Have you received an email recently promising you a large sum of money out of the blue? Messages with subjects like “IRREVOCABLE PAYMENT ORDER,” “OVERDUE FUNDS NOTICE,” or “CONTRACT PAYMENT” may sound enticing, but caution is advised. Behind the official-looking correspondence and tantalizing fortunes being dangled, these emails often hide a deceitful scam aiming to swindle and steal from unsuspecting recipients.

This con artist trickery has robbed millions of targets worldwide of their hard-earned money and sensitive personal data. But by understanding how the scam operates, you can learn to spot the warning signs and protect yourself. Don’t get tempted by promises of easy riches – let’s closely examine how scammers leverage this sinister fraud and why those millions never make it to your bank account.

Scam Overview

The IRREVOCABLE PAYMENT ORDER scam email is structured to appear like formal correspondence from a legitimate governmental organization or financial institution. The messages use convincing letterheads and sign-offs to seem authentic.

Common names used in the scam emails include the Economic and Social Council, the United Nations, the International Monetary Fund, and global banks. The senders go by titles like “Foreign Remittance Department,” “International Wire Transfer Division,” and “Foreign Exchange Commission.”

The emails state that the recipient is due to receive a large sum of money, ranging from hundreds of thousands to millions of dollars. Common reasons given for the payment include an inheritance payout, lottery or sweepstakes winnings, overdue contract payment, or outstanding compensation.

According to the message, the funds are ready to be transferred or paid out through cash, check, wire transfer or ATM card. However, the release has been delayed or blocked due to issues like:

- Required paperwork not being completed

- Unpaid fees and levies

- Incorrect recipient information

- Interference by corrupt officials

The email offers a solution. It provides instructions and contact information for the “agent,” “fiduciary,” or “card officer” who can purportedly assist in acquiring the awaited funds.

Targets are asked to provide personal details like:

- Full legal name

- Physical address

- Phone and fax numbers

- Bank account information

- Identification documents

- Fees for processing

These details are requested to appear legitimate and verify the recipient’s identity. But in reality, the scammers use the information to steal money and identities.

Once the initial contact is made, the criminals will fabricate reasons why more personal details, processing fees, taxes, lawyer fees, and bribes are required before the funds can be released. The fraudulent fees and requests multiply until the victim catches on or runs out of money.

Millions of these fake payment emails are sent out worldwide daily, aiming to lure in as many leads as possible. Even with low response rates, the scammers are able to reel in unsuspecting victims who ultimately end up losing significant sums of money.

The IRREVOCABLE PAYMENT ORDER scam rakes in an estimated $12 billion globally per year, according to the Federal Bureau of Investigation (FBI). Many victims are tempted by the promise of a quick payday and are unaware of the deceitful tactics used until it is too late.

How The Scam Works

The IRREVOCABLE PAYMENT ORDER scam is executed through the following steps:

1. Recipients Receive a Convincing Email

The scam starts with an email constructed to look like official correspondence from a trusted entity like a government agency or international organization. The message appears urgent and credible at first glance.

The sender uses legal and financial terminology to sound legitimate. The letterhead, signatures, seals, and logos are designed to look authentic.

The email is also personalized with the recipient’s name and email address to seem like valid one-on-one communication.

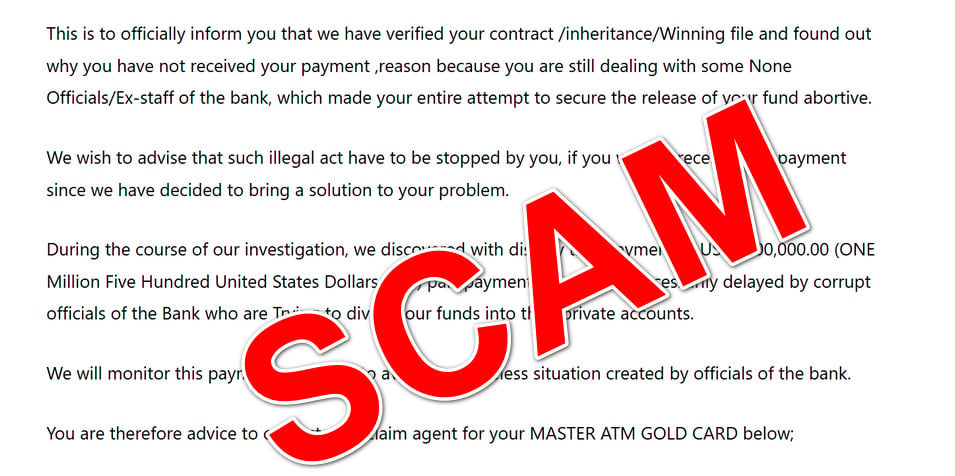

Here is how the scam email might look:

