Have you received a call or text message from a company named DMS Collect claiming you owe debt? Stop right there. DMS Collect may sound legit, but many unsuspecting people have been fooled by their professional-sounding claims and sophisticated website.

- Overview of the DMS Collect Scam

- How the DMS Collect Scam Works

- Who is Behind the DMS Collect Scam?

- 5 Red Flags to Spot the DMS Collect Scam

- Steps to Take if You Are Targeted by DMS Collect

- How to Report DMS Collect to Protect Yourself and Others

- Can DMS Collect Really Take Legal Action Against You?

- Frequently Asked Questions about the DMS Collect Scam

- The Bottom Line on the DMS Collect Scam

In reality, DMS Collect is 100% a scam operation that fabricates debts in order to bully victims into paying. Their threatening calls and seemingly official website are all an elaborate ruse designed to take advantage of everyday people already struggling with finances.

This comprehensive guide will uncover all the deceptive tactics used by DMS Collect and help you avoid becoming another victim. We’ll reveal the dead giveaways that it’s a scam, steps to take if they contact you, how to report them, and more.

Overview of the DMS Collect Scam

DMS Collect operates by cold-calling victims and claiming they owe a debt that must be repaid immediately. They use threats and intimidation tactics to pressure victims into paying, even when no legitimate debt exists.

Here are some key facts about the DMS Collect scam operation:

