headquarters is located, showing the scammers have done their research.

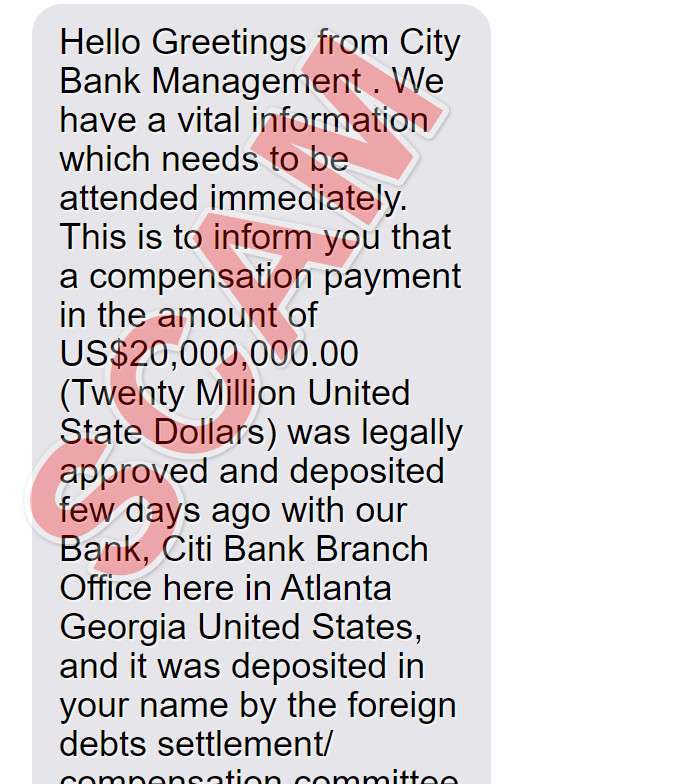

Here is how the scam text message looks:

Hello

Greetings from City Bank

Management .

We have a vital information which

needs to be attended immediately.

This is to inform you that a

compensation payment in the

amount of US$20,000,000.00

(Twenty Million United State

Dollars) was legally approved and

deposited few days ago with our

Bank, Citi Bank Branch Office here

in Atlanta Georgia United States,

and it was deposited in your name

by the

foreign debts settlement/

compensation committee of the

Executive Directors

Of World Bank Group in

conjunction with the European

Union Board Of Directors,

they instructed us to send this

fund direct to you with immediate

effect, Meanwhile, the good news

about your fund now is that your

compensation payment file with

some of the legal documents

backing this fund has been

approval, And we shall proceed

immediately . We like to hear from

you because we were mandated to

deliver this fund to you as one of

the beneficiary that his name is

listed in the World Bank foreign

beneficiary this year.

However, Please note that Citi

Bank have decided and agreed

together to

send this payment to you by either

by ATM Master card, or

consignment box means

depending the option you would

prefer to receive this fund for

security purpose, so you are

therefore advised to quickly get

back to the management of this

bank and let us know the option

you choose to have your fund, to

enable us proceed with the

delivery process of your fund

immediately.

We wait your immediate response

with your information below to

enable this

bank proceeds immediately with

the delivery of your fund as we

were directed.

Full Name :

Home Address :

email address :

Valid Phone number :

Kindly get back to us by

reconfirming your full information.

Thank you, God Bless America.

Mr. Denis Williams

Director Of Foreign Remittance

Department.

Citi Bank Atlanta Georgia Unites

Step 2: Hook and Excitement

The next part aims to hook the reader’s interest and trigger excitement by informing them a compensation payment worth $20 million has been approved in their name. A sum this vast exceeds most people’s lifetime earnings many times over. The huge dollar amount stimulates the brain’s innate reward system and stimulates feelings of shock and awe.

In reality, no such payment exists. But the principle of social proof makes this claim more believable. If esteemed groups like the World Bank and EU supposedly approved this windfall, it implies due diligence validating the payment already occurred. The average person is unlikely to think global financial leaders would be party to a fraudulent compensation.

