A new scam has emerged targeting Illinois drivers and their wallets. Unsuspecting motorists across the state have been receiving text messages claiming to be from the Illinois Tollway, warning them of outstanding toll fees and threatening penalties if immediate payment isn’t made. But in reality, these texts are nothing but a ruse designed to steal personal information and money.

- Scam Overview

- How the Illinois Tollway Text Scam Operates

- Recognizing Red Flags of the Illinois Tollway Text Scam

- What To Do If You Get the Illinois Tollway Text Scam

- What To Do If You Already Paid the Scammers

- Avoiding Text Message Scams in the Future

- Frequently Asked Questions About the Illinois Tollway Text Scam

- The Bottom Line

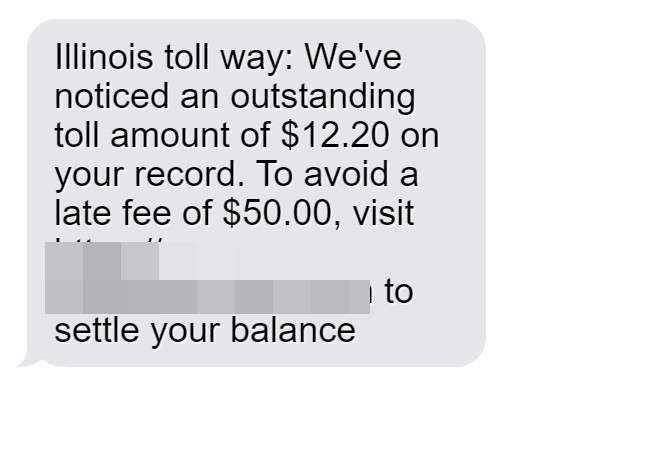

This scam is particularly devious, preying on people’s fears of financial consequences if they ignore what appears to be an urgent notification. The texts include convincing details like specific dollar amounts and due dates, making them seem credible. But understanding exactly how this scam works can help drivers in Illinois avoid becoming the next victim.

In this comprehensive guide, we’ll break down everything there is to know about the Illinois Tollway text message scam. You’ll learn how the scam operates, what techniques the scammers use, whether these texts are illegal, and most importantly, how to protect yourself.

Scam Overview

Across Illinois, drivers are being targeted by a dangerous new text scam impersonating the Illinois Tollway. Scam messages claim unpaid toll fees must be settled immediately to avoid hefty late penalties. But the texts are completely fake, aimed at stealing personal information and money.

In this overview, we’ll break down everything you need to know about this devious scam to avoid getting swindled.

Scam Operations Target Illinois Drivers

The text scam typically starts with an ominous message:

“Illinois Tollway: Our records indicate you have an outstanding balance of $12.20. Pay now at tollwayservices.com to avoid a $50 late fee.”

The message sounds official and urgent. But it’s simply scammers fishing for victims. Tens of thousands of these scam texts are being sent to random Illinois phone numbers every week.

Once a driver engages, elaborate fake websites impersonating the Tollway trick users into entering personal, financial, and payment card data. Scammers use this info for financial fraud and identity theft.

Devious Tactics Manipulate Victims

These fake texts and sites use clever psychological tactics to manipulate drivers, including:

- Threats of imminent late fees or penalties if tolls go unpaid. This pressures urgency to pay right away.

- Countdown timers showing penalties escalating if payment isn’t made in minutes.

- Realistic branding and logos make scam sites appear legitimate.

- Fake customer support via live chat convinces users the site is real.

- Familiar payment buttons for Apple/Google Pay, Venmo, PayPal build additional trust.

These tricks exploit victims’ fears and cloud judgement. Even savvy Illinois drivers are falling prey.

Scammers Disappear with Your Money

Once scammers obtain payment card or bank account numbers, they immediately process fraudulent transfers or purchases.

Or they sell the stolen payment data on the dark web to other criminals worldwide. Card numbers routinely fetch $5-$20 each in bulk.

By the time victims realize it’s a scam, the scammers have disappeared with their money, virtually untraceable. Banks often won’t cover unauthorized fraudulent transfers willingly submitted by the account holder.

Massive Tollway Data Breach? Unlikely

Some speculate that a data breach compromised Illinois Tollway customer data which was then used to target these scam texts.

However, this is very unlikely. The Tollway maintains highly secure systems that have shown no signs of intrusion. Scammers simply send blanket texts to random numbers. No actual Tollway data is needed.

