A new phishing scam targeting Alpine Bank customers has emerged in recent weeks. The scam takes the form of a text message that claims the recipient’s Alpine Bank account has been placed on hold for security reasons. The message contains a malicious link that leads to a fake Alpine Bank login page designed to steal usernames, passwords, and other sensitive information.

In this comprehensive guide, we will expose the inner workings of the Alpine Bank scam text message, provide tips on how to identify and avoid it, and detail steps you can take if you suspect your account information has been compromised.

Overview of the Alpine Bank Scam Text Message

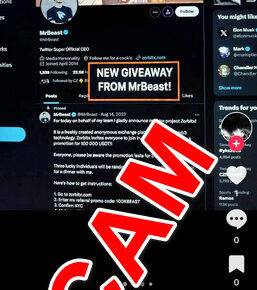

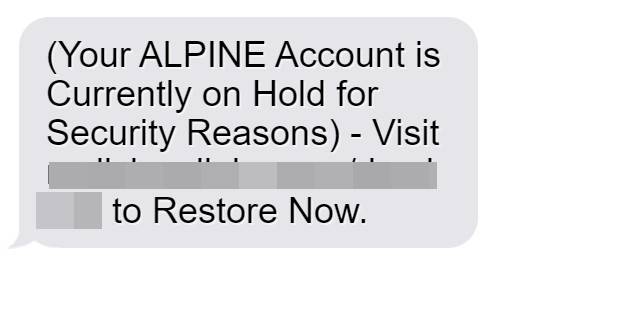

The Alpine Bank scam message is being spread via SMS text to consumer cell phones across the United States. The message reads:

“Your Alpine Account is Currently on Hold for Security Reasons – Visit [malicious link] to restore it.”

The text appears to originate from a local 10-digit phone number and provides no other identifying information about the source.

The link included in the text directs to a fake Alpine Bank login page that bears a striking resemblance to the real Alpine Bank website. However, upon closer inspection, subtle differences in the URL and branding reveal that it is a scam.

Entering usernames and passwords on this malicious site will expose sensitive account details and personally identifiable information directly to criminals running the phishing scam.

This is just the latest example of a rampant scam tactic – the use of fake security alerts to trick unsuspecting consumers into giving up their personal information.

By claiming that the recipient’s account is on hold for security reasons, scammers prey upon the consumer’s fear of being locked out of their account. This creates a sense of urgency to take immediate action by clicking on the link and logging in.

In reality, the scammers have no access to or control over the recipient’s real Alpine Bank account. But for those that take the bait, the consequences can be dire.

Detailed Breakdown of the Alpine Bank Scam Text Message

Now that we’ve outlined the general scam, let’s do a more in-depth analysis of the various components that make it work:

1. The Text Message Itself

The core element enabling this scam is the text message. Scammers are able to spread text scams widely by utilizing SMS spoofing technology. This allows them to mask the origin of the texts by making them appear to come from local phone numbers.

In the case of the fake Alpine Bank alert, using SMS spoofing provides two main benefits to the scammers:

- The local number format builds trust and familiarity, increasing the likelihood that recipients will assume the message is legitimate.

- The anonymous nature of the spoofed numbers makes it extremely difficult to track down the source of the scam messages.

The text message is concise and gets straight to the point with an alarming statement that the recipient’s account is on hold. The goal is to get the recipient to click the link out of fear and urgency without closely analyzing the message source or legitimacy.

2. The Malicious Link

At the end of the text is a link presumably leading to Alpine Bank’s website. However, the URL directs to a fake site set up by the scammers instead.

The domain name in the link may initially look like Alpine Bank’s real website. However, upon closer inspection, subtle differences reveal it is not the actual Alpine Bank site.

For example, the link domain may use an alternate spelling like alpinebankk.com or include additional words like alpinebankonline-authentication.com.

These techniques allow phishing links to bypass filters and trick users into believing they lead somewhere legitimate. Clicking the link on either a desktop computer or mobile device will typically open a convincing copy of the real Alpine Bank login page.

3. The Fake Alpine Bank Website

The fraudulent website accessed through the phishing link in the text is designed to mimic the real Alpine Bank login page. The scammers will use Alpine Bank’s logo, colors, fonts, images, and overall visual design to make their fake site appear authentic.

To the untrained eye, the phishing site looks like a perfect replica. However, paying attention to small details can reveal its illegitimacy.

Subtle spelling errors, slightly altered branding, or an incorrect URL are signs that something is amiss. The scam website’s URL may not match Alpine Bank’s actual domain – alpinebank.com.

Additionally, the site is not hosted on Alpine Bank’s servers and has no real connection to the actual online banking system. Any login credentials entered on the phishing site will be harvested by the scammers rather than authenticating through Alpine Bank’s real protocols.

4. Stealing Usernames, Passwords, and Financial Data

The ultimate goal of the fake login page is to trick users into entering their Alpine Bank usernames, passwords, and other sensitive information.

Account holders who believe the text alert and urgently try to unlock their “frozen” accounts by logging in at the phishing site will unwittingly expose their login credentials directly to the scammers operating it.