Step 3: Urgency and Scarcity

The message imparts urgency by stating immediate action is required, and the funds will be sent as soon as possible. This pressures readers to respond right away before properly evaluating the situation.

Phrases like “we were mandated to deliver this fund to you” also introduce scarcity. They imply a finite window of opportunity to secure this money, prodding the victim to act now before it’s too late. This discourages pausing to deeply consider whether the offer is legitimate.

Step 4: Personal Information Requested

Next, the scammers request the target’s personal details – full name, home address, email, phone number – allegedly to process the payment delivery. But in reality, this information will enable them to commit identity theft and financial fraud.

To appear official, the text states these details are needed for KYC (know your customer) regulations. But real banks would never request sensitive identifying information solely through unsolicited texts.

At this stage, the trap is set. The scammers leveraged excitement over a huge potential windfall to lower the target’s defenses and skepticism. So despite the unusual method of requesting private data, victims often feel sufficiently reassured by the earlier claims to comply with divulging their info.

Step 5: Follow-up Manipulation

Upon receiving the victim’s details, the scammers can now exploit them for criminal purposes. This may involve taking out loans or credit cards, filing fake tax returns, or selling the info on the black market.

They often follow-up with the target requesting additional payments to allegedly process the compensation money delivery. Common demands include:

- Advance payment processing fees

- Funds release fees

- Tax/duty payments on the transferred sum

- Changes in transfer method requiring new fees

The criminals use fear tactics insisting these fees must be paid to avoid criminal prosecution or forfeiting the money. This manipulates victims who already feel invested after expecting a huge payday. Wanting to realize that anticipated financial boon, they give in to the mounting demands.

Step 6: Disappearance

After extracting as much money as possible from the target through payment demands, the scammers ultimately disappear. The promised millions in compensation vanish along with them.

By this point, the con artists have already profited from selling the victim’s stolen identity info. The target is left dealing with the aftermath, including fraudulent accounts opened in their name, damaged credit, and stolen money sent to the scammers.

Executed strategically, this highly coordinated scam manipulates psychology and knowledge of bureaucratic processes to thoroughly dupe unwitting consumers. Avoid becoming a victim by recognizing these deceptive tactics and verifying any supposed compensation offers directly with reputable sources.

Recognizing Red Flags of the Scam

There are multiple red flags that indicate the City Bank compensation payment message is a scam:

- You did not initiate contact – Unsolicited messages should be treated with suspicion. Legitimate institutions will not contact you unexpectedly about surprise payments.

- Text messages used – Banks will not use text messages as the sole method to inform customers of large financial transactions. Phone calls or postal mail would be utilized.

- Promise of lavish payment – The promise of a sudden multi-million dollar payment you have no relation to should raise skepticism. If it seems too good to be true, it likely is.

- Urgency imposed – Scammers use high-pressure tactics about acting immediately to bypass scrutiny of their claims. Real institutions won’t force you to rush important financial decisions.

- Personal info requested – No legitimate bank will request sensitive identifying information like your SSN and date of birth over text. This is a major red flag of a scam.

- Poor grammar/spelling – Review the message closely. Errors like incorrect grammar and spelling indicate an unsophisticated scam attempt.

- Lack of verifiable details – Aside from mentioning City Bank in Atlanta, the message lacks any concrete details like case numbers that could be independently verified.

Staying alert to these red flags can help protect you from being ensnared by the City Bank compensation payment scam.

What to Do if You Are Targeted by This Scam

If you receive a text message claiming you are owed compensation money from City Bank, follow these steps:

- Do not respond – Do not reply to the message or provide any personal information. The scammers cannot take action without your participation.

- Report the scam – Alert your phone company about the fraudulent message so they can take action against the sender. Also report details to the FTC.

- Contact City Bank – If you have an existing account with them, call City Bank directly to confirm they did not send the message. Make them aware fraudsters are using their name.

