A new text message scam has emerged targeting unsuspecting drivers across the United States. The scam message claims that the recipient has an outstanding unpaid toll or invoice related to the Virginia Express Lanes. This menacing text prompts victims to visit a malicious website under the guise of paying off a small balance to avoid additional fees. However, the site is fake and set up solely to steal personal and financial information.

This scam demonstrates how cybercriminals are getting increasingly creative in their phishing techniques. The text message tricks users into thinking there is an urgent need for action to avoid extra charges. But in reality, it is a calculated fraud exploiting human tendency to act fast when money is at stake.

In this article , we will uncover everything you need to know about this “Virginia Express Lane” text scam. You will learn how the scam works, what techniques the fraudsters use, whether your information is at risk if you clicked the link, and most importantly, how to protect yourself.

Overview of the “Your Vehicle Has An Unpaid Invoice on the Virgina Express Lane” Scam

This scam starts with victims receiving an unsolicited text message stating:

“E-ZPass Virginia Service Center: Your vehicle has an unpaid invoice on the Virgina Express lane. To avoid a late fees of 35.00$, please settle your balance promptly. Total Amount Due: 4.15$. To make your payment, visit de the following link: VA-EZ.com (Enter link in your browser to securly access your fies).”

The message appears to come from an official transportation authority, the E-ZPass Virginia Service Center. E-ZPass provides electronic toll collection services on toll roads, bridges, and tunnels in 19 states, including Virginia. This adds legitimacy to the scam.

The text prompts urgent action, saying you must pay a small outstanding balance of $4.15 immediately to avoid incurring a much larger $35 late payment fee.

To trick victims into taking action, the scam text includes a malicious link to pay the fee. The link leads to a fake website impersonating a real E-ZPass payment portal.

If victims enter any information, the data gets harvested by scammers who can then commit identity fraud or steal money.

This is how the wicked minds behind the scam operate. They know that mentioning urgent fees will prod victims into clicking without thinking first. The creators also count on people being distracted and gullible when checking text messages fast on their phones.

How the Express Lane Scam Works

Let’s break down step-by-step how this deceitful Express Lane scam operates at every stage:

1. Victims Receive Unsolicited Text Message

The scam starts with an unsolicited text sent to the victim’s smartphone. The message arrives out of the blue, without the person signing up for any notifications or services related to E-ZPass in Virginia.

The text appears in the same message thread as any standard text conversation. It does not come marked as an alert, reminder, or from a shortcode number that would hint at it being marketing.

These techniques make the message seem personal, evading spam filters. The texts get blasted out randomly to thousands of phone numbers bought on the black market by scammers.

2. Text Message Designed to Create Urgency

The content of the message is crafted intentionally to spur victims into immediate action.

First, it mentions an alleged unpaid invoice related to your car and the Virginia Express Lanes. Identifying your vehicle grabs your attention quickly.

Next, it emphasizes late fees of $35 will be charged if the $4.15 balance remains unpaid. Threatening hefty fines preys on human tendencies to avoid losses.

Combined, these details create a sense of urgency. The scammers know you will act fast to avoid owing extra money.

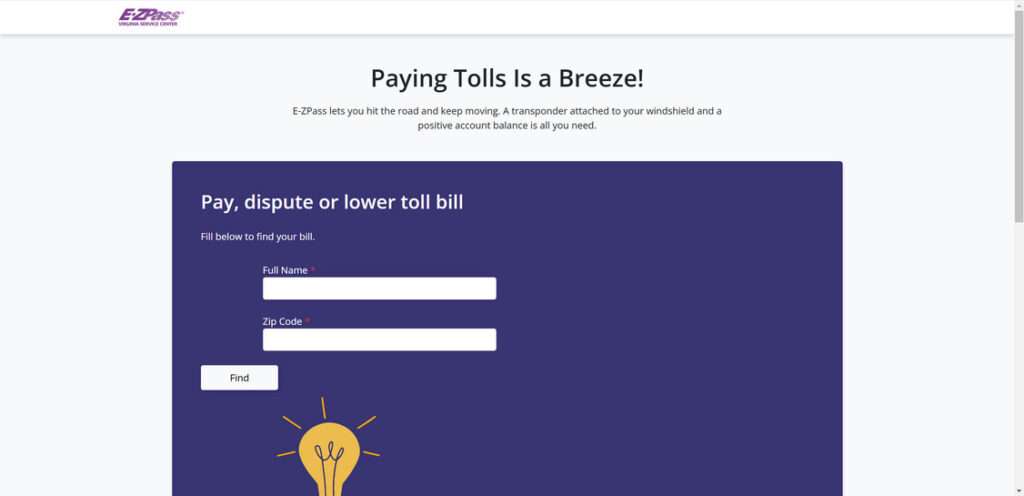

3. Fake E-ZPass Website

The text includes a link seemingly to pay the E-ZPass bill and avoid late fees. But the URL actually directs to a sophisticated fake website controlled by the scammers.

