The alarming rise of predatory collection scams has consumers on edge about suspicious calls or messages claiming they owe debts. One such scam that is infiltrating inboxes tries to fool victims by posing as a legitimate company called Sunrise Credit Services. This article exposes how these sunrise debt collector SMS messages and calls exploit consumer fears to commit egregious financial fraud. Arm yourself with knowledge to beat these debt vultures at their own game.

- Overview of the Sunrise Debt Collector Scam

- How the Sunrise Debt Collector Scam Works

- What to Do if You Get a Suspicious Sunrise Debt Text

- Warning Signs of the Sunrise Debt Collector Scam

- Debt Collection Laws & Your Rights

- Tips to Spot and Stop Debt Collection Scams

- The Bottom Line on Sunrise Debt Collector Scams

- Frequently Asked Questions about the Sunrise Debt Collector Scam

Overview of the Sunrise Debt Collector Scam

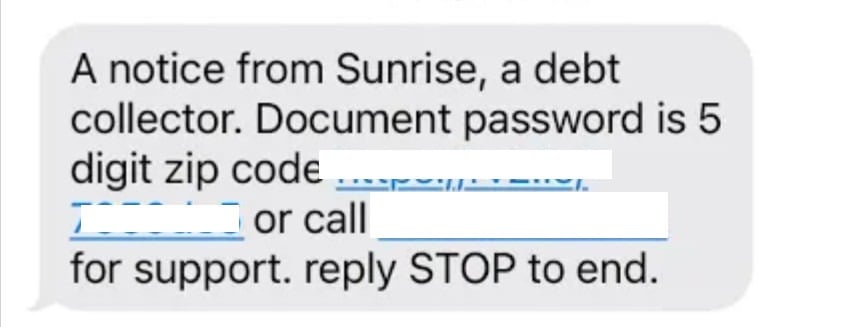

This disturbing scam starts with an unsolicited text message claiming to be from “Sunrise Credit Services”, stating that the recipient has an outstanding debt and urging them to call a provided phone number or visit a website to resolve it. The messages are specifically designed to scare recipients into thinking they must take immediate action to avoid consequences like lawsuits or garnished wages.

While Sunrise Credit Services is a real debt collection agency, scammers are illegally using the company’s name as a front for fraudulent activity. The texts are not actually from the real Sunrise. The phone numbers and websites lead unsuspecting victims directly into the hands of criminals posing as collectors.

Once targets call in or enter their information online, the scammers have access to steal personal and financial data. They use intimidation and threats to pressure victims into paying off bogus “debts” via gift cards, wire transfers, cash apps or mailed payments. The fraudsters will bully and deceive victims out of thousands of dollars if given the chance.

How the Sunrise Debt Collector Scam Works

The fraudsters carry out this insidious scam following these typical steps:

Step 1: Victims Receive a Text About Owing Debt

The scam starts with an SMS message sent to the victim’s phone number stating something like:

“SUNRISE CREDIT SERVICES: Our records indicate you have an outstanding debt with us. Please call [scam phone number] or visit [scam site] to resolve this issue and avoid further action.”

The ominous wording is meant to panic recipients into believing they owe money to this company and failing to pay will result in consequences.

Step 2: Victims Call or Visit the Scammer’s Website

Alarmed recipients will call the number or visit the website provided, believing they are contacting the real Sunrise Credit Services debt collection agency. But in reality, it routes them right to the fraudsters running the scam.

Step 3: Scammers Pose as Debt Collectors

Once contacted, the criminals pose as aggressive Sunrise debt collectors, demanding payment on a supposed outstanding bill. They refuse to provide any detailed validation about the “debt” if asked. The scammers invent fake late bills, loans, fees or other debts. Their intimidating, threatening manner is aimed at tricking victims into paying.

Step 4: Demands for Immediate Payment

The fake debt collectors apply intense pressure and scare tactics insisting the victim owes hundreds or thousands of dollars that must be repaid immediately to Sunrise Credit Services. They may falsely claim the “debt” will be sent to attorneys and the victim will be sued or arrested if unpaid.

