Tax season brings with it an uptick in scam attempts as cybercriminals try to steal money and personal information from unsuspecting taxpayers. One common scam involves emails and texts impersonating the IRS and falsely claiming the recipient is owed a tax refund. These communications aim to trick people into clicking links and providing sensitive data that can enable identity theft and financial fraud.

It’s important to understand how to recognize an IRS scam attempt and what actions to take if you fall victim. With some knowledge and preventative measures, you can avoid becoming a target of tax scams. This comprehensive guide will provide an overview of the IRS tax return scam, explain how it works, detail what to do if you were scammed, and offer key takeaways to keep in mind.

Overview of the IRS Tax Refund Scam

The IRS tax refund scam involves emails, texts, or calls that appear to come from the IRS. These scam attempts use the IRS logo and branding and claim that the recipient is owed money from the IRS in the form of a tax refund.

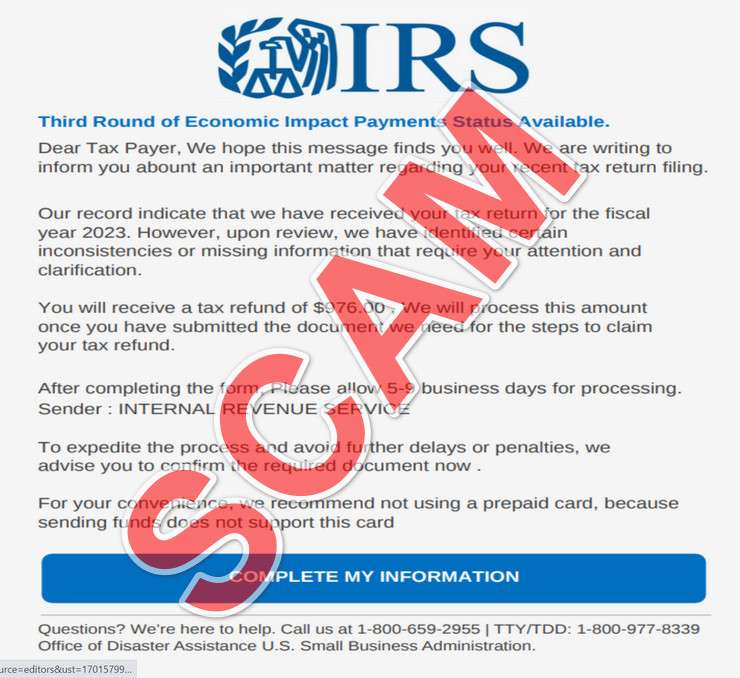

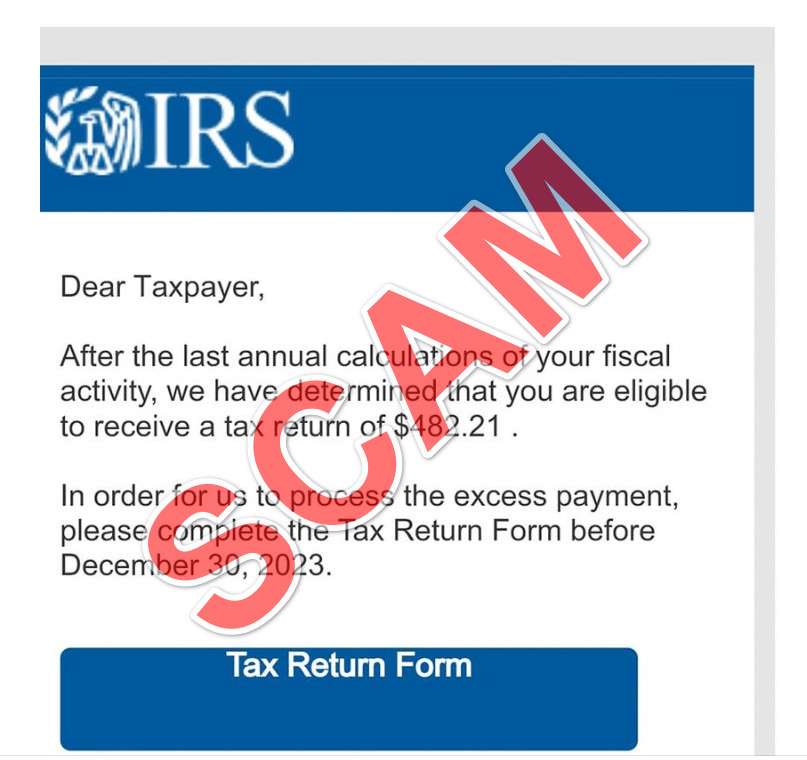

A sample email reads:

“IRS

Dear Taxpayer,

After the last annual calculations of your fiscal activity, we have determined that you are eligible to receive a tax return of $976.00.

