Have you received an alarming text message from “Equifax” claiming there is an urgent issue with your credit score or account security? Don’t take the bait. This is likely the Equifax Alert scam designed to trick you into giving up valuable personal information to fraudsters.

In this comprehensive guide, we will uncover how the Equifax Alert text message scam works, provide examples of the deceitful texts being sent, explain the potential risks and damages if you fall victim, and offer advice on how to protect yourself from this insidious identity theft tactic targeting consumers across the country.

Scam Overview

The Equifax Alert text message scam is a deceitful phishing tactic that involves receiving fraudulent text messages falsely claiming to be from Equifax. These illegitimate texts pretend there is an urgent issue that requires your immediate attention regarding your credit information or Equifax account.

The scam messages allege situations such as a sudden significant drop in your credit score, a problem with your account security, or that your account may have been hacked or compromised. The texts try to add credibility by including the Equifax name and urging you to take swift action by clicking on a link within the message.

However, in reality, these links redirect to fraudulent phishing websites designed to steal your personal information or expose you to additional scams. The fake sites may mimic Equifax’s legitimate website or other real credit information services. Despite appearing official, these text messages are completely fraudulent.

Equifax does not contact consumers via unsolicited text messages regarding alerts about their credit scores or accounts. Any legitimate alerts from Equifax would come through official communication channels, not random texts.

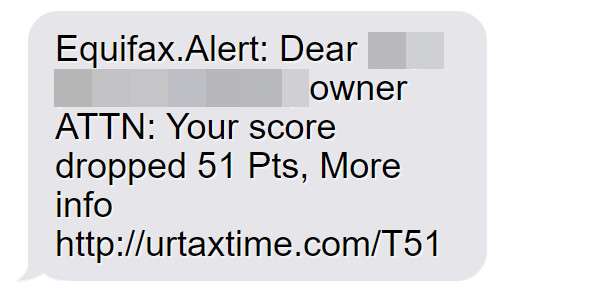

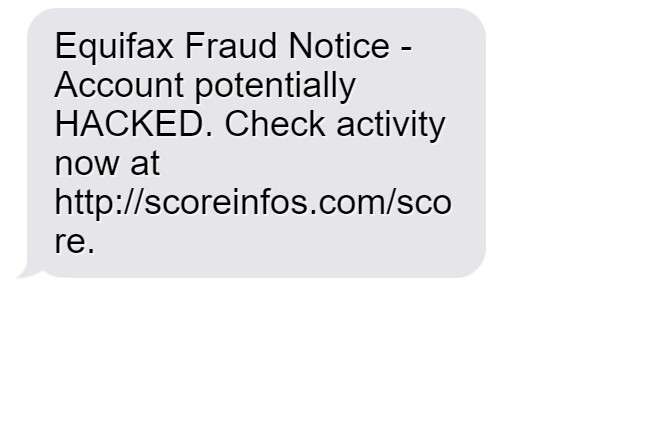

Some examples of the deceitful text messages you may receive include:

- “Equifax Alert: Your credit score changed. Check your report now at [malicious link].”

- “Urgent Notice from Equifax: Your account security is at risk. Please verify account immediately at [malicious link].”

- “Equifax Fraud Notice: Your account may be compromised. Check activity now to prevent identity theft [malicious link].”

- “Equifax.Alert: Dear [your name], your score dropped 61 points due to unpaid debt. More information: [malicious link].”

- “EQUIFAX ALERT: Potential unauthorized access detected on your account. Verify identity immediately at [malicious link].”

The phishing links within these scam texts may lead to a variety of fraudulent websites. Some are sophisticated impersonations of Equifax’s actual website, while others mimic different credit monitoring services or financial institutions.

The deception continues on the fake websites as scammers try to trick you into inputting personal information under the guise of “verifying your account.” The information harvested might include your name, date of birth, Social Security number, login credentials, or even credit card details.

In other cases, the fraudulent sites may contain malware that infects your device when visited. Or they may automatically sign you up and charge you for unwanted paid subscription services without your consent. Any credit card information entered on the sites can also be stolen and used for fraudulent purchases and charges.

Ultimately, the scammers facilitate identity theft by stealing personal information provided on the fake websites. Once your data is obtained, criminals can open unauthorized accounts or make purchases in your name, sell your information on the dark web, and commit other forms of fraud – often without you knowing until much later.