Subject: ATM Card

ECONOMIC AND SOCIAL COUNCIL

INTERNATIONAL ENVIRONMENTAL PROTECTION MOVEMENT

1775 K ST NW # 400, NEW YORK 20006-1500,

UNITED STATES

&n bsp; IRREVOCABLE PAYMENT ORDER

Dear valeri .

This is to officially inform you that we have verified your contract /inheritance/Winning file and found out why you have not received your payment ,reason because you are still dealing with some None Officials/Ex-staff of the bank, which made your entire attempt to secure the release of your fund abortive.

We wish to advise that such illegal act have to be stopped by you, if you wish to receive your payment since we have decided to bring a solution to your problem.

During the course of our investigation, we discovered with dismay that payment of US$1,500,000.00 (ONE Million Five Hundred United States Dollars only) part payment has been unnecessarily delayed by corrupt officials of the Bank who are Trying to divert your funds into their private accounts.

We will monitor this payment ourselves to avoid the hopeless situation created by officials of the bank.

You are therefore advice to contact your claim agent for your MASTER ATM GOLD CARD below;

CONTACT PERSON: MR. MICHAEL MALAKASA

DIRECT PHONE: +27844855074

E-MAIL: malakasa.mic@yandex.com

PAYOUT AMOUNT: US$1,500,000.00- (One Million, Five Hundred Thousand United States Dollars Only)

- Your Full Names:

- Address:

- Telephone/ Fax Numbers:

- Copy of Identification for payment:

- Country of Origin:

Note: Due to imposters, we request you present this reference code to the ATM Card officer ATM/UNSCXX0X5X9X3X25 when contacting him

Please make sure that your reply goes through any of the ATM Director email as stated above. We are sorry for PAIN you must have gone through.

On behalf of UNITED NATIONS

Yours Sincerely

DR. RHAI SAI

UNITED NATIONS OFFIC

2. The Message Promises a Large Sum of Money

The email states that the recipient is owed a substantial amount of money. Ranging from hundreds of thousands to millions of dollars, the promised fortune is attractive but just unrealistic enough to raise suspicion.

The reason given for the payment is an inheritance, lottery prize, overdue contract fee, wrongful termination settlement, or other windfall. Documents and case numbers may be provided as proof.

The scammers exploit the victim’s desire for a big payday. The huge potential payout blinds targets to the red flags and improbable circumstances.

3. Release of Funds is Stalled by Complications

According to the email, the payment is on hold due to missing paperwork, lapsed processing deadlines, unpaid fees, or similar issues.

Often, corrupt government or bank officials are blamed for deliberately blocking the payment through red tape and bureaucracy.

These fake complications create a sense of urgency and give reasons why the funds cannot be readily collected. They also allow the scammers to ask for sensitive information and payments to “resolve” the problems.

4. Instructions Provided to Claim the Money

The email provides specific instructions and contacts to claim the awaited funds. Directions are given to reach out to agents, attorneys, bank officers, or other intermediaries who can supposedly assist in acquiring the money.

Phone numbers, email addresses, and office addresses of these contacts are provided. The victim is asked to reach out and verify their identity, bank details, and other personal information in order to process the payment.

These contacts are characters fabricated by the scammers themselves. But their professional titles create an air of legitimacy.

5. Requests Made for Upfront Fees and Information

Once contact is made, reasons emerge for why additional fees, taxes, lawyer costs, and bribe money must be paid upfront before the funds can be released. The scammers fabricate bureaucratic hurdles and urgent deadlines to justify these on-the-spot payments.

Sensitive personal documentation and information like bank account logins, credit card numbers, photocopies of ID cards, and passport scans may also be requested.

