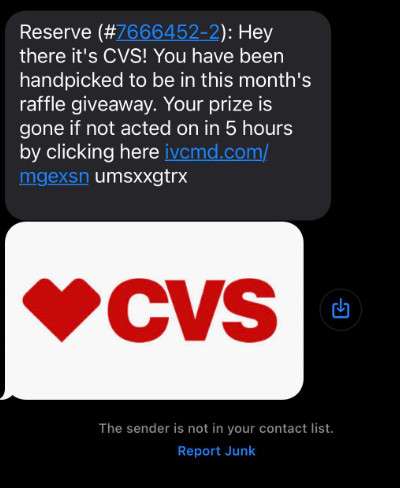

Have you recently received a text message claiming you’ve won a prize from CVS Pharmacy? This increasingly common scam attempts to trick recipients into providing personal and financial information under the guise of claiming fake sweepstakes winnings.

Overview of the CVS Prize Winner Scam

The CVS Prize Winner scam is a deceptive scheme currently tricking many unsuspecting consumers across the United States. This fraudulent scam begins when potential victims receive a text message that appears to come from pharmacy retailer CVS.

The message claims that the recipient has been randomly selected as the winner of an amazing prize in a recent CVS Pharmacy sweepstakes or raffle drawing. Prizes promised are often highly desirable items like gift cards, cash rewards, or big ticket electronics. The text urges the recipient to click on a link included in the message in order to claim their prize.

However, this link does not lead to any legitimate CVS website or sweepstakes redemption page. Instead, it directs victims to a fake website impersonating CVS and designed specifically to steal personal and financial information from site visitors under the false pretense they are collecting a prize.

These deceptive fake CVS websites are elaborately designed to appear convincing to trick unsuspecting visitors. They incorporate official CVS branding, logos, images, and colors. The site asks visitors for personal details like their name, phone number, home address, email address, and date of birth, claiming this information is required to verify their identity and eligibility to claim the prize.

In reality, these details are harvested by scammers to commit identity theft and gain access to any existing accounts the victim may have. Providing birthdates, addresses, and even partial Social Security numbers gives fraudsters key pieces of information needed to perpetrate more extensive forms of identity fraud.

After collecting these personal details, the fake CVS prize website then prompts visitors to pay a small shipping, processing, or delivery fee in order to finish claiming their prize. This fee is usually just a few dollars and made to seem like a normal requirement before prizes can be released. But in fact there is no actual prize, and victims are simply handing over their credit card information directly to criminals.

Those tricked into entering credit card information to pay the small fee soon find themselves signed up for expensive recurring monthly subscriptions to products or services they never agreed to. These unwanted monthly charges are usually between $39 to $89 per month and difficult to cancel. Examples of recurring subscriptions victims report being fraudulently signed up for include:

- Monthly subscription boxes for products like beauty, makeup, apparel, or pet items

- Meal kit delivery subscription services sending weekly food packages

- Book, magazine, or music subscription services with unwanted selections sent each month

- Discount clubs or travel websites offering future vacation deals and access to savings

- Dating website memberships and subscriptions

In addition to being signed up for recurring monthly billing, victims also have their credit card numbers stolen outright by scammers during this process. This allows criminals to make one-time fraudulent purchases that show up as mysterious charges on the victim’s statement. Or stolen card details are quickly sold on the dark web to be used by other fraudsters worldwide.

As you can see, this scam is extremely deceptive from start to finish. By impersonating trusted brands like CVS and tricking unsuspecting consumers into willingly providing the sensitive personal and financial information cybercriminals desire, scammers can steal identities and money with relative ease. This scam has become increasingly prevalent and consumers should be alert to red flags when receiving prize winner notifications.

How the CVS Prize Winner Scam Works

Here is a step-by-step overview of how this deceptive scheme operates:

1. Recipients Get a Text Claiming They’ve Won a Prize

The scam begins when the victim receives an unsolicited text message stating they’ve won a giveaway sponsored by CVS Pharmacy. Common examples include messages like:

“Congratulations! You have been randomly selected as the winner of our CVS Pharmacy sweepstakes. Claim your prize now at [malicious link].”

“You have won our CVS weekly raffle! Redeem your prize now by clicking here [malicious link].”

