The streets of New York City see millions of cars every day. With so much traffic, parking violations are bound to happen no matter how careful drivers try to be. That’s why scammers are taking advantage of unsuspecting drivers with the NYC City Pay Unpaid Parking Invoice text scam.

This scam starts with an alarming text message claiming you have outstanding parking tickets that must be paid immediately. If you fall for it, you could end up giving your personal information or credit card number to cybercriminals.

Read on to learn all about how this parking ticket scam works, how to avoid becoming a victim, and what to do if you received one of these scam texts.

Overview of the Scam

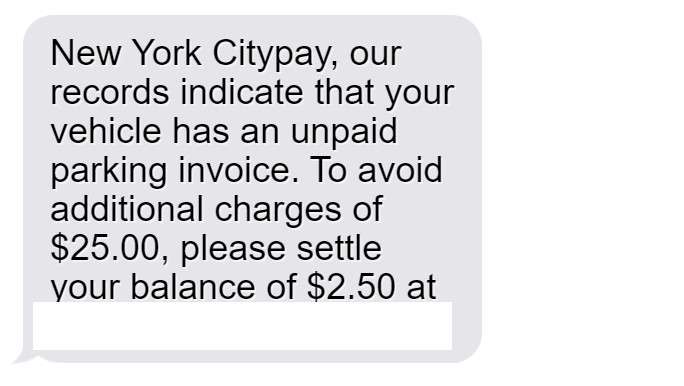

The NYC City Pay text scam targets drivers by claiming they have unpaid parking invoices that must be settled. The initial text will say something like:

“New York Citypay, our records indicate that your vehicle has an unpaid parking invoice. To avoid additional charges of $25.00, please settle your balance of $2.50 at nycitypay.com.“

This sounds legitimate at first glance. The message appears to come from an entity called “New York Citypay,” the fee amounts sound reasonable, and the website looks like an official city domain.

However, every part of this scam text is fraudulent. Here are the red flags:

- There is no such agency as New York Citypay – The city’s real parking violations bureau is called the NYC Department of Finance.

- The city does not text about parking tickets – You will receive notices by mail if you have outstanding parking fines.

- The website is fake – The real NYC violations website is nyc.gov/finance. The “nycitypay” site is operated by scammers.

- Threat of additional fees – Saying fees will escalate if you don’t pay immediately is a pressure tactic.

The scammers are trying to scare drivers into clicking the link and entering payment information. But the website is fake, designed only to steal your money and personal data.

How the Scam Works

The NYC City Pay scam is orchestrated in several steps once you receive the text:

Step 1: You Receive the Scam Text

The first contact comes as a text message to your mobile device. The scammers likely obtained your phone number through a data breach or by purchasing records from shady data brokers.

The text contents vary slightly, but always include:

- A statement that you have unpaid parking invoices

- An amount due – usually $2 to $5

- Threat of additional fees if you don’t pay quickly

- A fake website URL to settle the “balance”

The goal is to worry drivers that they owe money and get fines if they don’t pay right away. This pressures people to click the link without thinking it through.

Step 2: The Fake Website Requests Personal Information

If you click the link, it will take you to a website designed to look somewhat like an official city parking payment portal. However, the URL will clearly not be a valid city agency.

The website will have fields asking for personal information, such as:

- Full name

- Phone number

- Home address

- Email address

- Driver’s license number

- Date of birth

If you attempt to submit the form without entering details, you may get an error message demanding that you provide the info before proceeding.

Step 3: Scammers Request Credit Card Details

After submitting your personal information, you will be taken to another page asking for credit card details. This includes:

- Card number

- Expiration date

- CVV security code

There may again be error messages or other tactics to get you to input the data.

Step 4: Scammers Steal Your Money and Identity

Once you enter the credit card information, the scammers can charge your account and steal your money. They now also have your personal details to commit identity theft or sell your data on the dark web.

The website might show a fake confirmation that the parking tickets were paid. But in reality, your credit card was charged for nothing while your information ends up in the hands of criminals.

How to Spot the Parking Ticket Text Scam

Parking scammers rely on convincing messages and websites to deceive drivers. But if you know what to look for, you can identify the scam texts and sites:

Hallmarks of the Fraudulent Texts

- They come unsolicited out of the blue.

- The message warns of dire fees if you don’t pay promptly.

- They mention a made-up agency like “New York Citypay.”

- There is an urgent call to action to visit a website.

- The texts have grammar and spelling errors.

- The sender phone number is a random string of digits.

Red Flags of the Fake Websites

- The URL in the text uses “.com” instead of “.gov.”

- There are multiple pages asking for excessive personal details.

- Fields mark information as “required” before submitting each form.

- The site has no contact information or references to the official city department.

- You cannot find the site through legitimate search engines or city links.

- Information about tickets is vague with no specifics cited.

- Confirmation pages only show payment without ticket details.

Stay on guard for these scam giveaways in texts or websites about parking violations. And remember – legitimate notices only come through the mail from the NYC Department of Finance.

What to Do If You Get This Scam Text

If a questionable text about unpaid parking tickets appears on your phone, here are the steps to take:

1. Avoid Clicking Links or Calling Numbers

Do not click on any links, call any phone numbers, or reply to the message. This will only lead to scammers waiting to take advantage. Links could download malware or lead to phishing sites. Calls could connect to fraudulent voice prompts gathering your information. Even replying lets scammers know your number is active.

