A new phishing scam has emerged involving fake Venmo invoices for Norton security software purchases. Fraudsters are sending out emails requesting payment for $97.90 Norton purchases that the victim never actually made.

The emails state that if you want to cancel the bogus charge, you need to call the provided 804 number. However, this phone number goes directly to scammers impersonating Venmo or Norton support. Their aim is to manipulate victims into providing sensitive information and payment.

This scam combines two major elements – the reputation of Norton security and the popularity of Venmo peer-to-peer payments – to instill a false sense of urgency in recipients. But it’s entirely fraudulent, with the goal of stealing your money or data. In this comprehensive guide, we’ll break down exactly how the Venmo Norton invoice scam operates, what techniques to watch for, and steps to take if you receive one of these fake bills.

Overview of the Venmo Norton Invoice Scam

This emerging phishing scam takes advantage of two trusted brands – Norton and Venmo – to trick users into contacting scammers posing as billing support agents. The criminals send out fake Venmo invoices for $97.90 Norton purchases that the recipient never actually made.

The emails state that if you want to “cancel” the unauthorized charge, you need to call the provided 804 number immediately. However, this phone number goes directly to smooth-talking scammers ready to manipulate and deceive you in order to steal your money.

This scam is essentially a twisted hybrid between the notoriously common fake service invoice phish and tech support phone scams. The Norton angle exploits the widespread popularity of Norton antivirus and security products, which have over 300 million users worldwide. Venmo is also a household name, with over 60 million members in the US using its peer-to-peer payment app regularly.

Combined, the two brands paint a convincing picture that recipients really do owe $99.99 for some mystery Norton purchase or auto-renewal. The emails arrive out of the blue, so most victims don’t realize it’s all fake until they are already speaking with the fraudsters on the phone.

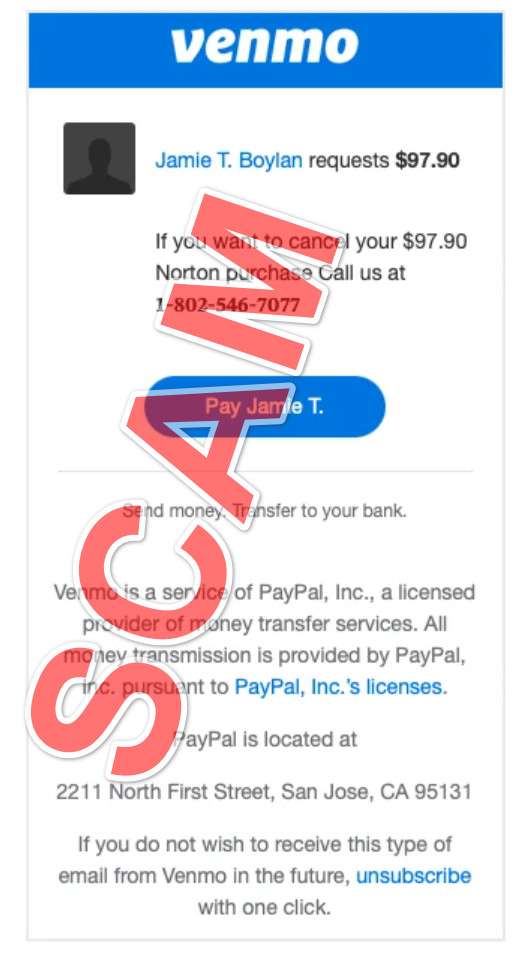

Some examples of the phony Venmo Norton invoices:

- “Clifford G. Harris requests $97.90 – If you want to cancel your $97.90 Norton purchase Call us”

- “Burton M. Kunze requests $97.90 – If you want to cancel your $97.90 Norton purchase Call us”

Both fake invoices list the same 804 number belonging to the scammers. This makes the scam seem uniform and credible, while allowing the criminals to rake in callers from all impersonal batch email variants.

Once recipients call the 804 number, the scammers begin leveraging social engineering mind tricks to extract as much sensitive data and money as possible before the victim catches on. Their end goal is to:

- Obtain credit/debit card details to charge at will

- Trick you into buying gift cards and reading them the redemption codes

- Gain remote access to devices to steal data or install ransomware

- Obtain online banking passwords, SSNs, or other identity theft fuel

To achieve this, they may pose as Norton billing reps and claim the charge is legitimate due to a past software purchase or renewal you don’t recall. Refusal to pay may mean being sent to collections or blacklisted.

Alternatively, they may pretend to be Venmo support staff and insist that a full refund is being processed, but they first need you to verify your account details and recent transactions.