In addition to usernames and passwords, the site may also aim to phish for other personal and financial details such as:

- Full name

- Email address

- Phone number

- Bank account and routing numbers

- Credit/debit card numbers

Victims may also be prompted to install fake “security software” which can infect their devices with malware like keylogging programs to steal data.

With logins, account info, and identity details in hand, scammers can break into Alpine Bank accounts, steal funds, open fraudulent credit lines, and commit identity theft using the names of their victims.

How the Alpine Bank Scam Text Message Works

Now that we have dug into the specific components of the scam text message, let’s outline the step-by-step process of how the Alpine Bank phishing scheme works to compromise unsuspecting consumers:

Step 1) Scammers Obtain Consumer Cell Phone Numbers

Like most phishing scams, the Alpine Bank text message scam starts with gathering a large swath of targeted consumer contact information.

The scammers acquire cell phone numbers through various legal and illegal data harvesting techniques:

- Buying consumer data from the dark web that was stolen in previous data breaches

- Utilizing phone number list generating bots that randomly combine exchanges and numbers

- Purchasing cell phone lists from shady data brokers

- Accessing public phone directory listings

- Harvesting numbers directly from public social media profiles

Cell phone numbers tied to Alpine Bank customers are the prime target. But scammers will also send the scam texts out randomly to general consumer numbers hoping to get a bite.

Step 2) Spoof Texts Are Sent from Local Numbers

Armed with consumer phone numbers, the scammers leverage SMS spoofing technology to disguise the origin of their scam texts.

Third-party SMS spoofing services allow scammers to auto-generate and send high volumes of texts from local 10-digit phone numbers. This provides two key advantages:

- Hiding the real source of the texts since they aren’t coming from the scammer’s device directly.

- Increasing perceived legitimacy and trust by making the messages appear to come from phone numbers familiar to the recipients’ locale.

From the recipients’ perspective, the texts look no different than any other normal message originating nearby. They have no way to discern these are spoofed texts spreading a phishing scam.

Step 3) Messages Claim Recipient’s Account is Frozen

Millions of the scam texts are sent to consumer phones over a short period of time. Each message is personalized to reference “Your Alpine Account” in the text.

The message states that the recipient’s account has been placed on hold for security reasons. This creates a sense of urgency and panic, playing upon the fear of being suddenly locked out of one’s account.

No mention of the reason for the account hold or explanation from Alpine Bank is provided. This is meant to pressure recipients into clicking the link to hastily unlock their account without asking further questions.

Step 4) Link Leads to Fake Alpine Bank Login Page

Included in the text message is a link presumably leading back to Alpine Bank’s website so recipients can remedy their frozen account.

However, clicking the link actually takes recipients to a fake Alpine Bank login page that the scammers have mocked up to replicate the real thing.

The URL may initially look correct or close to the real Alpine Bank site. But upon closer inspection subtle differences reveal the fraudulent nature of the phishing site.

Step 5) Users Expose Login Credentials and Personal Info

Victims who click the link in urgency are taken in by the authentic look and feel of the phishing site. Believing it to be Alpine Bank’s real login page, they quickly enter their usernames and passwords to get back into their account.

Scammers will also utilize psychological tricks and design elements to further manipulate users into entering additional sensitive data like card numbers, account details, SSNs, and more.

Meanwhile, everything inputted on the fake site flows directly to the scammers rather than Alpine Bank’s real systems.

Step 6) Criminals Leverage Stolen Data for Financial Fraud

With usernames, passwords, full names, email addresses and other personal data in hand from those compromised by the phishing site, the scammers move on to stage two of the scam.

They first leverage the stolen Alpine Bank credentials to break into victims’ real accounts and drain any available funds.

Beyond that, the scammers then utilize the emails, names, numbers and other details to commit broader identity theft – taking over accounts at other institutions, opening fraudulent lines of credit, filing false tax returns, and selling the data on the dark web.

The Alpine Bank phishing scam highlights why constant vigilance is so crucial in the modern world rife with data breaches and identity theft. A single slip can have disastrous financial consequences if scammers acquire your sensitive personal or account information.

What to Do If You Have Fallen Victim to the Scam

If you suspect you have fallen prey to the fake Alpine Bank security alert text message scam, immediate and decisive action is required to protect yourself from financial loss or identity theft. Here are the key steps to take right away:

Step 1: Contact Alpine Bank

Your first call should be directly to Alpine Bank via their legitimate customer service line.

Explain that you believe you were tricked by a phishing scam and entered your online banking credentials on a fake website accessed through a text message link. Alpine Bank will be able to quickly check whether your real account has been accessed or compromised.

Step 2: Reset Online Banking Password and Enable Extra Security

Once you have Alpine Bank on the line, request an immediate reset of your online banking password. This will revoke the phishing site’s access to your account if the criminals have already logged in.

Creating a brand new, strong password that scammers have not seen previously will secure your account. Enable any additional multifactor authentication options Alpine Bank provides as well.

Step 3: Closely Monitor Your Accounts

Carefully scrutinize all banking and financial accounts that you access online, not just Alpine Bank. Check balances, transactions, credit lines, and statements to detect any fraudulent activity stemming from your leaked credentials or personal details.