2. Check Your Account Status on Official City Sites

Instead of acting on the texts, proactively check your parking ticket status yourself through official city channels:

- Log into the NYC Department of Finance website to view any open parking violations.

- Call the DoF Contact Center at 311 to inquire if you have unpaid fines.

- Request a parking ticket status report by mail from the DoF.

If you do have outstanding fines, resolve them directly through the DoF – not through any links sent to you.

3. Report the Scam Text

Forward the scam text to SPAM reporting number 7726. This alerts your cell provider so they can take action against the scammer’s account.

You can also file complaints with the FCC, FTC, and NYC Department of Consumer Affairs to help authorities track scam trends and hold perpetrators accountable.

4. Monitor Financial Accounts Closely

If you did input any personal or financial information, start monitoring all related accounts for fraudulent activity. Watch for:

- Unexplained charges or withdrawals

- New credit cards or loans taken out in your name

- Suspicious login attempts to financial accounts

- Medical bills for services you didn’t use

Act swiftly if you see anything suspicious and notify the relevant institutions. Prompt action can limit damages from any leaked data.

5. Change Any Reused Passwords

Think back to whether you may have reused any existing usernames or passwords when entering information on the parking ticket scam site. If so, immediately change those credentials for every account that shares them.

Scammers will leverage reused passwords to infiltrate other accounts once they have them. Using unique passwords everywhere blocks this threat vector.

6. Place a Credit Freeze

Consider placing a credit freeze as a preventative measure after potential data exposure. This restricts access to your credit reports and makes it harder for identity thieves to open new fraudulent accounts.

Just be aware you’ll have to lift the freeze when applying for your own new credit lines down the road. But it can be worth it for the peace of mind.

7. Report Identity Theft

If you find yourself victim to full-blown identity theft after sharing information with the parking scammers, take action:

- File a report with the FTC and get an identity theft recovery plan.

- Dispute fraudulent accounts and charges with each company.

- Report identity theft to your local police department.

- Place a long-term fraud alert on your credit reports.

- Continually check credit reports and financial statements for further misuse.

- Consider a credit freeze if not enacted already.

- Change all account passwords and security questions/answers.

Though trying, navigating identity theft is manageable with quick attention and diligence.

Staying alert at the first signs of a scam gives you the chance to minimize harm or avoid it altogether. Don’t let these NYC parking ticket texts hook you.

Frequently Asked Questions About the NYC City Pay Unpaid Parking Invoice Scam

1. What is the NYC City Pay Unpaid Parking Invoice scam?

The NYC City Pay scam is a phishing text message sent to trick people into paying fake parking tickets. You’ll get a text claiming your car has unpaid parking invoices in New York City and that you must pay immediately to avoid fees. But it’s sent by scammers to steal your money and information.

2. How does the NYC City Pay scam work?

You’ll get a text that your car has unpaid NYC parking tickets that must be paid on a website URL in the message. If you click the link, it goes to a fake website asking for personal and credit card details to pay the fake tickets. The scammers then charge your card and steal your information.

3. Is there really an agency called New York Citypay?

No, New York Citypay does not exist. The real agency for parking violations is the NYC Department of Finance. The scammers use a made-up agency name in the texts to sound legitimate.

4. How do the scammers get your phone number?

They likely buy phone and vehicle owner data on the black market that was obtained through various data breaches. Or they may use phone number generating programs to send texts en masse.

5. What are some red flags of the parking ticket scam?

Red flags include threats of additional fees, urgent demands to pay, being contacted by text/phone, and the fake New York Citypay agency name. Parking tickets are only communicated via US mail.

6. What should I do if I get the NYC City Pay scam text?

Do not click any links, call numbers, or reply. Check your ticket status at the official NYC Department of Finance website. Report the scam text to 7726. Monitor accounts if you shared info. Place a credit freeze if concerned.

7. How can I protect myself from the parking ticket text scam?

Avoid clicking links or calling numbers in unsolicited texts. Never give out personal or financial details over text. Be wary of threats and urgent payment demands. Use official city sites and phone numbers to check status.

8. What should I do if I already paid the scammers?

Immediately call your credit card company to report the charges as fraudulent. Monitor your credit reports for any signs of identity theft. Change any passwords you may have used on the fake site. File a report with the FTC.

9. Can I get in trouble for real tickets if I ignore the scam?

No, the scam texts are not connected to any real ticket notices. Legit notices come via mail. Ignoring the scam texts will not affect paying actual parking violations you have.

10. How can I avoid parking ticket scams?

Remain vigilant about phone and text scams. Never click links or provide personal information unsolicited. Double check before paying fines. Monitor accounts and credit reports for suspicious activity.

The Bottom Line

The NYC City Pay Unpaid Parking Invoice text scam is making the rounds as cybercriminals seek to fool hurried drivers into paying fake fines. But knowing their tricks allows you to spot and stop the scam.

Legitimate cities don’t demand immediate fine payment via text. And they certainly don’t ask for personal or financial information by text either. Use caution, do some digging, and avoid acting in haste if you receive a surprise parking violation notice.

With scam awareness, you can hit delete on these fraudulent texts instead of getting hooked. Don’t let fears of escalating penalties or a website that looks official trick you. Stay focused on spotting the scammers trying to ticket you into handing over your data and money. Keep your guard up and keep control of your personal information to avoid becoming their next victim.