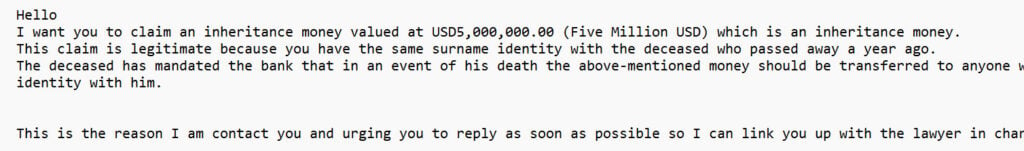

Have you ever received an email claiming you are entitled to receive a large sum of inheritance money from someone you don’t know? This is a common scam that tries to trick people into paying money upfront in order to receive an inheritance that doesn’t really exist.

Overview of the Claim Inheritance Money Scam

The claim inheritance money scam, also sometimes called the Nigerian inheritance scam or Nigerian prince scam, is a type of advance fee fraud that has been around since the early 1990s. Scammers send out emails claiming that the recipient is entitled to receive a substantial inheritance from someone they are supposedly related to or connected with in some way.

This type of scam email will claim that a person, often said to be a lawyer, banker, or other official, needs assistance from the recipient in order to access a large sum of money or inheritance left behind by someone who died or cannot access the funds themselves. Often the supposed inheritance is claimed to be worth millions of dollars.

The emails will request money upfront from the recipient in order to pay various fees or taxes required to access the inheritance. This is the key element that makes this scheme a scam – requesting money upfront before any actual inheritance is provided. No legitimate lawyer, bank, or other entity would ask for money in advance in order to receive an inheritance you are rightfully entitled to.

Once the victim sends the requested upfront fees, the scammer will continue inventing new reasons more money is required, sometimes asking for thousands of dollars at a time. Of course, once the fees are paid, the promised inheritance money never materializes.

This type of scam exploits people’s tendency to believe they may have unknown riches owed to them and to trust authority figures who claim to need assistance obtaining money. However, any unsolicited email requiring an advance fee payment to receive a sudden windfall of inheritance money is almost certainly a scam attempt.

History and Prevalence of the Inheritance Money Scam

The Nigerian inheritance scam originated in the late 1980s and early 1990s when messages were sent via postal mail, but the scam exploded with the advent of the internet and email in the mid 1990s. The widespread adoption of email allowed scammers to send out huge numbers of messages at virtually no cost.

Even prior to email, fake check and money order scams were used to try extracting fees from supposed heirs or lottery winners. The inheritance scam adapted these fraudulent tactics for the new technological landscape.

This scam was initially dominated by messages claiming to be from people in Nigeria, leading to the Nigerian prince nickname. However, similar inheritance scams now originate from anywhere in the world.

Hundreds of thousands of these fraudulent messages are still sent out daily, often from areas known for cybercrime activity. And unfortunately, many people continue falling victim, with reported losses in the millions each year. Education remains the best defense against this insidious scam.

Key Elements of the Inheritance Money Scam

These types of scam emails tend to follow a similar pattern, though details may vary. Some key characteristics include:

- Claims of unclaimed inheritance, lottery winnings, funds in dormant bank accounts, or other surprising windfalls

- Stated values typically in the hundreds of thousands or millions of dollars

- Requirement to pay taxes, fees, or bribes upfront before money can be sent

- Requests for personal details like bank account numbers, phone numbers, etc.

- Claims of urgent need for immediate response to release supposed funds

- Discussions of bank clearances, lawyer approvals, and other invented processes

- Follow up requests for additional payments, each time promising release of funds soon

- Broken English or otherwise poor grammar and spelling

- Use of threats or fake legal/government documents to add credibility

- In some cases, scammers may even impersonate real people and entities

Staying aware of these common tactics is the best way to recognize an inheritance scam attempt right away, before any losses occur.

How the Inheritance Money Scam Works

Scammers rely on the inheritance money scam working quickly to trick victims out of money before they realize it is a fraud. So how does this scam unfold step-by-step?

1. Initial Contact Via Email

The scam typically starts with an unsolicited email explaining that the recipient is entitled to claim an inheritance from someone they don’t know who died or can’t access the money themselves. The deceased is usually said to have no other living relatives, so the money can be claimed by someone with matching last names.