Look out for stolen funds, password changes, new account openings, suspicious charges, and more. Promptly report any fraud to your bank’s real fraud department. Signs of identity theft at other institutions also need to be addressed quickly.

Step 4: Place Fraud Alert and Freeze Credit

Since scammers may now possess personally identifiable information like your SSN, full name, birthday and address, you should take measures to lock down your credit.

Place an initial 90 day fraud alert on your credit by contacting one of the three credit bureaus. You can also freeze your credit with each bureau to fully block identity thieves from opening any new credit in your name.

Step 5: Change Email and Other Account Passwords

Think beyond just your Alpine Bank account. Change passwords, security questions and pin numbers on any other sensitive online accounts that scammers may attempt to access with your leaked credentials.

Prioritize accounts tied closely to your finances, such as email, credit cards, other bank/investment accounts, utilities, loans, and retail sites where your payment info is stored. Enabling two-factor authentication provides an extra layer of account security as well.

Step 6: Scan Devices for Malware

If you entered extensive information into the phishing site, scammers may have tried to trick you into downloading fake “security software” that instead loads spyware, keyloggers or info-stealing malware onto your device.

Run a Malwarebytes on your computer or smartphone to uncover and remove any dangerous programs that could be harvesting your sensitive data in the background. A device reset may be required in severe cases.

Step 7: Learn From The Experience

While this scam put your finances at risk, making it through the ordeal also provides an invaluable real world lesson.

Use the experience to cement best practices that will keep you safer moving forward:

- Never click links in unsolicited texts, even if they look official. Manually open sites instead.

- Double check URLs of linked sites and look for misspellings or odd words.

- Enable multifactor authentication whenever available.

- Never enter sensitive data on sites you access through text message links.

- Keep software patched and utilize antivirus protection.

- Set up text and email alerts on accounts to monitor suspicious activity.

With vigilance and caution moving forward, you can emerge wiser and better prepared to evade the next scam attempt.

Here is a FAQ section covering common questions about the Alpine Bank scam text message:

Frequently Asked Questions

What is the Alpine Bank scam text message?

The Alpine Bank scam is a phishing text message stating that the recipient’s Alpine Bank account is frozen for security reasons. It contains a malicious link to a fake Alpine Bank login page to steal account credentials and personal information.

How does the phishing text message work?

The text message is sent en masse to consumer cell phones via SMS spoofing technology that masks the origin. The text’s alarming security alert tricks users into urgently clicking the link to regain account access without verifying legitimacy.

What happens when you click the link?

The link goes to a convincingly designed but fake Alpine Bank login page controlled by scammers. Any data entered like usernames, passwords, SSNs, etc gets directly sent to criminals rather than Alpine Bank’s real website.

How do scammers profit from the phishing site?

Stolen login credentials let scammers break into victims’ Alpine Bank accounts to steal funds. Personal details enable broader identity theft to open fraudulent credit or steal money from the victim’s other accounts.

What are the red flags of the phishing text message?

Red flags include the unsolicited nature of the text, the anonymous sender, the high pressure security alert tactic, misspellings/odd URLs, and page design inconsistencies.

What should I do if I got the scam text message?

Do not click the link or provide any personal information. Contact Alpine Bank directly through their official number to check your account’s security. Legitimate companies don’t send account freeze alerts via unverified links.

What if I already clicked the link and entered information?

Immediately contact Alpine Bank to reset your password and check for fraudulent activity. Place a fraud alert on your credit, scan devices for malware, change passwords on other accounts, and learn from the experience to improve security habits.

How can I protect myself from this scam in the future?

Never click links in unsolicited texts, double check URLs before entering info, use multifactor authentication when available, and monitor accounts closely for suspicious activity. Report any phishing attempts directly to the legitimate company.

In Conclusion

The fake Alpine Bank SMS phishing scam exploiting a security alert about frozen accounts serves as an urgent reminder of the need for consumer savvy in the digital age.

Sophisticated use of social engineering in the text message preys upon our fear of being locked out of vital financial accounts. The deceivingly authentic-looking phishing site tricks users into handing over the keys to their identities.

With compromised accounts, stolen funds, and ruined credit scores so easy to come by at the hands of scammers, we must employ healthy skepticism before clicking links or providing sensitive data.

Double checking sender information, analyzing URLs closely, utilizing multifactor authentication, and enabling account alerts can mean the difference between avoiding or falling prey to a devastating phishing scam.

Heed the cautionary tale of this Alpine Bank text message scam, and commit to being an informed and proactive steward of your own sensitive personal and financial data moving forward. With care and vigilance, you can protect your accounts and identity even as phishing ploys grow more sophisticated.

Key Takeaways

- A new phishing scam targets Alpine Bank customers via a fake security alert text about accounts being frozen.

- The text contains a malicious link leading to a fake Alpine Bank login page to harvest user credentials.

- Consumers should never click links in unsolicited texts and should have their guard up about text-based scams.

- If you entered info, immediately contact Alpine Bank, reset your password, check accounts for fraud, place a fraud alert on your credit, and scan devices.

- Use this scam as a teaching moment to improve security practices and phishing awareness.