- Beware of follow ups – Scammers may call or email later claiming you need to pay fees before receiving your money. Ignore these attempted solicitations.

- Monitor accounts – Check your financial accounts and credit reports for any unauthorized applications or activity. Report any discovered fraud immediately.

- Change passwords – As a precaution, change the passwords and PINs for your financial accounts and mobile devices.

- Warn others – Share details of the scam to warn your friends, family members, and social networks against falling for it. Spreading awareness helps curb the scam’s success.

Frequently Asked Questions About the City Bank Compensation Payment Scam

1. What is the City Bank compensation payment scam?

The City Bank compensation payment scam is a fraudulent scheme where scammers send unsolicited text messages claiming the recipient is owed a large sum of money (usually millions of dollars) from City Bank as a “compensation payment”. The texts appear official and mention real organizations like the World Bank to seem legitimate, but it is all a deception aimed at stealing personal information and money from victims.

2. Who is behind the City Bank compensation scam?

The scammers behind this fraudulent scheme are organized cybercriminal groups who mass target potential victims using illegally obtained phone numbers and personal data. By automating scam texts and emails, they can reach millions of people rapidly looking for just a small bite of victims to be profitable.

3. How does the City Bank compensation payment scam work?

The scammers send a text claiming City Bank has approved a compensation payment in the victim’s name worth $20 million or more. They say this requires the victim’s personal info to process the payment. Once obtained, the scammers exploit the info through identity theft and demands for upfront fees before releasing the funds. The promised compensation payment never materializes.

4. What are some red flags of the City Bank compensation scam?

Red flags include being contacted unsolicited about a surprise multi-million dollar payment, urgent requests for personal data over text, grammatical/spelling errors, lack of verifiable details, pressure to act quickly or pay fees, and threats if demands aren’t met. Any of these are signs of a scam.

5. What personal information do the scammers request?

The texts instruct victims to provide their full name, home address, email address, phone number, and potentially other personal data like date of birth, Social Security Number, or bank account information. This allows the criminals to steal identities and commit financial fraud.

6. What do the scammers do with the victim’s information?

The scammers use stolen personal information to open fraudulent bank accounts, take out loans/credit cards, file fake tax returns for refunds, sell the info on the black market, and generally monetize the victim’s identity through various forms of theft and fraud.

7. How can you avoid or report the City Bank compensation scam?

Do not respond to any unsolicited contacts about surprise compensation payments. Report the scam attempts to your phone carrier, the FTC, and institutions like City Bank if their name is used. Monitor your credit reports and financial accounts for any signs of fraudulent activity.

8. Are compensation payment scams illegal?

Yes, these scams involve numerous illegal activities like wire fraud, identity theft, financial fraud, and extortion. The scammers violate multiple laws by deliberately deceiving and stealing from victims. Reporting their crimes can help authorities prosecute them.

9. How can you protect yourself from the City Bank compensation scam?

Never provide personal or financial information in response to unsolicited contacts. Verify any payment offers directly with reputable sources before taking action. Recognize warning signs like pressure, threats, and requests for money. Being cautious protects you.

10. What should you do if you already provided your information to the scammers?

Immediately contact your bank, report potential identity theft to the authorities and credit bureaus, and monitor your accounts closely for fraudulent activity. Change passwords and PINs on all financial accounts. Be vigilant about freezing your credit and authenticating any applications done in your name.

The Bottom Line

The City Bank compensation payment scam is an aggressive fraud attempt seeking to capitalize on unsuspecting consumers. While the promise of millions of dollars sounds enticing, this deceptive tactic aims to steal money and identities. With knowledge of how this scam operates, individuals can identify red flags that expose the fraudulent nature of this scheme. Avoid becoming a victim by recognizing this con attempt, refraining from providing personal information to scammers, reporting all details to appropriate authorities, and spreading public awareness. Remaining vigilant and informed is the best way to protect yourself and others from this predatory criminal activity.