In order for us to process the excess payment, please complete the Tax Return Form before December 5, 2023.”

The email then provides a link to a “Tax Return Form” on a fraudulent website designed to mimic an official IRS site.

If clicked, the link often leads to a realistic but fake IRS site stating:

“IRS Third Round of Economic Impact Payments Status Available.

Dear Tax Payer, We hope this message finds you well. We are writing to inform you about an important matter regarding your recent tax return filing. Our records indicate that we have received your tax return for the fiscal inconsistencies or missing information that require your attention and clarification. You will receive a tax refund of $976.00. We will process this amount once you have submitted the document we need for the steps to claim your tax refund.

Sender: INTERNAL REVENUE SERVICE.

Get My Payment.”

This page claims the victim is eligible for a refund and provides a “Get My Payment” link to submit personal details. In reality, scammers use these details to commit identity fraud. They may also request upfront fees for “processing” under the guise of taxes and fees.

Tactics Used

The IRS tax refund scam employs several deceitful tactics:

- Spoofed Emails/Texts: The scam emails and texts are designed to appear as if they come directly from the IRS. They contain IRS logos, branding, and convince wording to seem legitimate.

- Request for Personal Information: Scam communications request personal details like Social Security Numbers, bank account numbers, and credit card info under the pretense of confirming refund eligibility.

- Threats of Audits: Some scam attempts threaten an IRS audit or criminal charges if victims do not promptly confirm their details and eligibility.

- Requests for Upfront Fees: Scammers sometimes request upfront “fees” from victims by asking for prepaid debit cards, wire transfers, or gift cards to process the fake refunds.

- Realistic-Looking Websites: The scheme directs victims towards convincing mock IRS websites to input private data the scammers capture.

- Sense of Urgency: Scam emails impose strict deadlines like “Respond by December 5, 2023” to create urgency and trick victims into acting rashly.

These calculated strategies catch taxpayers off guard and exploit confusion over legitimate IRS communications. Unfortunately, many victims realize the scam too late once the damage is done.

Potential Damages

If taxpayers fall for an IRS tax refund scam, several grave outcomes can unfold:

- Identity Theft: By gaining access to Social Security Numbers, addresses, bank details and more, scammers can steal identities and commit serious fraud.

- Financial Theft: Scammers steal any prepaid cards, wire transfers, or gift cards victims send to allegedly cover “fees.” Bank accounts can also get drained.

- Credit Card Fraud: Any credit card details entered on fake IRS sites provide scammers the means to make fraudulent purchases.

- Phishing Vulnerability: After falling for one type of phishing scam, the victim’s information often ends up on lists sold to other scammers who deploy more phishing attempts.

The consequences underscore the need to exercise caution when receiving communications claiming to involve tax refunds. If you fall victim to an IRS scam, it is vital to take corrective actions immediately.

How the IRS Tax Refund Scam Works

IRS imposter scams unfold across several key stages:

Stage 1) Initial Contact

Everything begins when scammers acquire taxpayer data like names, addresses, phone numbers and emails. Cybercriminals can purchase this data illegally via the dark web. Or they obtain it through corporate data breaches involving finance companies, tax preparers, or government agencies.

Armed with taxpayer data, scammers send out mass scam emails and texts that mimic legitimate IRS communications. These emails contain:

- The IRS logo and branding elements

- A greeting line such as “Dear Taxpayer”

- An announcement of supposed tax refund eligibility

- Dire warnings of what happens if the recipient does not respond quickly

- A request to visit an included link to confirm refund eligibility and payout

For example:

“Dear Taxpayer,

Our records indicate you qualify for a $795 tax refund from overpayment last year. To claim your refund, please click here to confirm your eligibility and provide the necessary details within 24 hours.”

The texts contain similarly urgent messaging directing victims to click embedded links. These initial scam attempts aim to prompt rapid action rather than careful scrutiny.

Stage 2) Fake IRS Website

When recipients click the link, the scam directs them to a deceitful website pretending to be the official IRS site. To appear more genuine, scammers regularly register lookalike web addresses.

For instance, they may use IRStaxrefundstatus.com instead of the actual IRS.gov domain. The phony sites closely mimic IRS.gov with identical color schemes, logos, navigation and text.

