A new wave of scams have emerged on social media platforms like Facebook, Instagram, and TikTok, where scammers pretend to be billionaire investor “Evan Kate” and promise to give away large sums of money to people in need. These scams lure unsuspecting victims with promises of receiving thousands or even millions of dollars, only to steal their money once they are hooked.

- Overview of the Evan Kate Billionaire Money Giveaway Scam

- How the Evan Kate Billionaire Money Giveaway Scam Works

- How to Spot the Evan Kate Billionaire Money Giveaway Scam

- What to Do if You Have Fallen Victim to the Scam

- Frequently Asked Questions About the Evan Kate Billionaire Money Giveaway Scam

- The Bottom Line

This article will provide an in-depth look at how the Evan Kate Billionaire Money Giveaway Scam works, how to identify these scams, what to do if you have fallen victim, and why you should avoid engaging with them altogether. With online scams becoming increasingly common, it’s important to arm yourself with knowledge to stay protected.

Overview of the Evan Kate Billionaire Money Giveaway Scam

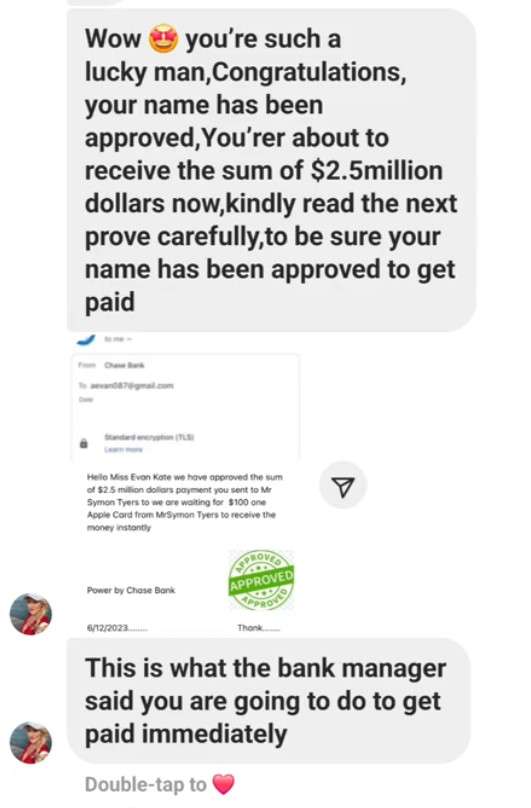

The Evan Kate Billionaire Money Giveaway Scam operates by scammers creating fake accounts pretending to be billionaire investor Evan Kate and reaching out to potential victims over social media. They claim Evan Kate wants to give away money to help people in difficult situations and ask them to connect to claim their reward.

Once victims engage, the scammers use convincing techniques to gain trust and persuade victims to send money in order to receive the promised reward. Scammers may send pictures of expensive cars and mansions or videos of people receiving money from Evan Kate. In reality, these are stolen images and videos used to manipulate victims.

Victims are instructed to communicate via Facebook Messenger, Instagram, WhatsApp or other messaging apps. They are asked to provide personal information and bank details, under the guise of identity verification and setting up an account to transfer funds.

At some point in the interaction, victims will be asked to pay a fee, tax, or other upfront cost in order to secure the transfer of their reward money. This is the main aim of the scammers – to extract money from victims. Once any amount is paid, the scammers disappear and victims never receive the promised rewards.

These scams are essentially a form of advance fee fraud, where victims are manipulated into paying money based on an false promise. It is important to recognize these scams and avoid engagement to prevent losing money.

