Parking tickets and unpaid invoices can be a frustrating and expensive hassle for drivers. However, scam artists are now exploiting this common nuisance to try and steal your personal and financial information.

Recently, phony texts purporting to be from the City of Houston have been making the rounds, claiming you have an outstanding parking ticket that must be paid immediately. While it may seem legitimate at first glance, this is nothing more than a scam designed to trick you into handing over sensitive data.

In this comprehensive guide, we will break down exactly how the Park Houston scam works, provide tips on how to avoid falling victim, and outline what to do if you have already been targeted.

Overview of the Park Houston Unpaid Parking Invoice Scam

The Park Houston Unpaid Parking Invoice scam starts with an unsolicited text message sent to random cell phone numbers across the Houston area. The message claims to be from the City of Houston and states that the recipient’s vehicle has an $4.35 unpaid parking invoice that must be settled immediately to avoid additional late fees.

A fraudulent website link is included, typically something along the lines of parkinghou.com or houstonparking.org. The scam texts use threatening language about “disconnection” or “penalties” if you do not pay right away. Some even use the City of Houston logo and official branding to appear more realistic.

However, this is all an act put on by scammers hoping victims will click the link and enter their personal and financial information without thinking. The fake parking invoice is completely fabricated. The scammers are phishing for credit card numbers, birth dates, addresses, and other identity theft data.

Unfortunately, many people fall for this scam every year, lured in by the seemingly urgent notice about unpaid tickets. The scammers rely on creating a sense of panic so that victims act before considering whether the message is authentic. But now that you know this is a common ploy, you can keep your wits about you.

How the Park Houston Unpaid Invoice Scam Works

Let’s look at exactly how this parking ticket scam unfolds, step-by-step:

1. You Receive an Unsolicited Text About an Unpaid Ticket

The scam starts with a text sent to your cell phone stating that your vehicle has an outstanding parking invoice in Houston that must be paid immediately. The amount listed is usually relatively small, around $5 to $15, so that it seems more credible.

The message will typically say you need to pay to avoid late fees or other penalties. Some versions threaten “disconnection” or even towing if you do not pay right away. This creates a sense of urgency.

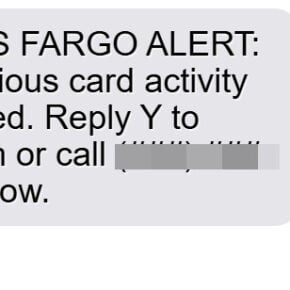

Here is how a typical message look:

This is a notice from City of Huston. Your vehicle has an unpaid parking invoice of $4.35. To avoid a late fees of 35$, please settle your balance promptly.

To avoid disconnection, please make a payment immediately by typing the link in your browser.

https://parkinghou.com

2. The Text Includes a Suspicious Link

The scam message includes a link to supposedly settle the unpaid invoice. The website URL looks semi-official, often using “Houston” or “ParkHouston” in the name. Examples include parkinghou.com, houstonparkingviolations.org, or parkhouston.org.

However, upon closer inspection, you will notice that these websites are not legitimate City of Houston domains. This is a huge red flag that indicates the link is a scam.

