Got a random WhatsApp message out of the blue promising easy riches through AI trading algorithms? Don’t let curiosity drag you deeper into the deception.

- What is the WhatsApp AI Trading Platform Scam?

- Dangerous Proliferation of the WhatsApp Trading Scam

- Crafting a Believable WhatsApp Trading Façade

- Who is Behind the WhatsApp Trading Scam?

- How Did the Scam Spread So Quickly?

- How to Spot the WhatsApp Trading Platform Scam

- Anatomy of the WhatsApp AI Trading Scam Step-by-Step

- What To Do If You Were Scammed by WhatsApp AI Trading Platform

- Frequently Asked Questions About the WhatsApp AI Trading Platform Scam

- Don’t Let WhatsApp Scammers Steal Your Financial Power

This hot new scam preys on people’s yearning for financial freedom and security. But it leads down a risky path far removed from passive wealth and automated profits.

By closely examining how the WhatsApp AI Trading Platform ensnares its victims step-by-step, you’ll clearly recognize why this scheme is nothing more than smoke and mirrors. Manipulation is the true name of the game.

What is the WhatsApp AI Trading Platform Scam?

This elaborate financial deception works by first connecting with victims through WhatsApp groups and chats. The scammers pose as representatives for an artificial intelligence cryptocurrency trading company called “WhatsApp AI Trading Platform 2.0.”

They spend time building rapport and gaining trust by asking friendly questions and expressing interest in the target’s personal situation and financial goals. Scammers empathize with any money concerns voiced and mirror wishes for greater financial freedom and security.

Once that emotional connection is built, the scammers recommend joining their automated cryptocurrency trading platform, which purportedly generates guaranteed profits for investors using AI algorithms and insider secrets.

The scammers claim the AI Trading Platform consistently earns users over 200% returns on their investment each week. To reinforce its legitimacy, they provide apparently verified promotional materials, fake company documents, and even videos showing the platform’s dashboard and features.

Victims are led to believe this is a risk-free, exclusive opportunity to easily profit by simply handing over an initial investment. Recommended deposits range from $250 to $500 to get started.

However, in reality, there is no actual registered corporation, no “WhatsApp AI Trading Platform 2.0”, and certainly no proprietary AI technology automatically generating cryptocurrency trading profits.

All the scammers’ claims are completely fabricated. The company registration papers, glowing testimonials, and screenshots of balances are forged. The AI trading platform demos are simulated fakes.

It is all an elaborate illusion of success designed to manipulate, deceive and extort money from unsuspecting WhatsApp users and their contacts.

Once users send over the requested initial deposit via wire transfer, gift cards or crypto, the scammers quickly invent reasons why more funds are “required” to access the advertised profits, applying pressure for further payments.

Victims are misled into believing their investment is safely growing as promised. But every dollar they send merely enriches the scammers. No genuine trading or investing is occurring in their name at all.

After the scammers are satisfied they’ve extracted the maximum funds possible, they abruptly cease all communication and block the victim.

Their WhatsApp account vanishes, leaving the victim with no path to recover their money or data. Within days, it dawns on the user that there will be no payouts forthcoming or responses to increasingly desperate pleas for help.

The extent of the crime slowly sinks in. But by then, it is far too late. The stolen funds are long gone.

Dangerous Proliferation of the WhatsApp Trading Scam

This detrimental scam has spread rapidly across social media in recent years. WhatsApp in particular provides direct channel access to users that scammers can exploit more personally. The app’s encryption also offers a layer of anonymity.

Once the fraudsters infiltrate a WhatsApp group, they have a captive audience to systematically target. They use the intimacy of private messaging to foster a false sense of trust and urgency around joining the phony trading program.

The scammers also promote the scam across Facebook, Instagram, Twitter and YouTube using fake accounts, bots, paid ads and influencer marketing. This hooks wider audiences to later shift into WhatsApp chats for more focused grooming.