How the Scams Spread on Social Media

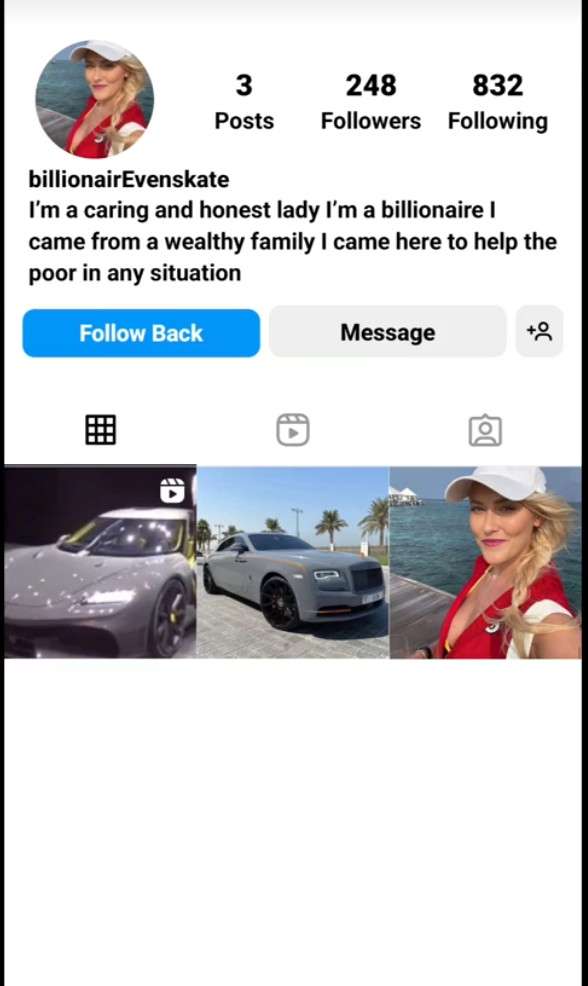

The scammers rely on social media platforms like Facebook, Instagram, TikTok and Twitter to reach a large pool of potential victims quickly. They create fake accounts posing as Evan Kate and post content intended to convince people the offer is legitimate.

- On Facebook, they send friend requests and messages directly to users. They also create fake pages and groups for “Evan Kate Billionaire” filled with fake posts.

- On Instagram, they direct message users, post giveaway announcements in Stories/Reels, and use hashtags like #EvanKateBillionaire to extend reach.

- TikTok is exploited through fake accounts posting videos announcing giveaways, showing money being given away, and people thanking Evan Kate.

- Twitter is used by creating fake accounts for Evan Kate and tweeting promises of cash rewards.

The scammers also purchase followers, likes and shares to make the accounts seem reputable. Photos and videos are stolen from unrelated sources and used to depict Evan Kate’s supposed wealth and philanthropic activities.

Warning Signs of the Evan Kate Billionaire Money Giveaway Scam

While the scammers go to great lengths to convince victims the offer is legitimate, there are several warning signs to recognize:

- Requests for personal information like bank account details, credit card numbers, copy of ID, etc.

- Upfront fees required – taxes, processing fees, administration costs, etc.

- Pressure to act fast and urgency conveyed in messages.

- Promise of guaranteed huge rewards, gifts or prizes.

- Communication only via messaging apps, refusal to talk on phone.

- Inability to find information on Evan Kate outside of their social media accounts.

- Fake accounts with limited followers/friends and lack of authentic engagement.

- Poor grammar, spelling mistakes, inconsistent details in messages.

Who is Targeted by These Scams?

The scammers cast a wide net targeting many types of social media users. However, certain demographics tend to be more vulnerable.

- People experiencing financial hardship or unemployment – scammers pretend to offer relief.

- Senior citizens and retirees – scammers perceive them as more trusting.

- Small business owners – scammers claim they want to invest.

- Non-profits/charities – scammers act as philanthropists offering big donations.

- Religious communities – scammers exploit faith and willingness to help others.

- Military members & veterans – scammers express desire to help veterans.

- Students with education costs – scammers offer to pay tuition.

Essentially, the scammers identify people who may be more receptive to promises of financial relief or support. Their messages are carefully crafted to align with the hopes, needs and interests of the target.

How the Evan Kate Billionaire Money Giveaway Scam Works

The scammers employ a number of psychological tactics and steps to manipulate victims into giving away money. Here is an in-depth look at how the scam unfolds:

Step 1 – Initial Contact

The first step involves the scammer initiating contact while posing as billionaire investor Evan Kate. This often occurs by:

- Sending a friend request on Facebook from a fake account.

- Direct messaging users on Instagram or TikTok.

- Replying to posts/comments offering help.

- Joining groups/pages related to the target’s interests and engaging there.

The messages express a desire to help people in need by giving away money. The amounts offered range from several hundred to millions of dollars.

Step 2 – Building Trust

Once contact is made, the scammer works to build trust and rapport with the target. Their messages come across as very friendly, compassionate, and genuine.

They ask questions to get to know the target and their needs. They convey empathy for any difficulties the person is facing. They emphasize how committed they are to charitable giving.

This develops a connection between the scammer and target. The scammer mirrors the target’s moods and language patterns. They show optimism about resolving the target’s issues through their rewards program.

Step 3 – Providing “Evidence”

To further gain the target’s trust, the scammer provides what appears to be evidence that Evan Kate is real and has helped others.