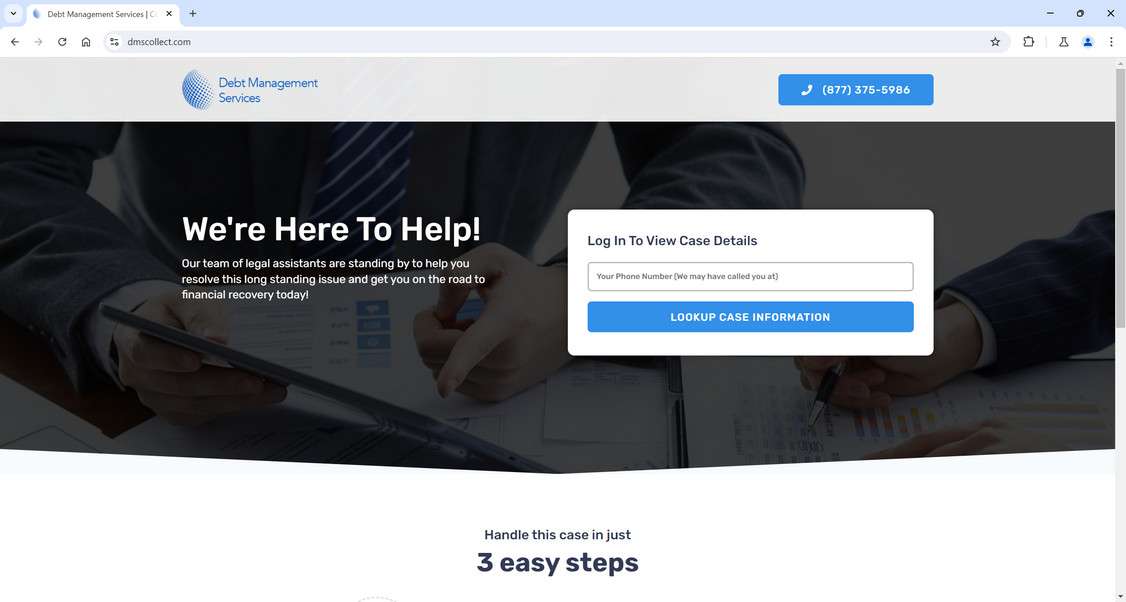

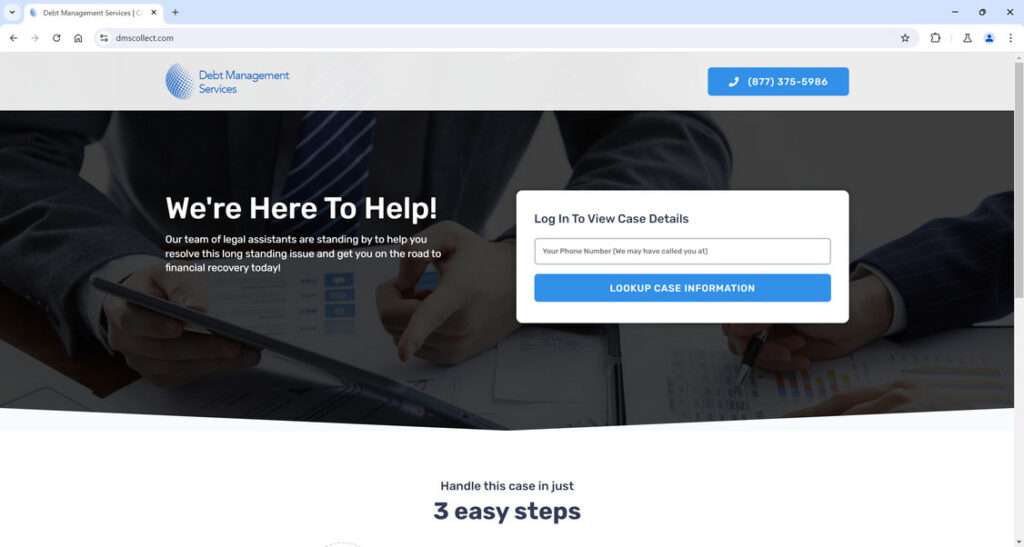

- Scam website: DMS Collect uses the website dmscollect.com to appear legitimate. However, a close look reveals many red flags (more below).

- No physical location: The scammers hide behind a website to remain anonymous. There is no street address, suite number, or physical location provided.

- Debts are fabricated: The debts collected by DMS Collect are completely fictional. The scammers reference real companies to sound credible but the debts do not exist.

- Payment pressure: Victims are pressed to pay the fake debt right away using prepaid cards, wire transfers, etc. Threats about lawsuits and jail time are common.

- Relentless calling: DMS Collect scammers repeatedly call victims from spoofed numbers. If you answer, they will continue to harass you.

It’s important to remember that DMS Collect is NOT a real debt collection agency. Their only purpose is to scare and manipulate victims into paying fabricated debts that are not legally owed. Keep reading to learn exactly how their scam works from start to finish.

How the DMS Collect Scam Works

The DMS Collect scam is carefully orchestrated to take advantage of everyday people struggling with debt. Here is exactly how their process works:

1. Cold Calling With Fake Debt Claim

The first step is a cold call from a DMS Collect scammer claiming you owe a debt. They likely found your name and number through skip-tracing methods rather than any legitimate channels.

Some details about the initial call:

- Spoofed numbers – Calls come from constantly changing spoofed numbers to hide identities. Area codes also change to appear local.

- Vague about debt – Won’t provide any written validation for the supposed debt when asked.

- High pressure – Threats of lawsuits, wage garnishment, etc. used right away to scare you.

- Fake credentials – The scammer implies they are a law firm, licensed collector, attorney, etc. when they are not.

- Requests for information – Scammers fish for personal information like SSN, DOB, employer that they can use against you. Provide nothing.

The goal of the initial call is to rattle and confuse victims so they comply with paying. Don’t fall for it.

2. Directing Victims to the DMS Collect Website

After the initial fake debt call, victims are directed to the DMS Collect website at dmscollect.com.

The scammers claim this is where you can “verify” the debt, make payments, and resolve the matter. However, the website is just another part of the scam.

Here are some red flags with the DMS Collect website:

- No company information – No mailing address, phone, corporate info, or physical location. Totally anonymous.

- No licensing disclosed – No FDCPA or state debt collection licensing mentioned anywhere.

- Domain registered recently – Website domain registered in June 2024. Very new, often indicates a scam site.

- No legal pages – No terms, privacy policy, or other standard legal website pages.

The website gives victims a false sense that DMS Collect is a real company. In reality, the site provides zero legitimate information.

3. Push For Immediate Payment

Whether via phone or their website, DMS Collect scammers push hard for immediate payment on the fake debt.

Some tactics they use:

- Threats of legal action – Baseless threats of lawsuits, wage garnishment, bank levies, or even arrest.

- Urgency – Insisting the full “debt” must be paid “today” and other high-pressure statements.