With so many families struggling financially since 2020, the opportunity for passive income without formal trading education resonates now more than ever. But those hopes are being weaponized against vulnerable citizens who end up losing everything.

Crafting a Believable WhatsApp Trading Façade

The WhatsApp Trading Platform scam succeeds by carefully manufacturing an image of legitimacy at every stage:

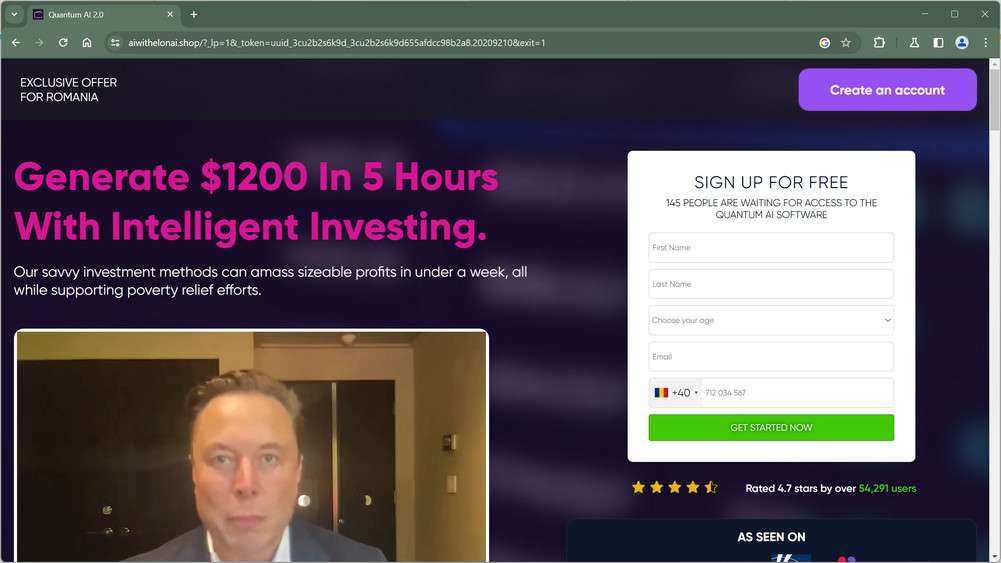

- Professional Profiles and Accounts – The scammers create polished WhatsApp profiles using AI-generated faces, business attire and bios conveying financial authority.

- Establishing Early Rapport – They build friendship using questions about personal interests, families and career goals to seem sincere.

- Dangling Hope – They empathize with money struggles then suggest joining the AI trading platform as the solution.

- Forged Documents – Fake account statements, company certificates and press releases purportedly vouch for the platform’s integrity.

- Videos and Images – Doctored photos depicting lavish earnings and swanky offices boost the WhatsApp scam’s credibility.

- Sales Pressure – Once targets are on the hook, scammers apply pressure to invest quickly or risk losing out on huge profits.

- Vanishing Act – After extracting the deposits, they delete all traces and disappear, leaving zero avenues for accountability.

This well-orchestrated deception manipulate psychological triggers like fear of poverty and desire for comfort to override critical thinking. The veneer of personalized advice and community erodes skepticism to convince victims to buy into the altered reality presented to them.

Who is Behind the WhatsApp Trading Scam?

The WhatsApp Trading scam is believed to originate from organized cybercriminal groups based overseas, though specific entities have yet to be conclusively identified.

Tech security researchers have linked the surge in WhatsApp financial frauds to expansions into new markets by Nigerian and Indonesian hacking networks infamous for email phishing and SMS text scams.

WhatsApp’s encrypted messaging provides a lucrative new avenue with reduced risks, letting them fly under the radar of moderation tools scanning more open platforms.

The apps growing ubiquity in emerging economies like Brazil, India and Mexico also gives scammers access to under-educated demographics less aware of manipulation techniques.

By socially engineering one-on-one intimacy through chat, they bypass many spam filters. Stolen funds are quickly laundered through cash exchanges abroad, beyond the reach of victim’s local authorities.