The message is intended to excite recipients into acting quickly without considering that it could be a scam. The inclusion of the CVS brand name provides a false sense of legitimacy.

2. The Text Includes a Link to a Fake Website

The prize notification text will include a link, urging the recipient to click it to claim their winnings. However, the link sends victims to a malicious website that simply impersonates CVS, rather than any real sweepstakes page.

This fake website is designed to steal the victim’s personal and financial data once they arrive. The site will display the CVS logo and branding throughout to appear credible.

3. The Website Asks for Personal Information

Once on the fraudulent website, victims will be asked to provide personal details like their name, address, phone number, birthdate, and more under the pretense it’s required to verify their identity and eligibility for the prize.

In reality, these details are used to commit identity theft and access any existing accounts the victim may have. The website may also install tracking cookies or malware onto the victim’s device.

4. Victims Are Told to Pay a Small Fee to Claim Their Prize

After collecting personal information, the website will state that a small fee is required to finish processing and shipping the prize to the winner. This is usually a few dollars and made to appear reasonable and normal.

In fact, there is no actual prize. The scammers are simply trying to collect credit card information to make fraudulent charges.

5. Paying the Fee Signs You Up for Monthly Subscriptions

Unfortunately, anyone tricked into entering their credit card information to pay the fee soon finds themselves signed up for expensive monthly subscriptions they never agreed to. These can include:

- Subscription box services

- Meal kit deliveries

- Beauty product replenishment programs

- Unwanted books or magazines

- Discount clubs or travel programs

These monthly charges are usually between $39 and $89 per month. The scammers make canceling very difficult once charges begin, siphoning even more money away from victims.

6. Credit Card Details Are Stolen for Further Fraud

In addition to unwanted monthly subscriptions, entering credit card information also allows scammers to make one-time fraudulent purchases or steal the card number for sale on the dark web.

Victims should watch for other suspicious charges from unfamiliar companies appearing on their statements. Freezing the compromised card right away can help limit losses from additional fraud.

This scam is all about tricking unsuspecting consumers into willingly handing over the sensitive information cybercriminals want to access. Avoiding falling victim requires spotting the red flags in any prize winner notification and verifying its legitimacy first.

What to Do If You’ve Fallen Victim to the CVS Prize Winner Scam

If you provided any personal or financial information to a suspicious prize website after receiving a text from “CVS,” take these steps right away to limit the damage:

Alert Your Bank and Card Issuers

Contact your bank and any credit or debit card companies to report unauthorized charges or suspected fraud. Request to block future charges and get replacement cards. This can prevent further fraudulent use of your accounts.

Freeze Your Credit Reports

Scammers could potentially open new accounts in your name with access to details like your SSN, address, and date of birth. Freeze your credit reports with Equifax, TransUnion, and Experian to block any accounts being opened without your permission.

Review All Accounts Carefully

Carefully review all your existing financial accounts and credit card statements for any unauthorized activity. Dispute any fraudulent charges with your bank or card issuer immediately. Enable text/email alerts for all accounts to monitor for suspicious charges going forward.

Change Online Account Passwords

Reset passwords for all your online accounts, especially banking, email, and financial accounts. Use strong, unique passwords, enabling two-factor authentication wherever possible. This prevents cybercriminals from accessing your other accounts.

Cancel Compromised Cards and Get Replacements

Contact your bank or card issuer to block any compromised card numbers and request replacement cards. Destroy and dispose of compromised cards to prevent future physical card fraud. Avoid further use of the original card numbers if available to scammers now.

Monitor Credit Reports and Statements

Carefully monitor your credit reports from Equifax, Experian, and TransUnion for any suspicious new accounts or inquiries, disputing anything fraudulent. Also watch statements for all financial accounts closely over the upcoming months for further signs of misuse of your information.

Consider an Identity Theft Protection Service

A legitimate identity theft protection service can help act on your behalf if any identity theft does occur by catching fraudulent activity early and resolving issues faster. Compare options to determine if the additional monitoring and protection could provide value and peace of mind after this scam.

Beware of Recovery Scams

Unfortunately, revealing you’ve fallen victim to a scam often attracts follow up recovery scams. Ignore any calls claiming they can recover lost money or fix your credit for an upfront fee—these are scams preying on the vulnerable. Recovery scams often do further harm.

