Have you ever received an email claiming your Venmo account is frozen? Don’t rush to send money – it’s likely a scam!

Scammers are unleashing a new scheme targeting Venmo users with an enticing bait-and-switch. Posing as interested buyers, they promise payments then hit sellers with phony account limitation emails demanding more money.

This con has cost victims hundreds or thousands of dollars. But with knowledge of how it works, you can spot red flags before it’s too late. Don’t become their next mark!

Read on to learn about the tell-tale signs of the “Your Venmo Profile is On Hold” scam and how to avoid being swindled when using payment apps. With the right precautions, you can protect your hard-earned cash.

We’ll reveal the scammer’s playbook and equip you to spot their tricks. You’ll also get tips to safeguard yourself when selling items online or sending/receiving payments virtually.

Don’t let scammers profit off your transactions! Wise up to the Venmo account limitation scam and take back control.

Overview of the “Your Venmo Profile Is On Hold” Scam

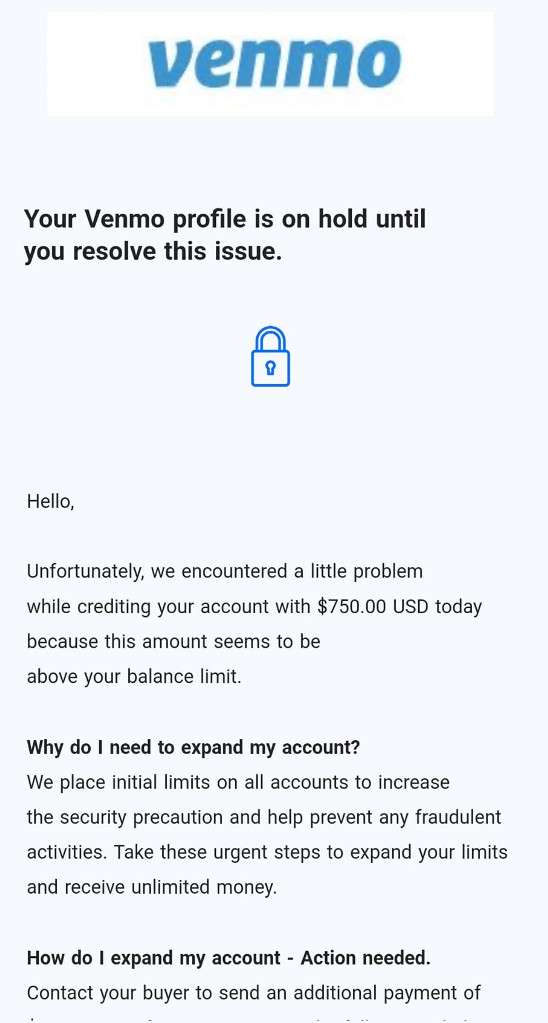

The “Your Venmo Profile Is On Hold” phishing scam typically starts when a recipient receives an unsolicited email purporting to be from Venmo. The email contains Venmo branding and logos, making it appear credible at first glance.

The message claims there is a problem with crediting the recipient’s account due to suspicious activity, and that the account is now frozen. It goes on to state that in order to “expand your limits and receive unlimited money,” the recipient must contact the buyer (the scammer) to send an additional $300 payment.

Once this is done, the email promises that the total sum of money will be credited to the recipient, along with a $10 “free compensation fee.” This tactic is used to entice the victim with a monetary reward in exchange for cooperating.

Of course, the entire email is a scam designed to manipulate recipients into handing over money or sensitive information. If the instructions are followed, the victim ends up sending $300 to the scammer’s account, while receiving nothing in return.

Common Traits of the Scam Email

While specific details may vary, the “Your Venmo Profile Is On Hold” scam email generally contains certain consistent attributes, including:

- The Venmo logo and branding elements to appear credible

- An urgent call to action stating the account is frozen

- Fake reasons for needing additional money (account limits, security precautions, etc.)

