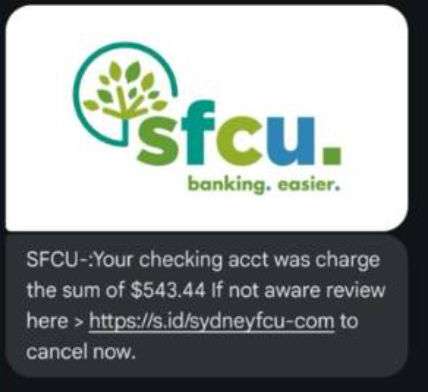

Have you received a suspicious text claiming a large charge was made to your SFCU account? It might have read something like:

“SFCU-Your checking acct was charge the sum of $543.44 if not aware review here https://idhiydneyfcu-com to cancel now.”

Or even:

“A pending charge of $899.99 on 04/09/2025, on your ‘Account’ if not you, visit https://mysydneymobile.org to cancel.”

If this looks familiar, you’re not alone—and more importantly, you’re being targeted by a scam. This comprehensive guide will walk you through everything you need to know about the SFCU text scam, including how it works, how to protect yourself, and what to do if you’ve already fallen for it.

What Is the SFCU Pending Charge Text Scam?

The “SFCU Pending Charge” scam is a phishing scheme where scammers send fraudulent text messages posing as Sidney Federal Credit Union (SFCU). These messages claim a large, unauthorized charge has been made to your account and urge you to click a link to cancel the transaction.

On the surface, these texts might seem urgent and convincing—especially to someone who banks with SFCU. The goal is to panic you into clicking a malicious link that leads to a phishing website, where you’ll be prompted to enter sensitive personal and financial information.

Common Characteristics of the Scam Texts:

- Use of urgency: The messages often mention high-dollar charges to scare you into immediate action.

- Fake links: Links usually resemble SFCU domains but include subtle misspellings or suspicious domain names like

idhiydneyfcu-comormysydneymobile.org. - Grammatical errors: Poor grammar, such as “Your checking acct was charge” instead of “charged,” is a major red flag.

- Out-of-state area codes: Many scam texts originate from phone numbers outside of the credit union’s normal service areas. For example, SFCU does not send alerts from California numbers like (858) 392-7769.

- Spoofed logos and branding: Scammers may include the SFCU logo to lend credibility, making it easy to confuse with legitimate communication.

Why This Scam Is Effective:

Scammers capitalize on fear and urgency. When users believe their money is at risk, they may act impulsively. The rise in digital banking and online transactions makes such scams increasingly sophisticated and widespread.

Unfortunately, phishing messages like these are not limited to one bank or institution—they’re part of a broader trend targeting financial institutions across the U.S.

The Real Danger: Identity Theft & Account Takeover

If you click the link and provide your login credentials, social security number, or other private data, scammers can:

- Drain your bank accounts

- Open new credit lines in your name

- Commit tax or insurance fraud

- Sell your identity on the dark web

How The Scam Works

Understanding how the SFCU scam works can help you avoid falling into the trap. Here’s a detailed breakdown of each stage:

Step 1: The Fake Alert

You receive a text message that appears to be from SFCU, stating that there is a large, unauthorized transaction on your account. The message includes a link to a site where you’re supposedly able to cancel or verify the transaction.

Step 2: Emotional Manipulation

The message creates urgency and fear—it may reference a large amount of money, like $543.44 or $899.99. Most people react quickly to protect their finances, and scammers know this.

Step 3: Clicking the Link

If you click the link, you are redirected to a fake SFCU website. This page might look shockingly similar to the real one, complete with logos, colors, and familiar layout.

Step 4: Data Harvesting

You’re prompted to enter sensitive information:

- Online banking username and password

- Social Security number

- Debit/credit card numbers

- Security questions and answers

Once submitted, this data is sent directly to the scammers.

Step 5: Account Access and Exploitation

Within minutes (sometimes seconds), scammers can:

- Log into your real SFCU account

- Transfer funds to external accounts

- Change your account passwords

- Lock you out of your own accounts

In some cases, they may monitor your account for days before striking, to gather even more information or wait for an optimal time to act.

