The Bank of America Wire Transaction Scam has emerged as one of the most insidious financial frauds targeting American bank account holders. This scam leverages text messages and emails designed to incite panic around unauthorized wire transfers in order to steal private information.

With losses regularly exceeding thousands of dollars per victim, awareness of this scam is critical. This comprehensive guide will provide an in-depth overview of how the Bank of America Wire Transaction Scam works, how to spot fraudulent messages, and what to do if you’ve fallen prey.

An Overview of the Bank of America Wire Transaction Scam

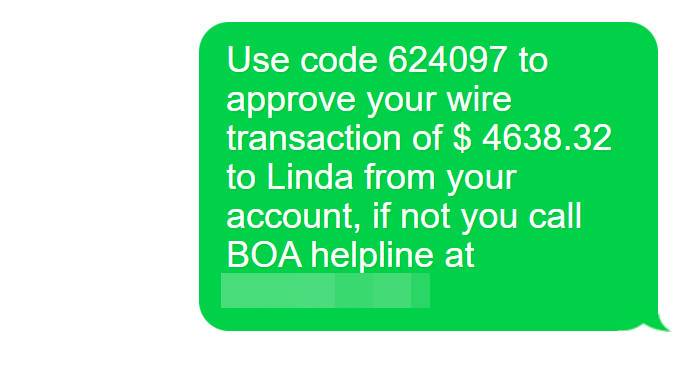

The Bank of America Wire Transaction Scam begins with an unsolicited text message or email sent to unsuspecting recipients. These messages are designed to appear as if they are official Bank of America communications warning the recipient of an impending wire transfer from their account.

The messages will contain several key elements intended to make the scam appear legitimate:

- The Bank of America name and branding within the message. Fraudsters often leverage forged email addresses and SMS shortcodes to mimic legitimate Bank of America contacts.

- Details of an unauthorized impending wire transfer. The messages will indicate a recipient name (often common like Linda or John) and a transaction amount that appears random (such as $4638.32).

- An approval code. The messages will provide a code, usually 6 digits, that the recipient is instructed to use to approve or cancel the transaction.

- A customer support number. This number differs from Bank of America’s official customer service lines and leads to the fraudsters instead.

The goal is to leverage recipient’s concerns around account security to provoke them into calling the number provided. When victims call this number thinking they are contacting Bank of America, they end up speaking to criminals posing as bank representatives.

These faux customer service agents then utilize manipulative tactics to extract private financial information under the pretense of helping the victim stop the unauthorized transaction. In reality, they leverage these details to directly access and drain consumer accounts.

With losses ranging from hundreds to thousands per incident, awareness around identifying and avoiding this scam is critical. Arm yourself with the insights below to help spot fraudulent contact attempts and prevent yourself from falling prey.

How the Bank of America Wire Transaction Scam Works

The Bank of America Wire Transaction Scam is carefully orchestrated to take advantage of recipient’s lack of awareness around how legitimate Bank of America communications are delivered. The following steps illustrate exactly how fraudsters execute this scam from start to finish.

Step 1: Unsolicited Contact

The scam begins when the victim receives an unsolicited text message or email without any prior engagement or context. The timing of this contact is completely random, as fraudsters mass blast these scam messages to thousands of phone numbers and email addresses at once.

They obtain these contact details through a variety of illegal methods, including:

- Previous data breaches where personal information was exposed.

- Botnets that send out thousands of messages hoping recipients have Bank of America accounts.

- Malware that accesses contact information stored on victim devices.

- Publicly available phone and email address databases.

Recipients are selected indiscriminately, with no need to have any prior relationship or even an active Bank of America account. The scam depends only on inciting fear around account security regardless of who the message reaches.

Step 2: Official-Looking Message

While unsolicited, these messages are carefully crafted to appear as if they come directly from Bank of America.

Fraudsters leverage the Bank of America name, branding, and messaging tactics to make the contact appear authentic. Some techniques include:

- Spoofed sender details – The from address in emails or the SMS shortcode for text messages are modified to mimic Bank of America. For example, using cs@bankofamerica.com or 534567 as the sending number.

- Bank headers and logos – Emails will utilize Bank of America header images and logos throughout to reinforce the appearance of legitimacy.

- Urgent and concerned tone – The language carries an urgent, concerned tone, just as a legitimate bank communication regarding account security would.

- Personal details – At times, fragments of real account holder information are interpolated within messages to further authenticate the scam. This is information stolen through separate security breaches.

- Inclusion of case numbers – Fraudsters will assign a fake case number to the supposed transaction or incident to make the message appear credible.

These tactics combine to make the unsolicited contact appear real and likely from Bank of America to most recipients.

Step 3: Warning of Unauthorized Wire Transfer

The crux of the scam relies on creating fear around an unauthorized transaction from the recipient’s account.

To spur this fear, the message highlights an impending wire transfer for a 3-4 digit dollar amount sent to a common first name like Linda or James.

Some additional details contained within the transaction warning include:

- The recipient name, shown as something generic like J. Smith to appear accidentally sent.

- A dollar amount between $200-$5,000, chosen to seem random yet concerning. $4638.32 is an example.

