Scammers are getting more creative in their phishing attempts, sending fake text messages that appear to come from reputable financial institutions. One such scam indicates that CIBC has implemented restrictions on your debit account and directs you to a phony website to release the restrictions. If you receive a suspicious text like this, it’s undoubtedly a scam designed to steal your personal and financial information. This article will provide an in-depth look at how the CIBC text message scam works, what you can do if you fall victim, and most importantly, how to protect yourself moving forward.

Overview of the CIBC “Restrictions On Your Debit Account” Text Message Scam

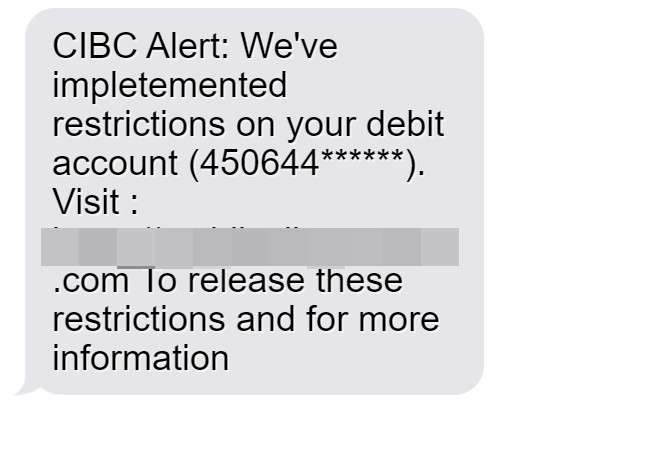

This scam starts with a text message stating:

“CIBC Alert: We’ve implemented restrictions on your debit account (450644*). Visit: https://mobilecibcsupport.com to release these restrictions and for more information.”

The phone number appears to come from a valid CIBC contact, the web link seems legitimate, and the message creates a sense of urgency. However, it’s all a fraud designed to trick recipients into sharing sensitive information and gain access to bank accounts.

This is just one variation of the scam, which may reference “temporary restrictions” or “unauthorized activity.” The goal is always the same – coerce consumers into clicking the link and entering account details, enabling scammers to steal funds or identities.

While scams impersonating banks and financial institutions are nothing new, the ubiquity of text messaging provides fraudsters with direct access to consumers’ phones. The impersonal nature of texts makes it harder to discern legitimate messages from scams. The result is an influx of phishing attempts like this CIBC scam.

How the CIBC Text Message Scam Works

The fraudsters behind this scam are quite strategic in their techniques, maximizing the likelihood that recipients will fall for the trap. Here’s a step-by-step look at how the scam unfolds:

Step 1: Recipients Receive a Text Message

The scam starts with an unsolicited text sent to the victim’s mobile phone. The message appears in the same messaging thread as previous CIBC communications, making it seem like a continuation of prior bank correspondence.

The content references an account restriction, creating a sense of urgency and pressure to take action. The link at the end gives specific instructions where to go to supposedly clear up the issue.

Step 2: Victims Click on the Link

If the text recipient doesn’t recognize this as a phishing scam, they will likely feel inclined to follow the link and address the supposed account restriction right away. The domain name looks believable, and the rest of the message appears legitimate.

In reality, the link goes to a fake website that scammers have designed to mirror CIBC’s real site. Without examining the URL closely, victims won’t realize they are entering account information on a fraudulent platform.

Step 3: Scammers Obtain Sensitive Information

On the phony website, victims will be prompted to enter personal details like:

- Account username and password

- Card number

- Security code

- Social Insurance Number

In some cases, they may be pushed to download malware disguised as “security software” which can harvest credentials directly from the device.

Either way, the scammers now possess all the personal information they wanted to infiltrate accounts and steal funds.

Step 4: Criminals Drain Accounts and Commit Identity Theft

With your username, password, SIN, and full card details, scammers can log into your actual CIBC account and initiate fraudulent transfers. Or, they might impersonate you and open brand new unauthorized credit cards and lines of credit.

Stolen SINs also facilitate tax refund fraud and other forms of identity theft far beyond the original bank account. Your information is sold on the dark web, fueling a global fraud network.

In many cases, victims don’t realize what happened until they notice money disappearing from accounts or fraudulent activity on their credit file. By this point, the scammers have already inflicted significant financial damage.

What to Do If You Fell Victim to the CIBC Text Message Scam

If you received this phishing text and submitted any account information or downloaded suspicious files, take the following steps right away to protect yourself:

Step 1: Contact CIBC Immediately

Call CIBC as soon as possible at 1-800-465-2422 to alert them about the scam and suspected compromise of your account credentials. This will allow them to take action like freezing the account, monitoring for irregular activity, and reissuing new account numbers. The sooner you notify them, the better chance you have of preventing unauthorized transactions.

Step 2: Reset All Account Passwords and Security Questions

Assume your username and password are compromised across the board. Log into all your CIBC accounts and reset your credentials. Create unique, complex passwords for each account using combinations of letters, numbers, and symbols. Avoid reusing the same password anywhere else.

Also reset security questions and update the answers – scammers could potentially access account recovery options with your personal details. Enable two-factor authentication for an added layer of security on all accounts.