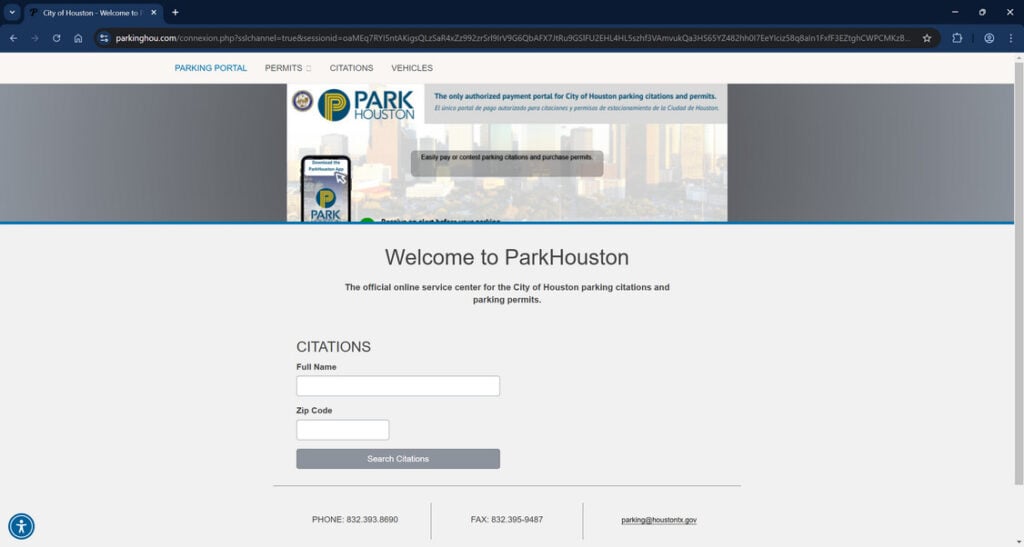

3. You Click the Link and Are Taken to a Fake Payment Page

If you unfortunately click the link, you will be taken to a fake parking ticket payment website. The site looks professional at first glance, showing the supposed unpaid invoice amount and a form to enter your personal and payment details.

You may even see the City of Houston logo and branding copied straight from the real City government website. This is all an act to trick you into thinking the site is legit.

4. You Enter Your Personal and Financial Information

The fake payment page will have forms asking you to enter sensitive personal and financial information, including:

- Full name

- Date of birth

- Home address

- Phone number

- Email address

- Credit card number

- Card expiration date

- CVV security code

If you submit this data, you are handing everything a scammer needs to steal your identity and money to the criminals behind this scam.

5. The Scammers Steal Your Information for Identity Theft

Once you click Submit, the scammers immediately gain access to all the details you entered. They can now use this information to open fraudulent accounts in your name, make purchases with your credit card, or sell your data on the dark web.

You may also suddenly start receiving more spam calls and texts, as scammers can sell phone numbers to shady telemarketers. Or they may target you for additional scams in the future now that they have your data.

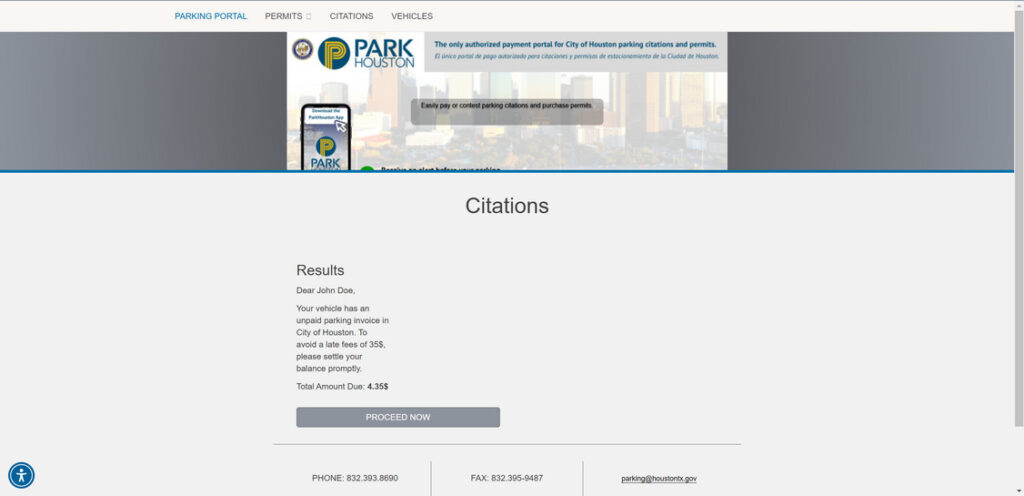

6. You Never Actually Pay Any Parking Invoice

Finally, the most insidious part of this scam is that you never actually pay any real unpaid parking invoice to the City of Houston. The entire notice is fabricated. The scammers pocket all the financial details you entered without paying a cent toward any legitimate fine.

