The Alert 1019 scam call is a fraudulent phone call scheme that aims to steal money and personal information from unsuspecting victims. This article will provide an in-depth look at how the scam works, what to do if you receive one of these calls, and how to best protect yourself moving forward.

Overview of the Alert 1019 Scam

The Alert 1019 scam begins with an automated phone call claiming that the recipient owes back taxes to the federal government. The robotic voice on the call claims these supposed tax debts can be absolved through something called the “Federal Economic Recovery Policy.”

Victims are directed to visit a fake government website, alert1019.com, to take advantage of this made-up policy. However, this website is a scam aimed at stealing sensitive personal and financial information.

This is just one iteration of a common scam technique called government impersonation fraud. By pretending to be federal authorities and leveraging fears over penalties like tax liens, these scammers manipulate victims into giving up valuable data and money.

The Alert 1019 scam is particularly insidious because it uses real-sounding policies and an authoritative communication style that can convince recipients the call is legitimate. However, make no mistake: Alert 1019 is 100% fake.

Hallmarks of the Scam

Several characteristics can help identify an Alert 1019 scam call:

- An unsolicited robocall from an unknown or unusual number

- References to owing federal back taxes or possible IRS action like tax liens

- Mention of a fake “Federal Economic Recovery Policy” to erase tax debts

- Instructions to visit alert1019.com to address tax issues

- An urgent, authoritative tone demanding immediate action

What Happens on the Fake alert1019.com Website

If scam targets visit the fraudulent alert1019.com website referenced in the robocall message, additional schemes aimed at information and money theft await.

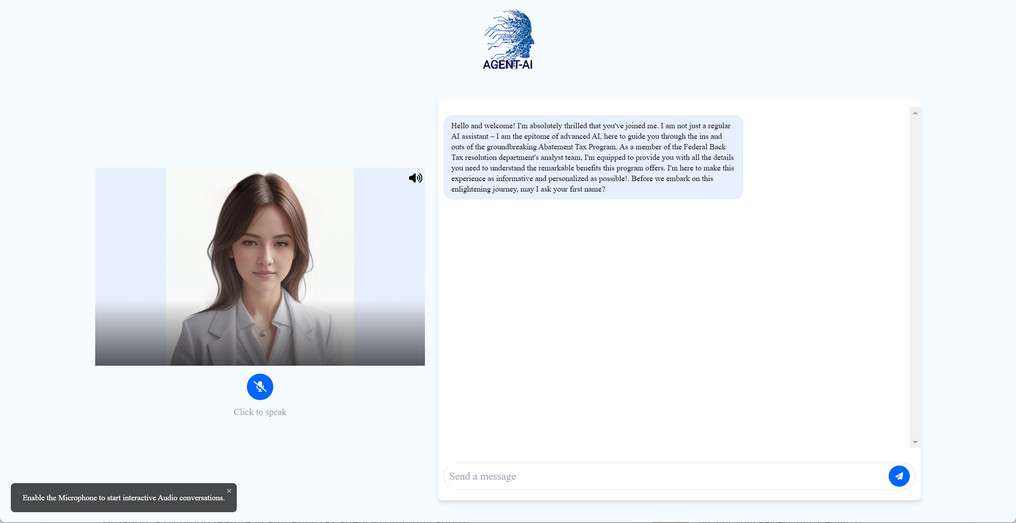

The site introduces victims to an AI-powered “agent” named Hope. Using natural language processing to seem friendly and helpful, Hope asks for personal details like your name, address, date of birth, and Social Security number under the pretense of checking eligibility for the fake tax relief program.

In reality, Hope and the scam website operators use this sensitive data to commit identity theft and drain bank accounts. Victims also start receiving additional scam calls and messages once the fraudsters have their information.

Besides basic personal questions, Hope and the website also try convincing victims to share credit card or bank account numbers to process a supposed “compliance fee” or verify assets. However, just like everything else on alert1019.com, this is merely a way to unlawfully take money from scam targets.

Who’s Behind the Alert 1019 Scam?

The exact source of the Alert 1019 scam remains unknown. Given its sophisticated use of robocalling technology and advanced AI chatbots, experts believe organized cybercriminal groups based internationally are behind the scheme.

These fraudsters likely operate alert1019.com and associated money laundering operations from overseas. That distance protects them from US law enforcement even as they steal from American citizens.

Furthermore, by hiding their real identities behind AI avatars like Hope and voice modulation software on the robocalls, the crooks make bringing them to justice extremely difficult.

