The buzz of a new text lights up your phone. The preview reads “EZPassMA – Pay balance of $4.15 to avoid fees.” Annoyed but resigned, you prepare to pay what you assume is a small toll charge. But before you respond, know this is just the latest Massachusetts E-ZPass scam trying to fool drivers like you.

- Overview of the Massachusetts EZ-Pass Text Toll Scam

- How the Massachusetts EZPass Text Scam Works

- What To Do If You Get the EZPassMA Text

- What To Do If You Paid the EZPassMA Scammers

- How to Avoid Falling Victim to EZPassMA Smishing Scams

- FAQ: The Fake Massachusetts EZPass Toll Fee Text Scam

- The Bottom Line

This article will uncover the truth behind these fraudulent EZPassMA texts demanding quick payment for fake toll fees. You’ll learn the exact techniques scammers use to impersonate state agencies and trick unwitting drivers into providing personal information. We’ll also detail what to do if you receive one of these deceptive texts, and how to protect yourself going forward. Don’t let them cash in on your hard-earned money.

Overview of the Massachusetts EZ-Pass Text Toll Scam

A new smishing scam targeting Massachusetts drivers aims to trick you into paying fake EZPassMA toll fees. Out of nowhere, your phone buzzes with an “urgent” warning from EZDRIVEMA that immediate payment of $4.15 is required for recent toll usage. If you take the bait, your identity and bank account could be at risk.

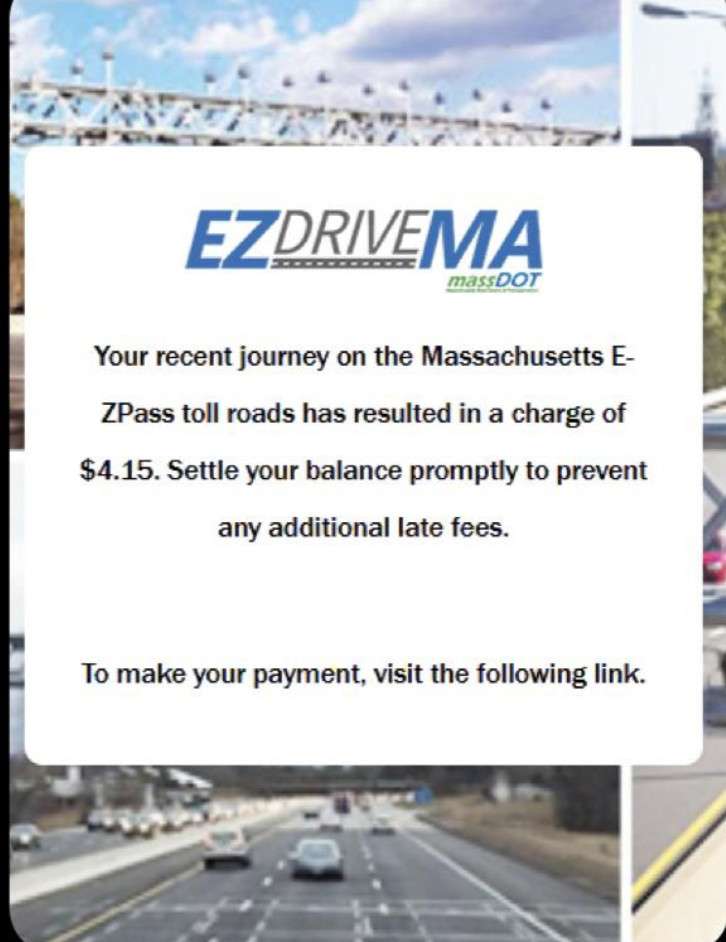

This clever scam starts with a text message stating:

“EZDRIVEMA massDOT Your recent journey on the Massachusetts E- ZPass toll roads has resulted in a charge of $4.15. Settle your balance promptly to prevent any additional late fees.

To make your payment, visit the following link.

hxxps://maeztoll.com”

At first glance, the message appears credible, invoking the name of the state’s EZPass program EZPassMA and the Massachusetts Department of Transportation. But closer inspection reveals red flags. The URL maeztoll.com is not an official state site, and EZPassMA never contacts drivers via text to demand payment. This is a smishing scam – phishing via SMS text messages.

