For decades, Publisher’s Clearing House (PCH) has been a household name, showing up on people’s doorsteps with oversized checks and prizes for lucky winners. However, in recent years, scammers have capitalized on PCH’s popularity and high-profile prize giveaways. They impersonate PCH representatives and use deceptive practices to steal money and personal information from unsuspecting consumers.

This article will take an in-depth look at how the scam works, who the scammers target, the lies they tell, and what you can do to protect yourself and your loved ones. With scam calls and incidents on the rise, awareness and caution are more critical than ever.

Overview of the Scam: How it Works

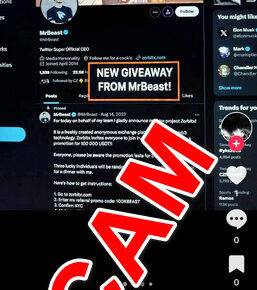

The Publishers Clearing House scam usually starts with an unexpected phone call, email, text message, or social media message informing you that you’ve won a lucrative cash prize or luxury item. The supposed PCH representative goes on to request personal details like your full name, address, age, phone number, family members, bank account numbers, social security number, etc. to “confirm” your prize eligibility.

Next, they tell you there’s a small fee (anywhere from $500 – $5,000+) required to process taxes, registration, delivery costs or other bogus fees. The con artists pressure targets into providing this money promptly via wire transfer, gift card numbers, prepaid debit cards, etc. They may even send fake checks for targets to deposit before withdrawing the “fee” amount.

In reality, the scammers pocket the money while the target gets nothing. Even worse, targets have now given scammers sensitive personal and financial details for identity theft or future extortion efforts.

Who Do Scammers Target?

PCH scammers cast a wide net, calling random phone numbers across the U.S. and Canada. However, older adults are more susceptible to falling for the scams and often have retirement savings, pension funds or equity in their homes for scammers to target.

People who have legitimately entered PCH contests get exploited too since they’re already familiar with sweepstakes entry. During major PCH contest events like the SuperPrize Giveaway or December Jackpot drawings, scam calls increase to capitalize on hype and confusion.

Lies and Manipulation Tactics

These con artists use clever psychological tactics to manipulate targets into falling for their schemes. Here are some of the most common lies and pressure tactics:

- Claiming there’s a limited time offer or deadline to pay the fee so targets panic and act rashly

- Pretending to be PCH president Todd Sloane or other real PCH public figures

- Warning targets not to tell friends/family or the prize will be revoked

- Using real sounding personal info like phone numbers, addresses or family member names

- Providing fake badge numbers or documents to appear credible

- Encouraging targets to lie about the reason for bank/gift card purchases

- Exploiting people’s financial vulnerabilities with promises of debt relief

They also use Caller ID spoofing technology to mimic real PCH customer service numbers. This fools targets into thinking the call is legit. Even savvy people can get deceived when skilled scammers combine urgency, authority and manufactured familiarity.

How the Publishers Clearing House Scam Works

The Publishers Clearing House scam is a deceitful process that involves multiple steps to successfully exploit victims. By understanding each step of the con, people gain crucial awareness to recognize and shut down scams promptly. Here is a walkthrough of the smooth-talking social engineering fraudsters employ:

Step 1: Initial Contact Through Random Cold Calling

The first phase involves mass cold-calling numbers across North America from fraudster call centers. Automated dialers produce countless calls which primarily get ignored or hung up on. However, eventually a recipient answers, intrigued by an unknown caller.

The fraudster launches their act as an enthusiastic PCH representative, faking familiarity by referencing contest entries the target may have legitimately completed. Their Smooth, friendly tone puts targets at ease quickly.

Step 2: Building False Rapport Through Deception

After capturing attention by mentioning potential prize winnings, fraudsters foster false familiarity and rapport. They reference the iconic PCH Prize Patrol and past winners, citing real public winners like Amy Bottomley who won $5,000 a week for life.

The scammers reinforce the random, lucky nature of winners, building suspense and excitement. They encourage targets to grab a pen and paper to jot down prize details and instructions. This further gains trust and engagement.

Step 3: Verifying Personal Details to Advance the Scam

Next, con artists ask for a range of personal details like full name, age, birthday, family members, physical addresses, etc. Supposedly this information verifies ID, but in reality it provides intel for identity theft. Fraudsters prod for specifics indirectly with subtle psychology. Most targets readily provide data, too distracted envisioning prize money to hesitate.

Step 4: Announcing the Big Winner Bait

After mining adequate personal data, scammers dramatically announce the prize total the target has “won.” Results get exaggerated further by referencing luxury vehicles, exotic vacations and home makeovers as inclusions. This stimulates intense emotion and overwhelms critical judgement in the heat of the moment.

Step 5: Introducing the Fee and Urgency Manipulation

Right after hyping the excessively generous prizes, fraudsters pivot the tone and story. They explain sizable taxes, duties or other fees must get paid before prize money releases. Most scammers cite sums from $500 to $5,000 or more. Then intense urgency pressure starts around short payment deadlines and legal threats if funds don’t clear.

This cues financial anxiety and rash decisions without proper analysis of the absurd requests. When our minds fixate on dollar signs, discernment fades.

Step 6: Coaxing Untraceable Payment Methods

Another cunning phase involves directing victims how exactly to pay the fee. Fraudsters instruct people to purchase gift cards, wire transfers or cryptocurrency instead of traditional checks or card payments. These avenues provide zero purchase protections and eliminate fraudster tracing.

Fear of losing one’s winnings motivates abandoning caution with payment types. Victims also get persuaded to lie to financial representatives about why they need various cards or wire transfers. For instance, common excuses include hospital bills, car repairs, home renovations, etc.