These fake IRS sites even implement SSL encryption causing “Secure” https protocol and padlock icons to appear. This signals to users the site is legitimate since encryption verifies a website’s authenticity.

The scam pages display messages echoing the initial email/text about overpayments and refund eligibility for sums like $895 or $976. The sites warn victims must confirm their status and details within strict deadlines or risk forfeiting the funds and facing IRS penalties.

Phrases on the pages state things like:

“You have been identified as eligible for a refund from overpayment of $895 from your 2021 taxes. To receive your refund, confirm your status and bank information by December 31st, 2023 or payment eligibility expires.”

Stage 3) Requests for Personal Data

To “confirm their refund status,” the mock IRS sites request victims’ sensitive personal and financial data including:

- Full legal name

- Physical address

- Email address

- Phone number

- Date of birth

- Social Security Number

- Bank account and routing numbers

- Credit/debit card details

The fake IRS pages claim this data gets submitted to “verify the taxpayer’s identity” and determine precise refund amounts owed into bank accounts.

In reality, scammers capture all entered data to perpetrate identity theft and drain victims’ financial accounts. However, the detailed data helps con victims into believing the sites are legitimately confirming their eligibility.

Stage 4) Requests for Upfront Fees

Beyond personal data, some IRS refund scams seek to extract money directly from victims through requests for upfront “fees.”

The phony sites claim taxes, processing charges, or release fees must get paid before the IRS can issue refund checks. The scammers insist these fees total a few hundred dollars and provide payment methods involving:

- Prepaid debit cards

- Wire transfers

- Gift cards (iTunes, Amazon etc.)

- Mobile payments (Zelle, CashApp etc.)

Scam sites even offer to “support” victims through the process of acquiring and submitting these payment types. This injects a sense of perceived assistance while duping taxpayers into covering made-up fees.

In truth, any form of upfront payment sent to the scammers equates to financial theft. And after sending money, victims receive nothing while scammers pocket the funds and utilize any collected personal data for identity theft.

Stage 5) Fraud Execution

Upon acquiring victims’ information through data entry or fee payments, IRS scammers swiftly undertake identity theft and financial fraud.

First, they sell victims’ personal data on the dark web for average prices of $1-$3 per record. This allows other scammers to commit additional fraud in the victim’s name.

Next, the original scammers leverage collected financial information to illegally withdraw funds from victims’ bank accounts. They may drain accounts in full or withdraw smaller sums to avoid immediate detection.

Scammers also open fraudulent credit cards using victims’ data and make unauthorized purchases. They prefer gift cards with quick resale potential to expedite converting stolen details into untraceable cash.

Without rapid intervention, victims can face months to years cleaning up the financial and legal fallout. But by recognizing the scam tactics and understanding common damage outcomes, taxpayers can implement prevention and recovery measures.

How to Spot an IRS Tax Refund Scam

As scammers grow more sophisticated, it becomes vital to recognize key signs of fraudulent IRS communications regarding tax refunds. Look for these common indicators to avoid falling victim:

Unexpected Emails or Texts

Legitimate IRS-initiated emails and texts remain extremely rare, especially messages claiming you are owed refunds out of the blue. The IRS typically first mails taxpayers standard notices via USPS to flag any issues requiring attention.

Additionally, look out for:

- Messages riddled with spelling/grammatical mistakes

- Threatening language and dire warnings if you do not act quickly

- Requests to click on hyperlinks and verify personal data urgently

- Unprofessional tone lacking specifics around your account history

Suspicious Return Addresses

Emails originating from generic accounts like support@accountservices.com demonstrate scammers impersonating IRS domains like IRS@tax.us.gov.

Similarly, text messages will come from numbers having no affiliation with government lines. Call the IRS directly at 800-366-4484 to check if any number contacting you matches theirs.

Unofficial Website Domains

If contacted by either email or text, scrutinize the actual domains you get re-directed to very closely after clicking any links. Scammers register addresses like IRSRefundsSite to mimic official channels.

However, the real IRS online services all utilize .gov domains tied exclusively to government entities. For instance, check for:

- https://www.IRS.gov/Refunds

- https://sa.www4.irs.gov/ola/

Typosquatting sites like IR.gov or replacing letters with numbers should instantly raise suspicions.

Requests for Excessive Personal Data

Legitimate IRS sites request only details directly relevant to resolving tax issues like Social Security Numbers and current banking information for refund deposits.