These are presented as required steps to verify identification, prove next of kin status, or meet other fictitious criteria. But in reality, they allow the criminals to steal identities and money.

6. Demands for More Money Continue

Victims already invested in the payout are strung along with more barriers and obligations. As soon as some fake fee or bribe is paid, new complications arise that require more upfront money.

Scammers exploit the victim’s sunk cost fallacy – the tendency of people already vested in a course of action to follow through rather than abandon their efforts and investments.

The demands multiply until the target is bankrupt, stops paying, or realizes it is a scam. Even when the victim catches on, the scammers often leverage threats to keep them quiet.

7. The Money is Never Paid Out

The promised jackpot never materializes. The supposed fees are endless. As soon as the victim stops sending money, the communication ends.

The criminals disappear with the money swindled from the target. They move on to perpetuate the same scam on a new batch of unsuspecting victims.

Some reasons the promised payment is never made include:

- The money never existed in the first place. The backstory of inheritance, lawyer fees, bribes, and other delays were all fabricated.

- The contacts cannot process the payment because they are fictional characters created by the scammers themselves.

- The scammers blocked the victim when they ceased sending money or caught on to the scam.

In the rare case that any funds are paid out to the victim, they are typically tied to additional criminal activity. For example, the scammers may send fraudulent checks and ask the recipient to wire back a portion of the funds. They profit off the wired money before the checks bounce.

The bottom line is the scammers have no intent or ability to pay out the promised fortune. The IRREVOCABLE PAYMENT ORDER scam relies entirely on deceit and elaborate pretenses to defraud victims out of money.

What to do if you have fallen victim to this Scam

If you realize you have fallen prey to the IRREVOCABLE PAYMENT ORDER email scam, remain calm and take the following steps right away:

- Stop all contact immediately: Do not respond to any more emails, texts, calls, or requests from the scammers. Cut off all communication with the fraudsters right away.

- Alert relevant institutions: Notify your bank and credit card companies if the scammers have your financial details. Place holds on accounts that may be compromised. Report identity theft if your personal documents have been stolen.

- Report the scam: File reports with the FBI’s Internet Crime Complaint Center (IC3) and Federal Trade Commission. Provide all available details of the scam correspondence. Also notify local law enforcement authorities.

- Secure your devices: Run anti-virus scans on devices that were used to communicate with the scammers. Assume your system is compromised. Change all account passwords accessed from those devices.

- Watch for further scams: Once victimized, your contact information may be used for follow-up scams. Remain vigilant against solicitations from unknown parties.

- Seek help: Contact your bank, legal aid entities, and law enforcement for guidance on how to recover lost funds and protect yourself from further fraudulent activity. Get counseling if you are experiencing trauma.

- Spread awareness: Share your experience to warn others who may be vulnerable to similar scams. Report fake email addresses and contacts to sites dedicated to catching scammers.

Falling victim to online scams can be an embarrassing and isolating experience. But receiving support, limiting damages, and alerting authorities are crucial next steps for fraud victims.

Frequently Asked Questions about the IRREVOCABLE PAYMENT ORDER Scam

1. What is the IRREVOCABLE PAYMENT ORDER scam?

The IRREVOCABLE PAYMENT ORDER scam is a fraudulent email scheme that targets victims by claiming they are owed a large sum of money. The emails pretend to be from legitimate organizations and promise lottery winnings, contract fees, inheritances, or other fake payments ranging from hundreds of thousands to millions of dollars. Scammers use forged documents, fake backstories, and urgent pleas to trick targets into providing personal details and upfront fees to claim the non-existent funds.

2. How do scammers carry out this scam?

Scammers execute this scam in the following steps:

- Send a credible-looking email pretending to be from a trusted entity like a bank or government agency.

- State that the victim is owed a substantial amount of money for reasons like a lottery prize or contract payment.

- Claim complications like processing delays or corrupt officials are preventing release of funds.

- Provide instructions to contact agents who can supposedly assist in releasing the payment.

- Demand upfront fees, taxes, bribes for fake requirements before releasing the money.

- Continually invent new obstacles and fees until the victim catches on or runs out of money.

- Ultimately never pay out the promised funds.