The message will seem urgent, claiming the funds need to be claimed quickly or they will be forfeited. Large dollar values like $5 million or 10 million are stated to make the windfall seem more enticing.

Fake names and titles are used to make the message appear credible, often claiming to be from a barrister, lawyer, bank representative, or other official source. The person contacting the victim claims they need some small assistance to access the funds and offers to share the money.

2. Victim Responds to Initial Contact

Once the scammer receives a response, the victim is considered “hooked” and the scam kicks into higher gear. The scammer will respond asking for personal details like name, occupation, address, phone number, etc.

They often claim this is needed for “identification purposes” or to begin processing the inheritance claim. Giving out these details allows scammers to create more personalized and believable messages.

3. Request for Upfront Payment is Made

After some further email exchanges, the scammer will explain that a fee needs to be paid upfront before the inheritance money can be released and transferred to the victim.

This is the key stage where victims get scammed out of money. Typical stories used include needing to pay legal fees, banking fees, courier charges, taxes, bribes, or other costs. The scammer promises the fee is tiny compared to the huge windfall.

The scammer may send fake documents to make these charges seem official. In reality, no legitimate company would ask for money upfront to release funds you are already entitled to. This is always a red flag indicating a scam.

4. Victim Sends Payment

Convinced by the official-looking documents and lure of a huge windfall, victims will usually wire an initial payment as requested, often a few thousand dollars. Money transfers via Western Union, MoneyGram, gift cards, or cryptocurrency are commonly requested since they are hard to reverse.

Some victims have lost their entire life savings at this point, but the scam often continues…

5. Additional Payments Requested

Once the scammer receives the first payment, they will invent new reasons why additional fees or taxes are required before the inheritance can be released. Each time, the victim is promised they will definitely receive the money after this one last payment.

The cycle continues as long as the scammer can convince the victim to keep paying. With each request, the promised payoff gets closer to keep the scam going. In reality, new payments will be demanded as long as the victim has money to give.

6. Cut Off Contact

At some point when the victim is either out of money or realizes it is a scam, they will stop making payments. The scammer will then cut off all contact, moving on to repeat the scam on new victims.

Even after losing money, victims may feel ashamed and not report the fraud, allowing the scammers to operate unimpeded. However, contacting authorities can help prevent further victims and potentially trace the criminals.

What to Do if You Have Fallen Victim to the Inheritance Scam

If you sent money to an inheritance scammer, don’t panic. Here are some steps you should take immediately:

- Stop all contact – Do not respond to any additional emails from the scammers or agree to send additional payments. Ignore further contact attempts.

- Report the scam – Notify relevant authorities about the fraud so they can potentially investigate the criminals behind it. File a complaint with the FBI Internet Crime Complaint Center.

- Contact your bank – If you sent a wire transfer or withdrew cash to send, call your bank right away. Some transfers may be reversible if caught quickly enough. Ask for chargebacks on any credit cards used.

- Change account details – Change online banking passwords, close any compromised accounts completely, and monitor all accounts for suspicious activity.

- Watch for identity theft – Scammers may have enough personal details to steal your identity. Monitor your credit reports and accounts closely for fraudulent activity. Consider a credit freeze.

- Get help – Talk to counselors at the FTC and AARP’s fraud support programs to get assistance recovering your finances and avoiding further losses.

- Spread awareness – Share your experience to warn others who may encounter similar inheritance scams. Your story can prevent someone else from being victimized.

The most important steps are to cut off contact with the scammers completely, monitor your accounts closely for unauthorized activity, report the fraud to authorities, and seek assistance from support organizations. By acting quickly, you may be able to halt further losses and recover some stolen funds.

Frequently Asked Questions About the Inheritance Money Scam

1. What is the inheritance money scam?

The inheritance money scam is a type of advance fee fraud where scammers send unsolicited emails claiming the recipient is entitled to receive a large inheritance from someone they don’t know. The emails claim fees must be paid upfront before the inheritance can be released. Once money is sent for fees, the scammers keep asking for more payments, inventing stories and fake documents to continue the scam. The promised inheritance never materializes.

