Have you received a suspicious text message claiming you have an outstanding toll balance of $12.20? Watch out – it’s a sneaky new scam designed to trick you into revealing your personal and financial information. In this article, we’ll dive deep into how this devious scam works and what you can do to protect yourself.

- “Outstanding Toll Amount of $12.20 On Your Record” Scam Overview

- How The Outstanding Toll Amount of $12.20 On Your Record Scam Works

- What To Do If You’ve Fallen Victim To The Outstanding Toll Amount of $12.20 On Your Record Scam

- Frequently Asked Questions About The “Outstanding Toll Amount of $12.20 On Your Record” Text Message Scam

- The Bottom Line

“Outstanding Toll Amount of $12.20 On Your Record” Scam Overview

The “Outstanding Toll Amount of $12.20 On Your Record” scam is a growing threat that exploits the rise of cashless toll systems and the public’s uncertainty about how they work. In this devious scheme, scammers send out mass text messages impersonating toll authorities from regions like Illinois, New York, and even New Zealand.

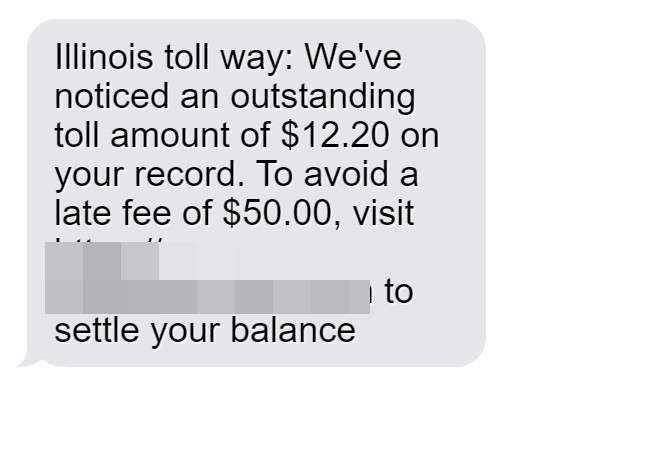

The fraudulent messages claim that the recipient has an unpaid toll balance, typically in the amount of $12.20. They create a false sense of urgency by threatening a steep $50 late fee if immediate action isn’t taken to rectify the alleged debt. For example, one common variation reads:

“Illinois toll way: We’ve noticed an outstanding toll amount of $12.20 on your record. To avoid a late fee of $50.00, visit [scam URL] to settle your balance“.

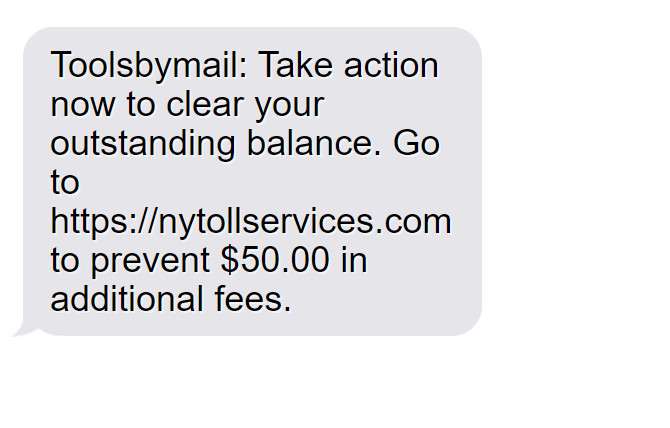

To lend an air of legitimacy, the texts often closely mimic the format and language of real toll violation notices. They may spoof the names of genuine toll agencies or include keywords like “toll authority” or “violation”. The included URLs frequently contain official-sounding domains like “tollwayservices.com” or “nytollservices.com”.

However, these websites are actually fakes set up to harvest personal and financial information from unsuspecting victims. If a person takes the bait and clicks through, they land on a page that reinforces the claim of an unpaid balance and repeats the threat of late penalties.

Under the guise of searching for and settling the fictitious debt, the bogus site prompts the target to input a wealth of sensitive data such as their name, address, phone number, date of birth, and credit card details. All of this information is pure gold for identity thieves.