Still, concerned drivers should call the Tollway to verify whether their phone number is on file and set up extra account security. Enable two-factor authentication if possible.

How Scammers Get Your Phone Number

A key question is how the scammers obtained your cell phone number to target you in the first place. Here are some of the ways schemers gather numbers for spam text scams:

- Purchasing lists of numbers. Shady dealers sell lists of cell phone numbers harvested from websites, social networks, and breached databases.

- Sending texts randomly. Scams will send huge volumes of texts randomly to see which numbers are active and responsive.

- You responded to a previous scam. Responding to one scam text puts you onto lists that get sold over and over to other scammers.

- Social engineering methods. Scammers use pretexting and phishing sites to trick users into entering their phone number.

- Malware or spyware. Data-stealing software on your device can grab contact info and send it to scammers.

Once your number ends up in scammers’ hands, they add it to lists used for countless text and phone scams going forward.

How the Illinois Tollway Text Scam Operates

Now that we’ve seen the ominous scam text itself, let’s dive into the specific techniques used by scammers to manipulate victims and steal their personal information and money. Understanding these deceptive tactics is key to recognizing and avoiding this scam.

1. Initial Contact – The Hook

The scam starts with texts sent en masse to random phone numbers. The message is crafted to instill urgency in the recipient:

“Illinois Tollway: We’ve noticed an outstanding toll amount of $12.20 on your record. To avoid a late fee of $50.00, visit https://tollwayservices.com to settle your balance.”

Several effective tactics are at work here:

- Specificity – An exact unpaid toll amount like $12.20 seems more legitimate than a round number. As does mentioning “Illinois Tollway” by name.

- Threat of consequences – The penalty for nonpayment being a steep $50 creates urgency to act fast. Victims want to avoid fines.

- Short deadline – No actual deadline given but the wording implies payment must be made immediately. This rushes victims.

- Believable domain name – While fake, tollwayservices.com looks plausibly real at first glance.

Together these factors make the texts appear credible on the surface. But it’s all a ruse to trick recipients into engaging further.

2. Gathering Your Data

If a victim clicks the link, they are taken to an elaborate fake site mimicking the Illinois Tollway. This phishing site requests personal information to “validate” your account, collect your supposed unpaid tolls, and apply penalties.

Commonly requested data includes:

- Full name

- Phone number

- Home address

- Email address

- Vehicle information like make, model, year

- Driver’s license number

- Partial Social Security Number

- Date of birth

Scammers will also have you enter fake “unpaid tolls” and even your full payment card details.

With this sensitive personal and financial information, scammers can engage in identity theft and bank fraud in your name. Emails and addresses also allow them to target you with additional scams.

3. Urgency Tactics

The fake Tollway site uses various psychological tricks to maintain that feeling of urgency created by the initial text. These include:

- Countdown timers pressuring you to pay before time expires. The timer will reset if more money is not entered quickly.

- Threatening warnings about escalating late fees, being reported to credit bureaus, or being unable to renew your driver’s license.

- Fake notices that your vehicle registration is now invalid until unpaid tolls are settled.

- Constant reminders about avoiding $50+ penalties by paying now.

These types of deceptive tactics reinforce urgency to trick users into entering payment information quickly without thinking.

4. Realistic Website Spoofing

The scam sites impersonating the Illinois Tollway are sophisticated operations:

- Official logos and branding match the real Tollway site.

- Domain names appear legitimate at first glance.

- Forms mimic ones found on the official Tollway site.

- Live chat features with fake “support agents” make the site seem authentic.

- Payment pages have professional designs that load familiar third-party payment processors. This helps build trust.

Without examining the full URL, most victims are convinced they are on the real site. This effective spoofing enables scammers to harvest entered data more easily.

5. Ongoing Attacks

Once scammers infiltrate your phone number and personal info, the attacks continue:

- Auto-dialers will call repeatedly requesting payments on “past due” fake tolls.

- Additional texts threaten arrest, license suspension, and wage garnishment if immediate payment isn’t made.

- Scammers sell your info to other fraudsters, flooding your phone and inbox with phishing attempts.

- They open unauthorized credit cards and bank accounts in your name via identity theft.

This is why it’s critical to never engage with suspicious texts, even to just tell them to stop. Information entry accelerates ongoing attacks.