This may include:

- Photos of expensive cars, mansions, vacations, and other luxuries. In reality, these are just stolen images found online.

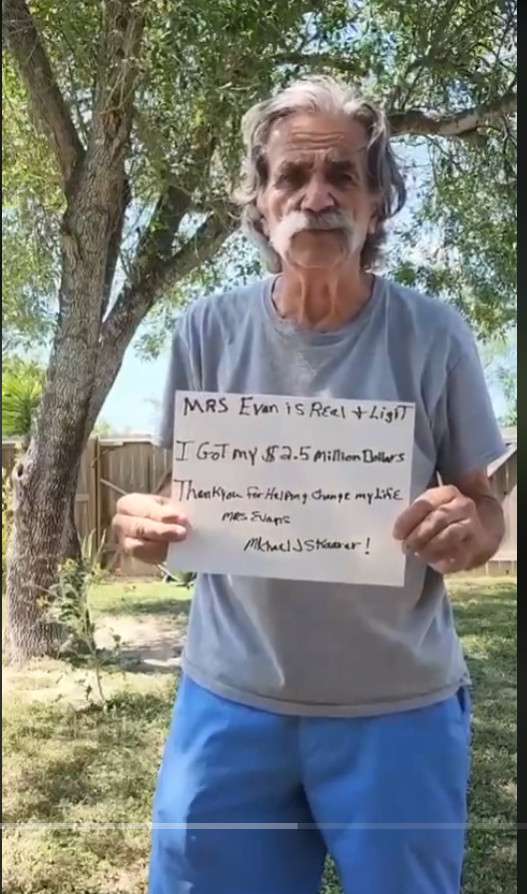

- Videos of people holding large checks or envelopes of cash thanking Evan Kate. These are other scam victims who were paid to make the videos.

- Fake documents like bank statements showing large balances, investment earnings reports, and news articles.

- Screenshots of online fund transfer receipts, intended to prove others have received payment already.

The scammer will emphasize how blessed Evan Kate feels to be able to share her wealth. This evidence helps convince the target they really can get money too.

Step 4 – Request for Personal Information

Once trust is established, the scammer will say they need some information to verify the target’s identity and eligibility for the reward program. They claim this is necessary to process payments.

Information requested may include:

- Full name, date of birth, home address.

- Bank name, account numbers, routing numbers.

- Photos/scans of government ID, driver’s license, or passport.

- Occupation details, annual income, education history.

- Phone number, email address, other social media contacts.

The scammer will say the details are necessary for Evan Kate’s due diligence and auditing. However, it is actually used to steal identities and enable further frauds.

Step 5 – Instructions to Communicate on Other Platforms

The scammer will then try to move the conversation off the original social media platform onto other messaging apps. They express a preference for WhatsApp, Facebook Messenger, Telegram, Google Hangouts, etc.

This allows the scam to continue if the social media account gets deleted or banned. It also enables the scammer to delete messages later if needed, eliminating evidence.

The target feels reassured that the deal is progressing to the next steps. In reality, this transitions the scam to a less regulated platform.

Step 6 – Introducing the Fake Bank Agent

Once on the new messaging platform, the scammer will claim that a bank transfer agent or affiliate needs to be added to the conversation. This person will supposedly help facilitate the transfer of funds.

The fake agent poses as a representative of legitimate financial institutions like Wells Fargo, Bank of America, Chase Bank, etc. They begin asking the target for personal documents and bank details again, under the pretext of identity confirmation.

Adding this middleman gives the scam an air of authenticity. But in reality, it is still the original scammer or an accomplice.

Step 7 – Request for Upfront Payment

This is the pivotal point where the scam pivots to extracting money from the target.

The fake bank agent will say that taxes, fees, or processing charges must be paid upfront before the reward funds can be released. These may include:

- Release fees, clearance fees, taxes on winnings.

- Anti-fraud or anti-money laundering charges.

- Currency conversion fees, international transfer fees.

- Shipping and handling costs for physical cash delivery.

- Attorney, documentation, audit and verification fees.

The reasons and amounts vary, but the pattern remains the same. The target is told to pay an upfront cost in order to receive their reward. Once payment is sent, the scammers disappear.

Step 8 – Urgency and Pressure

If the target expresses any reluctance or delay in sending the money, the scammers apply urgency tactics and high-pressure manipulation.

Some approaches include:

- Threats to give the reward money to someone else unless fees are paid immediately.

- False claims that this is a limited time offer about to expire.

- Saying the bank requires the payment or else the funds will be locked/frozen.