2. What are some typical stories used in this scam?

Some common fake inheritance cover stories include:

– Claiming to be a lawyer for a deceased wealthy businessperson or government official with no other living relatives besides you

– Stating a long-lost relative of yours has died and left you their fortune

– Claiming you have unknowingly inherited money from a dormant bank account or investment

– Telling you that you won an international lottery you don’t remember entering

3. How do scammers make their stories seem credible?

To make the inheritance story believable, scammers use tactics like:

– Using fake names and titles like barrister, director, doctor, judge

– Creating official looking documents with letterheads and stamps

– Claiming urgent deadlines before the money can be claimed

– Sending copies of fake death certificates and wills

– Impersonating real government officials and agencies

4. What types of upfront payments are requested?

Common payments scammers request include:

– Fees for processing paperwork, bank clearances, courier services

– Inheritance taxes or duty fees on transferred funds

– Bribe money supposedly needed to release funds

– Legal fees for attorneys involved in releasing the inheritance

– Advance dividend taxes that must supposedly be paid

5. How much money do victims lose on average?

According to FBI reports, the average loss to inheritance scams is around $5,000 to $10,000. However, losses can be as high as hundreds of thousands for wealthy victims ensnared by the false promises.

6. How can I tell if an inheritance letter is a scam?

Warning signs of an inheritance scam include:

– Claims of unclaimed assets worth millions

– Requests for personal details like bank accounts

– Demands for urgent response and quick action

– Poor grammar and spelling errors

– Requests for upfront payments before releasing funds

– Following up payment requests with more reasons money is required

7. What should I do if I already sent money to a scammer?

If you wired funds or otherwise paid an inheritance scammer, immediately:

– Stop all contact and do not pay anything more

– Call your bank to potentially reverse the transfer

– Report the fraud to the FBI IC3 and FTC

– Monitor all accounts closely for unauthorized charges

– Change online account passwords and security options

– Consider a credit freeze to prevent identity theft

8. How can I avoid inheritance scams in the future?

To avoid being scammed:

– Be wary of unsolicited contacts requiring upfront fees

– Research any companies or people contacting you

– Never wire money or pay with gift cards

– Don’t give out personal or banking details

– Use secure, traceable payment methods only

– Remember real inheritances don’t require you to pay money first

9. Are inheritance scams illegal? Can scammers be caught?

Yes, inheritance scams are completely illegal. Scammers can be criminally charged with wire fraud, mail fraud, and identity theft. Reporting details to authorities helps identify and prosecute scammers. Potential victims who avoid being ensnared also aid investigations.

10. How can I help warn others about inheritance scams?

To prevent more victims, share your knowledge through:

– Reporting scams to consumer protection groups

– Writing online reviews detailing the scam tactics

– Spreading awareness on social media about how these scams work

– Encouraging others, especially elderly relatives, to be cautious of unsolicited contacts requiring payments

The more people understand this scam, the harder it becomes for scammers to find new victims. Just discussing this topic helps protect others from fraud.

The Bottom Line on the Claim Inheritance Money Scam

The claim inheritance money scam is one of the most persistent and pernicious email frauds still circulating widely. While known as the Nigerian prince scam, these fraudulent messages originate from across the globe, trying to trick recipients with the lure of free millions.

Unfortunately, this scam continues duping unsuspecting victims into paying thousands of dollars in supposed fees to claim an inheritance that does not exist. No legitimate lawyer, bank, or other entity would ever require upfront payment to release an inheritance you are rightfully owed.

Once money is sent, scammers invent new reasons to keep payments flowing as long as funds last. Cutting off contact completely is essential to contain losses when this scam is identified. Reporting the fraud helps prevent the criminals from victimizing others.

Stay skeptical of any unsolicited contacts requiring upfront payments, no matter how convincing the stories may seem. Legitimate inheritances do not need recipients to pay fees or taxes before transfer. As the old saying goes, if it sounds too good to be true, it probably is. Arm yourself with awareness of the tactics scammers use and avoid falling prey to their lies.

For those unfortunate enough to be scammed, assistance is available to help potential recover some losses and rebuild finances. But the best outcome is avoiding the trap completely. By learning to identify key signs of inheritance and other money transfer scams, you can keep your hard earned money safely out of the hands of fraudsters. Just remember – easy money does not exist. If it seems too good to be true, it is!

![Remove Tintosporly.co.in Pop-up Ads [Virus Removal Guide] 8 McAfee scam 4](https://malwaretips.com/blogs/wp-content/uploads/2023/08/McAfee-scam-4-290x290.jpg)