The “Overdue Invoice” email scam is a prevalent phishing attack targeting businesses and individuals. This fraudulent email aims to steal personal information and login credentials. Read on to learn how to identify, avoid, and recover from this scam.

Scam Overview

The “Overdue Invoice” scam is phishing email poses as a service provider or vendor reminding you of an unpaid invoice. The goal is to get you to open an attached document which contains malware or directs you to a phishing site. Once there, you are prompted to enter your login credentials, exposing sensitive data like usernames, passwords, and financial information.

With your credentials and information compromised, scammers can access your accounts, steal funds, and leverage your identity for further frauds.

Anatomy of the Scam Email

The scam email subject line usually reads “Unpaid/Overdue Invoice” or “Final Notice” to incite urgency. The sender name spoofs a real vendor or service provider your company may use.

The email body thanks you for your business, before stating there is an outstanding invoice attached that requires immediate payment. Stylistically, it matches a typical invoice follow-up message.

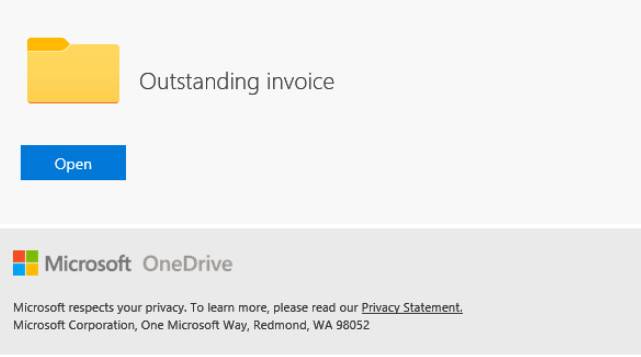

Attached is a document, often titled “invoice” or “statement.” Enabled macros download malware once opened. Or, it’s a fake portal grabbing your login data when accessed.

Well-crafted emails like this bypass spam filters and seem legitimate. But small details like incorrect names, logos, or email addresses may reveal it’s a scam.

How the Scam Works

The “Overdue Invoice” scam leverages urgency, familiarity, and authority to manipulate targets. Understanding the psychological tricks makes it easier to recognize before falling victim. Here’s how the scam operates at each step:

Step 1: Crafting a Credible Email

Scammers research the target company to make the email look authentic. The sender name, email address, and signature match real vendors or partners. Company logos are replicated in the attached documents.

Subject lines convey urgency like “Final Notice” and “Immediate Payment Required.” This rushed tone pressures the recipient to act quickly, overlooking red flag.

Details like dollar amounts, dates, and invoice numbers seem real. The message style mirrors a legitimate business correspondence to build familiarity.

Step 2: Directing to Malware or Phishing Sites

The email urges prompt payment and references the attached invoice document. Opening this initiates the scam.

Attachments contain macros which install malware like trojans or remote access tools when enabled. This grants scammers control over the target computer.

Alternatively, the attachment directs to a fake payment portal impersonating a real vendor site. On this phishing site, victims enter account credentials exposing sensitive data.

Step 3: Leveraging Compromised Accounts

With access to compromised accounts, scammers have multiple opportunities for exploitation. They can monitor inboxes to spy on ongoing communications and transactions.

Financial accounts can be drained through fraudulent transfers and purchases. Scammers can also reach out to contacts posing as the target requesting money or sensitive data.

Compromised business accounts provide cover to target partners, vendors, or customers with additional scams. Each exploited account expands the scam’s scope and earning potential.

Step 4: Concealing Fraudulent Activity

Scammers hide their activity within compromised accounts to avoid detection. They alter contact info and security settings to lock out the real account owner.

Communications are deleted, and documents altered to conceal fraudulent transactions. Multi-factor authentication is disabled making accounts easier to access.

With total control over accounts, scammers have ample time to exploit assets while avoiding anti-fraud alerts from banks and providers.

What to do if you have fallen victim

If you suspect you have fallen prey to an “Overdue Invoice” scam, remain calm and take immediate action to contain the damage. Follow these key steps to begin securing your accounts and assets:

Step 1: Contact Relevant Institutions

If you entered credentials, payment info, or downloaded attachments, alert associated institutions ASAP. Call banks and financial services to flag compromised accounts. Inform any vendors the scam email impersonated.

Enable transaction monitoring and strengthen fraud protections on accounts at risk. The sooner relevant parties are notified, the faster fraudulent activity can be spotted and limited.

Step 2: Change Passwords and Remove Unauthorized Access

Assume all passwords for accessed accounts are compromised. Rapidly change credentials on email, financial sites, company logins, etc. Make passwords long and complex to strengthen security.

Check accounts for unauthorized access and remove email forwarding rules, contact changes, or multi-factor authentication modifications enacted by scammers.

Step 3: Scan Devices for Malware

If you downloaded email attachments, scan associated devices to uncover malware like trojans, spyware, and remote access tools. Use up-to-date antivirus software to detect and remove discovered threats.