- Pretending there is a long waitlist of recipients ready to take the target’s spot.

- Insistence they are urgently trying to help people during these difficult times.

This places immense pressure on the target to pay without asking further questions. Combined with the false promises made earlier, many victims end up caving in.

Step 9 – Cutting Off Contact

As soon as any amount is paid, the scammers will cease all communication and block the victim.

The social media accounts, messaging app contacts, and phone numbers will get deleted or go unresponsive. The scammers pivot to searching for new potential targets.

Meanwhile, the victim is left distraught over losing their money and never receiving the promised rewards. Their personal data is now compromised and vulnerable to further exploitation as well.

This sums up how the Evan Kate Billionaire money giveaway scam strategically manipulates and deceives victims at every stage. Understanding these steps can help avoid getting ensnared.

How to Spot the Evan Kate Billionaire Money Giveaway Scam

The scammers behind the supposed billionaire giveaway scam are adept at making their lies seem credible. However, there are several common indicators that can help uncover their deceit:

Promises That Are Too Good to Be True

The main red flag is the promise of guaranteed huge rewards, gifts or cash prizes worth thousands to millions of dollars. Legitimate giveaways will never promise such extravagant and risk-free payouts to random individuals online. Be wary of language like “free money”, “no strings attached”, “yours to keep forever”, etc.

Urgency and High Pressure Tactics

Scammers will insist you act fast by claiming the offer is only available for a limited time. They may say positions are filling up quickly or present other faux deadlines. Any tactic to rush your decision or make you feel like you’ll lose out if you don’t pay quickly is a major warning sign.

Vague Details

When examining the offer closer, specifics around the sponsoring organization tend to be unclear or inconsistent. Details on Evan Kate’s background, the source of funds, delivery methods, winner selection process and eligibility rules are often vague, fabricated or contradictory.

Communication Restrictions

Insistence on keeping all discussions isolated to messaging apps is suspicious. As is refusing to talk over phone, video chat or meet in person. Scammers avoid live interaction where they could risk revealing their true identities.

Upfront Fees and Payments

Requests for upfront payments before delivering any reward should be an instant red flag. Whether it’s processing fees, taxes, anti-fraud charges, shipping/handling costs, or release fees, any reason you must pay first signals a scam.

Minimal Online Footprint

Scammers depend on fake accounts and personas. Searching for information on Evan Kate, their organizations and representatives beyond their own websites/profiles yields little verifiable results. No reputation or history exists because they are not real.

Grammatical and Spelling Errors

Messages are often littered with poor grammar, sentence structure issues and spelling mistakes. This signals scammers who do not natively speak English. Legitimate businesses will have proper language in official communications.

Stay vigilant for these and other warning signs. Verify sponsored offers through independent research. Consult with trusted contacts before providing money or personal data. If it seems questionable, disengage immediately. Use common sense precautions, and avoid falling victim to false promises.

What to Do if You Have Fallen Victim to the Scam

If you unfortunately discover that you have been deceived and already paid money to the Evan Kate Billionaire scam, here are the vital steps to take immediately:

Step 1 – Cease All Contact

First, cut off all contact with the scammers if they attempt to reach out again asking for more money. Block their accounts on social media, messaging platforms, and phone numbers.

This prevents continued manipulation and limits further losses on your end. Accept that the promise of rewards was false. Resist any urge to pay more in hopes of getting your initial money back.

Step 2 – Report the Accounts

Next, report the fake social media accounts and profiles used by the scammers to the respective platforms:

- On Facebook, Instagram and TikTok, find the account and select the option to report or flag them. Categorize it as a scam, fraud or fake account.

- On WhatsApp, tap on the contact, select Report Contact, and choose Report Spam or Report Scam option.

- Reporting helps get these accounts deleted so they cannot scam others. Provide as many details as possible in the report.

Step 3 – Contact Your Bank

Notify your bank immediately if you shared any bank account information or transferred money. Place a hold on the account if needed to prevent further unauthorized transactions.

Ask about tracking or reversing any fraudulent transfers. Also request new account and card numbers to prevent additional losses. Enable the strongest security settings possible.

Step 4 – Notify Authorities

File reports about the scam to authorities at:

- The Federal Trade Commission (FTC) through their online complaint form or 877-FTC-HELP hotline.

- The FBI’s Internet Crime Complaint Center (IC3) via their website or 1-800-CALL-FBI.

- Your state/city police department, so they can note it in their fraud statistics and investigations.

