In recent months, a dangerous email phishing scam has been targeting Capital One customers across the United States. The scam involves an email that claims a payment is pending approval for the recipient’s Capital One account. The email urges recipients to “Approve Your Payment Now” by clicking on a link or button that leads to a fake Capital One login page designed to steal personal information.

This article provides an in-depth overview of the Capital One “Approve Your Payment Now” phishing scam, exploring how it works, what you should do if you received this email, and key steps you can take to avoid falling victim. We’ll also outline what you should do if you unfortunately did provide information on the fake Capital One site.

Overview of the Capital One “Approve Your Payment Now” Scam

The Capital One “Approve Your Payment Now” phishing scam starts with an email designed to look like an official communication from Capital One. The email claims that a payment is pending approval for your Capital One account.

The email urges you to click on a link or button to “Approve Your Payment Now.” If clicked, this will take you to a fake Capital One login page that impersonates the real Capital One site.

On the fake login page, you’ll be prompted to enter your Capital One login credentials, along with other sensitive personal and financial information. The page looks authentic, featuring Capital One branding and web design elements.

However, the site is a scam operated by cybercriminals with the goal of stealing personal information. Any data entered on the fake site – including your username, password, social security number, or credit card details – will be harvested by scammers.

Scammers can then use your stolen login credentials to access your real Capital One account. They may drain your bank account funds, open fraudulent credit cards, take out loans in your name, or commit identity fraud using your personal information.

The Capital One name and brand are being used without authorization to execute this scam. The emails are not really from Capital One, and the fake login page has no affiliation with the real company.

Unfortunately, the scam emails can be quite convincing, featuring subject lines like:

- “Action Required: Approve Your Payment Now”

- “Capital One: A payment is pending approval”

- “Important: Confirm your Capital One payment”

The scam is essentially a form of phishing, which uses fake communications posing as trusted sources to trick recipients. Phishing is a common tactic used in many email and online scams today.

However, the Capital One “Approve Your Payment Now” scam is particularly insidious given how convincing the fake login page is. The page is designed to precisely mimic the real Capital One login portal, fooling many users into entering their sensitive data.

Below we’ll explore exactly how the scam works and key red flags to watch for.

How the Capital One “Approve Your Payment Now” Scam Works

The Capital One phishing scam is orchestrated using the following process:

1. Scammers send a scam email to target recipients

The scammers acquire or generate email addresses and send their phishing emails to recipients across the country. Email distribution software and compromised email accounts may be used to blast out the scam messages en masse.

The emails are made to look like they are from Capital One accounts, often using spoofed sender addresses like “security@capitalone.com.”

Deceptive subject lines like “Action Required: Confirm Your Capital One Payment” help the scam email blend into the inbox alongside legitimate notifications.

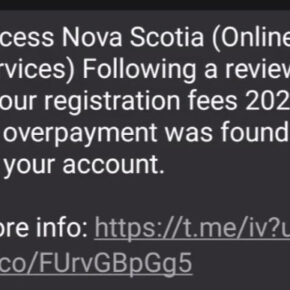

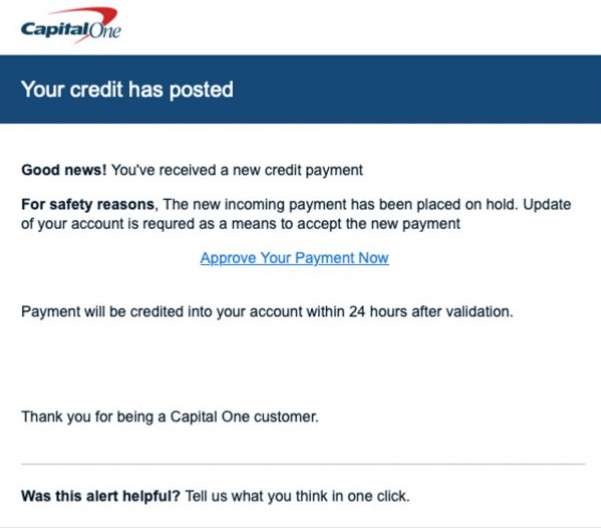

Here is how the fake Capital One scam email might look:

Capital One

Your Credit Has Posted

Good news! You’ve received a new credit payment.

For security reasons, The new incoming payment has been placed on hold. Update of your accounts is required as a means to accept new payment.

Approve Your Payment Now (link/button)

Payment will be credited into your account 24 hours after validation.

Thank you for being a Capital One customer.

