In recent years, scams impersonating banks and financial institutions have been on the rise. One such scam that has emerged targets PNC Bank customers through fraudulent text messages about unauthorized transactions.

This article will provide an in-depth look at how the PNC alert scam works, what to do if you receive one of these texts, and how to protect yourself from falling victim.

Overview of the PNC Alert Scam

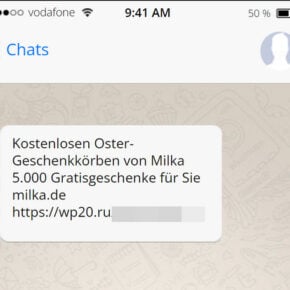

The PNC alert scam involves receiving a text message that appears to be from PNC Bank, warning of an unauthorized transaction on your account. The message will include a name, dollar amount, and question asking if you authorized the transaction. It aims to create a sense of urgency and trick recipients into calling the number provided to “dispute” the charge.

However, the number goes to a scammer posing as a PNC representative. They will gain your trust and then request sensitive information to “verify” your identity and cancel the fake transaction. With enough personal details, scammers can access your account or open fraudulent cards and loans in your name.

This scam is extremely effective because it spoofs real PNC phone numbers and texts from a shortcode registered to PNC. The texts can appear in existing message threads from prior legitimate PNC alerts. The criminals behind it are sophisticated, coordinating the texts with calls and capturing payment card details entered on fake customer service numbers.

How the PNC Alert Scam Works

The PNC alert scam is meticulously orchestrated to manipulate victims step-by-step into giving up sensitive personal information. Here is an in-depth look at how it works:

Step 1: Receiving the Fake Text

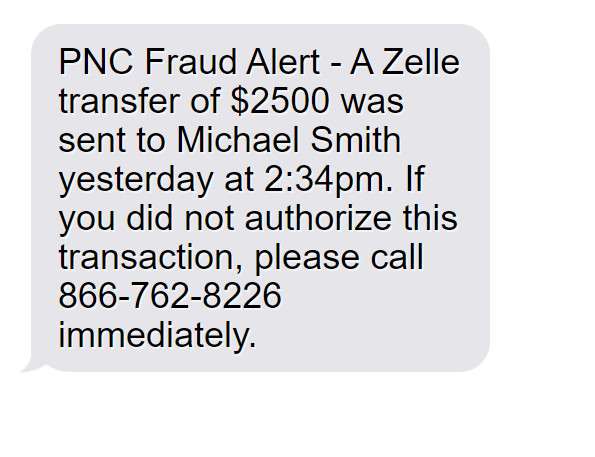

The scam starts with an SMS text sent to your phone, appearing to be from PNC Bank’s customer service number. The message references an unauthorized transaction, typically $1000 or more, sent to a random name you don’t recognize. For example:

“PNC Fraud Alert – A Zelle transfer of $2500 was sent to Michael Smith yesterday at 2:34pm. If you did not authorize this transaction, please call 866-762-8226 immediately.”

The text may come from a valid PNC shortcode or cloned number and often continues an existing message thread from previous real PNC alerts. This makes the text appear credible and urgent.

Step 2: Calling the Number Provided

Alarmed by the large unauthorized transaction, most recipients will call the phone number included in the alert text. However, this goes to the scammers instead of PNC Bank.

The number might be completely fabricated. But scammers often use spoofed caller ID to make it match PNC Bank’s real customer service line. When victims call, it sounds like PNC’s legitimate automated phone system.

This tricks people into thinking they’ve called the real PNC support number listed on the back of their card or PNC’s website. But in reality, they are speaking with criminals posing as PNC representatives.

Step 3: “Verifying” Your Identity

Once connected to the fake support line, you will speak to someone claiming to be from PNC Fraud Prevention. They will acknowledge the unauthorized transaction and ask for your full name and PNC account details to pull up your account.

Then, the scammer will explain that they first need to verify your identity before cancelling the fraudulent transaction. This is where the real manipulation begins.

The scammer will ask seemingly reasonable questions to “confirm” your identity, such as your:

- Full name

- Date of birth

- Social security number

- PNC account number

- Online/mobile banking username and password

They may also ask for the 3-digit CVV code from the back of your PNC debit or credit card.

Step 4: Gaining Access to Your Account

Armed with your sensitive personal information, the criminals can now directly access your PNC account online. They may change the online banking password, security questions, and contact info to lock you out.

The scammers can then initiate real fraudulent transfers and Zelle payments from your account to their own. They may also use your information and identity to open new credit cards or loans in your name.

In some cases, they keep you on the phone and have you log into your real PNC account. From there, you may be tricked into making a payment to cancel the fake unauthorized transaction. This sends your own money directly to the criminals.

Step 5: Realizing You’ve Been Scammed

By the time you realize it’s a scam, it’s often too late. The criminals will have ended the call after getting your key details. You will be left with actual unauthorized transactions draining your account and new accounts opened fraudulently in your name.

This devastating realization usually comes after logging into your real PNC account and seeing the damage. Or PNC Bank may call you to report real suspicious activity and accounts opened under your identity.

At this point, the scammers have your money and personal information. They will be nearly impossible to track down and prosecute. Your only recourse is to work with PNC Bank to recover losses and repair your credit.

What to Do If You Receive a PNC Alert Text

If you ever get an SMS out of the blue about an unauthorized PNC transaction, here are important tips:

- Do not call the number in the text. It likely goes to scammers, even if it looks like PNC’s real number.

- Log into your PNC account directly through your bank’s website or mobile app. Check for any signs of real fraud like withdrawals.

- Call PNC at the legitimate number on the back of your card to report the suspicious text. Have them confirm your account status.