Step 5: Requests for Personal Information

In the process of demanding payment, the criminals will phish for personal details like SSNs, bank account numbers, credit card info, online account logins, etc. This allows them to steal identities or siphon money.

Step 6: Instructing Victims to Purchase Gift Cards

The scammers often provide wire transfer information or request that victims go purchase gift cards from retailers like eBay, Google Play, iTunes or Amazon to pay the “debt”. They ask for gift card numbers to quickly liquidate the balance.

Step 7: Siphoning the Victim’s Money

Once they’ve scared the victim into complying and providing money or gift cards, the criminals rapidly steal whatever funds they can. The victim’s money quickly vanishes into the scammer’s pockets.

This wave of text message scams capitalizes on fears of debt collection harassment to steal thousands from unsuspecting consumers. Awareness of how these complex schemes work is key to protecting yourself.

What to Do if You Get a Suspicious Sunrise Debt Text

If you receive an unsolicited SMS message claiming to be Sunrise Credit Services demanding payment for a mystery debt, exercise caution:

- Do not call the number provided or visit the website. This directs you to the scammers.

- Look up the real Sunrise Credit Services contact info independently online or on your credit reports.

- Ask for written debt validation and only speak with verified Sunrise representatives.

- Check your credit reports thoroughly for any possibly legitimate collections items.

- Contact the original creditor listed on credit reports to see if the debt is valid.

- Understand your rights under the Fair Debt Collection Practices Act. Debt collectors cannot harass or threaten you.

- Report any illegal or suspicious contact to the FTC, Consumer Financial Protection Bureau, and state authorities.

These tips can protect you from being manipulated by text message debt scams trying to steal money and information by impersonating real collectors like Sunrise Credit Services.

Warning Signs of the Sunrise Debt Collector Scam

There are a few key indicators to recognize when a supposed “Sunrise Credit Services” contact is really just scammers impersonating their name:

- You receive an unsolicited text from “Sunrise” when you don’t recall owing any debt.

- The message comes from an unknown phone number, not Sunrise’s real contact info.

- The text threatens consequences like legal action or arrest if immediate payment isn’t made.

- You are asked to pay debts with unusual methods like gift cards, Bitcoin, cash apps, etc.

- The collector refuses to provide any written validation of the debt if you request it.

- The contact asks for banking login details or personal info like SSN.

Stay vigilant checking for these red flags that signal an interaction is a Sunrise impersonation scam versus legitimate collection work. Don’t provide money or information without verifying who you are really dealing with.

Debt Collection Laws & Your Rights

If contacted by a suspicious debt collector, be aware of your rights and protections under federal and state debt collection laws.

The Fair Debt Collection Practices Act requires that collectors:

- Send consumers a written “validation notice” within 5 days describing the debt details.

- Provide verification of the debt if the consumer disputes it in writing.

- Cease contact if requested in writing by the consumer.

- Refrain from threats, harassment, profanity, or violence when attempting to collect.

You have the right to control communication, record calls in one-party consent states, request verification, contest inaccuracies, report violations and sue for damages. Dishonest collectors often violate regulations, leaving them liable.

Tips to Spot and Stop Debt Collection Scams

Here are smart tips to protect yourself from text, call and email scams pretending to be from Sunrise Credit Services or other collectors:

- Never provide payment or personal info to an unverified source.

- Look up real contact info for collectors who contact you. Call their published numbers.

- Ask for proper written validation of the debt and review before paying anything.

- Check your credit reports and speak to the original creditor to confirm if the debt is real.

- Understand scam red flags like threats, pushy demands, and requests for unusual payment types.

- Report fraudulent activity to the FTC, CFPB, phone carriers, and state authorities. File complaints.

- Change phone number or block numbers to stop harassment from repeat scam calls/texts.

