Georgia motorists are being targeted by phishing websites claiming drivers must immediately pay “outstanding tolls” on their Peach Pass accounts. Scam texts direct users to fake “My Peach Pass” sites demanding payment to avoid penalties. This investigative piece will uncover how scammers are exploiting these misleading sites, equip drivers with tools to recognize and report them, and provide guidance for potential victims. As transportation fees increase, users must stay vigilant against toll-related phishing traps targeting their personal data.

Scam Overview

This scam starts with texts citing unpaid Peach Pass tolls that must be settled immediately via a provided “My Peach Pass” link. However, closer inspection reveals telltale signs of phishing, including poor grammar, legal threats, and an obscure link. In reality, the site is completely fake, designed to steal entered personal and financial details, not collect tolls.

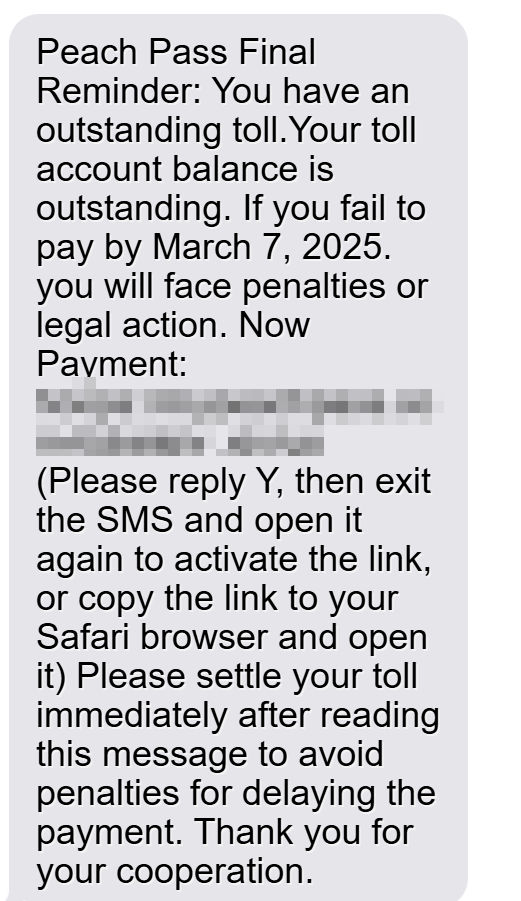

Here is how a scam text might look:

Peach Pass Final Reminder: You have an outstanding toll.Your toll account balance is outstanding. If you fail to pay by March 7, 2025. you will face penalties or legal action. Now Payment: https://mypeachpass.com-[phising domain]

(Please reply Y, then exit the SMS and open it again to activate the link, or copy the link to your Safari browser and open it)

Please settle your toll immediately after reading this message to avoid penalties for delaying the payment. Thank you for your cooperation

Though specifics vary, the core framework involves:

- Texts citing unpaid tolls demanding immediate payment

- A phony “My Peach Pass” link provided

- The link leading to a fake website impersonating Peach Pass

- Users prompted to enter personal/financial data

- Submitted details being stolen by scammers

By exploiting worries over missed toll payments and potential penalties, scammers can convince unwitting drivers to hand over valuable personal data via their fake sites. But understanding these consistent scam markers makes avoidance much simpler.

Spotting Fake “My Peach Pass” Websites

Several key indicators can help users identify fraudulent “My Peach Pass” websites:

- Misspelled or altered domain – Fake sites often have misspellings or extra words added to the domain.

- Plain appearance – Scam sites are plain with limited branding elements, not matching real Peach Pass.

- Poor grammar/spelling – Fraud sites contain numerous writing errors.

- Threats/ultimatums – Scammers use threats of penalties or deadlines to create urgency.

- Requests for sensitive data – Beware sites asking for full financial details and account logins.

- No customer service contact info – Phony sites won’t have real Peach Pass support numbers/emails.

Keeping these telltale signs in mind makes avoiding fake “My Peach Pass” pages much simpler.

How the Scam Unfolds

Fraudulent “My Peach Pass” sites rely on various manipulative strategies to generate and steal user data quickly before victims catch on:

1. The Initial Texts

Targets receive texts claiming they have unpaid Peach Pass tolls requiring immediate payment to avoid penalties. A “My Peach Pass” link is provided to supposedly settle the fees.

2. The Fake Website

Clicking the link leads to a website impersonating the actual MyPeachPass site. The phony portal displays Peach Pass branding and colors, but contains many textual errors that reveal it’s fake.