How the Alert 1019 Scam Call Works Step-by-Step

Now that you understand the basics of the fraud, here is a play-by-play look at the scam process from start to finish:

Step 1: Victims Receive an Unsolicited Robocall

The first step is an unrequested robocall placed to the victim’s phone. Using voice modulation technology for believability, an urgent-sounding automated message plays.

The recording claims the recipient has unpaid federal taxes subject to harsh IRS action. It references possible liens, asset seizure, and other threats that leverage financial fears.

However, the message promises a way out via non-existent “Federal Economic Recovery Policy” that supposedly renders the nonexistent tax debts non-collectible and eligible for dismissal.

Hello. This is an authoritative notice regarding potential federal back taxes you may owe. The intent of this message is to advise you of possible impending tax liens and bank levies. However, using the newly introduced Federal Economic Recovery Policy, you can prevent these liens and levies by choosing to act accordingly. You will not need to repay the overdue taxes. They will simply be classified as noncollectible and dismissed. Once your request is processed, act promptly and navigate to the website www. Dot alert 10 19 dot to move ahead with the process. Again that website spelled-out is you www the letters ALERT then the number is 1019 . com. So it reads alert1019.com. This call will now terminate and the message will be marked as delivered. Thank you for your attention.

Step 2: The Call Directs Victims to a Fake Government Website

After describing the scary IRS threats, the automated robocall message then pivots to a “solution” – visiting alert1019.com.

This website is presented as the necessary next step to resolving the made-up tax issues through the so-called federal program.

But in reality, it is a fraudulent website run by scammers to ensnare victims and steal personal data and money.

Step 3: Victims Interact with a Deceptive AI Chatbot

When victims arrive at alert1019.com, they encounter a friendly AI assistant named Hope. Seemingly there to help with the fake tax relief program, Hope asks for sensitive personal information.

With each piece of data collected, from names and addresses to Social Security numbers and birth dates, the fraudsters expand possibilities for identity theft and financial fraud.

Hope may also request credit card or bank details to process a phony compliance fee or verify assets. These monetary demands are pure fabrication, with any funds paid going right into criminal pockets.

Step 4: Fraudsters Leverage Stolen Data for Additional Crimes

Armed with social security numbers, bank account information, or credit card data, the Alert 1019 scammers use victims’ personal information to open fraudulent accounts, make unauthorized purchases, take over existing accounts, apply for loans and credit lines, file fake tax returns for refunds…the list goes on.

And thanks to Laclos’s Law – “Fraud begets fraud.” – original scam targets tend to suffer additional frauds once their data enters criminal networks.

Stolen information gets sold and traded on the dark web, fueling waves of damaging identity theft and financial fraud against victims.

What to Do If You Get an Alert 1019 Call

If you receive one of these scam robocalls, remain calm and avoid acting impulsively out of fear or urgency. Instead, follow these recommended steps:

1. Hang Up Immediately

As soon as you realize the call is suspicious, terminate the call. Ignore any threats or promises from the robocall message. Remain firm – do not speak to callers, provide information, or tap any numbers.

The quicker you disconnect, the better. Even seemingly harmless actions like staying on the line might confirm your number as active for more scam calls.

2. Beware Calls from Unfamiliar Numbers

One clue of a scam is calls coming from odd numbers. Fraudsters mask identities by using spoofed numbers that appear local or official.

If the incoming number looks strange or unknown, proceed with extreme caution and verify legitimacy before sharing anything sensitive. Ask pointed questions and leave if unsatisfied.

When possible, try to independently source callback numbers from official channels like company or government websites instead of trusting what callers provide.

3. Contact Authorities to Report the Incident

You have options like reporting to the FCC, FTC, Treasury Inspector General for Tax Administration, and your local authorities. Supply details like the phone number, recordings, and website information.

The more evidence authorities have, the better chances of investigations and enforcement leading back to the crooks. You may also contact phone carriers to try blocking further spam calls.

4. Monitor Accounts Closely for Suspicious Activity

Carefully check financial statements, credit reports, and account activity often in the weeks following an attempted fraud. Reporting issues early limits damage from any stolen data.

Consider putting extra protections like multifactor authentication or verbal passcodes on accounts as well. Being proactive goes a long way towards keeping information secure.

5. Educate Yourself on Common Scam Tactics

Learn warning signs of social engineering techniques like phishing emails, smishing texts, vishing calls, and more used to manipulate victims. Understanding these threats helps you recognize and shut down scams faster.

Resources like consumer protection bureaus and cybersecurity firms provide excellent educational materials on identifying and stopping frauds. Invest time into learning – it will pay dividends through increased safety.

How to Protect Yourself from the Alert 1019 Scam

Beyond specific precautions if targeted by Alert 1019 criminals, you can take broader measures to guard against this and other fraud types:

Be Wary of Unsolicited Contacts

Never trust unexpected calls, emails, texts, letters or visitors without verifying credibility through separate channels. Disconnect suspicious communications ASAP.