- Messaging about the wire “pending approval”, noting the recipient must act quickly.

- Claims that the transaction originated from the recipient’s checking or savings account specifically.

- City and state names of where the wire transfer originated and is being sent.

The combination of an unknown recipient, large dollar amount, and wire transfer threat creates high anxiety for the message recipient. This incites the desired fear that their account security has been compromised.

Step 4: Provide Fake Approval Code

To cancel what appears to be an unauthorized wire transfer, the scam messages provide a 6-digit “approval code” and instructions to confirm or deny the transaction.

This code is completely fabricated but made to look like something a financial institution would use to validate account activities.

The recipient is told to reference this code when calling the provided customer support number to either authorize or cancel the transfer immediately.

The urgency around acting quickly before the wire goes through is reinforced here to get the victim to call as soon as possible.

Step 5: Provide Fraudulent Customer Support Number

The final element of the scam message is an included customer support number. The instructions claim this is a Bank of America support line where the recipient can obtain assistance canceling the wire transfer using the provided code.

In reality, this number leads directly to the fraudsters running the scam. It is designed to appear similar to Bank of America customer service lines with a legitimate-looking 10-digit format.

Victims are reassured that calling this number will allow them to verify the legitimacy of the transfer and cancel it if unauthorized. This leads victims directly into the scammer’s trap.

Step 6: Fake Customer Service Call

When the concerned message recipient calls the provided number, they are connected to a criminal posing as a Bank of America representative.

These fraudsters are skilled at replicating customer service interactions. They leverage familiar terminology, vocal inflection, system noises, and hold times to replicate a support call.

The fake agent expresses concern about unauthorized account activity and reassures the victim they are there to help. They claim to pull up the recipient’s account and ask them to verify some details to cancel the transfer.

This evolves into a series of scripted security questions aimed at extracting personal information:

- Account number, routing number, online banking passwords

- Social security number, date of birth, mother’s maiden name

- Online account username, password, security answers

- Credit card numbers, CVV codes, expiration dates

Victims are reassured providing this information is a standard process to verify their identity and stop fraud on their account. In reality, it enables account takeover.

Step 7: Account Drain

With the sensitive details obtained, the fraudsters move quickly to leverage this information to drain the victim’s account.

They will initiate fraudulent transfers and withdrawals, draining checking and savings accounts within minutes. If they secure credit card data, high dollar purchases, and cash advances are rapidly executed as well.

Savings, checkings, credit cards, brokerage accounts and more may be wiped clean in this process, with average losses reaching well into the thousands.

By the time victims realize the ruse, their accounts have been completely emptied through the details they provided over the call unknowingly.

Spotting Fake Bank of America Wire Transfer Scam Messages

Preventing financial loss from the Bank of America Wire Transfer Scam requires being able to effectively identify and avoid fraudulent contact attempts.

Here are 8 tell-tale indicators that a message is a scam attempt, not legitimate Bank of America communication:

1. Unsolicited Contact

Legitimate Bank of America communications will always relate back to an existing banking relationship or ongoing account inquiry. Random, unsolicited messages are a top red flag of a scam.

2. Generic Wording

Bank of America will include your name and specific account details within any messages. Vague references like “valued customer” or no custom details indicate a scam.

3. Urgent Tone

Bank communications allow reasonable timeframes to address issues. Scams insist immediate action is required, creating false urgency.

4. Confirmation Codes

Real Bank of America messages will never ask you to confirm financial actions with approval codes or similar specifics. Requests for undefined “codes” signal fraud.

5. Mismatched Details

Incorrect names, dollar amounts, addresses on file, and more can expose scam attempts impersonating Bank of America.

6. Instructions to Call

Legitimate messages invite discussing over secured online account messaging, not phone. Calls to provided numbers always warrant scrutiny.

7. Text Messages

Bank of America does not discuss account activity over text messages. Any SMS correspondence referencing security or transfers is an automatic red flag.

8. Plain Text Emails

Bank of America emails use secure HTML formatting. Plain text content within emails indicates spoofed correspondence.

Equipped with this checklist, you can review any suspicious messages for these scam indicators. Reach out directly to Bank of America if ever unsure of a communication’s authenticity as well. Avoid calling, clicking or replying to any questionable messages without verification first.

What to Do if You Have Fallen Victim to the Scam

If you suspect you have fallen prey to the Bank of America Wire Transaction Scam, immediate and decisive actions are required to contain damages.

Here are the essential next steps to take right away:

Step 1: Contact Bank of America

Your first call should always be directly to the official Bank of America customer support lines, specifically their fraud department.

Alert them that you have reason to believe your account security has been compromised. They can rapidly initiate security procedures to freeze online access, reject fraudulent transfers, cancel affected debit/credit cards, and more.

Having the bank shut down account access and flag it for suspicious activity can stop the criminals mid-theft. But don’t delay, as each minute the scammer has your details the more they can steal.

Step 2: Change Account Passwords and Security Details

Assume any account passwords, security answer or PINs you provided over the scam call to be compromised. Change these credentials immediately for Bank of America accounts first.

Be sure to avoid reuse of any breached passwords on other accounts. Use updated, secure credentials unique to each financial account you hold.

