In the fast-paced world of cryptocurrency, new scams seem to emerge every day that prey on excited investors looking to make quick profits. One such scam that has recently gained traction is called BlackRockFund. This comprehensive article will provide an in-depth look at how the BlackRockFund scam works, who is behind it, and most importantly, how to avoid becoming a victim.

With the rising popularity of cryptocurrencies like Bitcoin and Ethereum, scammers have devised cunning schemes to steal digital assets from unsuspecting victims. BlackRockFund utilizes deception and social engineering tactics to drain cryptocurrency from connected wallets.

This fraudulent scheme aims to capitalize on the name recognition of BlackRock Inc., one of the world’s largest asset management companies, to ensnare potential victims. However, BlackRockFund has absolutely no affiliation with the legitimate BlackRock Inc.

By providing a detailed breakdown of BlackRockFund’s underhanded tactics, investors can educate themselves on how to spot and avoid cryptocurrency scams.

An Overview of The BlackRockFund Crypto Scam

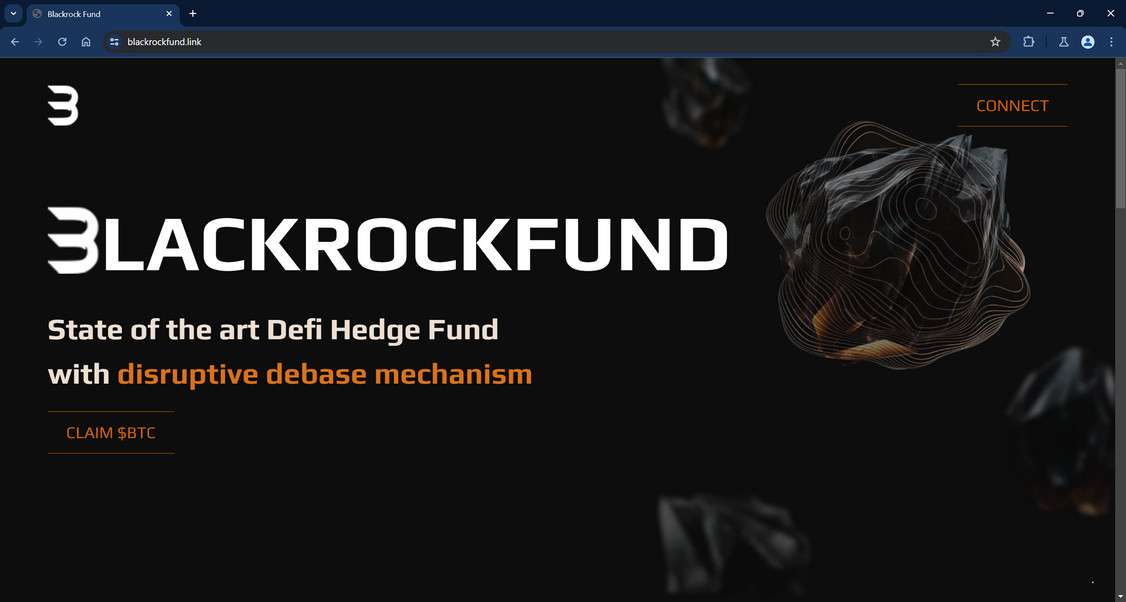

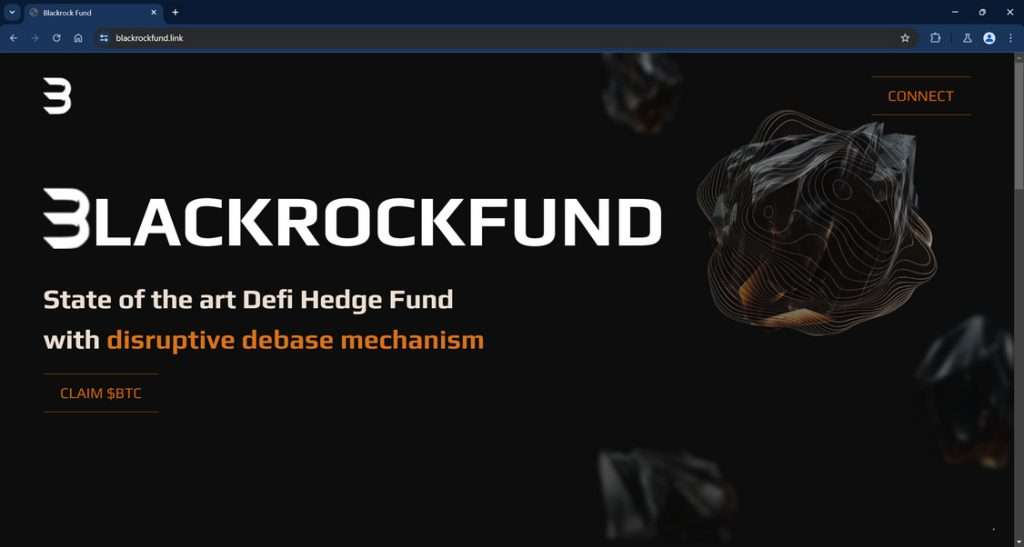

BlackRockFund promotes itself as a cutting-edge decentralized finance (DeFi) hedge fund that offers enticing rewards to investors. However, behind the flashy website and promises of profit lurks a sinister scam built to siphon away cryptocurrency.

The BlackRockFund website utilizes the BlackRock Inc. logo and name without permission to create an air of legitimacy. The site claims users can “claim Bitcoin cryptocurrency” by connecting their wallet and staking assets.