The Equifax Alert scam succeeds by deceiving recipients with texts that sound extremely urgent and credible on the surface. But any concerning texts about your sensitive financial information or accounts should be verified directly with Equifax before taking any action. If Equifax did have a legitimate alert for you, they would use official communication methods.

This scam is prevalent because unsuspecting consumers often click on links in texts without considering they could be fraudulent. The texts instill fear that your account or credit score might be compromised, so people react hastily. However, all links in unsolicited texts regarding your financial accounts should be treated as suspicious.

How the Scam Works

The Equifax Alert scam operates through several cunning steps designed to mislead recipients and steal their personal information.

Step 1: Receiving the Fraudulent Texts

The first step involves the victim receiving an unsolicited text message alleging an urgent issue requires your attention regarding your credit score or Equifax account. These texts are sent at random to consumers’ cell phones, hoping some recipients will be Equifax customers and fall for the scam.

The message claims there is a problem you must address right away by clicking on a link within the text. Some examples include:

- Your credit score has suddenly dropped due to unpaid debts or other fraudulent activity.

- Your account may have been compromised through hacking or unauthorized access.

- There are important changes or alerts related to your credit report you must review now.

- Suspicious activity has been detected and you must verify your identity immediately.

The texts instill urgency and concern by alleging financial risks like identity theft or significant drops in your credit score. This motivates recipients to react swiftly out of fear and click on the link without proper scrutiny.

Some specific scam text examples:

- “Equifax Fraud Alert – It appears your identity may have been compromised. Please verify your account immediately by clicking here: [malicious link]”

- “URGENT: Equifax has detected unauthorized credit inquiries on your account. Verify account ownership now to override credit freeze: [malicious link]”

- “ALERT: Your Equifax credit score dropped 75 points due to delinquent payment history. Review full credit report now: [malicious link]”

- “EQUIFAX – Account Alert: Possible fraudulent activity associated with your account. Verify identity and check activity status: [malicious link]”

The texts add credibility by mentioning Equifax and sounding quite urgent. But the links actually lead to fraudulent phishing websites designed to steal your information.

Step 2: Visiting the Fake Websites

If you unfortunately click on the link within the scam text, you will be redirected to a fraudulent website impersonating Equifax or another trusted financial site. These websites are specifically designed to mimic legitimate sites from reputable companies.

The fake site will request personal information from you related to verifying your identity or credit account. For example, it may promise to show you your updated credit report, recent account activity, or new score if you enter your SSN, date of birth, and other details.

In reality, any information you enter will go directly to scammers running the fraudulent site. The realistic impersonations convince victims their data is safe, when in fact it is all being stolen.

Some specific examples of information requested on the phishing sites:

- Full name and date of birth to “confirm your identity”

- Social Security number to “access your credit report”

- Credit card information to “unlock your account” or for a “small processing fee”

- Login credentials like username and password to “verify your account”

- Physical addresses or phone numbers under the guise of “updating your account security settings”

Step 3: Personal Information is Stolen

Once you enter any sensitive personal information on the fake phishing websites, the scammers immediately gain access to it. They now possess data like your SSN, bank account details, login credentials, addresses, and more.

The criminals may use your stolen information in a variety of fraudulent ways:

- Access your financial accounts to steal funds

- Make unauthorized credit card charges

- Apply for loans or credit cards in your name

- File fraudulent tax returns to steal refunds

- Steal the identity of you or family members

- Sell your information on the dark web to other criminals

Step 4: Credit Damage and Financial Risks

With your compromised personal information, scammers can inflict significant credit and financial damage in your name. Some potential consequences include:

- Credit scores plummet due to delinquent payments on accounts opened in your name

- Existing accounts are drained through unauthorized charges and withdrawals

- Loan and credit applications lead to accounts opened with your stolen identity

- Tax refund fraud results in you owing back taxes to the IRS

- Out-of-pocket costs to replace IDs, close fraudulent accounts, and reverse damages

Step 5: Ongoing Account Access

If you entered any login information on the fake sites, scammers now have this as well. They can now directly access your existing financial accounts using your compromised usernames and passwords.

This allows criminals ongoing access even after stealing your initial information. They can periodically log in to steal more funds or continue racking up fraudulent charges.

Changing account passwords, enabling two-factor authentication, and staying vigilant for suspicious activity are required to secure existing accounts following this scam.

Step 6: Increased Vulnerability to Additional Scams

Submitting any information to the fraudulent sites also exposes you to further scams. The criminals now have your contact information and know you are susceptible to phishing tactics.