What makes this scam particularly sneaky is how it exploits the uncertainty many people feel about cashless tolling. With the proliferation of systems like toll-by-plate, where cameras snap photos of license plates and mail bills to the registered owner, drivers are increasingly accustomed to getting toll notices after the fact.

Scammers take advantage of this unfamiliarity to make their claims of surprise toll bills seem plausible. They bank on people’s anxiety about racking up penalties to short-circuit their better judgment and override any skepticism

For an extra veneer of credibility, some versions of the scam may include “official” branding, misleading messages like “We’ve attempted to reach you previously regarding this matter”, or even realistic-looking citations of toll authority regulations.

To further ratchet up the pressure, the texts and websites often set looming deadlines by which the purported toll must be paid to avoid penalties. This manufactured time crunch is designed to fluster victims into acting quickly before they have a chance to step back and scrutinize the claims.

While the $12.20 amount is most common, scammers may switch it up to avoid detection or target different demographics. Similarly, the listed late fee – usually $50 – is completely arbitrary and intended to provoke alarm. The scammers have no actual power to levy fines.

Variations of the scam may pose as different agencies, including state DMVs, regional transportation authorities, or even federal entities. However, the core elements remain constant – the claim of a small unpaid toll, the threat of big penalties, and the link to a phishing site.

No one is immune from being targeted. The scam texts are blasted out indiscriminately in hopes of snaring as many victims as possible. And with cashless tolling expanding to new highways and bridges every year, the pool of potential marks keeps growing.

All it takes is a moment of inattention for someone to mistake the fraudulent message for a real toll notice. A distracted click later and they’re in the scammer’s clutches, at risk of having their identity stolen and finances drained.

As we’ll see in the next section, these scam messages can be quite convincing if you aren’t on guard. So it’s crucial for consumers to be aware of the red flags in order to avoid becoming the next victim. No one is immune, as the scammers blast out the texts far and wide hoping to snare whoever takes the bait.

How The Outstanding Toll Amount of $12.20 On Your Record Scam Works

The “Outstanding Toll Amount of $12.20 On Your Record” scam is executed in a simple yet highly effective multi-step process designed to trick distracted victims:

Step 1 – Scammer sends a phony text message claiming to be from a toll agency like the Illinois Tollway. The message claims the recipient has an unpaid toll balance, typically $12.20. It creates a false sense of urgency by threatening a $50 late penalty if immediate action isn’t taken.

Step 2 – The message includes a link to a fake payment portal and instructs the target to go there to pay the fictitious unpaid toll. The URL usually contains the name of the agency being impersonated to boost its air of legitimacy, like “nytollservices.com” or “tollwayservices.com”.

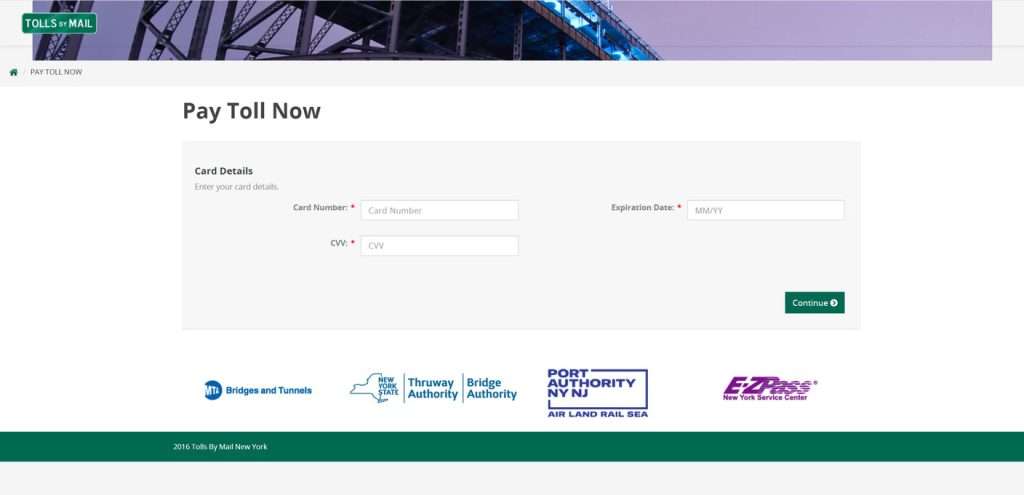

Step 3 – If the victim takes the bait and clicks through to the fraudulent website, they see an official-looking page that reinforces the claim of an outstanding toll balance. Using language like “Invoice” and “Transaction #”, it presents a breakdown of the supposed amount owed and late fees.

