Have you received an email claiming you’ve won millions of dollars from the Federal Reserve? This increasingly common scam attempts to swindle unsuspecting recipients out of their hard-earned money. Read on to learn how to identify this fraudulent email and protect yourself.

Overview of the Scam

The Federal Reserve Award scam starts with an email sent to random recipients across the country. The message enthusiastically claims the recipient has been awarded an incredible sum of money, usually $2 to $3 million, through a “randomized selection process” conducted by the Federal Reserve.

To claim the non-existent prize, the recipient is instructed to contact an email address provided in the message. This kicks off a process designed to extract sensitive information and money from the victim.

Unfortunately, this tantalizing promise of instant wealth is a complete fabrication. The Federal Reserve does not conduct prize drawings or grant individuals millions of dollars out of the blue. The emails are sent out randomly in the hopes of luring in gullible responders.

While the presentation varies slightly, the scam email usually includes:

- An attention-grabbing subject line, such as “Congratulations! You’ve Won!” or “Selected to Receive Millions!”

- An opening expressing enthusiasm and excitement about the “winnings.”

- Mention of an extravagant cash prize in the millions.

- False claims that the recipient was chosen through a “random selection process” or “computer ballot system.”

- Instructions to contact an email address or agent to begin the prize collection process.

- A fake name representing the Federal Reserve or another government agency.

- A “Claim ID” number the recipient is supposed to reference.

- Congratulatory language expressing how thrilled the Reserve is for the recipient.

The sophisticated scam plays on people’s desire to be specially selected to receive life-changing amounts of unexpected cash. But in reality, the only special selection process is the scammers randomly targeting as many email addresses as possible.

How the Federal Reserve Award Scam Works

Once recipients respond to the Federal Reserve scam email, they enter a sequence of events designed to steal their money and important personal information. Here is a step-by-step explanation of how the predatory scheme unfolds:

Step 1: Initial Response to Scam Email

The scam begins when the target responds to the deceptive email, either by contacting the fake Federal Reserve representative or simply replying to express excitement or ask questions. The scammers immediately know they’ve hooked a potential victim.

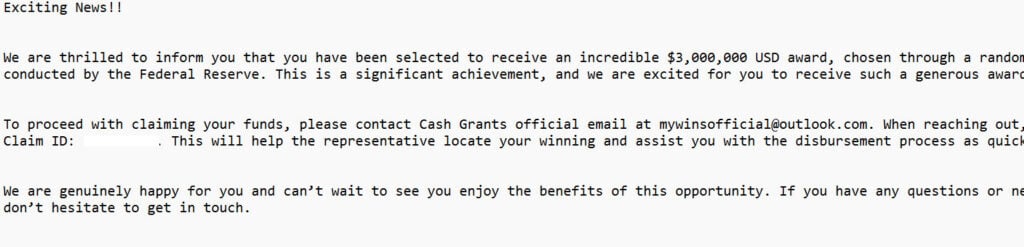

The email scam might look like this:

Subject: Breaking News: Notification as an Official Winner from the Fedrl Reserve $3 Million USD Prize Awarded

Exciting News!!

We are thrilled to inform you that you have been selected to receive an incredible $3,000,000 USD award, chosen through a randomized selection process conducted by the Federal Reserve. This is a significant achievement, and we are excited for you to receive such a generous award!

To proceed with claiming your funds, please contact Cash Grants official email at mywinsofficial@outlook.com. When reaching out, be sure to include your Claim ID: . This will help the representative locate your winning and assist you with the disbursement process as quickly as possible.

We are genuinely happy for you and can’t wait to see you enjoy the benefits of this opportunity. If you have any questions or need further assistance, don’t hesitate to get in touch.

Congratulations once again!

Estevan Hernandez

Federal Reserve Bank Representative

Federal Reserve System

Step 2: Follow-Up From “Representative”

A scammer posing as a Federal Reserve employee responds enthusiastically and asks the target to complete a form with personal information like their full name, birthdate, address, and bank details. This starts the process of identity theft and obtaining access to the victim’s finances.