By understanding the scam’s step-by-step playbook, we can more readily identify their tactics before falling victim. Get familiar with the warning signs and remain vigilant.

Recognizing Red Flags of the Illinois Tollway Text Scam

Now that you understand the inner workings of this tollway text scam, it’s important to recognize the specific red flags that signal a fraudulent text:

1. Generic greetings – Legitimate Tollway texts will address you directly, not use generic phrases like “Dear driver.”

2. Sketchy links – Watch for odd links that don’t match official Tollway websites. Never click.

3. grammatical errors and typos – Official texts from agencies like the Tollway will not contain blatant misspellings or syntax issues. These mistakes reveal an amateur scammer.

4. Aggressive threats – Real Tollway notices would not use intimidating demands, threats of legal action, or force deadlines under 24 hours.

5. Requests for sensitive information – The Tollway would never ask for private data like social security numbers over text.

6. Follow-up texts – Scammers often send second texts if you don’t respond, urging you to act before “penalties” escalate.

7. Charges for unusual amounts – Real toll charges would not be random numbers like $12.20. This signals a scammer blindly making up details.

What To Do If You Get the Illinois Tollway Text Scam

If you receive a suspicious text claiming to be from the Illinois Tollway, here are the steps to take:

- Do not click on any links provided within the text message. As explained above, they direct to fake lookalike sites designed to steal your information.

- Do not reply to the text. Any response verifies your number as active to scammers and leads to more unwanted texts in the future.

- Report the text to your cell phone carrier as spam. You can often forward scam texts to 7726 (SPAM) to notify your provider.

- Contact the Illinois Tollway. The real Tollway wants to be made aware of scam texts impersonating their agency. Contact them at (800) 824-7277 or email customerservice@getipass.com.

- Block the number. Check if your phone allows you to block specific numbers from texting you again. This prevents repeat messages from the same scammers.

- Change any passwords previously entered on scam sites. If you mistakenly provided personal info, change passwords on any associated accounts right away.

- Watch for additional fraud. Keep monitoring your accounts, credit reports, and phone for signs of misuse of your data. Report any suspicious activity immediately.

Remaining vigilant against this insidious tollway text scam is key. But if you accidentally fall victim, here’s how to get help and limit the damage.

What To Do If You Already Paid the Scammers

If you submitted payment information or paid fake toll fees to the scammers, take these steps right away to protect yourself:

- Call your credit card company. Alert them to the fraudulent charges so they can reverse the payments, block the merchant, and issue you a new card number.

- Place a fraud alert on your credit reports. This warns creditors to verify your identity before approving new accounts. It also allows you to get free credit reports to check for misuse.

- Reset all account passwords used on the fake sites as a precaution.

- Monitor your accounts closely. Watch for any signs of identity theft stemming from the compromised information. Check bills, statements, and credit reports regularly in the following months.

- File an FTC complaint. Submit a scam report with the Federal Trade Commission so they can investigate the criminals behind the operation.

- Report it to the Illinois Attorney General. Notify the AG’s consumer protection division about the Illinois-specific scam targeting drivers.

- Dispute unauthorized charges. If any charges slip through, dispute them with your credit card company or bank immediately to start a chargeback. Provide details on the scam and fraudulent nature of the merchant.

- Consider a credit freeze. Stop all new credit accounts from being opened in your name until you resolve any identity theft issues. This requires contacting each credit bureau individually.

While falling for the Illinois tollway text scam can be costly, contacting authorities and financial institutions right away can help limit damages. Ongoing monitoring of your accounts in the following months is crucial as well.

Avoiding Text Message Scams in the Future

Looking ahead, implementing a few simple precautions can keep you safe from text scams in the future:

- Be wary of unknown senders. Do not trust urgent texts from numbers you don’t recognize. Verify messages through an official website or phone number.

- Watch for poor spelling/grammar. Typos and syntax errors often give away frauds. Legitimate businesses will not have glaring mistakes.

- Never click suspicious links. Go directly to a company’s official site to check any payment requests or account alerts sent.

- Don’t reply. Responding, even just to ask a question, verifies your number as active for more scam attempts.

- Review permissions. Don’t enable auto-payment requests from texts. Scammers can submit unauthorized billing.

- Report spam texts. Forward scam texts to 7726 or your provider’s spam reporting number right away so they can investigate.

- Stop oversharing. Be wary posting your phone number publicly. Scammers troll websites and social media harvesting contact data.