Step 4 – The bogus site prompts the victim to enter personal details purportedly needed to search for and pay their balance. Fields ask for data points like name, address, phone number, and date of birth – valuable fodder for identity theft in the wrong hands.

Step 5 – After entering their personal info, the victim is then instructed to input their credit card number and billing details to make the fraudulent payment and clear the contrived debt. This allows the scammer to steal payment credentials for financial fraud.

Step 6 – With the victim’s personal and financial information illicitly captured, the scammer can sell this sensitive data on the dark web black market and/or use it themselves for criminal gain, eg. making fraudulent purchases and opening accounts in the victim’s name. The victim is left vulnerable to identity theft and monetary losses.

Throughout the process, the scam leverages manipulative psychological tactics to cloud the victim’s judgment and induce them to act against their own interests:

- Impersonating authority – by posing as a legitimate toll agency, the scammer creates a false sense of legitimacy and taps into ingrained conditioning to comply with official requests.

- Instilling urgency – threatening a large $50 late fee if payment isn’t made by a specified deadline provokes a kneejerk response and overrides the victim’s rational evaluation.

- Exploiting unfamiliarity – since many are uncertain about how toll-by-plate and similar systems work, scammers take advantage of this unfamiliarity to make their claims of surprise bills seem believable.

- Feigning helpfulness – using language like “take action now to clear your outstanding balance”, the fraudster positions themselves as assisting the victim, reducing their defenses.

By combining an alarming claim with high-pressure tactics, this cunning scam lures unwitting victims down a garden path to willingly give up the keys to their identity and finances. In the next section, we’ll look at what to do if you’ve fallen prey.

What To Do If You’ve Fallen Victim To The Outstanding Toll Amount of $12.20 On Your Record Scam

If you made the mistake of clicking the link in one of these scam texts and providing your personal and/or financial information, don’t panic. You’re not alone and there are concrete steps you can take to mitigate the damage and protect yourself going forward:

- Immediately contact your financial institutions and credit card companies to alert them that your accounts may be compromised. They can put protections in place such as freezing your cards and monitoring for suspicious activity.

- Change the login credentials and passwords on any online accounts that use the same email address, username, or password that you provided to the scam site. Scammers will attempt to use stolen data to hack your other accounts.

- Place a fraud alert on your credit reports by contacting any one of the three major credit bureaus – Experian, Equifax, or TransUnion. This makes it harder for identity thieves to open new accounts in your name. You may also consider implementing a credit freeze for maximum protection.

- Closely monitor your credit card and bank statements for any unauthorized charges or suspicious activity. If you spot anything, report it to your financial institution right away to dispute the charges and prevent further losses.

- Preemptively request copies of your medical records from your healthcare providers to ensure that scammers haven’t opened accounts in your name or fraudulently filled prescriptions.

- Report the scam text to your cellular carrier by forwarding it to 7726 (SPAM). This helps the mobile providers identify and block scam numbers faster. You should also file a complaint with the FTC at ReportFraud.ftc.gov.

- Consider enrolling in an identity theft monitoring service, especially if you divulged enough info for scammers to impersonate you (like SSN). These services track your credit report and alert you to any new accounts or inquiries made in your name.

Remember, you have a right to place a fraud alert for free and dispute fraudulent charges. Stay vigilant and don’t hesitate to take advantage of all the tools available to protect your identity and accounts. The quicker you spring into action, the better off you’ll be.