So you go from thinking you paid a small ticket fee to having your identity and money stolen. This is why it is critical to recognize the signs of parking ticket scams before mistakenly handing over any of your info.

What to Do If You Have Fallen Victim to the Scam

If you unfortunately submitted personal or financial data through one of these parking ticket scams, here are the steps you should take right away:

Contact Your Credit Card Company and Banks

Your first call should be to the bank that issued the credit card you entered on the scam website. Report the fraudulent charges so they can quickly shut down your card and prevent any unauthorized transactions.

Also contact your bank and any other financial accounts to alert them that your information was compromised. Work with them to put holds or extra security measures in place to protect your assets.

Place a Fraud Alert on Your Credit Reports

Notify all three major credit bureaus – Equifax, Experian, and TransUnion – to place a fraud alert on your credit reports. This signals lenders to be extra vigilant about any new accounts opened in your name.

Also closely monitor your credit reports yourself for any suspicious activity. Check your reports from each bureau every few months for the next year.

Reset All Account Passwords

Take the time to reset the passwords and security questions for every online account associated with the compromised information. If the scammers gained access to your email, phone, or home address along with financial data, they may try break into other accounts too. Refreshing your passwords locks them out.

File a Police Report

Filing an official incident report with local law enforcement creates a paper trail of the scam. This can help if you need to dispute fraudulent charges or accounts later. The police may also be able to trace patterns to identify the scammers targeting people in your area.

Learn From the FTC’s IdentityTheft.gov

Finally, IdentityTheft.gov from the Federal Trade Commission is an excellent resource on all the best steps to take after a scam and how to monitor and safeguard your personal data going forward. Bookmark it in case you need guidance responding to identity theft down the line.

Frequently Asked Questions

1. I received a text about an unpaid parking ticket in Houston. Is it real?

No, this is likely a scam. The City of Houston does not contact residents via text message about unpaid parking invoices. Any communication would come via mail. Be wary of texts demanding payment, even if they seem official.

2. What details are included in the scam parking texts?

The fraudulent texts mention specifics like an outstanding balance of $4.35, threats of a $35 late fee, and a link to supposedly settle the payment. The texts appear credible by citing real locations, departments, and fees. But it’s all a scam designed to steal your information.

3. What happens when you click the link in the text?

The link goes to a fake website asking for personal and payment information to process the parking invoice. However, it’s a phishing scam to harvest your credit card number, birth date, address and other sensitive details. Don’t enter any information.

4. How can I tell if a parking violation text is fake?

Warning signs include being contacted via text, threats of immediate late fees, and requests for personal/payment data.Houston only communicates parking violations via US mail. Legit texts will never demand immediate payment or sensitive information.

5. What should I do if I got one of these scam parking texts?

Do not click any links, provide information, or make payments. Report the scam text to the Houston Police Department at 713-884-3131. You can also file a complaint with the FCC and forward the text to 7726 (SPAM). Delete the message.

6. Could I get in trouble if I don’t pay the scam parking bill?

No, there is no real unpaid invoice so you cannot get in trouble. The texts are sent at random hoping to fool victims. Disregard any threats made in the phishing texts about penalties or fees.

7. How can I avoid falling for phishing text scams?

Be wary of any texts demanding immediate payment, threatening fines if you don’t pay, or asking for personal information. Contact the organization through an official channel to verify legitimacy. Don’t click links or call numbers in suspicious texts.

The Bottom Line

Deceptive parking ticket scams are on the rise as fraudsters get more clever with realistic-looking fake texts and websites. But now that you know exactly how these ploys work, you can avoid being fooled if you ever receive a suspicious unpaid invoice notice.

Legitimate cities like Houston will never text you out of the blue demanding immediate payment on a parking fine. Carefully inspect any links and urgently worded messages about overdue tickets. And never enter personal or financial data on a website you did not visit directly through an official government domain.

Stay vigilant about phony unpaid parking scams, and steer clear of handing over your info. With smart practices, you can protect your identity and accounts from sneaky fraudsters looking for their next victim. Don’t let them take you for a ride.