- Use call/text blocking. Check if your phone provider has advanced call and text blocking options to stop suspected scam communications.

- Register with the Do Not Call list. While this is more aimed at telemarketers, registering your number can help reduce unwanted calls and texts.

- Avoid SMS-based two-factor authentication. Opt for authentication apps or hardware tokens instead of SMS codes, which are more vulnerable to interception.

Staying vigilant against text scams and limiting the personal information you share is your best defense. If a text ever seems suspicious or “too good to be true,” err on the side of caution by avoiding engagement. Remember, legitimate companies will never threaten dire consequences if immediate payment isn’t made over text. By understanding common scam tactics, we can outsmart these frauds and warn others about the latest schemes aiming to profit off deception.

Frequently Asked Questions About the Illinois Tollway Text Scam

1. How do I recognize the Illinois Tollway text scam?

The scam starts with an urgent text claiming to be from the Illinois Tollway and saying you owe immediate payment on toll fees to avoid penalties. Indicators it’s a scam include:

- Links to non-official domains

- Threatening language about imminent late fees

- Requests for personal info and payment

- Poor spelling and grammar

- Not addressing you by name

Any unexpected text demanding payment from the Tollway is likely a scam. Contact them directly if you have any doubts.

2. How did scammers get my phone number?

Scammers buy lists of numbers, use tools to generate random numbers, steal contact data from websites and breaches, and more. Once you respond or provide info, that number goes onto lists for more scam attempts. Avoid posting your number publicly.

3. What’s the purpose behind the Illinois Tollway scam?

The goal is to trick you into providing personal information and credit card details by impersonating the Tollway demanding payment on fake toll fees. They use your details to steal your money and commit identity theft.

4. What happens if I click the link in the text?

You’ll be sent to a spoof site impersonating the Tollway and asked to enter your number, address, DOB, and payment info to pay “unpaid tolls.” All data entered is harvested by scammers to steal your money and identity. Never click links in suspicious texts.

5. How can I tell if a Tollway text is real or fake?

The Tollway only contacts customers by mail, never text, regarding unpaid tolls. Official texts would address you directly by name and never include threats or urgent demands. Do not trust any texts requesting payments, personal data, or account access credentials.

6. What should I do if I get the Illinois Tollway scam text?

Do not click the link or reply. Report the text to your mobile carrier as spam. Contact the Tollway to notify them of the scam texts happening. Block the sender’s number. Monitor all accounts for fraudulent activity just in case.

7. What if I already replied to an Illinois Tollway text scam?

If you responded to a scam text or entered information onto a linked site, take immediate action to protect yourself:

- Reset all account passwords entered on the sites

- Place fraud alerts on your credit reports

- Monitor all financial accounts closely for suspicious charges

- Freeze your credit reports to prevent identity theft accounts from opening

8. Who can I contact to report the Illinois Tollway scam?

You should report scam texts to the Tollway, your cell provider, the FTC’s Do Not Call registry, and the Illinois Attorney General. These agencies all collect scam complaint data from the public to investigate and pursue enforcement actions against scammers.

9. How can I avoid text scams in the future?

Steps to take include:

- Block unknown senders

- Never click text links from unknown senders

- Turn off automatic billing approvals via text

- Use a call/text blocking app

- Don’t post your number publicly

- Limit personal info sharing

Stay vigilant and double check any odd texts demanding you take action. Scammers are constantly evolving new schemes to steal your money and data via text.

The Bottom Line

The Illinois Tollway text scam reveals how convincing and manipulative these frauds can be. Scammers will capitalize on whatever vulnerabilities they can find, like fears of financial penalties. But awareness of their deceptive tactics allows us to identify the ruses and protect our private data.

Any urgent text demanding fast payment should be verified by contacting the company directly. The Illinois Tollway reminds customers they will only be contacted by mail, never text, for unpaid toll notifications. Legitimate texts will never include threats if immediate payment isn’t made.

Before clicking links, submitting payment info, or even replying to an odd text, pause and validate the request through known channels. In the case of this Illinois scam, diligence prevents drivers from getting swindled.

By exercising caution and looking for red flags, Illinois residents can stay a step ahead of these opportunistic scammers. Make sure to report any scam texts to warn others and help shut down these deceptive operations. Don’t allow tech-savvy schemers to take advantage of you. A dose of awareness and vigilance goes a long way in protecting our hard-earned money and personal data.