Frequently Asked Questions About The “Outstanding Toll Amount of $12.20 On Your Record” Text Message Scam

Q1: What is the “Outstanding Toll Amount of $12.20 On Your Record” text message scam?

A: The “Outstanding Toll Amount” scam involves fraudsters sending out fake text messages claiming to be from toll authorities like the Illinois Tollway or New York DMV. The texts falsely assert that the recipient has an unpaid toll balance, usually $12.20, and must pay immediately to avoid hefty late fees. In reality, it’s a phishing scheme designed to steal people’s personal and financial information.

Q2: How can I tell if a toll violation text message is a scam?

A: There are several warning signs that a toll violation text may be fraudulent:

- The message appears out of the blue with no prior notice from the toll authority

- It includes a link to an unfamiliar website asking you to input sensitive data

- The URL contains typos, extra hyphens, or otherwise looks suspicious

- The message is riddled with grammatical and spelling errors

- It creates a false sense of urgency, threatening big fines if you don’t pay a small amount ASAP

- You never travel on toll roads in the region mentioned in the text

Legitimate toll agencies will never ask you to provide personal information or payment via an unsolicited text message. If in doubt, contact the toll authority through official channels to verify.

Q3: What should I do if I get one of these scam texts?

A: If you receive a suspicious text claiming you have an unpaid toll, do not click any links in the message. Delete the text immediately. Forward the message to 7726 (SPAM) to alert your carrier and help them block the number.

If you’re unsure whether you actually owe a toll, look up the toll authority’s official website and contact them directly to inquire. Have your license plate number handy in case they need to look up your account.

Q4: What happens if I click the link in a scam toll violation text?

A: Clicking on a link from an “Outstanding Toll Amount” scam text will direct you to a fraudulent website set up to collect your personal and financial info. The site will likely ask you to input sensitive details like your name, address, date of birth, and credit card number under the guise of paying the fictitious unpaid toll.

If you provide this information, you open yourself up to identity theft and financial fraud. The scammers can use the data to make unauthorized purchases, drain your bank accounts, open new credit lines in your name, and more.

Q5: I accidentally clicked the scam link and entered my info. What do I do now?

A: If you fell for the scam and disclosed your personal/financial details, take these steps ASAP:

- Contact your bank and credit card companies to alert them and lock down your accounts

- Change the passwords on any online accounts that use the same credentials you gave the scammer

- Place a fraud alert on your credit file with the three major credit bureaus

- Closely monitor your bank and credit card statements for fraudulent activity

- Consider enrolling in identity theft monitoring services for added protection

- Report the scam to the FTC at www.reportfraud.ftc.gov

Acting quickly can help minimize the damage and prevent scammers from fully exploiting your information.

Q6: How can I protect myself from toll violation phishing scams?

A: To safeguard yourself from these increasingly common scams:

- Familiarize yourself with how the toll systems in your area actually notify drivers of violations and collect payments

- Be suspicious of any unsolicited texts demanding payment or personal info

- Verify suspected toll balances by directly contacting the toll authority through official channels

- Never click links in surprise texts, even if they appear to be from a government agency

- Keep your accounts secure with strong, unique passwords and two-factor authentication

- Regularly check your financial statements and credit reports for signs of fraud

- Spread awareness by alerting friends and family to the prevalence of this scam

Scammers are always devising new tricks, so staying informed and cautious is key to thwarting their schemes. When in doubt, verify before you click or share sensitive data.

The Bottom Line

In conclusion, the “Outstanding Toll Amount of $12.20 On Your Record” text scam is a stark reminder of how crucial it is to stay alert in this era of rampant digital fraud. By impersonating toll authorities and using scare tactics, these scammers manipulate victims into serving up their sensitive data on a silver platter.

As more toll roads adopt cashless systems, we can expect to see this scam proliferate in different jurisdictions and guises. So treat any text message demanding payment or personal info with a healthy dose of skepticism, even if it appears to come from a legitimate source.

If you’re ever unsure about the status of your tolls, contact the toll agency through official channels, never via links in unsolicited texts. Together we can deprive these fraudsters of ill-gotten gains by arming ourselves with awareness and caution.