- Payment demands – Requests for prepaid debit/gift cards, bank account access, wire transfers, etc.

- Low payoff offers – Offering to settle debt for a smaller upfront payment via money transfer.

- Call recording – Possible recording of calls to allegedly “use against you” (entirely empty threat).

No matter what threats or tactics are used, remember this debt is completely fictional. Do not pay anything to DMS Collect.

4. Continued Harassment

Unfortunately, paying DMS Collect will not get them to stop. Since you are a victim who gave in once, they will keep calling back demanding more payments.

Some continued harassment tactics:

- “Debt sold” – Calling back claiming the fake debt was sold to another collector that now demands payment.

- “Different debt” – Alleging you owe money for a brand new debt (also fictional).

- Threat escalation – Increasing threats with each call, progressing to threats of arrest, violence, etc.

Your information has simply been added to a “lead list” that will continue to be called and harassed indefinitely. Don’t fall for it anymore.

Who is Behind the DMS Collect Scam?

DMS Collect goes to great lengths to hide the identities of those behind their scam operation. Here is what we know:

- Located overseas – Strong indications the calls originate from India-based scam centers.

- Constantly changing numbers – Use spoofing technology to rotate numbers and appear local.

- Fake names & titles – Scammers provide false aliases and credentials to sound legitimate.

- Access to lead lists – Likely purchased lead lists with names/numbers from other scammers.

- Coaching & scripts – Well coached scammers use scripts and share tactics to refine approaches.

While the exact individuals behind DMS Collect cannot be traced, it is certainly an offshore fraudulent operation. Many similar debt collection scams also originate from overseas illegal call centers.

5 Red Flags to Spot the DMS Collect Scam

While DMS Collect’s tactics can be convincing, they do make many mistakes that expose their operation as a scam. Here are 5 key red flags to watch for:

1. Threats and aggression – Legitimate collectors follow strict FDCPA guidelines regarding conduct. DMS Collect relies on threats, aggression, and intimidation indicating scam.

2. Refusal to provide written validation – By law, collectors must provide written proof of the debt if requested. DMS Collect will not.

3. Missing license and corporate information – Legal collectors display licensing, corporate info and addresses on their website and correspondence. DMS Collect does not.

4. Use of prepaid/gift cards – A huge red flag is demanding payment via non-traceable methods like gift cards or cryptocurrency.

5. Changing numbers – Scammers use spoofing to frequently change their numbers to avoid detection and blacklists.

Any single red flag is enough to proceed with extreme caution. Multiple red flags together confirm you are dealing with a scam.

Steps to Take if You Are Targeted by DMS Collect

If DMS Collect contacts you demanding payment on a suspicious or unfamiliar debt, here are the steps to take:

Do not pay anything. Regardless of threats, it’s almost certainly a scam. Paying will also open you up to further harassment.

Report to authorities. File reports with the FTC, state attorneys general, and law enforcement about the call.

Add numbers to block list. With your phone carrier, block the numbers used by the scammers. Consider third-party call blocking apps as well.

Screen unknown calls. Let unknown callers go to voicemail so you can research numbers to avoid scams.

Place fraud alert. Contact credit bureaus to request fraud alerts in case your info was compromised. Monitor credit reports closely too.

Send cease and desist letter. Write a letter demanding DMS Collect cease contact with you and it violates FDCPA. Send copies to your state A.G. as well.

Following these steps can help shut down the harassment from DMS Collect quickly. Do not engage with or acknowledge the scammers in any way.

How to Report DMS Collect to Protect Yourself and Others

Since DMS Collect is a fraudulent operation, it’s important to report them to prevent further victims. Here are the best ways to file reports:

- FTC: File complaint at FTC.gov with all details about DMS Collect contacts.

- State authorities: Contact your state attorney general’s office and submit a complaint

- CFPB: The Consumer Financial Protection Bureau investigates scams like DMS Collect. File a report at consumerfinance.gov.

- FCC: Lodge complaints about illegal robocalls and spoofing practices with the Federal Communications Commission.

- Carriers: Your phone carrier may offer call blocking and tracing options. Provide details to help identify DMS Collect numbers.

- Law enforcement: Contact your local police and submit an affidavit about the scam calls and harassment.