Also change all passwords from any potentially infected devices once cleaned to eliminate continued account access. Enable two-factor authentication where possible for added security.

Step 4: Monitor Accounts Closely

Carefully check all exposed accounts over the following weeks for signs of unauthorized access, fraudulent activity, and spear phishing attempts targeting your contacts. Report suspicious activity to associated institutions.

Request increased transaction verification where available. Update account security questions and continue using strong, unique passwords for each service.

Step 5: File a Police Report

File a report with your local law enforcement agency detailing the scam, exposed accounts, and impact experienced. Provide any documents, emails, and evidence to aid investigation and recovery efforts.

This creates an official record that can help prove fraud to institutions and help authorities identify and prosecute scammers. Records also support insurance claims associated with losses.

How to Avoid “Overdue Invoice” Scams

While no single tactic prevents all scams, layers of defense make this fraud easier to catch and limit damage from. Follow these tips to keep your business or accounts protected:

Enable Email Security

Use email security services that scan attachments, filter spam, and block phishing tactics. Features like DMARC authentication and anomaly detection identify red flags in messages.

Enable spam filters, and set security settings to block executable files, Office macros, and other dangerous attachments typical in scams.

Use Caution with Unexpected Attachments

Do not open unanticipated attachments even if seemingly from known contacts. First verify by phone or separate email such requests are legitimate and expected.

Have IT scan attachments on a separate system before accessing on company devices if urgent. Require management approval before opening to encourage scrutiny.

Limit Account Access

Restrict and closely monitor employee access to financial accounts and sensitive company data relevant to payments. Require secondary approvals for fund transfers and transactions.

Enable transaction alerts and monitor activity logs to regularly audit access. Limit account access once staff leave the company or change roles.

Beware Urgent Requests

Train staff to be wary of urgent payment requests and verify independently. No legitimate firm will threaten legal action or require immediate payment without notice.

Verify invoices match records and contact senders through known company channels if unsure. Avoid email links and handle payment offline.

Report Scams

If targeted, report scam emails to associated institutions. Forward messages to the Anti-Phishing Working Group to aid scam prevention efforts. Report fraud to the FBI’s Internet Crime Complaint Center.

Notifying key groups ensures scam patterns are tracked and resources focused on protecting other potential targets in the future.

Frequently Asked Questions About the “Overdue Invoice” Email Scam

What is the “Overdue Invoice” email scam?

This is a phishing scam where targets receive an email claiming there is an unpaid invoice requiring immediate payment. The email contains a malicious attachment or link to a fake portal to steal login credentials.

Who conducts this scam?

Cybercriminals seeking financial data and account access target businesses and personnel handling payments. Scams originate from anonymous accounts spoofing real company names.

How does the scam email reach my inbox?

Scammers spoof legitimate business names and email addresses when sending “Overdue Invoice” phishing emails. Advanced social engineering and spamming tactics bypass filters to reach inboxes.

What information is at risk with this scam?

Scammers mainly seek login credentials for financial accounts, company networks, and email. With account access, funds can be stolen, and further scams launched against contacts.

What are signs an invoice email is a scam?

Watch for slight variations in company names, urgency claims of legal action, and unexpected attachments. Verify with the sender over other channels before trusting messages.

What should I do if I provided information to a scam email?

Immediately change any exposed passwords and alert relevant institutions to fraudulent access. Scan devices for malware if you downloaded attachments. Monitor compromised accounts closely for unauthorized activity.

How can I avoid falling for “Overdue Invoice” scams?

Use secure email tools, limit account access, verify unusual payment requests independently, and train staff to recognize phishing tactics. Report scam emails to raise awareness of new ploys.

What steps should my business take to prevent this scam?

Enact email security protections like spam filters and attachment scanning, implement approval controls for payments, restrict account access, and educate personnel on scam identification.

How can I report “Overdue Invoice” scams or recover lost funds?

File detailed complaints with the FBI’s Internet Crime Complaint Center (IC3), Federal Trade Commission, and local law enforcement to aid investigation and recovery efforts.

Are there resources to help improve my scam awareness?

Groups like the Anti-Phishing Working Group (APWG) provide updated scam alerts and cybersecurity education programs to better identify and manage email fraud threats.

Conclusion

The “Overdue Invoice” phishing scam threatens businesses and individuals handling payments. This guide outlined how to recognize fake invoice emails, respond if targeted, and implement practices to avoid becoming a victim. While scams grow more advanced, education and layered security provide the best defense.

Being aware of common tactics, verifying unusual requests, limiting account access, and using secure tools can stop most scams before they start. With proper diligence, individuals and companies can identify risks early and manage them effectively.

Staying vigilant and using safe online practices makes all the difference in protecting finances and sensitive information from growing cyber threats. Heeding this advice empowers professionals to confidently avoid distracting and damaging invoice scams.