They may follow up with additional scam emails, texts, or phone calls impersonating Equifax, banks, government agencies, or other entities. Knowing you complied previously, scammers will barrage you with more scams hoping you fall for those as well.

Without realizing it, a single mistake can open you up to a cascade of additional frauds and financial risks.

What to Do If You Have Fallen Victim

If you suspect you have fallen for the Equifax Alert scam, take these steps immediately:

Step 1: Stop Engaging with the Scammers

- Do not enter any more information on their sites

- Do not click any other links in the text messages

- Block the phone number that sent the text to prevent more messages

Step 2: Change All Passwords

- If you entered any login information, change those passwords immediately

- Make them strong and unique for each account

- Enable two-factor authentication wherever possible for added security

Step 3: Contact Your Financial Institutions

- Notify your credit card provider and bank about any data you shared

- Monitor all accounts closely for fraudulent charges and activity

- Consider preemptively canceling current cards and requesting replacements

Step 4: Check Your Credit Reports

- Obtain copies of your credit reports from Equifax, Experian, and TransUnion

- Look for any suspicious new accounts or charges you don’t recognize

- Consider placing a credit freeze to prevent scammers opening new accounts

Step 5: Report the Scam

- File a report about the scam with the FTC and FBI IC3

- Report it to Equifax that their name is being misused for fraud

- Notify local law enforcement if identity theft has occurred

- Submit a complaint to the FCC about illegal scam robotexts

Frequently Asked Questions about the Equifax Alert Scam

Consumers targeted by the fraudulent Equifax Alert text message scam often have many questions. Here are answers to some frequently asked questions to help you protect yourself.

1. How do I know if a text is really from Equifax?

Equifax will never contact you unexpectedly by text message regarding your credit information or accounts. Any texts alleging urgent issues are scams. Verify directly with Equifax if you receive any questionable texts.

2. What should I do if I receive an Equifax Alert text message?

Do not click any links within the text. Report the scam text to Equifax so they can track this fraud. Block the phone number that sent it. Delete the text immediately.

3. What are examples of the fraudulent Equifax Alert texts?

Examples include:

- “Equifax Fraud Notice – Account potentially HACKED. Check activity now at [malicious link].”

- “EQUIFAX ALERT: Your credit score dropped 61 points due to unpaid debt. More info: [malicious link].”

- “Equifax.Alert: Account security at risk. Verify identity immediately at [malicious link].”

4. Why does Equifax warn against these scam texts?

Equifax warns consumers because scammers are falsely using their brand to add credibility to the phishing scam texts. The links in the messages can steal your personal information or expose you to additional scams.

5. What happens if you click the link in an Equifax Alert text?

The links take you to realistic but fake websites impersonating Equifax or other financial sites. If you enter information on the fraudulent sites, scammers can steal it to commit identity theft.

6. Should I ever click on links in text messages?

No, you should never click links in texts from numbers you don’t recognize. Even if the message claims there is a problem with one of your accounts, always contact the company directly yourself to verify.

7. What types of information do the scammers want?

The fake Equifax Alert websites are designed to harvest sensitive personal data that can facilitate identity theft, like your SSN, birthdate, login credentials, or credit card numbers.

8. What should I do if I already clicked a link and shared information?

Immediately change any compromised passwords and freeze your credit reports. Monitor your financial accounts closely for fraudulent activity and notify relevant institutions. You may need to take steps to recover from identity theft.

9. How can I report these scam text messages?

Report them to the FTC, FCC, your local authorities, and Equifax. The more reports filed, the greater chance of stopping this scam campaign.

10. How can I protect myself from the Equifax Alert scam?

Be wary of texts claiming account or credit issues. Contact companies directly if concerned. Don’t click links in messages. Use unique passwords and enabling two-factor authentication also helps guard against identity theft threats.

The Bottom Line

The Equifax Alert scam tricks users through convincing but fraudulent text messages. Do not click any links within unsolicited texts related to your accounts or credit information. Equifax only communicates account alerts through official channels like postal mail. Verify the legitimacy of any concerning texts directly with Equifax before taking action.

If you entered information, take swift precautions like changing passwords, contacting financial institutions, and monitoring your credit reports. Report the scam to help warn others and limit the criminals. With vigilance and prompt response, you can minimize potential damages from this scam.

![Remove Bxjb-protect.pro Pop-up Ads [Virus Removal Guide] 5 McAfee scam 4](https://malwaretips.com/blogs/wp-content/uploads/2023/08/McAfee-scam-4-290x290.jpg)