Scams have become an unfortunate reality in the digital age, with cybercriminals constantly devising new ways to deceive unsuspecting individuals. One such scam that has been on the rise is the HMRC ‘Payment Credit Issuance’ tax refund phishing scam. This article aims to provide a comprehensive overview of this scam, including what it is, how it works, what to do if you have fallen victim, technical details, and relevant statistics.

What is the HMRC ‘Payment Credit Issuance’ Tax Refund Phishing Scam?

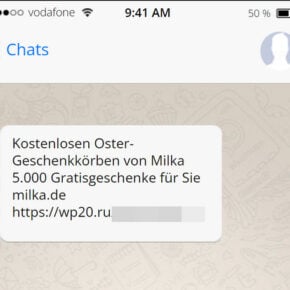

The HMRC ‘Payment Credit Issuance’ tax refund phishing scam is an attempt by cybercriminals to trick individuals into providing their personal and financial information under the guise of receiving a tax refund from HM Revenue and Customs (HMRC), the tax authority in the United Kingdom. These scammers send out fraudulent emails or text messages claiming that the recipient is eligible for a tax refund and needs to provide their details to process the refund.

The emails or text messages often appear legitimate, using official HMRC logos, email addresses, and even names of real HMRC employees. This makes it difficult for recipients to distinguish between genuine communication from HMRC and the scam.

How Does the Scam Work?

The HMRC ‘Payment Credit Issuance’ tax refund phishing scam typically follows a similar pattern:

- The scammer sends an email or text message to the target, claiming to be from HMRC and informing them that they are eligible for a tax refund.

- The message includes a link or attachment that the recipient is instructed to click or download to proceed with the refund process.

- Clicking the link or downloading the attachment leads the recipient to a fake website that closely resembles the official HMRC website.

- The fake website prompts the recipient to enter their personal and financial information, such as their full name, address, date of birth, bank account details, and even their National Insurance number.

- Once the recipient submits their information, the scammers have access to their sensitive data, which they can use for identity theft, financial fraud, or sell on the dark web.

It is important to note that HMRC will never contact individuals via email or text message regarding tax refunds. They primarily communicate through traditional mail or through the secure messaging service on their official website.

What to Do If You Have Fallen Victim?

If you have fallen victim to the HMRC ‘Payment Credit Issuance’ tax refund phishing scam, it is crucial to take immediate action to minimize the potential damage:

- Contact your bank or financial institution to report the incident and secure your accounts. They can help monitor your accounts for any suspicious activity and guide you on the necessary steps to protect your finances.

- Change your passwords for all online accounts, especially those related to banking and financial services.

- Report the scam to HMRC by forwarding the fraudulent email or text message to phishing@hmrc.gov.uk. This helps HMRC in their efforts to track down and shut down these scams.

- If you have provided your personal or financial information, consider placing a fraud alert on your credit file to prevent any unauthorized activity.

- Regularly monitor your financial statements and credit reports for any suspicious transactions or accounts opened in your name.

It is also advisable to run a scan on your devices using reliable antivirus or anti-malware software to ensure that no malicious software has been installed. Malwarebytes Free is a highly recommended tool for scanning and removing malware.

Technical Details of the Scam

The HMRC ‘Payment Credit Issuance’ tax refund phishing scam relies on various techniques to deceive recipients and make the scam appear legitimate:

- Spoofed email addresses: Scammers often use email addresses that closely resemble official HMRC email addresses, making it difficult to identify the fraudulent communication.

- Phishing websites: The scammers create fake websites that closely mimic the design and layout of the official HMRC website. These websites are used to collect the personal and financial information of victims.

- Social engineering: The scammers use psychological manipulation to create a sense of urgency or fear in the recipient, compelling them to act quickly without thinking critically.

- Malware attachments: Some versions of the scam involve sending malicious attachments that, when opened, install malware on the recipient’s device. This malware can then capture sensitive information or provide remote access to the scammers.

Statistics on the HMRC ‘Payment Credit Issuance’ Tax Refund Phishing Scam

The HMRC ‘Payment Credit Issuance’ tax refund phishing scam has been a prevalent threat, affecting a significant number of individuals. Here are some statistics that highlight the scale of this scam:

- In 2020, HMRC received over 846,000 reports of phishing scams, with a significant portion related to tax refund scams.

- According to Action Fraud, the UK’s national reporting center for fraud and cybercrime, victims of HMRC tax refund scams lost a total of £2.4 million in 2020.

- Research conducted by cybersecurity firm Proofpoint found that tax-themed phishing attacks, including those impersonating HMRC, increased by 6,000% in 2020.

Summary

The HMRC ‘Payment Credit Issuance’ tax refund phishing scam is a prevalent and dangerous scam that aims to deceive individuals into providing their personal and financial information. By understanding how this scam works and taking necessary precautions, such as being cautious of unsolicited communication and regularly monitoring financial accounts, individuals can protect themselves from falling victim to this scam. Remember to report any suspicious emails or text messages to HMRC and consider running a scan with Malwarebytes