3. How can I spot IRREVOCABLE PAYMENT ORDER scam emails?

Watch for emails that:

- Promise large payments from lotteries and other unlikely sources

- Are formatted like official correspondence from banks and government agencies

- Cite bureaucratic hurdles as reasons why funds are on hold

- Request personal details and upfront fees before releasing payment

- Push urgency and short deadlines for actions like paying fees

- Refuse to pay out the funds after repeated problems and payments

4. What are some examples of fake names used in the scam?

Some fake entities and organizations scammers commonly impersonate include:

- United Nations

- FBI, CIA and other government agencies

- Economic and Social Council

- International Monetary Fund

- Global banks like CitiBank, Wells Fargo, etc.

5. What types of personal details do scammers request from victims?

Scammers will try extracting details like:

- Full legal name

- Physical address

- Phone numbers

- Bank account details

- Credit card numbers

- Photocopies of ID cards and passports

- Login credentials for online accounts

6. What happens if I provide my information to the scammers?

Providing the scammers your personal details allows them to:

- Steal your identity and commit fraud in your name

- Access and drain your financial accounts

- Make unauthorized purchases using your payment cards

- Hijack your online accounts

- Commit other cybercrimes using your compromised data

7. What should I do if I already replied to an IRREVOCABLE PAYMENT ORDER scam?

If you responded to one of these scam emails, immediately:

- Cease all further contact with the scammers

- Notify your bank and credit bureaus

- Place fraud alerts and freezes on your financial accounts

- Change online account passwords that may be compromised

- Monitor your accounts and credit reports for fraudulent activity

- Report the scam attempt to authorities

8. How can I avoid falling for the IRREVOCABLE PAYMENT ORDER scam?

To avoid this scam:

- Be wary of out-of-the-blue emails promising large payments. Verify a message’s authenticity before responding.

- Never give out personal or financial details to unsolicited contacts.

- Watch for urgent pleas, short deadlines, and requests for upfront fees. These are red flags of a scam.

- Thoroughly scrutinize incredible payment claims before taking any requested actions.

- Cut off all contact and report the scam if you suspect fraudulent activity.

9. Where can I report the IRREVOCABLE PAYMENT ORDER scam?

Report scam emails and contacts to:

- The FBI’s Internet Crime Complaint Center at www.ic3.gov

- The FTC at www.ftccomplaintassistant.gov

- Your local law enforcement authorities

- ISPs, search engines, email services, and websites used by the scammers

By spotting red flags, safeguarding your data, and reporting scams, you can protect yourself from deceitful frauds like the IRREVOCABLE PAYMENT ORDER email scam. Share information on this scam to help prevent more people from being victimized.

The Bottom Line

The IRREVOCABLE PAYMENT ORDER email scam relies on forged documents, elaborate backstories, and social engineering techniques to swindle and manipulate its targets. Despite its official appearance, telltale signs expose it as an insidious fraud scheme.

Key things to remember about this scam:

- The emails pretend to be from legitimate government, financial, or international organizations. They are fake.

- Promises of large inheritance payments, contract fees, or lottery winnings always prove false. No money exists.

- Reasons for delayed payments are a fabricated pretext for requesting personal details and upfront fees.

- Contacts provided to collect the funds are characters created by the scammers themselves.

- Demands for sensitive data, processing fees, and urgent bribes always multiply. The scammers operate through deception.

- No matter the amount of time, effort, or money invested, the promised jackpot will never pay out.

Be wary of unsolicited correspondence mentioning money ready for payment. Verify a message’s legitimacy with the organization it claims to represent before divulging information or sending funds. If an offer appears too good to be true, it most likely is.

Guard personal and financial details closely. Never share such information with unknown entities promising large payouts. Scrutinize incredible payment claims and urgent requests for money or data – these are tactics scammers leverage against unwitting targets.

If a scam is suspected, cease all contact and alert the appropriate fraud reporting agencies right away. Spread awareness to help others avoid these predatory schemes. With vigilance and education, potential victims can protect themselves against sinister frauds like the IRREVOCABLE PAYMENT ORDER scam.

![Remove TimeSearchWeb.com Redirect [Virus Removal Guide] 6 1 1](https://malwaretips.com/blogs/wp-content/uploads/2023/10/1-1-290x290.jpg)