With potentially millions of dollars extracted per campaign, these scam networks are heavily incentivized to keep refining their playbook and evading policing efforts.

How Did the Scam Spread So Quickly?

The WhatsApp scam proliferated rapidly through direct injection into WhatsApp group chats that act as captive pools of targets.

Once gaining access to a group, scammers befriend its members, gauging vulnerabilities and marketing their fake opportunity. This access lets them systematically groom victims en masse.

Those persuaded seed the scam by legitimizing the opportunity amongst contacts and recruiting new group participants for scammers to target. These victims essentially become unwitting accomplices.

Scammers also mass-message potential leads directly using phone numbers purchased on black markets to penetrate unsolicited.

To cast the widest net possible, fake social media profiles and YouTube videos are used to promote the AI Trading Platform. These lure users offsite into harder-to-police WhatsApp exchanges.

The scam preys on people’s anxiety around financial security, a feeling greatly exacerbated since 2020 for millions. By pretending empathy and friendship, scammers persuade even prudent people to override caution.

With the right psychological triggers pulled, the con artfully exploits blind spots innate to even smart individuals when making decisions under high emotion. This allows the deception to compel victims against their own best interests.

How to Spot the WhatsApp Trading Platform Scam

While the scammers go to great lengths to make their ruse seem legitimate, there are telltale signs that can expose their deceitful intentions:

They Reach Out First

One red flag is if an unknown person or company contacts you out of the blue promoting investment opportunities. Genuine financial advisors typically wait for people to seek them out, not cold message strangers.

Overly Consistent Profits

Their marketing materials highlight remarkably steady and high returns week after week, regardless of normal market volatility. This is a huge indicator the platform is fiction. Real trading results fluctuate.

Limited Access

Playing up exclusivity and limited access pressures you to join quickly before missing out. But legitimate platforms have no need to invent false scarcity. This sense of urgency is meant to bypass your skepticism.

Pushy and Evasive

When pressed for more info, the representatives turn pushy and evasive rather than transparent. Scammers fear scrutiny exposing thetruth.

No Verifiable Registration

Searching for the company name turns up no business registration or credentials on LinkedIn and other databases. Any documents they provide are likely forged.

Phony Associations

Scammers pretend endorsement from celebrities and the ultra wealthy. But these alleged affiliations don’t check out against the public comments of those figures or companies.

If an opportunity throws up this many caution flags, it’s best to trust your gut and steer clear. Don’t let fear of lost potential profits outweigh sound judgment.

Anatomy of the WhatsApp AI Trading Scam Step-by-Step

While cleverly executed, becoming aware of the key stages of this insidious financial scam can help citizens spot red flags and avoid being swindled:

Stage 1 – Initiating Contact

The first phase involves the scammers introducing themselves on WhatsApp either in existing group chats or through cold outreach. They often pose as wealthy entrepreneurs or cryptocurrency traders.

Their profile photos, bios and opening messages aim to build credibility, such as claiming they made their fortune through AI trading algorithms. Some will send proof like fake account screenshots showing large balances.

Once engaged in conversation, they begin asking benign personal questions and looking for common ground connections to build rapport. This sets the groundwork before pivoting the discussion to financial matters.

Stage 2 – Assessing Targets

During the rapport building, the scammers subtly pivot conversations to assess the financial situation, interests and goals of those they are grooming.

They listen for telltale concerns about money, work dissatisfaction or desire to have more freedom and time for family. This intel informs how best to craft and market the scam opportunity to the target.

By mirroring their wishes for a better lifestyle and promising a simple way to attain it, the scammer begins planting the seeds of deception.

Stage 3 – Introducing the WhatsApp Trading Platform

Now having built enough familiarity with the targets, the scammers segue conversations into introducing their AI-powered trading platform as the solution to the target’s financial problems.

They manufacture an aura of exclusivity around the opportunity. The scammer explains they normally only open access to business associates, but are making a special exception.