The site mirrors the real E-ZPass payment portal, using the same branding, colors, logos, and web address with minor modifications. This tricks victims into thinking the site is legitimate.

In reality, it is a malicious phishing website deployed solely to steal entered data.

4. Entering Personal and Financial Information

Once on the fake site, victims get prompted to enter personal and financial details to “pay their bill.” The information requested often includes:

- Full name

- Home address

- Phone number

- Credit/debit card number

- Card expiration date

- CVV code

If victims enter any data, it transmits directly to the scammers.

5. Criminals Steal and Abuse Information

With your information, criminals can perpetrate identity fraud or steal money. Common forms of abuse include:

- Selling data on the dark web – Full identity profiles fetch high prices.

- Opening fraudulent accounts – Criminals apply for credit cards to max out.

- Cloning cards – Duplicates are used to buy goods shipped to different addresses.

- Phishing for more info – Scammers can exploit details shared to try to steal passwords, account numbers, etc.

- Money theft – Bank accounts get drained through transfers/payments.

6. Victims Have Accounts Emptied and Identity Stolen

For victims unfortunately tricked by the scam, the consequences are severe.

With your personal data, criminals can mimic your identity online to open accounts in your name. They rack up credit card debt under your Social Security number.

Meanwhile, your financial accounts get emptied through fraudulent transfers and charges. Retirement savings built over decades can vanish in minutes.

Recovering from identity theft is challenging too. You must report it to agencies, place fraud alerts, contest criminal accounts/debts, and constantly check credit reports for new misuse. This long process can stretch for months or years.

Ultimately, an unchecked scam text luring victims to a phishing site can ruin financial and credit health. Criminals will steal every penny and bit of information they can in the aftermath.

What to Do If You Already Clicked the Link

If you received the Express Lane text scam and already clicked the embedded link, don’t panic. Here are important steps to take now:

- Contact your bank/credit card company – If you entered any financial account data, call your bank and credit card company immediately. Alert them you shared information on a phishing site and want to protect your accounts. They can place holds, report fraud, monitor for suspicious charges, and issue new account numbers. Acting quickly can stop criminals from draining accounts already compromised.

- Place a fraud alert – Consider placing 90-day fraud alerts with the three credit bureaus – Equifax, Experian, and TransUnion. This flags your credit file and makes opening new accounts harder. Most states also let you freeze credit reports more permanently. If identity theft occurred, extend to 7-year fraud victim alerts.

- Change account passwords – If you reuse the same password across accounts, cybercriminals who gain one password through phishing can access other accounts easily. Reset all account passwords to unique, complex phrases to lock criminals out across the board. Enable two-factor authentication as an extra layer of security.

- Monitor accounts and credit reports – Keep vigilant watch on all your financial accounts and credit reports to spot any signs of misuse. Unfamiliar transfers/charges, new account openings, address changes, loan applications, collections notices, and credit score drops all warrant investigation. Report confirmed fraud right away.

- Avoid further scams – Criminals target those already tricked since you’re clearly vulnerable. Be extra skeptical of calls, texts, or emails requesting personal data over the next months. Never share information with unverified parties. Legitimate businesses won’t cold call demanding sensitive details unexpectedly.

How to Protect Yourself from the Express Lane Text Scam

While hindsight is 20/20, here are key tips to protect yourself from the dangerous Express Lane scam going forward:

- Think before clicking – The #1 rule is never click links in unsolicited texts or emails. Stop and consider if you can verify the sender’s legitimacy first. Contact supposed businesses through published customer service lines or websites you find through an independent search engine query.

- Check for red flags – Spot telltale signs like grammar/spelling errors, threats demanding immediate payment, and unknown senders. Urgent requests out of the blue to pay small fees should always raise skepticism.

- Review URLs carefully – Don’t trust that links go to where they claim. Hover to preview addresses and look for slight misspellings or substitutions. Secure sites start with “https://”, not “http://”. Call the company to verify if unsure.

- Never enter information on suspicious sites – Secure official company websites through your own search before entering login credentials or sensitive data.

- Install security apps – Get scam call/text blocking apps like Robokiller or Truecaller to detect and stop many fraudulent messages before they reach you. Enable caller ID and filter unknown senders directly through your smartphone settings as well.

- Don’t overshare online – Limit personal and financial details given online to reduce exposure. Fake “quizzes” and surveys harvest data too. Assume posts reveal more than you intend, as scammers piece together details for targeted social engineering.

- Set up account alerts – Many financial institutions let you set mobile alerts for payment thresholds, suspicious activities, password changes, etc. Activating alerts can flag criminal changes on compromised accounts faster.

- Avoid texts/clicks when distracted – Times of distraction increase risk of clicking without thinking first. Avoid texts when driving, working, or otherwise occupied. Slow down and verify the sender and link later after careful inspection.