- Promises of receiving much more money in return for sending a smaller amount

- Poor grammar, spelling mistakes, and other signs of a fraudulent message

Who is Targeted?

This Venmo scam is particularly likely to target individuals who currently have items listed for sale on platforms like Facebook Marketplace, Craigslist, eBay, and others.

The scammer pretends to be interested in purchasing the item, then sends this phishing email claiming they need help resolving an issue to complete the sale. This provides a believable context and call to action for potential victims.

However, anyone with a Venmo account could receive this fraudulent email out of the blue. The scammers blast out as many messages as possible, hoping some recipients will fall for the scheme and comply with the demands.

How the “Your Venmo Profile is On Hold” Scam Works

To fully protect yourself, it’s crucial to understand the step-by-step tactics scammers use to carry out the “Your Venmo Profile Is On Hold” scam. Let’s walk through the anatomy of this scam in detail:

Step 1: Scammer Finds a Target

Scammers find potential targets by browsing platforms like Facebook Marketplace, Craigslist, or eBay for individuals selling desirable items that could plausibly warrant a large transaction. For example, they may look for postings selling jewelry, electronics, vehicles, antiques, or other high-value goods. The scammer will also assess if the seller seems potentially naive or desperate to make a sale.

Step 2: Scammer Reaches Out Posing as an Eager Buyer

Once identifying a target, the scammer will contact the seller posing as an extremely interested buyer ready to purchase the item immediately at full asking price. They will inquire about specifics like condition, dimensions, functionality to appear engaged.

The scammer will provide a believable backstory on why they want the item so badly. For example, they may claim to be buying a rare coin collection as a gift for their husband who is a devoted collector. Or they need a used car in a rush because their current car just broke down.

This helps build trust and prevents the seller from suspecting they have ill intentions. The scammer will seem polite, appreciative, and ready to buy.

Step 3: Scammer Requests Venmo Info to Send Payment

Shortly after expressing interest, the eager “buyer” will say they want to purchase the item right away for the full asking price. They will request the seller’s Venmo username or associated email address so they can instantly send the Venmo payment.

The scammer will convey excitement to finally find this item and gratitude to the seller for their willingness to sell. This helps persuade the seller to hand over their Venmo details quickly in order to complete the lucrative sale.

Step 4: Seller Receives Fake “On Hold” Email

Within minutes after providing their Venmo username, the unsuspecting seller will receive an email with the subject line “Your Venmo Profile Is On Hold Until You Resolve This Issue.”

The email will contain Venmo logos and branding elements to appear convincing. The message will claim Venmo encountered an issue crediting the seller’s account with the payment due to exceeding the seller’s balance limit.

The email may reference the specific payment amount the seller was supposedly expecting to reinforce that a legitimate transaction was underway. Seeing those exact details can increase the email’s credibility.

Step 5: Email Instructs Seller to Send Money to Unlock Account

The fraudulent email will urge the seller to immediately send a smaller sum of money (usually $300) back to the buyer in order to lift the account limit and receive the full payment.

It will provide wire transfer details, Venmo username, PayPal address, or other payment info belonging to the scammer for the seller to use to send this money.

The email will emphasize the urgency to complete this step before the held payment goes back to the buyer. It will promise that Venmo will credit the full payment plus a bonus fee after the limit is expanded.

Step 6: Scammer Receives Money, Seller Gets Nothing

If the seller falls for the scam email and sends the requested $300 or so to the provided account, the scammer will receive this money.

But the seller receives nothing – no held payment will be released, because it never existed in the first place. There is no actual issue with the Venmo account limits or receiving the money.

Step 7: Scammer Disappears and Blocks Seller

After fraudulently obtaining the wire transfer, the scammer will cease all communication with the seller and block them on all platforms. The seller will be unable to reach the “buyer.”

The scammer will immediately withdraw the funds from whatever account the seller sent money to, so even if the transfer is flagged, the scammer still gets away with the cash.