3. Pressuring Users

The site emphasizes the urgent need to pay outstanding tolls, using threats of fines or legal action if users don’t settle the balances shown. These high-pressure tactics are intended to panic users into entering their data.

4. Requesting Personal Details

The phony portal contains forms prompting users to input sensitive personal and financial information, such as:

- Full name, birthdate, and address

- Contact info like phone number and email

- Vehicle details

- Credit card number, security code, and expiration date

None of this data goes towards paying tolls. It is instead stolen by scammers.

5. Stealing Entered Data

Once submitted, all the personal and financial details entered into the fraudulent site are stolen by criminals. This data enables them to commit identity fraud using the victim’s name and accounts.

Avoiding Fake “My Peach Pass” Websites

Drivers can avoid the traps set by fake “My Peach Pass” websites using these key tips:

- Verify texts/calls with Peach Pass – Never rely solely on texts directing you to pay. Call Peach Pass directly using an official number to confirm any balances.

- Watch for red flags – Analyze sites carefully for telltale signs of phishing like strange links, writing errors, threats, and requests for sensitive data.

- Check the URL – Fake sites often have slightly altered domains. Verify you are on the real MyPeachPass.com.

- Use official login – Avoid “account lookup” tools. Only login via Peach Pass’s official account portal after navigating there directly.

- Don’t auto-save links – Entering site URLs manually each time prevents accidental clicks on trapped links.

- Report fake sites – Notify Peach Pass and anti-fraud authorities to get fraudulent sites shut down and prevent spreading.

What To Do If You Entered Your Data

If you already provided information to a potentially fraudulent “My Peach Pass” site, take these steps right away:

- Contact your bank/credit card issuer – Alert them that your financial data may be compromised and request that new cards and accounts be issued.

- Place fraud alert – Notify credit bureaus to place an initial 90-day fraud alert on your credit file preventing new lines of credit being opened.

- Monitor your credit – Order credit reports and sign up for credit monitoring to detect any signs of identity theft.

- Change passwords – Update passwords on all financial accounts and Peach Pass to prevent unauthorized access. Enable two-factor authentication where possible.

- Review statements – Review all bank and credit card statements closely for any suspicious or unauthorized charges and report them immediately.

- File an ID theft report – Submit an identity theft report with the FTC and provide this to creditors if any fraudulent accounts are opened in your name.

The Bottom Line

The use of fake “My Peach Pass” websites to steal drivers’ personal data highlights the growing threat of toll-related phishing scams. But understanding the key traits these sites exhibit makes them easier to recognize and avoid falling victim. Remaining vigilant and using official login portals is crucial to keeping our information safe amid rising transportation fees.

FAQ: “My Peach Pass” Websites for Unpaid Tolls

1. What are the fake “My Peach Pass” scam websites?

Scammers are creating fake “My Peach Pass” websites that mimic the real Peach Pass site. They send texts claiming you have unpaid tolls and must pay immediately on their site. However, these fake sites are designed to steal your personal and financial information.

2. How can I recognize these fake sites?

Watch for misspellings in the web address, lack of HTTPS security, plain look, poor grammar, threats of penalties, requests for sensitive information, and no customer service contact information. These are signs it’s a scam site, not the real Peach Pass.

3. What do the scam texts say?

The texts falsely claim you have outstanding Peach Pass tolls that must be paid urgently via their provided “My Peach Pass” link to avoid fines or legal action. But this links to a phishing website.

4. What’s the scammer’s goal with these sites?

The fake sites aim to trick users into entering personal, financial and account details, which the scammers then steal and use for identity theft or financial fraud.

5. What should I do if I get a text about unpaid tolls?

Do not click any links. Contact Peach Pass directly through official channels to verify if you actually have any unpaid tolls. Avoid calling phone numbers or using sites sent in suspicious texts.

6. How can I stay safe from these scams?

Always independently confirm unpaid tolls with Peach Pass before paying. Verify site URLs carefully. Monitor accounts closely for fraudulent charges if you did enter info. Report scam texts and sites to authorities.

Conclusion

As toll tags become more prevalent, so too have sophisticated phishing tactics involving them. Scammers are eager to exploit the concerns over missed payments to trick motorists into providing sensitive data. But being armed with the facts on common scam techniques, verifying texts with agencies directly, and utilizing safe login practices will empower drivers to confidently navigate the road ahead.