In reality, this process grants the scammers access to the victim’s wallet, allowing them to drain all cryptocurrency assets from the account. The criminals behind BlackRockFund are in no way associated with the real BlackRock Inc., one of the world’s most reputable investment management corporations.

Once connected to the scam website, victims’ wallet addresses and private keys are compromised. The criminals then initiate transactions behind the scenes to drain crypto funds from the wallets into their own accounts.

Some estimates indicate that BlackRockFund may have stolen anywhere from $5 million to $15 million worth of cryptocurrency assets. However, the true scope of the damages is difficult to ascertain due to the anonymity of crypto transactions.

The BlackRockFund scam highlights the importance of exercising extreme caution when engaging with new DeFi platforms. Conducting thorough due diligence is essential before connecting wallets to any website offering investment opportunities.

How the BlackRockFund Crypto Scam Works

BlackRockFund employs some clever social engineering techniques to ensnare unsuspecting cryptocurrency investors. Here is a step-by-step breakdown of how this scam operates:

1. Building a Veneer of Legitimacy

- The scammers create a website utilizing the BlackRock Inc. name and logo without permission. This is done to make the platform appear to be associated with the large, reputable asset management firm.

- The website refers to decentralized finance principles like staking, bonds, treasuries, and revenue sharing. This DeFi terminology is used to further reinforce the impression of legitimacy.

- Fake email addresses with “blackrockfund.link” domains are listed on the site for inquiries. This hints that the platform is officially sanctioned by BlackRock.

- Photos of the BlackRock Inc. headquarters and executives are deceptively used on the website.