2. Email urges recipient to click link and “Approve Your Payment”

The scam email claims a payment is pending approval for your Capital One account. It provides little detail, but stresses you need to act quickly to “Approve Your Payment” before it expires.

Typical text urges you to click a link or button now to confirm the payment and avoid any delay. This gives a sense of urgency to get the recipient to click without thinking.

3. Link leads to an extremely convincing fake Capital One login page

When clicked, the link or button in the email leads to a fake Capital One login page. This page is incredibly realistic, featuring precise Capital One branding and web design.

The page has a URL designed to resemble the real Capital One site, often involving subtlety manipulated domain names. For example, it may use “capiialone.com” instead of “capitalone.com.”

Without scrutinizing the full URL, it can appear you are on a legitimate Capital One subdomain.

4. Fake login page requests sensitive user data

On the fake Capital One login page, language urges you to login to your account to approve the pending payment. Input fields request the entry of your:

- Capital One username

- Capital One password

- Social security number

- Full name

- Address

- Phone number

- Credit card number

- CVV security code

- ATM PIN

After entering any data, you are taken to an “error” page. Meanwhile, your sensitive personal and financial information has now been harvested by scammers.

5. Scammers steal user data entered on the fake page

Everything typed into the fake Capital One portal is recorded and stolen by scammers to use maliciously. This may include your:

- Bank login credentials – Enables scammers to access and drain your account

- Social security number – Allows for identity theft and serious financial fraud

- Credit card details – Used to make unauthorized purchases or clone your card

- Personal details – Facilitates identity fraud

6. Scammers use stolen data for financial theft and fraud

With your stolen data, scammers can now commit serious identity theft and financial fraud, including:

- Logging into your real Capital One account to drain funds or redirect them to a different account.

- Applying for fraudulent loans or credit cards under your name and Social Security number. This damages your credit score.

- Making unauthorized purchases online or in-person with your credit/debit card number.

- Committing government, health insurance, or tax fraud under your identity.

- Selling your information on the dark web to other cybercriminals.

The consequences can be very severe, from fraudulent charges and damaged credit to frozen accounts and stolen identities. Significant time and effort is required to undo the damage.

This is why it is critical not to submit any information on the deceptive fake Capital One site.

What to Do If You Receive the Capital One “Approve Your Payment” Email

If you receive an email claiming to be from Capital One asking you to “Approve Your Payment” or “Confirm Your Payment,” here are important steps to take:

Carefully inspect the email address of the sender

While scammers spoof legitimate Capital One email accounts, there may be telltale signs, like:

- Sender address is from a public domain like Gmail or Yahoo rather than an official capitalone.com address.

- Variations in spellings, like capitaIone.com or capitaione.com

- Letters are replaced by numbers, like capitaI0ne.com.

If anything looks suspicious, the email is likely a scam.

Check the link URL before clicking

Hover over any links or buttons without clicking on them. The URL they lead to should be examined closely.

Watch for typosquatted or misleading URLs intended to imitate a real Capital One subdomain. If the URL looks suspicious, it’s best not to click.

Do not provide any sensitive information

If you clicked the link, you’ll likely arrive at an extremely realistic fake Capital One login page. But no matter how authentic it looks, do not enter your login credentials or any personal or financial information.

Report the scam email

Forward the phishing email to Capital One at abuse@capitalone.com so they can investigate the scam and work to shut it down. You may also report phishing emails to the FBI at https://www.ic3.gov.

Scan for malware

Scam emails may contain malware downloaders that infect your device. Run a scan using reliable, updated antivirus software to check for any malicious programs.

Change your Capital One password

Even if you didn’t fall for the scam, it’s wise to change your Capital One password as a precaution. Avoid reusing old passwords.

Monitor your accounts for suspicious activity

Carefully monitor your Capital One account activity for signs of unauthorized access, as well as your credit reports for any suspicious or fraudulent activity.

By remaining vigilant and taking precautions, you can protect yourself from threat actors targeting Capital One customers. Remember, Capital One will never email you out of the blue demanding you urgently confirm or approve a payment. Use skepticism before clicking links or entering any information.

What to Do If You Entered Information on the Fake Site

If you unfortunately provided sensitive information on the deceptive Capital One scam site before realizing it was fraudulent, take the following steps right away:

Alert Capital One

Contact Capital One’s customer service right away and explain you were tricked into providing your account login details on a fake phishing site. This will allow them to take action to secure your account.

Change your Capital One password

Immediately change your Capital One password and security questions. Make your new password unique and strong. Do not reuse the password anywhere else. Enabling two-factor authentication is also recommended.