Staying vigilant following any scam can help limit the fallout from shared sensitive info. While you can’t fully prevent others from misusing your information once captured, taking proactive precautions can reduce the financial and identity theft risks considerably.

Frequently Asked Questions About the CVS Prize Scam

The deceptive CVS prize scam catching many consumers off guard raises several important questions. This FAQ provides detailed answers to help you identify, avoid, and address this fraudulent scheme.

What is the CVS Prize Scam?

This scam begins with victims receiving a text claiming they’ve won a prize from CVS Pharmacy. The message includes a link to “claim your reward” which actually directs consumers to a fake website impersonating CVS. This malicious site is designed to steal personal and financial information as well as sign victims up for unwanted monthly subscription charges.

How Does the CVS Prize Scam Work?

- You receive a text stating you’ve won a CVS sweepstakes/raffle and containing a link to claim it

- The link sends you to a fake website pretending to be CVS

- The site requests personal info to “verify” your identity

- You’re prompted to pay a small “fee” to claim the prize

- Entering payment info actually signs you up for recurring monthly charges

What Red Flags Indicate it’s a Scam?

Watch for these telltale scam indicators:

- Receiving an unsolicited prize claim notification

- Urgent call to action to click a link and claim the winnings

- Requests for personal/financial information upfront

- Requirement to pay fees or provide credit card to claim prizes

- Mismatched URLs (e.g. .net instead of .com)

- Spelling/grammar errors

- Threats of disqualification for non-compliance

What Information Do Scammers Obtain?

Scammers aim to steal identities and money. They collect:

- Full name

- Phone number

- Home address

- Email address

- Credit/debit card numbers

- SSN and other ID details

- Account logins and passwords

What Harm Can Result From This Scam?

Potential impacts include:

- Recurring monthly subscription fees

- One-time fraudulent purchases

- Identity theft

- Credit card fraud

- Compromised login credentials

- Damaged credit history

How Can I Check If a Prize Is Legitimate?

To verify real wins, independently look up the sponsor’s contact info to check directly. Most legitimate giveaways provide winner specifics like prize value, when you registered, or entry details. Prizes never require upfront fees—taxes/processing come after acceptance.

What Should I Do if I Fell for This Scam?

- Contact banks/card companies to block charges

- Freeze credit reports

- Reset account passwords

- Monitor statements closely

- Sign up for identity theft protection

Avoid paying any upfront fees to restore your credit or recover lost money, as those are likely scams too.

How Can I Avoid the CVS Prize Scam in the Future?

Protect yourself by:

- Ignoring unsolicited prize claims

- Independently verifying legitimacy

- Avoiding entering info on unfamiliar sites

- Using strong unique passwords

- Checking URLs for “https” and padlocks

- Enabling two-factor authentication

- Monitoring accounts routinely for fraud

Staying vigilant and questioning any random prize claims can keep you from falling victim to this and similar scams using the CVS name.

The Bottom Line: How to Avoid the CVS Prize Winner Scam

Falling for prize and sweepstakes scams can have devastating financial consequences. Use caution with any unexpected prize win notifications, especially through text, email, or on social media. Avoid the CVS prize scam specifically by:

- Watching for urgent prize claims using the CVS brand name and including a link to “collect your winnings.” These are telltale signs of a scam attempt.

- Verifying the sweepstakes sponsor contact info independently if unsure. Real notifications will provide legitimate contact details to confirm the prize claim directly.

- Ignoring instructions to provide personal information or credit card numbers upfront. Real sweepstakes never require this to award legitimate prizes.

- Declining to pay any fees to claim a prize. Taxes or processing fees are paid after you accept a prize, not before.

- Checking website URLs carefully before entering any info. Secure CVS pages will have “https://” and display a lock icon.

- Enabling two-factor authentication and using strong unique passwords to protect online accounts. This prevents password reuse if one account is compromised.

- Monitoring credit reports and financial statements routinely for any unusual activity that could indicate fraud.

With scam tactics constantly evolving, staying vigilant about protecting your personal and financial details has never been more important. The CVS prize scam is just one example of fraudsters attempting to profit from consumers through deception. But understanding common scam hallmarks like urgent claims, requests for sensitive information upfront, and instructions to pay a fee makes it possible to recognize and report fraudulent activity when it crosses your path.