Scam sites ask for unnecessary extra data like full credit card numbers and photos of driver’s licenses. This signals mass harvesting of info for identity theft schemes.

Threats of Audits or Legal Action

IRS communication regarding discrepancies or underpayments provide clear guidance on next procedures needed to rectify issues. They only suggest penalties or legal risks if you intentionally avoid addressing identified problems over long periods.

Messages immediately threatening audits or criminal charges aim to scare recipients into ignoring better judgement and swiftly clicking on included links. Verify any such messages directly via calling IRS administrators with your case history handy.

Requests for Irregular Payments

Genuine IRS documents list standard repayment options involving checks, money orders, or authorized online payments via IRS Direct Pay. Scammers instead seek various untraceable and unsanctioned means like:

- Prepaid gift cards

- Cryptocurrency purchases

- Cash reloads added to payment apps

- Wiring money to third parties

By remaining vigilant around these common scam indicators, taxpayers can reliably detect fraudulent IRS refund offers long before surrendering money or sensitive personal data. Make sure to immediately flag all suspicious correspondence to antiphishing@irs.gov. Together we create first lines of defense against evolving fraud tactics threatening consumers each tax season.

What to Do If You Fall Victim to An IRS Tax Refund Scam

Despite all cautions, sophisticated IRS refund scams still dupe taxpayers each year through compelling websites, emails and texts. If you realize you may have fallen victim, remain calm and quickly take the following steps to minimize damages:

Step 1) Contact Banks and Credit Bureaus

The very first action is calling your bank and credit/debit card issuer to halt any ongoing fraud. Request replacement cards, close compromised accounts, and dispute any recent unauthorized charges. Doing so prevents further damages as scammers seek to monetize your data.

You must also call Equifax, TransUnion and Experian to request credit freezes halting approval of any new credit applications. Freezes restrict identity thieves opening fraudulent accounts and loans under your name. Ensure you keep records of everyone contacted alongside the date, time, representative’s names, and any useful case numbers.

Step 2) Change All Account Passwords

Instantly change passwords for email, bank, tax, Social Security, retail and every other sensitive online account. Use strong unique passwords for each updated the account while enabling enhanced security features like two-factor authentication (2FA) whenever available.

Updating compromised passwords limits damages by blocking scammers from your existing accounts. Enabling 2FA adds an extra credential for login like a code from your phone. So even having the new password is insufficient for account takeover.

Step 3) File an IRS Identity Theft Affidavit

You must then formally alert the IRS by filing an Identity Theft Affidavit documenting your status as a tax scam victim. To file the affidavit complete IRS Form 14039 providing key details including:

- Personal account identifiers compromised

- A description of the scam attempt

- Law enforcement departments notified

- Contact information for ongoing communication

Submitting this affidavit flags your accounts to block fraudulent tax returns in your name. It also initiates an IRS investigation seeking to hold scammers accountable to the full legal extent.

Step 4) Monitor Credit Reports and Accounts

For many months following a scam, consistently monitor your credit reports and financial/online accounts for any signs of suspicious activity. Watch for unapproved address changes, new accounts or loans taken out in your name, or abnormal charges within existing accounts.

Immediately report any fraudulent activities to the associated institutions. Also file additional dispute paperwork around inaccurate information added to credit reports by identity thieves. Diligent monitoring is essential to nip all lingering fraud attempts in the bud.

You may need to check reports weekly at first since identity thieves strike quickly after acquiring data. Over time you can taper down to monthly checks for 6-12 months following the scam.

Step 5) File a Local Police Report

File an official scam and identity theft complaint with your local police department or county sheriff office. Bring all documentation, completed IRS affidavit, contact records, fraudulent emails/texts and other evidence. The formal report supports prosecution efforts and insurance/bank claims.

Having a theft case on file also ensures any lingering financial/legal issues get correctly pinned on scammers rather than appearing like your own wrongdoing. Keep the report number handy when filing disputes via providers as well.

Step 6) Contact the FTC, FCC and IC3

To further aid prosecutions, file complaints detailing your scam experience with:

- Federal Trade Commission (FTC) via IdentityTheft.gov

- Federal Communications Commission (FCC) through their Consumer Complaint Center

- FBI Internet Crime Complaint Center (IC3) by visiting IC3.gov

These agencies aggregate scam data to strengthen cases and investigations against sophisticated crime rings. Reporting all details around emails, domains, payment flows and experienced damages aids their enforcement initiatives.