The more complaints that government agencies receive about DMS Collect, the more motivation they will have to investigate and prosecute the scammers. Get others you know who were targeted to report as well.

Can DMS Collect Really Take Legal Action Against You?

A common fear is that not paying will spur DMS Collect to take serious legal action like filing a lawsuit or garnishing wages.

The good news? These threats are 100% empty since:

- DMS Collect has zero legal authority – They are scammers, not licensed attorneys with authority.

- No legal merit – There is no real contract or documentation to justify any lawsuit.

- No legal standing – Since the debt is fabricated, they have no grounds to take you to court.

- Costly and traced – Filing an actual lawsuit would cost them money and expose identities.

So in short – no, DMS Collect cannot take any legal action against you despite their threats and claims. Do not let fear or intimidation sway you into paying anything.

Frequently Asked Questions about the DMS Collect Scam

1. What is DMS Collect?

DMS Collect poses as a debt collection agency but is really just a scam operation trying to get victims to pay fabricated debts. They cold call people claiming debts are owed and use threats/pressure to collect payments. Their website dmscollect.com is also part of the scam despite appearing legitimate.

2. How does the DMS Collect scam work?

The scam begins with a call from DMS Collect claiming you owe a debt and must repay immediately. They then direct you to their website to “verify” the debt and make payment. In reality, the debt is completely fake and the website just provides credibility. DMS Collect scammers then keep insisting on payment via hard to trace methods.

3. What laws are DMS Collect breaking?

DMS Collect violates numerous debt collection laws like the FDCPA by harassing and threatening consumers over totally false debts. They illegally pose as attorneys and licensed collectors as well. Their calls also break telemarketing and robocalling laws.

4. What are some red flags of the DMS Collect scam?

Red flags include aggressive/threatening behavior, refusal to provide written validation of debts, lack of licensing/corporate information, demands for prepaid cards, frequently changing spoofed numbers, and more. Any single red flag is enough to proceed with extreme caution.

5. What should I do if DMS Collect contacts me?

If contacted, do not acknowledge, pay or provide the scammers any information. Hang up immediately. Make sure to report them to the FTC, CFPB, your state authorities, phone carrier, and through official complaints. Also request credit reports to check for any signs of identity theft.

6. Can DMS Collect take legal action against me?

No, DMS Collect cannot take any legal action against you despite their threats to sue or garnish wages. They have no legal standing, authority, documentation, or basis to pursue legal action over the imaginary debts. All threats are completely empty.

7. How can I protect myself from the DMS Collect scam?

Protect yourself by being aware of their tactics, reporting all contact, blocking their numbers through your phone carrier, using call screening apps, never paying or providing info, and monitoring your credit. Share details of the scam with others to prevent more victims.

8. How can I report DMS Collect?

To protect yourself and others, report DMS Collect to the FTC, CFPB, FCC, your state attorney general, and local law enforcement. File detailed complaints about the harassment, fake debts, illegal threats, etc. The more reports filed, the more motivation authorities will have to prosecute.

9. Is there any way to identify who is behind DMS Collect?

Unfortunately DMS Collect goes to great lengths to hide the identities of those behind their scam operation. They likely operate overseas and use constantly changing spoofed numbers and fake names. While the exact individuals cannot be traced, it is certainly a fraudulent offshore operation.

10. How can I learn more about debt collection scams?

The FTC has excellent resources on illegal debt collection tactics and common schemes to watch for. Also read consumer guidance from the CFPB detailing your rights and protections. Stay alert about the latest scams through consumer watchdog groups and by reading guides like this.

The Bottom Line on the DMS Collect Scam

DMS Collect uses high-pressure tactics, threats, and outright lies to trick victims into paying fictional debts. Their website and processes only exist to provide false credibility.

If contacted by DMS Collect:

- Do not acknowledge, engage with, or pay the scammers

- Note details about the call and report to authorities

- Block their constantly changing numbers

- Put up credit monitoring in case your info was accessed

- Follow up all scam contacts with official cease and desist letters

Spreading awareness about debt collection scams like DMS Collect is also vital to protect others from falling victim. Share this guide, report contact instances, and steer clear of any suspicious collectors demanding immediate payment over the phone.