- Report scam texts – Forward scam texts to 7726 (SPAM) to report them to carriers. Submit phone numbers making scam calls to the FTC’s Do Not Call registry online too. Consumer complaints help authorities identify and shut down fraudsters.

Staying vigilant against phone and text scams protects you, your identity, and your hard-earned money. Outsmarting criminals requires knowledge of how these devious scams operate combined with safe habits. Avoid texts urging quick action, slow down, verify senders, check URLs, and never enter data on sites you didn’t independently search for and verify. Following these tips makes you an informed, cyber-secure citizen able to spot and stop scams.

Frequently Asked Questions about the “Your Vehicle Has An Unpaid Invoice on the Virgina Express Lane” Scam

1. What exactly is the “Your Vehicle Has An Unpaid Invoice on the Virgina Express Lane” scam?

This is a text messaging phishing scam where victims receive a text claiming their vehicle has an unpaid invoice or toll balance owed to the Virginia Express Lanes. The text includes a malicious link and urges immediate payment of a small balance to avoid higher late fees. However, the link goes to a fake website impersonating a real payment portal in order to steal entered financial and personal information.

2. How does the Virginia Express Lane scam work?

You receive an unsolicited text message stating you owe a small unpaid toll invoice of around $4-5 on the Virginia Express Lanes. To avoid a $35 late fee, the text instructs you to click on a link and pay the balance immediately. However, the link goes to a sophisticated fake EZPass website that mimics the real payment portal. If you enter any information, the data is harvested by scammers who can steal your identity or money.

3. What details does the Express Lane scam text message contain?

The text message is made to look like an official notice from EZPass. It contains your vehicle information, an amount due like $4.15, threats of additional late fees if the amount is not paid promptly, and a link seemingly to settle the outstanding balance. The link in the Virginia Express Lane scam text actually goes to a malicious lookalike website controlled by fraudsters.

4. What type of personal information do scammers seek?

The fake EZPass payment website prompts victims to enter sensitive personal and financial details including:

- Full name

- Home address

- Phone number

- Credit/debit card information

- Social security number

- Driver’s license details

- Bank account login credentials

5. What do scammers do with my personal information?

Scammers use stolen personal information for financial fraud in many ways, including:

- Selling complete identity profiles and bank details on the dark web

- Taking over and draining financial accounts

- Opening fraudulent credit cards to max out

- Cloning debit cards for fraudulent purchases

- Filing fake tax returns to collect refunds

- Committing medical insurance scams with your information

6. What damage can happen if I share information via the Express Lane scam?

Devastating financial and identity theft can occur if you input information on the Virginia Express Lane scam fake payment portal. Scammers can steal and wipe out your savings. They open fraudulent accounts and rack up debts in your name damaging your credit. Recovering can take many months and incur costs for credit monitoring.

7. What should I do if I already entered information into the fake Virginia EZPass site?

If you already input your data, immediately contact your bank and credit card companies to inform them and monitor for fraud. Place 90-day fraud alerts on all three major credit bureaus and consider a credit freeze. Reset all account passwords to new secure phrases. Moving quickly can help minimize some of the potential damage from this scam.

8. How can I protect myself from the Express Lane scam?

To avoid falling victim, remember simple tips like never clicking links in texts from unknown numbers. Verify a sender’s legitimacy through an independent search first. Review linked URLs for minor misspellings indicating a fake site. Only enter data directly on company sites found through search engines, never via text or email links.

9. How can I report the Virginia Express Lane scam?

If you receive an Express Lane scam text, report it by forwarding to 7726 (SPAM). You can also file complaints with the FTC’s Do Not Call registry and your state attorney general’s office. Sharing scam information helps warn others and assists investigations working to shut fraud down.

10. What is the big picture lesson about the Express Lane scam?

This scam reveals how text messaging is an increasingly common vehicle for phishing attempts seeking your sensitive personal and financial data. Always stay vigilant against texts urging quick action or threatening immediate fines. Verify legitimacy before clicking links or entering any information to protect yourself.

The Bottom Line

The “Your Vehicle Has an Unpaid Invoice on the Virgina Express Lane” phishing scam reveals how deeply deceptive some fraudsters have become. Avoid losing money by learning to identify and manage these text message scams.

Key lessons include:

- Urgent texts threatening fines try to spur fast action without critical thinking. Slow down instead.

- Never trust links in unsolicited messages – verify legitimacy first.

- Enter personal/financial data only on company sites you find yourself through a search engine.

- If compromised, alert institutions immediately to minimize damage.

- Ongoing vigilance still required after falling victim once.

I hope this guide arms you with the knowledge needed to recognize phishing scams and handle them safely. Share the tips with family and friends to spread awareness too. Deploying your new skills makes you better prepared to outsmart cybercriminals seeking money and identities from innocent victims.