Seeking Legal Action

In some major scam cases involving large financial damages, victims may consider retaining legal counsel to pursue civil action. An attorney can review details and determine if grounds exist to sue individuals or entities whose failures may have enabled aspects of the scam.

For example, if a tax preparer or software company suffered a breach exposing customer data subsequently used in IRS scams, their negligence may provide means for legal accountability. Other parties like banks or credit agencies could also hold liability for failing to halt damages flowing from confirmed identity theft.

Though rarely the best initial time investment, consulting an attorney after reporting and securing critical accounts can help convey options around recouping major losses. Scam victims should first emphasize rapid containment actions before assessing legal pursuits.

Frequently Asked Questions About the IRS Tax Refund Scam

As scammers exploit tax season to steal money and personal information, many questions arise for vigilant taxpayers. These FAQs offer answers to help you steer clear of tax refund scams.

What are the most common forms of IRS refund scams?

The majority of scams originate via unsolicited email or text messages pretending to come directly from the IRS. These phishing attempts alert recipients to nonexistent tax refunds awaiting claim pending “verification”. Scammers then provide links to fake IRS sites stealing entered personal/financial data.

Some scammers also impersonate IRS agents over phone calls making the same fake refund claims and demanding immediate payments to release funds. These tactics catch recipients off guard whether via messages, sites or calls to surrender sensitive information hastily.

How do scammers obtain my personal data to launch IRS refund scams?

Swindlers purchase stolen data bundles illegally on the dark web containing names, addresses and contact info. They also steal taxpayer data from breached third-party entities like tax prep services, software firms or government agencies.

Armed with names and contact records, fraudsters can launch precisely targeted attempts surrounding fake overpayments and refunds owed. This personalization tricks many recipients into believing the communications legitimate.

Why does the IRS refund scam give specific potential refund amounts like $976?

By providing unique dollar amounts vs generic $100 or $500 figures, scammers add authenticity enticing recipients to follow included links. The random values aim to match what taxpayers may realistically expect for refunds based on prior year filings.

The specificity triggers recipients thinking “That IRS amount seems to align with my tax situation, I should confirm if real”. This convinces more folks to click-through and get ensnared.

What tips off the refund scam emails/texts as fakes if details look legitimate?

Despite official logos and personal financial figures, closer inspection reveals subtle giveaways:

- Poor grammar/spelling mistakes unlikely in official correspondence

- Threatening urgent tones insisting you will miss out or face legal peril

- Requests for private data entry on third-party sites versus IRS.gov domains

- Usage of insecure http rather than encrypted https connections

When scrutinized, these signals betray the ruse behind scam payment claims and data harvesting sites.

What steps should I take if I shared information or paid fees on an IRS refund scam website?

If you supplied data or funds to scammers, immediately:

- Contact banks/credit bureaus to halt financial fraud

- Reset all account passwords and enable enhanced security

- File an IRS Identity Theft Affidavit (Form 14039)

- Monitor accounts closely for suspicious activities

- Report the scam attempt to antiphishing@irs.gov

By acting swiftly, you can contain damages from any surrendered account details or payments. Make sure to formally document the scam attempt with as many details as possible for investigators.

The Bottom Line on the IRS Tax Refund Scam

The IRS tax refund scam offers a sobering example of how convincing phishing attempts threaten unwary victims each tax season. Yet with sufficient awareness around common scam indicators, tactics and response steps, taxpayers can equip themselves to evade and combat imposter fraud threats.

To recap, be wary of any outreach claiming IRS tax refund eligibility and requesting urgent personal/financial data entry. Signs of scams involve:

- Threatening IRS messaging and unrealistic deadlines

- Requests for private data like SSNs and bank details

- Demands for upfront wire transfers and gift card payments

- Poorly constructed web domains with the IRS name (IRStaxreturnstatus.com etc.)

- Grammatical errors, strange phrases, excessive exclamation points!!!

The real IRS does communicate around potential refunds but never via threatening unsolicited messages. And it always provides taxpayers ample time (90+ days) for responses.

Ultimately deleting any questionable communications provides the easiest protection measure to maintain personal data security. But even scam victims who shared information or sent money can still limit damages through quick account freezes, password changes, and fraud reports.

Combating increasingly sophisticated scams poses challenges but an empowered, vigilant populace remains the most potent defense. We all must spread awareness around fraud techniques, victim response protocols and the need for proactive cyber safety habits in the digital finance age. Through collective vigilance and timely reporting, IRS imposter scams will prove far less effective and pose less citizen danger each successive year.