- The social media platforms themselves about violating their policies around scams/fraud.

Reporting helps identify criminals, aids investigations and protects more people.

Step 5 – Monitor Accounts and Credit

Keep vigilant watch for any suspicious activity in your financial accounts in the upcoming months. Many scammers steal personal information for identity theft or sell it to other parties.

Also monitor your credit reports frequently for any signs of accounts opened without authorization. Place fraud alerts and consider credit freezes if needed. Manage reputational risks as well.

Step 6 – Seek Legal Counsel

Consult an attorney to understand if any legal recourse is possible, based on the details of your specific situation. They can advise if it’s feasible to pursue the scammers and recover lost money.

Law enforcement is unlikely to be able to recover losses, but lawsuits directly against the scammers are an option in some cases.

Step 7 – Learn From the Experience

While being scammed can be devastating emotionally and financially, also treat it as a powerful lesson for the future. Learn to identify warning signs in online offers that are too good to be true. Exercise more caution when sharing personal information.

Implement stronger security on accounts. Set Google alerts to monitor your information online. Avoid clicking links or engaging with unsolicited messages from strangers. Stay vigilant against increasingly sophisticated social media scams.

Frequently Asked Questions About the Evan Kate Billionaire Money Giveaway Scam

- Who is Evan Kate?

Evan Kate is a fictional identity made up by scammers to portray a generous billionaire willing to give away money. There are no records of a real billionaire named Evan Kate. The fake social media profiles were created to post scam giveaway offers.

- How do the scammers reach people?

The scammers aggressively leverage social platforms like Facebook, Instagram, TikTok, and Twitter using fake accounts posing as Evan Kate. They send direct messages, create fake giveaway posts, use hashtags, purchase followers/likes, and join groups to extend reach.

- What techniques do they use to build trust?

Scammers use messages showing compassion, screenshots of bank balances and transfer receipts, videos of people receiving checks, and photos of expensive items. This fabricated “evidence” aims to convince targets that Evan Kate is real and willing to help.

- What information do the scammers request?

To appear legitimate, scammers request personal information like your full name, date of birth, contact details, government ID, bank account/routing numbers, occupation, income details and education history.

- Why do they want to switch to other messaging platforms?

The scammers prefer other apps like WhatsApp, Telegram, Facebook Messenger, etc. This hides their trail once social media accounts get deleted. Chats can also be erased on these platforms to eliminate evidence later on.

- Who is the fake bank transfer agent?

Once on another messaging app, the scammer introduces a fake agent pretending to work for banks like Chase, Wells Fargo, etc. This character poses as a legitimate middleman but is just another scammer personality.

- What upfront payments do they demand?

Before any reward is given, the scammers demand upfront payment of various fake fees like taxes, processing charges, conversion fees, shipping and handling costs, anti-fraud fees, etc. This is the main aim.

- Why should I avoid this scam?

No actual billionaire named Evan Kate exists. The promised rewards are completely fabricated to lure and manipulate victims. All evidence presented is fake. Once payments are made, scammers disappear without providing anything in return.

- How can I report these scammers?

Report fake accounts/posts to social media platforms. File complaints with the FTC, FBI, IC3, and local police. Contact banks if your information was compromised. Consult attorneys regarding legal options as well.

- What precautions can I take to avoid scams?

Do thorough research beyond scammers’ claims. Watch for red flags like urgent requests, pressure tactics, and demands for upfront payment. Guard personal data carefully. Report suspicious activity. If it seems too good to be true, it always is.

The Bottom Line

The supposed Evan Kate Billionaire money giveaway scam circulating social media is just an updated version of the classic advance fee scheme. By pretending to offer large rewards in exchange for a small upfront payment, scammers exploit victims’ financial desperation and desire to trust others.

Recognizing the manipulative psychological tactics and steps involved in this scam is key to avoiding getting ensnared. If you do fall victim and share sensitive information or pay money, cease contact immediately and report the accounts. Also notify relevant authorities, financial institutions, and legal counsel to limit damages.

Ultimately, extreme caution is warranted when interacting online with unverified users promoting over the top offers. Verify identities, watch for red flags, guard personal data, and never send unrecoverable payments solely based on promises from strangers. With vigilance and awareness, social media users can better protect themselves from predatory fraudsters.

![How to Remove Praspanegual.co.in Pop-ups [Virus Removal Guide] 8 McAfee scam 4](https://malwaretips.com/blogs/wp-content/uploads/2023/08/McAfee-scam-4-290x290.jpg)