Step 3: Phony Fees and Taxes

After the target provides the requested personal information, the “representative” follows up explaining there are essential fees and taxes to be paid before the non-existent prize funds can be released. The unsuspecting victim is asked to pay these supposed costs upfront, usually through wire transfer or prepaid gift cards.

Step 4: More Fake Fees and Urgency

Once the victim wires over an initial sum, the scammers invent new reasons more money is required before funds can be disbursed. They may claim additional transfer fees, processing costs, or taxes and duties need to be covered. Messages insist immediate payment is essential and urgency is applied to pressure the target.

Step 5: Continued Demands for Money

The charade continues as long as the scammers can siphon money from the victim. The phony narratives become more complex and urgent as the scammers insatiably demand more funds. Once the target stops paying, they are often threatened with legal action or consequences.

Step 6: The Big Letdown

At some point, the victim either realizes it’s a scam or simply runs out of money. The charade falls apart when the promised millions never appear. Calls to the “representative” go unanswered, and the scammers disappear with the stolen funds. The target is left with financial loss, a compromised identity, and no prize.

As you can see, the scammers leverage the victim’s excitement and trust to methodically extract money through deception and manipulation. The ruse continues as long as they can come up with new fictional emergencies requiring immediate payment.

Common Characteristics of the Federal Reserve Award Scam

While specifics vary between individual scam attempts, there are common themes and characteristics to be aware of:

- Unsolicited Initial Contact: Recipients did not enter or request to be part of any Federal Reserve contest or award program. The contact happens completely unprompted.

- Too Good to Be True: Instantly winning millions without any action or purchase seems highly improbable. Claims that funds are coming from the U.S. Federal Reserve also raise suspicion.

- Random Selection Claims: Language about computer ballot randomization or selection processes is used to make the supposed win seem legitimate. But no such contests truly exist.

- Requests for Personal Financial Information: No legitimate contest or government agency would request upfront fees or your banking and personal details before disbursing prize funds.

- Urgent Requests for Payment: Scammers introduce fictional emergencies supposedly requiring additional fees before funds can be released. This tricks the victim into wiring money quickly without thinking.

- Pushy Representatives: If questioned or slowed down, the “representatives” become aggressive and pushy, insisting funds will be forfeited if the victim fails to act quickly.

- No Free Option: There is never a zero-cost way to secure the promised winnings. Fees and taxes are required upfront, always at the victim’s expense.

- Disappearing Act: Once discovered, scammers abandon all communication and disappear with the money, leaving the target with nothing but loss and regret.

Paying attention to these typical scam characteristics can help recipients identify and avoid being conned. If an email or call sets off warning signals, proceed with extreme caution.

What to Do If You Are Targeted by This Scam

If you receive a suspicious email claiming you have won millions from the Federal Reserve, here are important steps to take:

- Do Not Respond or Contact: Avoid replying to the scam message or calling any provided phone numbers. This alerts scammers you’re a willing target and they will aggressively pursue you.

- Report the Email: Forward scam emails or screenshot scam voicemails and report them to spam@uce.gov. This helps authorities track and shut down scams.

- Check Credit Reports: Request free annual credit reports at AnnualCreditReport.com to identify any signs of existing identity theft or accounts opened in your name. Consider placing a credit freeze if you suspect financial fraud.

- Monitor Statements: Review financial statements frequently for any unusual or unauthorized charges. Report any suspicious transactions to your bank or financial institutions immediately.

- Change Passwords: Reset the passwords on your email, financial, and other major accounts. Use strong unique passwords to protect each account. Enable two-factor authentication wherever possible.

- Beware of Any Calls or Emails Requesting Money or Information: Never provide personal or banking details, wire money, or pay claimed fees in response to unsolicited outreach. Stop all communication if asked for such information.

- Educate Yourself on Scams: Learn about additional online and phone scams consumers should watch out for. Knowledge can prevent you from being victimized.

- Share Warnings: Help spread awareness by warning family and friends, especially senior citizens who may be frequent scam targets. Report fake emails or fake websites to the appropriate companies. Post scam alerts on neighborhood groups and social media.