This conveys privilege and scarcity to incentivize signing up before the limited slots are filled. Some may even offer referral bonuses or discounts for joining early.

Stage 4 – Providing Proof

To reinforce credibility, the scammers provide supposedly verified materials that validate the WhatApp trading platform’s legitimacy and profitability.

Fake documents include company registration papers, certifications, press releases, testimonials, and even screenshots or videos showing the AI trading interface in action.

The litany of manufactured evidence aims to overcome any lingering hesitation or skepticism that their platform is not real. The quality forgeries make the remarkable earnings claims seem plausible and risk-free.

Stage 5 – Requesting the Initial Deposit

Once satisfied that the target is convinced, the scammer moves to the pivotal ask for an initial investment deposit to activate the AI trading account and start generating astounding profits.

Typical minimum amounts range between $250 to $500. The scammer emphasizes how minor this is compared to the potential returns exceeding 200% per week that the platform will swiftly produce.

To create urgency, the scammer stresses limited slots and that delays in funding your account risks losing out entirely. This high-pressure tactic spurs victims into wiring over deposits without taking time to deeply consider it.

Stage 6 – Extracting More Funds

After victims make the first deposit, scammers will fabricate reasons for why more money is required to fully unlock the advertised earnings.

Bogus explanations include needing to upgrade to premium account status, new user bonuses becoming available or investment tiers increasing.

Targets already bought in are less likely to question sending additional funds. Once satisfied they have extracted enough, the scammers move to exit and cash out.

Stage 7 – Cutting Off Contact

Shortly after the deposits clear from victims, the scammers invent excuses for why they need to temporarily go offline. They promise to return shortly with positive progress updates.

Instead, they immediately block all contact with the victims. The WhatsApp accounts, phone numbers and linked social media profiles all vanish. They want to minimize any chances of recovery claims against them.

Many victims do not understand the gravity of the scam until days later when promised payouts fail to materialize. By then, it is far too late to rescue any stolen money or data.

What To Do If You Were Scammed by WhatsApp AI Trading Platform

Here are the recommended steps if you were scammed by the WhatsApp AI Trading Platform:

- Contact Your Bank – Notify your bank and credit card company that you believe you were defrauded. Request they reverse any recent transfers associated with the scam, or stop payments not yet processed. This can limit how much the criminals siphon away. Monitor accounts closely for any unauthorized charges as well.

- Secure Accounts – Change passwords on online accounts, especially financial and email. Enable two-factor authentication where possible. Disconnect any linked payment apps or sources to prevent further abuse. Scan devices for malware that could be spying on you.

- Collect Evidence – Gather screenshots, chat logs, videos and transaction records documenting your interactions with the scammers. Do not delete or throw away any mailing materials sent. Retain evidence to support your fraud claim and assist investigations.

- Report the Scam – File a report with the FTC at ReportFraud.ftc.gov and their equivalents in your country. Submit a complaint to WhatsApp detailing how its platform was abused. Provide information on the scam tactics, accounts and damage done. This creates a record and can help authorities pursue legal actions.

- Dispute Transactions – If money was wired or transferred from debit/credit accounts, dispute those transactions with your bank as unauthorized. Provide the fraud documentation and cooperate fully with bank investigators. Pushing payment processors like Visa can also help recover funds or penalties from recipient accounts.

- Beware Recovery Scams – Fraudsters sometimes reach back out posing as investigators to retrieve money. Anybody demanding upfront fees to recover stolen funds or provide loans is just perpetuating the scam cycle. Cease all engagement.

- Consult an Attorney – Discuss potential civil action with a lawyer focused on cybercrime litigation. They can send cease and desist notices to offending parties, or see if class action lawsuits are already underway you can join. Laws may allow damages for image misuse, data violations, traumatic stress and other impacts.

- Spread Awareness – Help those around you avoid the same scam by sharing your experience on social media. Report fake accounts and investment profiles promoting the scheme to get them taken down quicker. The more citizens look out for each other, the harder it becomes for these scams to flourish.