In reality, neither company would ever demand immediate payment via sketchy methods or require remote access to your computer. But through authoritative insistence and false threats, the criminals often succeed in overriding common sense.

Some specific lies and manipulation tactics employed include:

- Threatening account suspension or legal action if the fake Venmo bill isn’t paid

- Warning your devices have viruses or have been hacked as an excuse for remote access

- Offering to renew your Norton subscription at a discount, then overcharging your card

- Pretending to be a Venmo supervisor to win trust during escalated calls

- Claiming the payment is an accidental authorized transaction that still must be honored

- Stating that a refund is being issued, but requiring account verification beforehand

- Asserting the chargeback dispute window has passed and payment can’t be avoided

With so many angles of deception, it’s not surprising that a good number of recipients end up complying by the end of the call. The scammers can be extremely crafty and persuasive over the phone.

Now that we’ve covered the general scam overview, let’s examine step-by-step exactly how this con unfolds.

How the Venmo Norton Invoice Scam Works

While cleverly executed, knowledge of the step-by-step process can shed light on how recipients ultimately get deceived and exploited. Here’s an in-depth look at exactly how the criminals carry out this scam:

1. Recipient Email Lists are Compiled

First, the scammers acquire large mailing lists containing thousands of potential victims’ names, emails, and phone numbers. These get stolen through data breaches, purchased on the black market, or compiled using specialized scraping software.

2. Fake Invoices are Created

Using the stolen names and logos, the scammers carefully craft fake Venmo invoices for $99.99 Norton purchases. These are made to precisely mimic the look and wording of legitimate Venmo bills for services.

Various templates may be used with differing recipient names and randomized details to make each seem unique.

3. Invoices are Sent En Masse

Using the lists of recipients, the fake Venmo Norton invoices get blasted out to thousands of inboxes per batch. A single scammer group may send hundreds of thousands or even millions of these emails per day.

4. Recipients Open and Review Invoices

With a tantalizing subject line like “Your Venmo Payment Receipt for Norton”, enough recipients will open the scam email and view the fake invoice inside. They will likely be alarmed and confused by the unknown $99.99 charge.

5. Victims Call the Phone Number

Panicked about an unauthorized transaction from their connected Venmo account, many will urgently call the 804 number listed on the invoice to halt the charge. This directly connects them with the scammers.

6. Scammers Leverage Social Engineering

When victims call, the fraudsters are now able to leverage various social engineering techniques over the phone to manipulate them into complying. A few examples:

- Posing as technicians or support reps – The scammer will pretend to be a billing agent or technician from Norton or Venmo to sound legitimate.

- Gaining trust with personal details – They will reference the victim’s full name, email, partial card number or previous transactions to appear credible.

- Claiming account issues exist – Scammers may insist unknown Norton purchases were truly authorized or legitimately refunded to the victim’s account already.

- Verifying account activity – Alternately, they may claim that a refund is currently being processed for the bogus charge, but they first need to validate the victim’s account details to confirm identity.

- Warning of consequences for nonpayment – Scammers may threaten account suspension, collections referrals, or legal action if the fake invoice isn’t paid immediately. This scares victims into compliance.

7. Remote Access is Requested

Once they gain trust, scammers will request remote access to the victim’s computer by guiding them to apps like AnyDesk. This gives full device control.

8. Computer is Compromised

With remote access granted, the scammers can now deploy malware, steal passwords, or hold the computer ransom by encrypting files.

9. Fake Services are Sold

Another aim is to sell unnecessary or fake antivirus software and tech support plans by convincing victims their computer is infected or unstable.

10. Payment and Financial Details are harvested

Ultimately, the scammers leverage social engineering to extract credit cards, bank logins, SSNs, and gift card codes, which allow them to steal funds. Victims may willingly purchase the cards.

11. Stolen Data Fuels Further Fraud

With bank account numbers and logins, scammers can now commits additional fraud like wire transfers or account draining. SSNs and names can be sold on the dark web.

12. Money is Laundered

Finally, the scammers launder and cash out the stolen money through cryptocurrency exchanges or money mules, disappearing without a trace before victims realize what happened.

This scam begins with a simple phishing email but can escalate quickly into serious identity theft and financial fraud in the hands of deceitful callers. Awareness of their step-by-step process is key to recognizing red flags early and avoiding being manipulated.

Next, we’ll go over important recovery steps if you have already fallen victim and lost money to this scam.