2. Encouraging Users to Connect Wallets

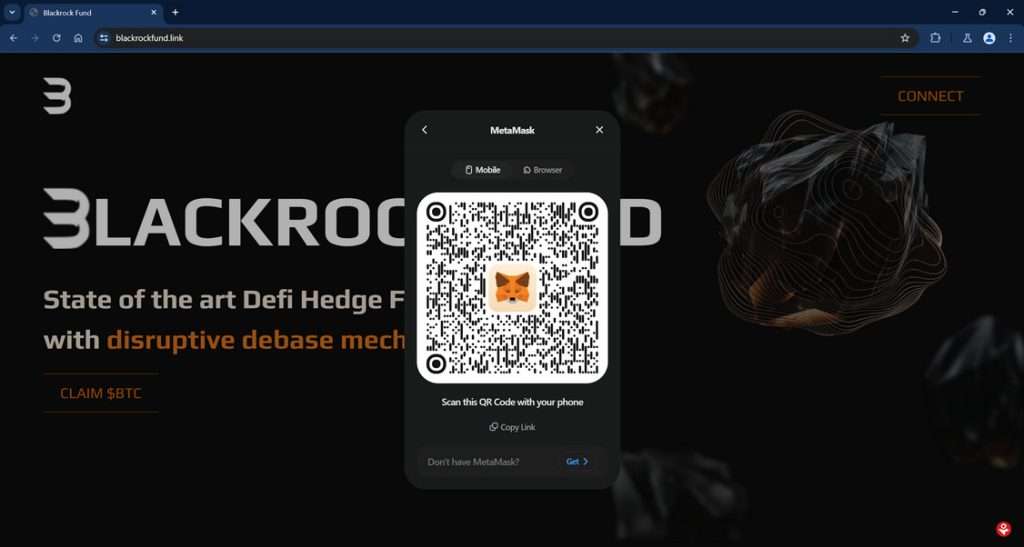

- The site prompts users to “Claim Bitcoin” by connecting a cryptocurrency wallet. Recommended wallets include MetaMask, Coinbase Wallet, WalletConnect, and others.

- After connecting a wallet, users are encouraged to buy tokens, invest, and stake in liquidity pools.

- Referral bonuses are offered for bringing in other investors. This develops a sense of community and urgency around the platform.

- Constant notifications and alerts pressure users to actively engage with the site and connect multiple wallets.

3. Draining the Wallets

- Once wallet connectivity is established, the scammers can view balances and transaction details.

- They initiate complex transactions from connected wallets to obfuscate their activities. Victims usually do not recognize these unauthorized transfers in time.

- The criminals systematically drain all cryptocurrency assets from connected wallets, syphoning funds back to their own accounts.

- Due to the irreversible nature of crypto transfers, victims have no way to reclaim their stolen funds.

- Millions in cryptocurrency have reportedly been stolen through these means before victims catch on to the scam.

Warning Signs of the BlackRockFund Scam

While BlackRockFund goes to great lengths to appear legitimate, there are several red flags that investors should watch out for:

- Website Registered Recently: BlackRockFund’s website domain was registered just weeks or months before the scam surfaced. Reputable companies have domain registration histories spanning several years.

- Contact Information Suspicious: The phone numbers and emails on the site are clearly fake and not actually associated with Blackrock Inc.

- Promises of Guaranteed Returns: No investment comes with guaranteed profits, so claims like “stake tokens to earn 5% daily returns” should raise skepticism.

- Spelling/Grammatical Errors: Scam platforms often have writing errors throughout their website copy.

- Anonymous Team Members: All team profiles either have fake names or stock model photos. No real individuals take accountability for the project.

- Aggressive Time Pressure Tactics: Constant notifications compel users to hurry up and connect wallets or risk missing out on big profits. This is a common high-pressure sales tactic.

- Absent or Mismatched Social Media Profiles: Scams typically will not have properly integrated social media platforms corroborating the website content.

Staying vigilant for these types of warning indicators can help investors avoid entanglements with cryptocurrency scams like BlackRockFund. Only invest through platforms that have established long-term reputations and clear signs of validity.

What To Do If You Are a Victim of the BlackRockFund Scam

If you connected your wallet to the fraudulent BlackRockFund website and had cryptocurrency assets drained, here are some steps to take:

- Disconnect Wallet Immediately: Remove wallet connectivity from BlackRockFund to prevent further theft. Clear browser cookies and cache.

- Record Transaction IDs: Gather transaction details that trace the unauthorized transfers of funds from your wallet. This creates a paper trail.

- Contact Wallet Support: Report the scam to the wallet provider (e.g. MetaMask, Coinbase) so they are aware and can assist.

- Inform Crypto Exchanges: If any accounts on exchanges were impacted, contact their fraud departments immediately with transaction records.

- Report to Authorities: File a report with the FBI’s Internet Crime Center at ic3.gov and submit to the FTC at reportfraud.ftc.gov.

- Consult a Lawyer: A cyber crimes attorney can assist with tracing funds and determining legal recourse options, if any.

- Reset All Accounts: Change passwords, revoke connected apps, generate new wallet addresses, and enable 2FA across all cryptocurrency accounts for extra security.

- Avoid Interacting With Scammers: Disregard any further outreach from the criminals behind BlackRockFund. Do not pay any demanded “fees” to reclaim lost funds.

- Spread Awareness: Share information about this scam with family and friends to help protect them in the future. Report the fake URLs on forums and via social media.