Closely monitor your accounts

Carefully monitor all your Capital One accounts for any unauthorized transactions. Watch for suspicious transactions on any linked bank accounts, credit cards, loans, or lines of credit. Report any fraudulent activity to Capital One immediately.

Check credit reports

Obtain copies of your credit reports from Equifax, Experian, and TransUnion to look for any fraudulent accounts or activity opened in your name. Consider placing a credit freeze if needed.

Contact financial institutions

For any other bank accounts, credit cards, or financial services you use, contact them as well. Alert them your information was compromised. Closely monitor statements and transaction histories.

File an identity theft report

File an identity theft report with the Federal Trade Commission at https://www.identitytheft.gov as well as your local police department. Provide this report when disputing fraudulent accounts or transactions.

Change passwords and enable two-factor authentication

Change passwords on all financial, email, social media and other online accounts. Use strong unique passwords for each account. Enable two-factor or multi-factor authentication wherever possible for an added layer of security.

Be vigilant about future scams

Unfortunately, once information is stolen, you may be targeted by follow-up scam attempts. Be extra vigilant about phishing emails, phone calls, texts, and other contacts impersonating trusted entities in the future.

By taking proactive measures as soon as possible, you can contain the damage from scammers gaining access to your sensitive personal and financial data. Don’t delay in securing all compromised accounts and reporting fraudulent or suspicious activity.

Frequently Asked Questions about the Capital One “Approve Your Payment Now” Scam

What is the Capital One “Approve Your Payment Now” scam?

The Capital One “Approve Your Payment Now” scam is a phishing scam where targets receive a fraudulent email claiming that a payment needs approval for their Capital One account. The email includes a link to a fake Capital One login page that steals user’s sensitive information.

How does the Capital One payment approval scam work?

The scam starts with an email made to look like it’s from Capital One, stating a payment requires approval. It urges the recipient to click a link leading to an extremely realistic but fake Capital One login page. If users enter their username, password, or other sensitive info, scammers steal it.

What is the goal of the fake Capital One payment scam?

The goal is to trick users into entering their Capital One login credentials and personal information onto a fake page controlled by scammers. This allows them to steal user’s data to access their accounts, commit identity theft, and perpetrate financial fraud.

What are some red flags of the Capital One phishing scam?

Red flags include suspicious sender addresses, typos in URLs, urgency to act without verifying, requests for sensitive user data, and generally any unsolicited emails about a Capital One payment needing approval.

What information do scammers seek with this scam?

Scammers want users to enter Capital One login usernames and passwords. They also try to harvest social security numbers, full names, addresses, phone numbers, credit card details, and other personal data using the fake site.

What should I do if I get the Capital One payment email?

Do not click any links or provide information. Check the sender address for authenticity. Report the scam email to Capital One and consider changing your account password as a precaution after verifying there is no suspicious activity.

What if I entered information into the fake Capital One site?

Immediately contact Capital One to secure your account. Change your password and enable two-factor authentication. Monitor statements closely and check credit reports for signs of fraudulent activity. File an identity theft report.

How can I avoid falling for the Capital One phishing scam?

Avoid clicking links in unsolicited emails. Carefully inspect sender addresses and URLs for authenticity. Never provide sensitive information on unverified pages. Use unique strong passwords. Enable two-factor authentication when available.

How can I identify a fake Capital One email or website?

Fake emails may have odd sender addresses. Fake sites use misleading URLs and imitation designs. Neither will explain payment details upfront without user action. Calls to “confirm” or “approve” payments urgently are red flags.

The Bottom Line

The “Approve Your Payment Now” phishing scam targeting Capital One customers demonstrates how important it is to be wary of unsolicited emails and hyper-realistic fake websites.

With convincing web designs and carefully crafted messages capitalizing on urgency, it can be easy for cybercriminals to fool internet users into handing over valuable personal data that enables identity theft and financial fraud.

Being aware of the hallmark traits of phishing scams, double checking sender addresses, scrutinizing URLs before clicking, and never entering sensitive data on unverified pages are all vital for protecting yourself online.

If you receive any suspicious communications claiming to be from Capital One, err on the side of caution and verify before taking any requested actions. Report phishing attempts to help curb these criminal operations.

Unfortunately, phishing scams and data breaches remain common. But by being informed and proactive, you can greatly reduce your susceptibility to having your sensitive personal or financial information fall into the wrong hands.

Pay close attention and think twice before clicking any links or submitting data. If you have been victimized, take swift action to minimize damage and regain security over your accounts and identity.

Stay vigilant to keep your Capital One accounts, along with all of your online identities and finances, safeguarded from fraud.