With some diligence and patience, it is possible to limit losses, clear your name and potentially achieve some restitution from these complex WhatsApp trading scams. Do not let embarrassment prevent you from seeking assistance. The criminals are hoping victims will stay silent rather than expose their unethical deception. By working together and speaking out, we can build a safer community for all.

Frequently Asked Questions About the WhatsApp AI Trading Platform Scam

1. How do the scammers initially contact victims?

The scammers first connect through WhatsApp chat, either joining existing groups or messaging targets directly. They build rapport through friendly small talk, posing as wealthy investors or entrepreneurs. Once they gain trust, they pivot to introducing their phony AI trading platform.

2. What techniques do they use to build credibility?

They manufacture fake documents like financial statements and press releases. Doctored photos depict lavish lifestyles and offices. Videos pretend to show the AI trading interface. Established business personas and emotional manipulation convince targets the opportunity is genuine.

3. What is the WhatsApp AI Trading Platform?

It is a completely fictitious automated cryptocurrency trading service. The scammers falsely claim proprietary AI algorithms generate guaranteed returns of 200% or more per week. There is no real registered company or technology behind it.

4. How much does it cost to join the trading platform?

Scammers typically request a minimum deposit between $250 to $500 to activate an account and start earning profits. Once sent, they invent reasons why additional funds are required, extracting as much as possible.

5. How do victims send money to the scammers?

Methods include bank wire transfers, credit card payments, peer-to-peer apps, cryptocurrency transfers and gift card purchases. Scammers often push for irreversible payment options to avoid reversals.

6. What happens after victims send money?

The scammers fabricate excuses to abruptly cease contact via WhatsApp. They block users to eliminate any path for accountability. Without promised payments made as pledged, victims soon realize they have been defrauded.

7. How can you check if an investment offer is legitimate?

Perform due diligence before sending any money. Search for the company by name online and via registration databases. Check social media for warnings. Request video calls to verify identities. Seek second opinions from legal/financial experts.

8. Are there any ways to recover lost funds sent?

If recent, contact banks immediately to freeze transfers. Dispute transactions with credit card companies. Report unauthorized uses to facilitate chargebacks. Consulting an attorney can determine civil litigation options in certain cases. Government recovery assistance may apply if criminal prosecuted.

9. How can the WhatsApp scam be avoided?

Never trust investment opportunities from unsolicited messages. Check endorsements are from real verified accounts. Beware pressure for immediate action. Verify registration directly through official channels. Report suspicious accounts/activities to WhatsApp.

10. How can WhatsApp moderation be improved?

More proactive detection of fraudulent accounts via profiles, behavior analysis and network patterns. Swift removal of scam content. Visible warnings if engaging suspicious accounts. Tighter identity verification. Direct end-to-end messaging encryption retains privacy while allowing server-side threat monitoring.

Don’t Let WhatsApp Scammers Steal Your Financial Power

In summary, the WhatsApp AI Trading Platform scam is an alarming development in how fraudsters directly manipulate and deceive individuals through personalized messaging. Their ability to win trust and persuade intelligent people to make rash financial decisions is a testament to the power of psychology when employed unethically.

But now that this sinister tactic has been dragged into the light, everyone can take back control by simply sharing this knowledge. Once people understand the detailed mechanisms of the scam in full clarity, the structure of lies instantly crumbles.

Awareness spreads, scrutiny triumphs, and the scammers lose their grip as their playbook is exposed. Users can band together, report fake accounts, and warn each other of suspicious activity. United and informed, the community can obstruct all avenues the criminals rely on to operate unchecked.

The allure of easy money can be intoxicating. We all want comfort and security for our families. But let this desire drive you towards authentic skill-building and measured investing, not down a path of magical thinking and manipulation. Wield your economic power with eyes fully open.

Stay vigilant and stay connected. With care, empathy and wisdom, we can make our virtual spaces adverse environments for these complex financial predators to thrive. Our digital future is ours to shape if we take thoughtful action. The time to start is now.