- Consult with credit counselors and consumer protection attorneys to understand your rights.

You have the power to fight back against debt collection scams and predation. Don’t become a victim of fear-based schemes aiming to exploit lack of knowledge. Master the techniques fraudsters use and turn the tables on them.

The Bottom Line on Sunrise Debt Collector Scams

Sophisticated SMS and phone scams impersonating real companies like Sunrise Credit Services are running rampant. If you receive a text demanding payment for a mystery debt, proceed with extreme caution.

Never provide personal or financial information, or pay the alleged debt without first validating everything in writing according to your rights. Be on guard for threatening language and pushy demands – clear red flags of a scam. Master the signs of fraudulent debt collectors and report them.

With awareness and vigilance, you don’t have to become the victim of text message scams exploiting fear and confusion about debt collection harassment. You have protections under state and federal laws that can also be used to take legal action if collectors cross lines.

Fight back against predatory fraudsters masquerading as legitimate companies like Sunrise Credit Services. Protect yourself, your data and your money from falling into the hands of scammers obsessed with exploiting consumers.

Frequently Asked Questions about the Sunrise Debt Collector Scam

1. I got a text from Sunrise Credit Services about a debt I don’t recognize. Is it real?

No, it’s most likely a scam. Real debt collectors are required to send written notices, not just texts demanding payment on mystery debts. Do not call the number or give any information. Look up the real Sunrise contact info and call them to check if it is legitimate.

2. What are some signs of the Sunrise debt collector scam?

Warnings signs include aggressive threats in the messages, being asked to pay in gift cards, refusal to provide written debt validation, contact from spoofed numbers, phishing for your personal information, etc.

3. What should I do if I already called the number or gave them information?

If you already engaged with the scammers, immediately contact your bank and credit card companies to monitor for fraud. Place a fraud alert and check your credit reports. Change online account passwords that may have been compromised.

4. Why do they ask for gift cards?

Scammers ask for gift cards because they can easily be turned into cash quickly. Gift cards are untraceable so it’s an easy way for fraudsters to steal money. Never pay any company demanding payment in gift cards.

5. How can I check if a debt collection contact is real?

To verify a debt collector, look up the company’s official contact info and call them directly – never use the number provided. Review your credit reports for collection accounts and get written validation of any legitimate debts. Ask the original creditor if it was assigned for collection.

6. What laws protect me from fake debt collectors?

The Fair Debt Collection Practices Act and Telephone Consumer Protection Act regulate debt collectors. Collectors using deceptive practices or trying to extort money can be sued for breaking these federal laws. State debt collection laws also apply.

7. Where should I report fake Sunrise debt collectors?

Report text scams to the FTC’s Complaint Assistant, the CFPB, the FCC, local authorities, and your phone carrier. Provide screenshots and details to get these scammers blocked and help warn others.

8. Will paying them make the debt collectors stop contacting me?

No, paying the scammers will probably result in more demands. Cease all contact and block numbers. Send a cease and desist letter. If they continue, report them to regulators to face penalties. Don’t give in to harassment or threats.

9. Could I really get sued or arrested over fake debts?

No, scammers posing as debt collectors cannot have you sued or arrested, no matter how serious they sound. Do not believe claims that police will show up at your door or job. They are lies aimed to intimidate you into paying.

10. How can I recover money lost to a Sunrise debt scam?

If you wired money or paid with gift cards, immediately contact the companies to try stopping the transactions. File disputes and fraud reports with your bank and credit card provider. Report the losses to the FTC and consider small claims court if you have the scammer’s details. Recovering funds can be very difficult once scammers get access. Avoid payment until debts are thoroughly validated.

This article is for educational purposes only and does not constitute professional, financial or legal advice. The content is intended for general information and should not be construed as definitive guidance. Information contained herein is subject to change without notice. For concerns, please contact us via the provided form.

If you are the owner of the website or product in question and wish to offer clarifications regarding your business or website, please reach out to us through the provided Contact Form.