- Do not share any information with the supposed PNC rep who calls about the text. Real PNC employees will never ask for your online banking password, social security number, or full card details by phone.

- Forward the text to PNC and report it to spam reporting agencies. This can help identify and shut down the numbers being used for the scam.

- Be extra vigilant about checking your account statements and credit reports for signs of new unauthorized activity during the next few months. Alert PNC right away about anything suspicious.

Remember that PNC and other banks will never contact you asking for sensitive details to verify transactions. If in doubt, reach out directly to PNC through their official channels to inquire. It’s better to be safe than to fall victim to this devastating scam.

What to Do If You Already Shared Information with Scammers

If you already called the fraudulent number and shared personal or financial details with the scammers, take these steps immediately:

Alert Your Bank

- Call PNC’s real customer service line and report that you were scammed. Explain what information you provided to the criminals impersonating PNC.

- Ask to speak with PNC’s fraud department. Request that they monitor your accounts for unauthorized activity.

- Inform PNC if the scammers now have access to your online/mobile banking password. Request a password reset.

Review Accounts and Credit Reports

- Log into your PNC accounts frequently to check for unauthorized transactions. Review account statements to spot fraudulent activity.

- Obtain your free annual credit reports from Equifax, Experian, and TransUnion. Check for any signs of new accounts or loans opened in your name by scammers.

- Consider signing up for identity theft monitoring services that can alert you of suspicious new accounts.

Change Online Account Passwords

- Change the passwords for your PNC online and mobile banking immediately. Make them strong and unique from passwords on other accounts.

- Also update passwords on your email, social media, and any other important online accounts. Use two-factor authentication when available.

Place Fraud Alerts

- Contact Equifax, Experian, and TransUnion to place fraud alerts on your credit reports. This makes it harder for scammers to open new credit in your name.

- You can request to freeze your credit reports which blocks access to them. But this also prevents you from opening new accounts easily.

File Reports

- File an identity theft report with the Federal Trade Commission at IdentityTheft.gov. Provide details on how your information was compromised by scammers.

- File a report about the scam text with the FTC’s Do Not Call Registry and the FCC. Provide the phone numbers used by the scammers.

- File a local police report about the fraud. Get a copy of the report to submit to banks and credit bureaus.

Monitor Accounts Diligently

- Carefully review bank and credit card statements every month for at least the next year. Dispute any unauthorized charges immediately.

- Consider using account monitoring tools from your bank and credit cards that can alert you to suspicious activity.

- Monitor your credit reports frequently for any accounts you don’t recognize. Use AnnualCreditReport.com to check them weekly or monthly.

Frequently Asked Questions About the PNC Alert Scam

What is the PNC alert scam?

The PNC alert scam involves receiving a fraudulent text message claiming there was an unauthorized transaction on your PNC Bank account. The message provides a fake customer service number and urges you to call to dispute the charge. However, the number actually connects you to scammers impersonating PNC.

How do the scammers profit from this scam?

The scammers will request personal and financial information under the pretense of verifying your identity and cancelling the fake transaction. With enough details like your social security number and online banking password, the criminals can access your real PNC account and drain or take over the account. They may also open fraudulent credit in your name.

How can I tell if a PNC alert text is fake?

Be skeptical of any text claiming an unauthorized transaction was made, especially if it includes a phone number to call. Log into your PNC account directly through the real website or app and check for signs of fraud. Call PNC at the verified number on your card or statement to inquire. Never call the number in a suspicious text.

What should I do if I receive one of these scam texts?

Do not call the number in the text. Log into your PNC account immediately to check for unauthorized transactions. Contact PNC directly to report the fake text. Do not share any personal or account information if you receive a call about the message.

What if I already called the number and shared information?

Alert PNC Bank right away and request increased monitoring on your accounts for fraud. Reset your online banking password if compromised. Review your credit reports for any suspicious new accounts. File reports about the scam with the FTC, FCC, and your local police.

How can I protect myself from this scam moving forward?

Never call numbers in suspicious texts, always contact PNC directly using verified information on their website. Don’t share sensitive data like passwords or social security numbers over the phone. Sign up for fraud alerts on your credit and monitor accounts closely for unauthorized activity.

Can PNC see I received a scam text?

No, PNC has no visibility into scam texts as they do not actually come from PNC Bank. They appear to look real but are sent by scammers who spoofing PNC numbers. You need to be proactive in reporting any suspicious texts you receive to PNC for investigation.

What is PNC doing to stop this scam?

PNC is aware of this scam and works with authorities to try to shut down the phone numbers involved. They also have dedicated fraud teams to assist any customers who unfortunately fall victim. You can help by reporting details on any fake texts to PNC Bank directly.

The Bottom Line

The PNC alert scam can be devastating financially and emotionally for victims tricked into sharing sensitive personal data with fraudsters. But there are ways to identify, avoid, and recover from this scam:

- Be skeptical of any texts about unauthorized bank transactions and verify them directly with PNC before taking action.

- Never share personal or account information with supposed bank reps contacting you unexpectedly. Real banks don’t operate this way.

- Take swift action if you unfortunately did fall victim to lock down accounts and monitor for fraudulent activity.

- Report the scam to help shut down the phone numbers and warn others about current tactics.

- Sign up for fraud alerts and monitoring to protect yourself from identity theft and account takeovers.

Staying vigilant against financial scams and verifying any suspicious activity directly with PNC Bank can help you avoid becoming the next victim. Being cautious about sharing sensitive data and acting quickly if your information is compromised will limit potential damage. Do your research, trust your instincts, and don’t be afraid to hang up and call the bank back on a verified line.