Step 6: Widespread Damage

Once they have access to your identity, the impact can be devastating. Victims often find themselves dealing with:

- Credit score drops

- Collection notices

- Difficulty opening new accounts or getting loans

- Emotional stress and anxiety

What to Do If You Have Fallen Victim to the Scam

If you’ve clicked the link or provided any personal information, act immediately. Here are the steps you need to take:

1. Contact SFCU Directly

Call Sidney Federal Credit Union at (877) 642-7328 or visit your local branch. Let them know what happened so they can:

- Freeze or close compromised accounts

- Monitor for fraudulent activity

- Help you open new, secure accounts

2. Change All Affected Passwords

Immediately update your passwords for:

- Online banking

- Email accounts

- Any site where the same password was used

Use a strong, unique password for each.

3. Place a Fraud Alert

Contact one of the major credit bureaus:

- Equifax: 1-800-525-6285

- Experian: 1‑888‑397‑3742

- TransUnion: 1-800-680-7289

This will notify creditors to take extra precautions when verifying your identity.

4. Check Your Credit Reports

Request free reports from annualcreditreport.com and look for:

- Unauthorized accounts

- Inquiries you didn’t initiate

- Address changes

5. File a Report With the FTC

Submit a complaint at identitytheft.gov to begin a formal recovery plan.

6. Report the Scam Text

Forward the scam message to 7726 (SPAM) to notify your mobile carrier.

You should also report it to:

- SFCU’s fraud department

- The FBI’s Internet Crime Complaint Center (IC3)

Frequently Asked Questions (FAQ)

What is the SFCU Pending Charge Text Scam?

The SFCU Pending Charge Text Scam is a phishing attempt where scammers impersonate Sidney Federal Credit Union by sending fraudulent texts about a fake charge to your account. These texts urge recipients to click on a link to cancel the transaction, leading to a fake site designed to steal sensitive information.

Is Sidney Federal Credit Union actually sending these texts?

No. SFCU does not send unsolicited texts asking members to verify charges or provide account information via links. If you receive such a message, it is a scam.

How can I tell if a text message is a scam?

Look for red flags like:

- Poor grammar or spelling errors

- A sense of urgency or panic

- Suspicious or misspelled URLs

- Requests for login credentials or personal information

- Unfamiliar phone numbers, especially from different states

What should I do if I clicked the link in the text?

If you clicked the link but did not enter any personal information, clear your browser history and run a virus scan on your device. If you did enter personal details, immediately contact SFCU, change your passwords, and report the incident to the FTC and credit bureaus.

How do scammers get my phone number?

Scammers often obtain phone numbers from data breaches, online directories, social media platforms, or by randomly generating numbers in bulk. It’s not always clear how they get your information, which is why it’s important to stay vigilant.

Can scammers access my bank account just from clicking the link?

No, simply clicking the link won’t give scammers access to your account. However, if you input your login or personal information on the fake site, they can use that to access and potentially steal from your real account.

How can I report a scam message?

You can report scam texts by:

- Forwarding the message to 7726 (SPAM)

- Reporting to the FTC at identitytheft.gov

- Contacting SFCU directly to alert their fraud department

- Filing a report with the FBI’s Internet Crime Complaint Center (IC3)

How can I protect myself from text scams in the future?

- Never click links in unsolicited messages

- Enable two-factor authentication on your accounts

- Use strong, unique passwords

- Regularly monitor your bank and credit card activity

- Sign up for transaction alerts through official banking apps

Will SFCU reimburse me if I was scammed?

SFCU may be able to help, especially if the fraud is reported quickly. Each case is handled individually, so it’s crucial to contact them as soon as possible to discuss next steps and potential reimbursement options.

The Bottom Line

The SFCU “Pending Charge on Your Account” text scam is a growing threat that exploits fear and urgency to steal personal information. But now that you know what to look for, you’re in a much stronger position to protect yourself.

Remember:

- Never click on suspicious links.

- Legitimate institutions won’t ask for sensitive info via text.

- When in doubt, call SFCU directly.

Your awareness is your best defense. Share this information with friends and family to help keep everyone safe. If you found this guide helpful, consider bookmarking it or passing it along—it might just save someone a whole lot of stress.

Stay safe and stay informed.

![Remove Spolanamph.com Pop-up Ads [Virus Removal Guide] 4 McAfee scam 4](https://malwaretips.com/blogs/wp-content/uploads/2023/08/McAfee-scam-4-290x290.jpg)