While the irreversible nature of cryptocurrency transfers makes reimbursement very difficult, reporting the scam can potentially prevent further harm to others. Victims can also take steps to revamp security and safeguard any remaining assets after the breach.

Frequently Asked Questions About the BlackRockFund Crypto Scam

1. What exactly is BlackRockFund and how does it work?

BlackRockFund is a fraudulent website that claims users can obtain free cryptocurrency after connecting their wallet. However, it is actually a scam operation that utilizes malware scripts to infiltrate connected wallets and drain cryptocurrency into accounts controlled by the scammers.

2. Is BlackRockFund really associated with the BlackRock corporation?

No. BlackRockFund has no affiliation whatsoever with the legitimate BlackRock Inc. investment firm. The scam simply hijacks the recognized brand name to appear credible and trick users.

3. How does the BlackRockFund scam drain cryptocurrency from wallets?

Once a user connects a wallet, embedded malware scripts infiltrate it using vulnerabilities like approval hijacking or keylogging. The scripts rapidly initiate many small, covert transactions to transfer funds from the wallet to accounts controlled by the criminals behind the scam.

4. What types of cryptocurrency does BlackRockFund target?

The scam mainly targets holders of major cryptocurrencies like Bitcoin, Ethereum, and Tether stablecoins. But any crypto assets accessible in a connected wallet could potentially be drained by the malware scripts.

5. What is the estimated number of victims and amount stolen so far?

According to analytics, BlackRockFund has already drained an estimated $7.2 million worth of crypto assets from over 4,300 victims and counting. The scam continues to operate and claim new victims daily.

6. What techniques does the scam use to appear legitimate?

BlackRockFund utilizes fake celebrity endorsements, fraudulent news articles, and manipulated SEO to rank high in search results. This fools users into thinking the site is credible and associated with real BlackRock.

7. Why is it difficult for victims to recover lost funds drained by this scam?

Due to the irreversible and pseudonymous nature of crypto transactions, funds drained from wallets and laundered through tumbler services are almost impossible to retrieve. This allows the scammers to cash out without being tracked.

8. What should I do if BlackRockFund has already drained cryptocurrency from my wallet?

Immediately disconnect the wallet, notify authorities, inform related crypto services, monitor transactions closely, change credentials, beware recovery scams, and seek legal counsel from an attorney experienced in crypto fraud cases.

9. What precautions can I take to avoid becoming a victim of this scam?

Only access well-known reputable platforms, be wary of “free crypto” offers, watch for fake celebrity endorsements, learn proper security protocols, closely monitor wallet activity, and never connect your wallet to an unfamiliar website.

10. How can I identify the warning signs of potential cryptocurrency draining scams?

Look for promises of free cryptocurrency, requests to connect your wallet, misappropriated celebrity images, grammatical errors, manipulated search rankings, missing contact info, recent domain registration dates, and no mention of an actual product or service.

The Bottom Line on the BlackRockFund Scam

In summary, BlackRockFund is a fraudulent scheme disguised as a DeFi investment opportunity. By mimicking the brand of BlackRock Inc., it aims to lure cryptocurrency holders into connecting their wallets so funds can be stolen.

Investors should be extremely wary of any platform promising exceptional returns for staking tokens or providing liquidity. These incentives are often Trojan horses for accessing wallets.

Conducting due diligence on any DeFi site before connecting a wallet is essential. Be on high alert for fake contact information, promises of guaranteed profits, spelling errors, and other red flags.

In addition, take steps to avoid phishing attempts via email or text that try to replicate credible brands like BlackRock. Report any suspicious communications and be vigilant against sharing account credentials.

Strengthen all cryptocurrency account security measures with two-factor authentication and use well-secured devices. Refrain from connecting wallets to any platform without first verifying its legitimacy through multiple independent sources.

Spreading awareness about current crypto scams can help protect the community. Anyone who believes they may have fallen prey to BlackRockFund should immediately cease all engagement, record transaction details, notify authorities, and consult qualified fraud support professionals.

Staying informed on the latest cryptocurrency scams and prioritizing security is the most effective way to safeguard your digital assets in the long-term. With knowledge and preventative vigilance, investors can avoid the devastating losses that platforms like BlackRock