Smishing has exploded in recent years as fraudsters leverage the ubiquity of smartphones to launch broad texting scams impersonating government agencies and businesses. A 2022 Federal Trade Commission report found a median loss of $960 from smishing scams in 2021, quadrupling from 2020. As smishing surges, Massachusetts drivers must stay vigilant of text scams.

In this scam, fraudsters register deceptive domains like maeztoll.com designed to mimic the look and feel of EZPassMA’s site. They blast out texts en masse hoping to snare a few unaware victims. If you click through, you’ll be prompted to enter personal and payment information to settle the fictional toll fees.

With your details, scammers can siphon money through fraudulent charges or sell your identity on the dark web. They may follow up with additional phishing attempts via email or text. Meanwhile, victims are left to deal with drained accounts, identity theft, and damage to their credit and finances.

These toll fee smishing scams cast a wide net, texting millions of unsuspecting drivers across Massachusetts. No target is too big or too small. Their success depends only on the likelihood that a few rushed or unwitting users will fall for the phony texts and provide their details without verifying first.

Some red flags include:

- Messages received out of the blue with no prior toll usage history

- Claims of urgent action required to avoid extra fees

- Links to non-official domains like maeztoll.com

- Requests for personal information like SSN and credit card numbers

- Spoofed numbers in the sender ID mimicking EZPassMA

With the right insights, Massachusetts drivers can confidently delete these fraudulent texts and avoid falling into the trap. Don’t let smishing scammers cash in on your accounts.Share

How the Massachusetts EZPass Text Scam Works

The scammers start by blasting texts en masse to random phone numbers across Massachusetts. By name dropping trusted state agencies, the messages gain instant credibility with drivers. But make no mistake – the entire interaction is a fraudulent attempt to steal your details.

Step 1: Click the Link

The text prompts you to visit maeztoll.com to view and pay the supposed toll balance. But the site you land on is a complete fake designed to mimic official DOT and EZPassMA portals.

While appearing legitimate at first glance, the URL, small spelling errors, and page layout should raise red flags.

Step 2: Submit Your Information

On the phony site, you’re prompted to input personal, contact, and payment details to settle the fictional unpaid toll charges of around $4 to $8.

Requested information includes full name, home address, driver’s license, phone, payment card number, security code, and more. The extensive data harvest fuels the identity theft to follow.

Step 3: Fraudulent Use of Your Details

In possession of your information, scammers can wreak havoc:

- Drain your bank account via connected debit/credit cards.

- Open fraudulent credit accounts under your identity.

- File false tax returns to collect refunds in your name.

- Sell your complete identity profile on the dark web.

You may only realize once you spot unrecognized charges or accounts opened under your SSN. Meanwhile, the scammers move on to repeat the scam and steal more identities.

What To Do If You Get the EZPassMA Text

If you receive this fraudulent text, do not click any links or provide personal information. Take the following steps immediately:

- Delete the text – Don’t even open it after reading the initial preview.

- Call your cell carrier – Report the scam text to have the sender blacklisted.

- Contact EZPassMA – Notify them of texts falsely claiming to be from their brand.

- Monitor accounts – Watch for unauthorized charges tied to any details already shared.

- Change passwords – If you provided login credentials, update passwords as a security precaution.

- File complaints – Report the smishing scam to the FCC and FTC to protect other consumers.

Cut off all engagement with the scammers – further interaction risks more personal data loss. Reporting aids investigators in tracking down texting scams exploiting the EZPass name.

What To Do If You Paid the EZPassMA Scammers

If you already provided your personal information and paid the fake toll fees, don’t panic. But you must act swiftly to limit damages and restore your identity and finances. Follow these steps:

Step 1: Contact Your Bank Immediately

Report any fraudulent charges or withdrawals from your bank account associated with the scam. Ask for any linked debit or credit cards to be cancelled and reissued with new card numbers to prevent further unauthorized charges.

Monitor your accounts closely over the next few weeks for additional suspicious charges tied to your compromised card numbers. Any unauthorized charges should be promptly disputed. Enable text or email alerts on accounts for notifications of payments over a minimum threshold.

Step 2: Place a Fraud Alert on Your Credit

Contact one of the three major credit bureaus – Equifax, Experian, TransUnion – to place an initial 90-day fraud alert on your credit file. This requires creditors to verify your identity before opening new accounts, making it harder for scammers to use your identity.

Updating one bureau will automatically notify the other two to also initiate fraud alerts. You can renew for an extended 7-year alert if identity theft is confirmed.