The Federal Reserve scam can seem convincing thanks to urgent, enthusiastic language and tantalizing promises. But knowing the scheme’s red flags and likely progression can help recipients recognize and shut down the fraud before any damage is done. Caution and awareness are your best defenses.

Frequently Asked Questions About the Federal Reserve Scam Email

Wondering if that email you received promising millions from the Federal Reserve is legitimate or how to protect yourself? This comprehensive FAQ answers common questions about this widespread scam.

Is the Federal Reserve really giving away millions of dollars randomly?

No, the Federal Reserve does not run contests, lotteries, or prize draws to award millions of dollars to random individuals. Any communication stating you specifically have been selected to receive millions is certainly fraudulent.

How does the Federal Reserve scam email work?

The initial email claims you won millions through a fake Federal Reserve contest. Responding initiates demands for personal information and payments to cover supposed fees and taxes before funds can be released. Scammers then invent reasons you must send additional funds urgently, siphoning as much money as possible.

Are these scam emails targeted or sent randomly?

The messages are sent randomly en masse, often using botnets or hacked accounts to distribute them. They are not targeted to specific individuals. The scammers use broad randomization hoping to bait response from as many recipients as possible.

Does the Federal Reserve really require fees before awarding contest winnings?

No, the Federal Reserve does not award contest winnings or require any upfront fees or payments. These are fabricated emergencies to trick victims into wiring money to the scammers. No legitimate sweepstakes would require you to pay fees or taxes simply to receive funds you won.

Should I respond to an email notifying me I won Federal Reserve money?

No, you should never respond to messages claiming you won money from the Federal Reserve. Any response signals willingness to engage and kicks off demands for money and information. Forward scam emails to spam@uce.gov and delete.

What personal information do the scammers ask for?

Scam emails often request targets complete a form providing their full name, physical address, phone number, birthdate, Social Security number, bank account details, and other sensitive identifying and financial information. This enables identity theft and account access.

What should I do if I already responded and provided information?

Immediately contact your bank, financial institutions, and credit bureaus to report potential identity theft and request fraud alerts on your accounts. Change online account passwords, enable two-factor authentication, and monitor your financial statements vigilantly for unauthorized activity.

Can the scammers really seize or freeze my bank account or assets?

No, the scammers cannot legally seize or freeze accounts or assets. Those are fabricated threats designed to frighten and pressure victims. However, protect your information and accounts, since provided details could enable fraud. Monitor closely and report unauthorized charges promptly.

Should I report scam emails pretending to be from the Federal Reserve?

Yes, you can help shut down scams and prevent others from being defrauded by reporting fraudulent emails to spam@uce.gov. You can also forward scam emails to the Federal Reserve at phishing@frb.gov and contact the FTC to file a scam report.

How can I identify and avoid email phishing scams?

Be wary of unsolicited emails asking you to click links or provide sensitive information. Look for poor grammar, fake addresses, urgent demands, and phony claims. Never wire money based on an email. Try to independently verify any requests by contacting the company.

Stay vigilant against out-of-the-blue communications that tempt you with false promises. Actively protecting your information and accounts can help you avoid being scammed.

The Bottom Line

The supposed Federal Reserve email award scam is a complete fabrication designed to trick trusting recipients and steal their money. No legitimate government agency or organization is contacting people at random and granting them millions of dollars.

If an unsolicited email appears in your inbox promising lottery-like winnings from the Federal Reserve, ignore it completely or report it. Any response kicks off a sequence of financial extraction and identity theft. Exercise extreme care when contacted out of the blue with over-the-top, money-oriented offers.

Rather than excitedly responding to the fraudulent email, take sensible precautions like checking credit reports and financial statements. Look out for additional phishing attempts using this scam narrative. Share what you’ve learned to help friends and family identify and steer clear of this insidious financial fraud.

![Remove Adwizz.net Pop-up Ads [Virus Removal Guide] 4 McAfee scam 4](https://malwaretips.com/blogs/wp-content/uploads/2023/08/McAfee-scam-4-290x290.jpg)