Slow Down and Verify Before Acting

Take time validating directives before sharing information or money. Ask clarifying questions and leave if unsatisfied. Don’t fall for artificial urgency or threats.

Guard Personal and Financial Information

View sensitive details like account logins, Social Security numbers, etc. as confidential. Only provide when truly necessary and convinced of security.

Use Caution Online

Keep device security, firewalls and anti-virus software updated. Encrypt sensitive data. Use strong, unique passwords for each account, with multi-factor authentication when possible.

Monitor Accounts and Credit Reports Regularly

Watch statements and reports routinely for fraudulent activity and report issues immediately. Set up transaction alerts for account logins and key activity. Consider fraud monitoring services.

Educate Yourself on Risk Reduction

Read government and nonprofit guidance to learn best practices for identifying risks. Promote awareness of frauds like Alert 1019 within your community. Stay vigilant long-term.

Frequently Asked Questions about the Alert 1019 Scam

What is the Alert 1019 scam?

The Alert 1019 scam is a fraudulent robocall scheme where victims receive phone messages claiming they owe federal back taxes. The calls threaten liens and asset seizures but promise to erase the fake debts through a non-existent “Federal Economic Recovery Policy.” Recipients are instructed to visit alert1019.com to address their tax issues, but this website is a scam aimed at stealing personal and financial data.

How does the Alert 1019 scam work?

The scam begins with an automated voicemail loaded with IRS threats and demands for immediate action. Victims are directed to alert1019.com, where an AI chatbot named “Hope” requests sensitive details to supposedly check eligibility for the fake tax relief program. In reality, this data allows criminals to steal identities and money. Hope may also try to collect fake “compliance fees” using victims’ credit cards or bank accounts.

What is the fake Federal Economic Recovery Policy?

The Federal Economic Recovery Policy does not exist. It is fabricated by scammers to add legitimacy to Alert 1019 calls and convince victims to share information at alert1019.com. There is no real program to instantly absolve individuals of tax debts, liens, or threats of asset seizure like referenced in the robocalls. Any promises around eliminating back taxes are 100% false.

Is alert1019.com a real government website?

No. Alert1019.com is a fraudulent website run by scammers to deceive victims by impersonating federal tax authorities. No genuine US government site would ever demand upfront fees or full Social Security numbers to address tax issues. Avoid visiting alert1019.com at all costs.

Should I pay any compliance or verification fees requested?

No. Demands for compliance fees, asset verification charges, or any other payments via alert1019.com are purely scams aimed at stealing money. Never make payments to suspicious third-parties claiming to represent government tax authorities. Real IRC communications never require upfront fees using retail payment processors.

Is the AI chatbot “Hope” a real government agent?

No. The AI assistant “Hope” on alert1019.com is an invention of scammers to extract personal details from victims. No legitimate US government representative would request sensitive identification or financial account access credentials upfront to resolve tax issues. Share no information with “Hope” or anyone else who contacts you from alert1019.com.

Who is behind the Alert 1019 scam robocalls?

Experts believe sophisticated overseas cybercriminal rings are behind Alert 1019. The ability to spoof credible robocalls and leverage advanced AI chatbots suggests highly skilled fraud groups likely operating beyond US law enforcement jurisdiction. Still, reporting details via the FTC, FCC, TIGTA or FBI helps authorities piece together leads.

What should I do if I receive an Alert 1019 scam call?

Immediately end any suspicious calls directing you to alert1019.com. Call authorities to report the fraud attempt and monitor credit reports/accounts closely for misuse of any shared information. Also contact phone carriers to block further spam calls from the same number.

How can I protect myself from the Alert 1019 scam?

Hang up on all surprise tax-related calls, never give info to unverified parties, use strong account security like multi-factor authentication everywhere possible, and learn to recognize social engineering manipulation tactics fraudsters use to trick victims.

The Bottom Line

The Alert 1019 scam preys on citizens through authority-sounding robocalls and advanced fraud tools like AI chatbots. By pretending to be IRS and government sources, these international cybercriminal groups steal massive amounts of sensitive data, money and identities.

If you receive one of these scam calls, hang up right away. Never visit the fake alert1019.com website or trust the “Hope” AI assistant. Report incidents to authorities and monitor accounts closely for fraudulent misuse.

Ongoing education on scam methods along with proactive precautions around sharing personal information are the best ways to protect yourself from threats like the Alert 1019 fraudsters going forward. Through increased vigilance and awareness, we can work together to stop these calculating criminal groups.