Step 8: Seller is Left With No Recourse

The unfortunate seller is now out whatever money they sent to the scammer, with virtually no way to reclaim the lost funds. The seller authorized the payment, so Venmo will not reimburse them.

Banks may be unable to stop or reverse the fraudulent wire transfer once completed. The scammer’s accounts used to collect the money are generally untraceable and based overseas.

The seller is left having lost money while the scammer has disappeared with the profits and is on to the next victim. This is why it’s critical not to fall for the fake “Venmo on hold” email’s demands.

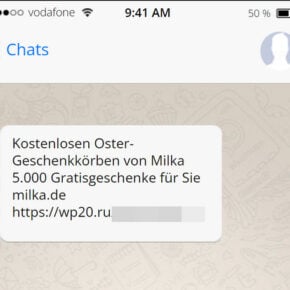

Examples of How Scammers Carry Out This Fraud

To see how this scam specifically plays out, here are some real-life examples reported by victims:

- Jewelry Scam: A scammer contacted a seller listing a $2000 diamond bracelet set on Craigslist. They requested the seller’s Venmo to immediately pay the full $2000 cost. Minutes after getting the Venmo username, the seller received the “account on hold” email instructing them to send $500 to a PayPal address to lift Venmo’s transfer limit in order to receive the $2000. The tempted seller complied, only to have the scammer pocket the $500 and disappear.

- Electronics Scam: A Nintendo Switch console listed on Facebook Marketplace for $400 attracted a supposed eager buyer who insisted on paying the seller through Venmo right away. After receiving the seller’s Venmo username, the phony buyer sent the fraudulent Venmo limitation email. It claimed to be from Venmo support and directed the seller to send $200 via Zelle to the provided account in order to unlock the full $400 payment being held. The scammed seller complied and never heard from the “buyer” again or received payment.

- Antique Scam: A scammer posed as an excited buyer for a rare antique vase listed on eBay for $1200. They requested the seller’s Venmo to pay immediately. The seller soon received a sneaky email saying Venmo encountered a limit issue on their account with the $1200 and directing them to quickly send $400 through Western Union to the provided name. The scammed seller wired the money, allowing the criminal to grab the cash and disappear – never having actually sent any payment.

These examples illustrate how scammers use the lure of a hot item attracting interest and urgency of a sale to trick trusting sellers into falling for the fake Venmo account limitation email. Don’t get fooled by this increasingly common scam.

Protecting Yourself from the Venmo “Account on Hold” Scam

Now that you understand how this scam unfolds, here are some tips to help avoid becoming a victim yourself:

Look for Red Flags in Communication

If a supposed buyer starts making strange requests or claims there are issues with sending the payment, it should raise red flags. Legitimate buyers will smoothly complete transactions.

Never Send Money Back to the Buyer

No genuine reason exists for a buyer to request you to send some of the money back to them. Ignore instructions to transfer funds back.

Don’t Provide Personal Information

Never give out financial information, account details, passwords, or other sensitive data in response to suspicious emails.

Contact Venmo Directly if Unsure

If you are uncertain whether a message actually came from Venmo, contact their customer support for verification before taking any action.

Use Caution When Dealing With Strangers

Extra skepticism is warranted when selling high-value items to buyers you don’t know. Scammers routinely browse sales listings for victims.

Only Use Venmo’s Official Website and App

Communicate with buyers and conduct transactions exclusively through the real Venmo platform. Ignore any outside emails, texts, or calls.

Monitor Your Account Closely

Keep a close eye on your Venmo account activity, notifications, and balance to spot any signs of unauthorized access or activity indicating a scam.

What to Do if You Fall Victim to the Venmo Scam

Unfortunately, some people do end up falling for the “Your Venmo Profile Is On Hold” email scam, whether due to the deceptive nature of the message or simple oversight. If you realize you were tricked and already sent money to the scammer, here are the steps to take:

1. Contact Venmo Immediately

Notify Venmo as soon as possible that your account has been compromised. Report fraudulent activity. This can help minimize damages.