Step 7: Disappearance After Theft with No Prizes

After victims share gift card codes or send wire transfers, fraudsters disappear instantly with no further contact. No prizes manifest either, aside from more charges to credit cards/accounts now compromised through previously shared personal data.

Victims face financial blow after blow. And without any way to ID where funds got sent, recovery gets very difficult. Also no good documentation or verification of scam representatives exists thanks to everything only occurring verbally by phone.

What To Do If You’ve Fallen Victim to the Scam

If you realize you’ve fallen prey to a PCH sweepstakes scam, remain calm but act quickly. Every second counts when stopping fraudsters and limiting damages. Follow these steps:

Step 1: Contact Institutions Involved

If you shared any financial, personal or account details, contact relevant institutions ASAP. Alert your bank, credit card company, retirement fund manager, etc. so they can freeze accounts, monitor for suspicious charges, and help protect assets.

Also call phone/virtual gift card companies like Visa, Mastercard, Google Play or iTunes if scam artists stole gift card numbers. Request refunds or credits if applicable. The sooner these companies know about compromised information, the better.

Step 2: Report the Scam

Reporting scams helps authorities track fraud patterns and build cases against perpetrators. Use the FTC, FCC, RCMP and BBB scam reporting portals below:

File detailed fraud reports regarding what information got compromised, how much money lost, payment methods coerced, and where funds got sent. Provide phone numbers, names, addresses, or agency/badge numbers cited by scammers too.

Step 3: Warn Loved Ones

Many targets feel ashamed about falling for scams which lets fraud go unreported. But coming forward can prevent others from being hurt. Educate close family and friends about the scam details and common tricks. Guide them on what red flag statements to listen for and what institutions to call for asset protection. Valor, not shame, is needed to move scam crackdowns forward.

Step 4: Seek Legal Counsel

Consult qualified attorneys regarding legal options around disrupted assets, compromised identities, fraudulent activity on accounts or other damages from the scam. Threatening scammers with court action may also make them abandon exploitation attempts earlier.

Depending on case specifics, potential civil action routes exist like suing scam ring leaders, phone carriers used, banks with security negligence, etc. Criminal charges could also get filed for extortion, wire fraud, willful misrepresentation, conspiracy, etc. if substantial evidence gets furnished.

Having an informed legal perspective bolsters protection, reveals recourse, deters future bad actions, and starts undoing scam damages.

Frequently Asked Questions About the Publishers Clearing House Scam

The Publishers Clearing House (PCH) scam tricks many people into relinquishing money and personal data. This FAQ covers common questions targets ask when navigating this fraud minefield. Peruse and share the guide to bolster protection all around.

How do scammers get your phone number?

Cold-calling technology lets fraudsters auto-dial random numbers until recipients answer. They also buy lead lists with names/numbers from data breaches, contests entries or website polls where people registered personal details.

Is it really Publishers Clearing House calling?

Almost never. Authentic PCH only contacts entrants who actively won current contests like the SuperPrize or December Jackpot. They’ll never call about random winnings requiring upfront fees via gift cards or cryptocurrency. Nor will PCH aggressively push urgency tactics and threats.

What prizes do scammers typically offer?

Cash prizes advertised generally range between $500,000 to $5 million dollars. Luxury vehicles, exotic vacations and home makeovers also get referenced as common prize “inclusions.” Basically, scammers leverage extreme financial desires by citing life-changing sums.

How much are the fake “fees” victims must pay?

Fraudsters usually pressure victims to pay between $500 to $5,000 or more in supposed taxes, duties or processing fees. Targets get convinced prize money hangs in the balance to coerce this payment. In reality, it’s just open theft.

Why do scammers want gift cards or wire transfers?

Untraceable money transfer methods let fraudsters rapidly take funds while eliminating tracing capabilities. Gift cards, cryptocurrency, wire transfers and reloadable debit cards enable this criminal-friendly cash flow.

What’s the end goal of the scam?

These scams ultimately aim to steal money and personal information. Fraudsters disappear after collecting payments, leaving targets empty-handed. Then people’s compromised identity data gets sold on the dark web or used for future exploitation.

What tactics do fraudsters use?

Scammers build false familiarity, project authority with badges/titles, and leverage public records for biographical data tidbits. They also impose deadlines and legal threats to stimulate panic. Promises of over-the-top wealth triggers emotionally charged compliance too.

How can you avoid falling victim?

Refuse unsolicited calls about prize winnings requiring upfront fees, no matter how convincing the pitch sounds. Report scam calls to authorities and confirm legitimacy directly with PCH before providing personal data or payments.

Staying vigilant against smooth-talking social engineering keeps people of all ages safe. Always verify independently before sharing anything sensitive or financial. Empower yourself and others against exploitation with awareness.

The Bottom Line

As scammers grow increasingly sophisticated, we must strengthen awareness, safeguards and support systems to counter the PCH scam epidemic. Boost immunity by learning common fraudster tactics, protecting financial data diligently, communicating with care, and reporting predatory activity the moment it emerges. With collective vigilance, we can create a world where criminal minds have no place left to hide.

This article covered the following key points:

- How the scam ensnares victims with urgent calls about prize winnings that require upfront “fees”

- Targeting tactics focused on older adults and prior PCH entrants

- Manipulation methods via impersonation, threats, fake documents, and other deceit

- Steps to report fraud, halt asset loss, warn others, and pursue legal options

- Ongoing need for awareness, caution, and reporting to curb scamming

Stay alert out there and confirm legitimacy before money changes hands. through guarded action and courageous honesty, we can all do our part to turn the tide. The power rests in our hands.