What to Do if You’ve Been Scammed By a Fake Venmo Norton Invoice

If you already contacted the scammers and provided payment or sensitive information, take these steps immediately:

1. End All Contact with the Scammers

If still on the phone with them, hang up now. Block their number to prevent further manipulation. Never call them back for any reason.

2. Contact Your Bank and Venmo

Alert your bank and Venmo that your account information may have been compromised. Freeze or close accounts if needed.

3. Reset ALL Passwords

Change the passwords on every online account, especially financial accounts and email. Enable two-factor authentication also if possible. Use long, complex unique passwords for each account.

4. Run Security Scans

Scan your devices with antivirus and anti-malware software to check for anything covertly installed by the scammers while accessing your computer. Remove anything found.

5. Monitor Accounts Closely

Carefully monitor bank accounts and credit cards for fraudulent charges over the next several months. Report any unapproved or suspicious activity ASAP.

6. File Police Reports

File detailed police reports on the scam, providing as much evidence as possible like emails and call logs. This creates an official record of the crime.

7. Report to Relevant Institutions

Alert Norton, Venmo, the FTC, FCC, and FBI to provide information so they can investigate the scammers. Reporting helps authorities build cases against them.

If you act quickly following a scam, you can contain the damage and prevent further exploitation of your stolen details. Don’t let embarrassment or fear of getting into trouble prevent you from speaking up as soon as unauthorized account activity is noticed.

Frequently Asked Questions About the Fake Venmo Norton Invoice Scam

What is the Venmo Norton invoice scam?

This is a phishing scam where criminals send fake Venmo emails claiming you owe $97.90 for a Norton purchase. The emails instruct you to call a provided 804 number to cancel the bogus charge. However, the number actually reaches scammers seeking your financial details.

How does the scam email appear?

The fake invoices mimic real Venmo bills, with logos and payment terminology. They reference your name and a small Norton charge of usually $99.99 or $97.90. The scammers want it to seem like a valid accidental payment.

Why do they want me to call them?

By getting you on the phone, scammers can leverage manipulation tactics and social engineering to access your accounts, trick you into purchasing gift cards, install malware through remote access, or steal your personal data.

What techniques do the scammers use over the phone?

They may pretend to be Venmo or Norton reps, warn of account suspension, offer to refund the charge, claim you must pay due to past purchases you don’t remember, or insist on verifying financial details to process a refund.

What are the scammer’s end goals?

Ultimately they want to steal your credit card number, bank account login, social security number, or take over your computer remotely to deploy ransomware or steal data to enable identity fraud.

What should I do if I receive a suspicious Venmo Norton invoice?

Do NOT call the phone number on the email. Report the fake invoice to Venmo as phishing. Check your account to confirm you did not actually make the purchase stated. Delete the email immediately.

I already called the scammers. What now?

End all contact immediately and block their number. Alert your bank and Venmo of potential account compromise. Reset all passwords and run antivirus scans to check for malware. Monitor your accounts closely for fraudulent activity and report the scam to the authorities. Do NOT provide the scammers with any additional information or payment.

How can I avoid falling for this scam?

Use caution with any unexpected invoices demanding payment, especially for software purchases you don’t recall making. Verify by contacting the company directly using official channels. Never call unsolicited numbers or provide banking details to random callers.

How can I secure my Venmo account?

Always use strong unique passwords. Enable two-factor authentication. Check your account often for unknown charges. Only link bank accounts and cards directly to Venmo that you fully trust. Never share Venmo logins or codes.

How do I know if a Venmo invoice is real?

Log in to your Venmo account to verify any transactions. Legitimate Venmo invoices will never demand immediate payment via gift cards or cryptocurrency. Venmo will also email you receipts after any actual approved payments you make.

The Bottom Line

The fake Venmo Norton payment invoice scam preys on a sense of urgency and fear of your accounts being drained. By impersonating two major, trusted brands, the criminals hope to manipulate victims into complying over the phone so money and data can be stolen.

With awareness of how this scam unfolds and proper precautions, this attack can be recognized and avoided before falling prey. Use extreme caution with any unexpected invoices demanding payment, especially those involving software subscriptions or peer-to-peer payments. Verify before providing your information over the phone.

Remember:

- Legitimate companies won’t demand immediate payment via unusual methods like gift cards.

- Confirm bills are real by contacting the company directly using official contact channels only.

- Don’t trust sudden urgent requests for your financial or personal data.

- Never provide banking, credit card, or account login details to random callers.

Stay vigilant online and over the phone to recognize telltale signs of scams. Don’t hesitate to hang up on suspicious calls demanding immediate payment. With proper awareness, modern phishing scams like the fake Venmo Norton bill attack can be defeated.