2. Change Your Venmo Password and Settings

To secure your account, change your Venmo password, set up two-factor authentication, and adjust privacy settings to limit visibility.

3. Watch for Other Suspicious Activity

Carefully monitor your Venmo account as well as connected bank accounts and credit cards for signs of any other unauthorized transactions.

4. Dispute the Charges

Dispute the charges with Venmo directly to attempt recovering lost funds. You can also dispute with your bank or credit card company.

5. Block the Scammer

Make sure to block the scammer’s username on Venmo and any other platforms used to prevent further contact.

6. Report the Scam

File reports regarding the scam with the Federal Trade Commission (FTC), FBI Internet Crime Complaint Center (IC3), and other relevant agencies.

Frequently Asked Questions About the “Your Venmo Profile is On Hold” Scam

1. How do I know if an “account on hold” email I received is really from Venmo?

Venmo will never send you an email claiming your account is frozen and requiring you to send money to unlock it. Any message making such claims is fraudulent, even if it contains Venmo logos. Do not reply or click links. Forward suspicious emails to Venmo for verification at phishing@venmo.com.

2. What are some indicators an Venmo “account on hold” email is a scam?

Red flags include poor grammar/spelling, threats to close your account, requests to send money, short deadlines, fake Venmo addresses, asking for sensitive information, or any urgent call to action. Venmo does not communicate account issues that way.

3. Why does the scam email ask me to send more money?

The email’s goal is to trick you into wiring money to the scammer under the pretense it will unlock a payment Venmo is supposedly holding from an “interested buyer.” No payment exists – the scammers pocket the money you send and disappear.

4. What should I do if I realize I was scammed?

Immediately cease communication with the scammer. Contact Venmo to report fraudulent activity. Dispute the charges with your bank/credit card company. Change your Venmo password and enable two-factor authentication. Watch for other suspicious transactions.

5. How can I recover money lost in this scam?

Unfortunately, recovery options are limited since you authorized sending the money. File disputes and fraud reports with your bank and payment services used. Venmo may not reimburse you, but reporting the scam can get the criminal’s account shut down.

6. Where can I report the “Your Venmo Profile is On Hold” scam?

File reports about the scam with the FTC, FBI IC3, Ripoff Report, Venmo, and anywhere else you interacted with the scammer. Providing documentation helps build cases against the fraudsters.

7. How can I identify the scammer to prevent them from targeting others?

Gather details like the Venmo username, email, phone number, social media accounts, or addresses used by the scammer. Screenshot your conversations. Cross reference details to uncover other fake accounts they are using to run this scam.

8. What precautions can I take to avoid this scam when selling items online?

Insist on buyer protection payment methods like credit cards. Never send money to a buyer. Beware buyers wanting to pay via Venmo/PayPal. Don’t rush – verify unusual payment requests. Only communicate via the sales platform.

9. Are other payment platforms also used for this “account on hold” scam?

Yes, scammers have adapted the scam for platforms like PayPal, CashApp, Apple Pay, Zelle and cryptocurrencies. Be wary if a buyer insists on using peer-to-peer apps then claims an issue arose requiring you to send funds.

10. How can I help warn others about Venmo scams like this?

Share your scam story on sites like Ripoff Report, social media, and neighborhood forums. Spread awareness of how the scam works so others can identify red flags. Report scammer accounts to get them shut down.

Let me know if you need any clarification or have additional questions to add to this FAQ!

The Bottom Line

The “Your Venmo Profile Is On Hold” phishing scam can seem convincing and tempting with promises of receiving more money back. However, engaging with the scammer’s demands will only end up with you losing funds. Protect yourself by recognizing red flags, using caution when contacted, and never sending reverse payments.

If you do fall victim, act quickly to report the fraud, secure accounts, attempt to recover losses, and alert the community. With awareness and proper precautions, we can try to curb these scams that seek to deceptively prey on unsuspecting Venmo users.