Step 3: Monitor Your Credit Reports

Check your credit reports frequently for any signs of fraudulent accounts or lines of credit opened in your name by scammers.

You can access free weekly reports from each bureau at annualcreditreport.com. Scan carefully for unrecognized accounts. Dispute any fraudulent accounts immediately with supporting documentation like the identity theft report you’ll file next.

Step 4: File an Identity Theft Report

Submit an identity theft report to the FTC at identitytheft.gov detailing the scam situation and any financial or identity fraud impacts. Provide any evidence you have, like the scam text itself or confirmation of fraudulent charges.

This report can help with recovering from identity theft and undoing financial damages. For example, you can use it to support disputes of fraudulent accounts opened in your name.

Step 5: Update Account Security Precautions

For any account you logged into on the scam site, immediately change your password and security question answers. Enable two-factor authentication anywhere it is offered to require secondary login verification beyond just a password.

Avoid using public WiFi for logging into any accounts, as open networks make your activity easier to intercept. Only login via private, password-protected home and work networks.

Step 6: Watch for Follow Up Scams

Fraudsters who have your details may follow up with additional smishing, phishing, or vishing (voice call) scams. Remain vigilant about unsolicited communications asking for account details or payments. Skip links and call numbers provided – independently look up official sites and helplines.

By taking swift action, you can contain the damage from submitted information and emerge wiser about smishing tactics on the other side. Don’t let slip ups derail your financial health long-term.

How to Avoid Falling Victim to EZPassMA Smishing Scams

Once targeted, drivers must take proactive measures to avoid being scammed again:

- Never click suspicious links or call unknown numbers.

- Independently verify bills and violations through official sites/numbers only.

- Enable multi-factor authentication on accounts when available.

- Use call blocking apps to filter likely scam texts.

- Avoid public WiFi for any finance login or transactions.

- Keep phones and apps updated with the latest security patches.

With improved security habits, Massachusetts drivers can confidently ignore dubious texts about EZPassMA tolls. Don’t let scammers further exploit trusted state programs.

FAQ: The Fake Massachusetts EZPass Toll Fee Text Scam

1. What is the EZPassMA scam text?

The EZPassMA scam text is a smishing fraud impersonating the Massachusetts electronic toll service. You may get a text claiming you owe urgent toll fees and providing a fraudulent website link to pay. The goal is identity theft.

2. How do I recognize the EZPassMA scam text message?

Red flags include texts out of nowhere demanding immediate payment, threats of fees, odd URLs like maeztoll.com, and requests for personal data. Legitimate EZPassMA texts would only come after enrollment in their service.

3. What happens if I click the link in the scam text?

The link goes to a fake website dressed up to look real asking for your personal information to process fake toll payments. Any details entered expose you to identity theft once in criminal hands.

4. How do scammers get my phone number?

Scammers use robodialing programs to text random numbers across Massachusetts casting a wide net for victims. Your number may also have been leaked in a data breach then sold on the dark web.

5. What are the scammer’s end goals?

Scammers aim to get your personal information to open fraudulent accounts or make unauthorized charges in your name. They may also sell your identity and details on the dark web for other criminals to abuse.

6. What should I do if I got the scam text?

If you get it, delete it immediately without clicking the link. Check your real EZPassMA account through their official site. Report the scam text to your cell provider and EZPassMA.

7. What if I already entered my information?

Contact your bank immediately about any fraudulent charges. Place an initial fraud alert on your credit files. Continuously monitor bank and credit accounts for additional identity theft.

8. How can I avoid future text scams?

Use call blocking apps to filter likely scams. Enable multi-factor authentication when available. Never click links in odd texts – call or visit real websites instead. Don’t provide personal information by text.

9. How can I report the EZPassMA scam text?

You can report the smishing attempt to EZPassMA, the FCC, your mobile carrier, the FTC’s Complaint Assistant, and the FBI’s IC3.

10. How can I identify smishing scams in general?

Look for suspicious links, threats, spoofed sender IDs, and requests for your personal data as red flags. Verify any payment demands directly with companies through official sites or customer service lines.

The Bottom Line

Use caution if you get a text out of the blue demanding payment for EZPassMA toll fees. Scammers impersonate real agencies hoping you pay first and ask questions later. But legitimate toll programs won’t demand urgent fees via unsolicited SMS messages. Recognize these telltale scam signs to protect your identity and hard-earned money.