Updating this information limits damages now, while more permanently preventing access from breached data later.

Step 3: Review Accounts for Unauthorized Activity

Carefully review transaction histories across all banking and payment services you utilize for any signs of unauthorized transactions executed.

Look for wires, transfers, balance withdrawals, charges, withdrawals, account creations and more that you didn’t personally conduct. Document details on timing, amount and recipient of identified fraudulent actions.

Step 4: Contact Major Credit Bureaus

Contact Experian, Equifax and TransUnion to place a credit freeze if any credit card or identity information was exposed. This prevents criminals from opening any new lines of credit under your identity.

Also request current credit reports to review for any newly open accounts not your own. Make note of any address, employer or inquiries changes not initiated by you.

Step 5: File Police Reports

File reports with both your local police department and the FBI’s Internet Crime Complaint Center. Provide all documented unauthorized activity and details on the scam itself.

Obtain the report numbers provided by each agency. This creates an official record of the crime that aids any financial reimbursement fights.

Step 6: Dispute Fraudulent Transactions

For any unauthorized bank withdrawals, wire send outs, credit charges and account openings documented, formally dispute these transactions with the institutions involved.

Provide transaction details, police report case numbers and banking institution confirmation the actions are fraudulent. Identity theft attestation may be required as well.

This activates fraud protocols where available that can limit losses and possibly refund stolen amounts.

Stay persistent if reimbursement is denied, leveraging every escalation path available. Having an official fraud paper trail aids this.

How to Prevent Future Banking Scam Victimization

Beyond mitigating current scam impact, it’s critical to take preventative measures to block future victimization. Here are 5 best practices:

- Avoid call backs from unsolicited contacts – Never call numbers provided within random texts, emails or voicemails regarding your accounts. Verify through official channels first.

- Update account security features – Use multifactor authentication, verbal passcodes and biometrics to secure accounts. Don’t rely solely on passwords.

- Screen unknown callers – Use tools like Google Call Screen to intercept unrecognized calls before answering. Avoid answering calls from unknown numbers.

- Limit security detail sharing – Guard details like account numbers, SSNs, and online banking passwords. Only provide over verified calls you initiate to trusted numbers.

- Monitor account activity frequently – Review transaction histories and credit reports routinely to catch any signs of unauthorized activity immediately.

Placing these safeguards prevents you from being as vulnerable to fast-moving account theft schemes in the future.

Frequently Asked Questions about the Bank of America Wire Transaction Scam

What is the Bank of America Wire Transaction Scam?

The Bank of America Wire Transaction Scam is a fraud technique where scammers send fake text messages or emails pretending to be Bank of America. The messages warn recipients of an unauthorized pending wire transfer from their account. A fake customer service number is provided to call to cancel the wire. When victims call, scammers posing as bank reps ask for personal account details that are then used to drain their accounts.

How do scammers send fake Bank of America messages?

Scammers use spoofing techniques to falsify sender phone numbers and email addresses to make messages look like they come directly from Bank of America. They utilize Bank of America branding, logos, and messaging formats to appear legitimate.

What details do the scam messages contain?

The fake Bank of America messages mention an unauthorized wire transfer about to happen, provide a 6 digit approval code, and instruct the victim to call the included customer service number immediately. Details on the wire amount, origin, sender name, and case number make the message convincing.

What happens when you call the number?

The phone number goes to scammers impersonating Bank of America representatives. They express concern about fraud and request personal details like account and credit card numbers, passwords, and SSN allegedly to “verify identity” but really to enable account takeover.

What are some indicators a message is a scam?

Unsolicited contact, non-customized content, excessive urgency, approval codes, phone number callbacks, text messages, and plain text emails are red flags of the Bank of America wire scam.

What should you do if you provided your account details over the scam call?

Immediately contact the Bank of America fraud department, change your account passwords, review transactions for unauthorized activity, contact credit bureaus, file police reports, and dispute any fraudulent transactions. Act quickly to limit losses.

How can you avoid being scammed in the future?

Never call back unsolicited texts/emails, use enhanced account security beyond just passwords, leverage call screening, limit info sharing, and monitor accounts routinely to avoid future victimization.

Conclusion: Stay Vigilant Against the Bank of America Wire Transaction Scam

The Bank of America Wire Transfer Scam is a potent example of how authentic-looking banking messaging can be carefully fabricated by fraudsters to financially devastate victims.

Awareness of common scam techniques, red flags to spot, and swift actions if compromised are critical to avoid crippling losses from this scam. Don’t wait to verify questionable communications, share account details freely, or delay seeking account security support if targeted.

Implement proactive safety measures as well, including enhanced account security tools, call screening, and transaction monitoring. With sound prevention and rapid response, the devastating impact of bank wire scams can be avoided.

Stay wary of this insidious scam and trust your instincts if an unsolicited contact just doesn’t feel right. Reach out to banking institutions directly to validate legitimacy, rather than assuming authenticity based on convincing branding and urgency.

Exercising caution around unexpected financial account communications protects you and your hard-earned assets from falling prey to fraud. Maintain vigilance and verify any alarms raised through appropriate banking channels.