Step 3: Sign Up For Credit Monitoring

Check your credit reports and sign up for credit monitoring services. This will alert you about any attempts to open unauthorized accounts in your name so you can take quick action disputing fraudulent activity. Place a fraud alert or credit freeze if you see signs of identity theft.

Step 4: Scan Devices for Malware

If you downloaded any suspicious files the scammers sent, your device could be infected with malware designed to steal personal data. Run a full system scan with updated security software to find and remove any threats. Doing a factory reset is the best way to fully eliminate malware.

Step 5: Block Numbers Associated with Scam

Block the phone number that text originated from and report it on the CNCL (Canadian Anti-Fraud Centre) website. This helps identify the scam source. You can also block potential scam numbers through your mobile carrier by activating scam call identification and blocking tools.

Step 6: Notify Police and Relevant Institutions

File a report with local law enforcement and the Canadian Anti-Fraud Centre. Provide details about how the scam occurred, losses incurred, and information obtained by the scammers. This establishes an official record of the incident.

Also inform the credit bureaus, CRA, and other entities that may be impacted by potential identity theft. The more informed all parties are, the better protected you’ll be against additional repercussions.

Frequently Asked Questions About the CIBC “Restrictions on Your Debit Account” Text Message Scam

1. What is the CIBC “Restrictions on Your Debit Account” text message scam?

This is a phishing scam where victims receive a text message stating that CIBC has implemented restrictions on their debit account due to suspicious activity. The text directs victims to a fake website to supposedly remove the restrictions. However, the website is fraudulent and designed to steal victims’ personal and financial information.

2. How do I recognize the scam text message?

The scam message will include the recipient’s partial debit card number and state that CIBC has restricted their account. It will provide a suspicious link to click on to supposedly remove the restrictions after entering personal information. Legitimate CIBC messages would not request sensitive data via text links.

3. What happens if I click on the link in the text message?

The link goes to a fake website impersonating CIBC’s real website. If you enter any account usernames, passwords, or other requested information, the scammers will steal this data and use it to drain your bank account and commit identity theft.

4. What information are the scammers trying to steal?

The scammers will try to obtain banking usernames and passwords, debit/credit card numbers, SIN, account security questions, and any other details they can use to access accounts and steal your identity. Downloading any files could also result in device malware.

5. Will CIBC actually text me about account restrictions?

No, CIBC will never send texts about account restrictions or request sensitive information over text. Any message of this nature is a scam, regardless of appearing to come from a legitimate CIBC number.

6. What should I do if I fell for this scam?

- Contact CIBC immediately to notify them and try to freeze your account

- Reset all account passwords, security questions, and enable multifactor authentication

- Sign up for credit monitoring to catch any fraudulent activity

- Scan devices for malware if you downloaded anything

- Block the scam number and report it to the Canadian Anti-Fraud Centre

- File a report with police and inform credit bureaus of potential identity theft

7. How can I protect myself from this scam in the future?

- Never click links in unsolicited texts requesting your information

- Manually navigate to any bank website/app to view notifications

- Verify the URL of any page asking for login details

- Don’t call phone numbers sent via questionable texts

- Turn on multifactor authentication as an extra account safeguard

- Monitor bank accounts and credit reports regularly for suspicious activity

- Slow down and contextualize any urgent call-to-action messages before reacting

8. What should I do if I’m worried my device has malware?

Run a full scan with updated security software to try to detect and remove any malware. If malware is found, it’s best to do a factory reset to fully eliminate it from your device and protect your data. Avoid downloading software from unverified sources in the future.

9. How can I report this scam?

You can report details about the scam content, links, and numbers to the Canadian Anti-Fraud Centre. Reporting scams helps identify fraud trends and combat phishing attempts. You should also report it to mobile carriers, CIBC, and police.

10. How can I learn more about protecting myself from scams?

Visit the Canadian Anti-Fraud Centre website for scam alerts and tips. Enable fraud monitoring with your bank and monitor credit reports regularly. Seek guidance on security best practices from financial institutions, mobile carriers, and technology specialists.

The Bottom Line

The CIBC text scam preys upon consumers’ willingness to trust notifications from their financial institutions. The scheme is designed to prompt urgent action before recipients have time to think critically. However, as convincing as these phishing attempts may seem, always exercise caution with unsolicited messages requesting personal information.

Here are key takeaways to protect yourself:

- Never click links in suspicious texts – Manually log into your account via the official mobile app or website to view any notifications.

- Avoid entering information on unofficial domains – Double check that any login page matches the institution’s domain exactly.

- Contact institutions via published numbers – Don’t call numbers provided in a questionable text. Look up the official contact information to validate any issues.

- Enable enhanced account security settings – Turn on multifactor authentication and other features to establish additional safeguards.

- Monitor accounts and credit regularly – This makes it quicker to spot any fraudulent activity and limit consequences.

Exercising vigilance and verifying messages through separate channels is the best defense. If a text creates a sense of urgency or pressure, slow down and contextualize the situation before reacting. Ultimately, your savvy judgment is your most essential fraud fighting tool.