Have you received an unsolicited email claiming you are owed millions of dollars that can be deposited into your bank account? This is a common scam that tries to trick people into sending money or personal information to fraudsters. Keep reading to learn all about how the US$8,600,000 bank account scam works and how to protect yourself.

Overview of the Scam

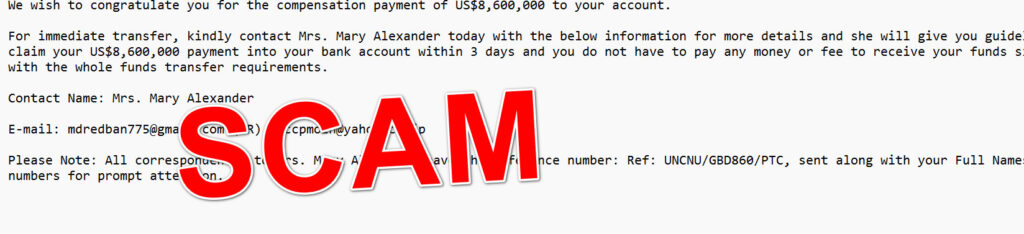

The US$8,600,000 bank account scam involves an email sent to unsuspecting recipients promising a large sum of money that can be deposited into their bank accounts.

The email will include an official-looking reference number like “Ref: UNCNU/GBD860/PTC” and the promise of a multi-million dollar payment, usually US$8,600,000. It will instruct the recipient to contact someone like “Mrs. Mary Alexander” to claim the funds and provide their banking details.

This is a complete fabrication designed to steal money and personal information from victims. No legitimate business or organization would operate in this manner. The emails are sent out randomly in bulk to millions of addresses. There is no real payment waiting for the recipient.

Tactics Used to Deceive Victims

The US$8,600,000 bank account scam uses various deceptive tactics to convince recipients the offer is real, including:

- Use of official logos like the UN or World Bank to appear credible

- Reference numbers to look like a valid funds transfer

- Promises of “no fees” required to claim the money

- Time pressures like “contact within 48 hours” to claim the funds

- Follow-up emails if ignored, urging the victim to act quickly

The scam emails are designed to look legitimate to trick users into responding. But it is all a façade with no truth behind it.

Goals of the Scammers

The goals of the US$8,600,000 bank account scam are simple – to steal money and personal information.

Specifically, the scammers aim to:

- Trick victims into paying upfront fees and taxes to release the “funds”

- Obtain bank account details to steal money

- Collect personal ID documents and information for identity theft

- Install malware on victim’s devices from infected email attachments

No matter what story the scammer tells, their end goal is always illicit profit through deception and theft.

How the US$8,600,000 Bank Account Scam Works

The US$8,600,000 bank account scam unfolds in several cleverly orchestrated steps designed to reel in victims:

1. Unsolicited Email

The scam starts with an unsolicited email being sent to the victim’s inbox. The email is made to look official and will include a reference number, promise of payment, and instructions to contact someone to claim the funds.

2. Follow-Up Communication

If the victim responds to the initial email, the scammer will follow up with a phone call or additional emails under the guise of helping release the funds. They will claim to be from a bank, government agency, or third-party company to sound legitimate.

3. Request for Personal Information

To advance the scam, the fraudster will request personal information from the victim including copies of ID documents, bank account details, and credit card information. This is done under the pretense it is required to verify identity or process the payment.

4. Demand for Upfront Payment

Once the scammer has gained the victim’s trust, they will fabricate reasons why an upfront payment is required before the funds can be released. This may be for fake fees, taxes, lawyer costs, or bribes. The purpose is to extract money from the victim.

5. Stealing the Money

With bank account access and/or credit card details, the scammers can now steal directly from the victim. They may also use personal information obtained for identity theft.

6. Ceasing Contact

Once the scam is complete and the scammers have stolen money, they will cease all contact with the victim. The fake promises of millions in payments will never materialize.

What to Do if You’ve Fallen Victim to the Scam

If you have fallen prey to the US$8,600,000 bank account scam and suffered financial losses, here are important steps to take:

1. Contact Your Bank

Alert your bank immediately about any unauthorized charges or suspicious activity. Your bank may be able to stop additional money being stolen.

2. Report the Fraud

File a scam report with the FTC and FBI’s Internet Crime Complaint Center. Provide all details about how you were targeted and exploited.

3. Monitor Accounts Closely

Carefully monitor all your financial accounts and credit reports for signs of identity theft. Scammers may have stolen your personal data for ongoing fraud.

4. Reset Online Passwords

Change passwords on all email, bank, and other online accounts. Scammers may have accessed your accounts. Use unique, complex passwords for each account.

5. Watch Out for Recovery Scams

Beware of “recovery scams” where fraudsters claim they can recovery lost money for an upfront fee. This is always a scam tactic.

6. Report Social Media Accounts

If the scammers contacted you via social media, report the fake accounts used to the platforms.

Frequently Asked Questions

1. I received an email about owing me millions. Is it real?

No, this is a very common scam. Emails promising millions of dollars in exchange for your personal information are always fraudulent regardless of how official they look. No legitimate organization operates in this way.

2. How do the scammers make the emails look real?

The scam emails use fake logos, official sounding names and reference numbers, and urgent calls to action to appear credible. But it’s all an act aimed at deceiving victims. Nothing in the email is true.

3. What’s the end goal of this scam?

The scammers aim to steal money and personal information. They want victims to pay supposed “fees” to receive the funds, provide bank account access, or share ID documents. This allows them to steal directly from victims.

4. Why would they promise such a large amount?

The promise of $8.6 million USD is used to bait victims. People are much more likely to take a scam seriously if the payoff is high. It’s designed to entice victims with greed.

5. How do they actually get my money?

Once given bank account access or credit card details, they can steal directly. Or they manufacture reasons for upfront “fees” to release the funds, which are really just payments to the scammers.

6. What should I do if I already responded to the scammers?

Contact your bank immediately about any unauthorized charges. Report the fraud to authorities. Monitor your credit and accounts closely for signs of identity theft. Do not correspond any further with the scammers.

7. Can the police help recover lost money?

Unfortunately, it is very rare to recover money lost in these scams. The scammers are often international and very sophisticated at covering their tracks. Prevention is truly the best remedy.

8. How can I avoid becoming a victim?

Simply ignore and delete emails promising free millions. Never send money or information to strangers who contact you unexpectedly online. Protect your personal and financial data carefully.

9. Are these scams illegal?

Yes, these scams violate numerous anti-fraud laws. But scammers are very skilled at hiding their tracks and identities across international borders, making enforcement very difficult.

10. Where can I report the scam?

Report details to the FBI’s Internet Crime Complaint Center at ic3.gov. You can also file reports with the FTC and your local law enforcement.

The Bottom Line

The US$8,600,000 bank account scam is a complete fabrication aimed at stealing funds and information from victims. No legitimate company or organization will promise millions of dollars for free and request personal details to release payments.

If contacted with an offer like this, it is always a fraudulent scheme. Do not send any money, share your information, or communicate further with the scammers. Carefully protecting your identity and accounts is key to avoiding financial frauds online.